Currency Notes

Mountains of Cash

Finance & Development, September 2016, Vol. 53, No. 3

Switzerland bucks the global trend by maintaining a cash tradition

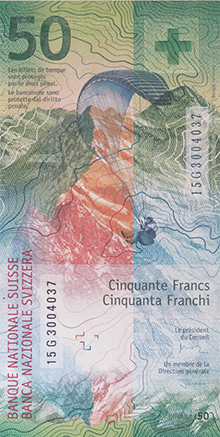

The Swiss are rarely late. But a new series of bank notes has been in the making since 2010. The new Swiss franc notes are finally being released, starting with the 50-franc bill rolled out earlier this year.

This latest series of Swiss banknotes arrives as alternative forms of payment are gaining popularity worldwide and cash, particularly in high-denomination notes, is being closely monitored to prevent counterfeiting and crime.

In Switzerland, however, tradition trumps trend. Cash remains the preferred method of payment and is unlikely to lose that position anytime soon. In fact, banknote circulation has increased from a nominal value of 40 billion francs in circulation in 2007 to more than 65 billion in 2015.

“Despite rapid technological developments in the payments arena, cash has yet to be superseded; indeed, it is still a widely used and popular option in Switzerland,” said Swiss National Bank Chairman Thomas Jordan earlier this year.

A recent study by the Bank for International Settlements confirms this trend: the ratio of credit card payments to GDP in Switzerland is only 10 percent, compared with 25 percent in Sweden and 34 percent in the United Kingdom.

A thousand reasons

Other countries are eliminating high-value notes like the 10,000–Singapore dollar note and the 500-euro note from circulation amid concern over crime funding and tax avoidance. But Jordan says, “We’re not looking at withdrawing the 1,000-franc note. It’s used a great deal in Switzerland as a means of payment.” In fact, demand for the renowned 1,000–Swiss franc note—the second-highest-valued note in the world, after Brunei’s $10,000 bill—soared in popularity when Swiss interest rates were cut to negative territory in December 2015. According to the Swiss National Bank, 45.2 billion Swiss francs in 1,000-franc notes were circulating in December 2015, up from 40.5 billion the previous year. The new series will include a 1,000-franc note.

As the sixth most traded currency in the world, the Swiss franc runs a high risk of counterfeiting. Nevertheless, it is one of the most secure banknotes in the world.

The Swiss National Bank says in its 2015 Annual Report that only 2,400 counterfeit banknotes were seized, or about six notes for every million in circulation.

But even the Swiss are not taking any chances and are relying on forward-looking technology to preserve a tradition of cash and high-value notes.

The new 50-franc banknote includes 15 security features to prevent forgery. If tilted in a certain way, it displays an outline of the Swiss Alps in rainbow colors. A Swiss cross, mirroring the national flag, is also visible from a particular angle.

In a nod to one international trend, the new Swiss franc note has a polymer core sandwiched between two layers of cotton paper. The new notes are expected to last at least 15 years.

Design thinking

The Swiss may not be in a rush to change the way they use banknotes, but it’s a different story when it comes to designing them. The new series has moved away from depicting well-known Swiss personalities in favor of more nuanced and abstract concepts.

Under the theme of “the many facets of Switzerland,” each note displays a different concept from a Swiss perspective. “Each characteristic is communicated via an action, a Swiss location, and various graphic elements,” according to the central bank.

The 50-franc note, which previously portrayed Dada artist Sophie Taeuber-Arp (the only woman in the old series of eight notes), now uses wind as the key motif to symbolize the wealth of experiences Switzerland has to offer, represented by a dandelion and a globe on the front and a paraglider traversing the Alps on the back. Other notes will embody time, water, matter, and language.

The new banknotes also include tactile features to help visually impaired people distinguish between the different denominations.

While the final design of the next banknote in the series remains to be seen—the 20-franc note is scheduled for release in 2017—it is safe to say that Switzerland will continue doing some things differently so that other traditions can be preserved. ■

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.