Dollar Dependence

Finance & Development, September 2016, Vol. 53, No. 3

Luis A.V. Catão and Marco E. Terrones

The move away from domestic dollar use ended in most emerging markets after the global crisis, but not in Peru

Dollarization, the partial or full replacement of a country’s domestic currency with a foreign currency, spread widely in the 1970s in Latin America, when high and hyperinflation robbed national currencies of their traditional roles as a stable medium of exchange and store of value. Households and firms in these countries began to use foreign currencies—typically the dollar—to save and to buy and sell big items like real estate.

The phenomenon eventually spread far beyond Latin America to become a generalized feature of financial sectors in many emerging market economies. By the early 1990s, the banking systems in Turkey and several economies in Africa, Asia, and eastern Europe routinely accumulated substantial dollar-denominated assets and liabilities. The possibility of dollar-denominated bank liabilities substantially exceeding dollar-denominated bank assets presented a serious risk to financial systems in the event of a large and sudden exchange rate devaluation or depreciation. Regulators and policymakers worried, rightly it turned out, that because dollars would be much more expensive after a devaluation or depreciation, the imbalance between banks’ dollar-denominated liabilities and assets could trigger large losses and cause systemic financial instability. This asset-liability mismatch was behind some of the gravest financial crises in emerging market economies during the mid-1990s and early 2000s—including Turkey in 1994, Argentina in 1995, Russia in 1998, and Argentina again in 2001.

Dollarization began to subside in the early years of this century as economic conditions improved in many emerging market economies. Favorable terms of trade, more flexible exchange rates, and better economic policies—including the adoption of inflation targeting and greater fiscal discipline—helped keep inflation low and reduced the risk of abrupt currency devaluations in many of these economies. In recent years, however, large currency depreciations coupled with less-well-anchored inflation expectations and companies’ greater exposure to dollar-denominated debt made it less likely that the move away from the dollar would continue, which appears to be what is happening. A broad look at international data since the global financial crisis shows that dedollarization has halted and even reversed in many emerging market countries. But notable exceptions are found precisely in the birthplace of modern financial dollarization—Latin America, where movement away from the dollar has continued. We look at the Peruvian experience in detail and find some key policy lessons that may be relevant for many other countries.

A global look

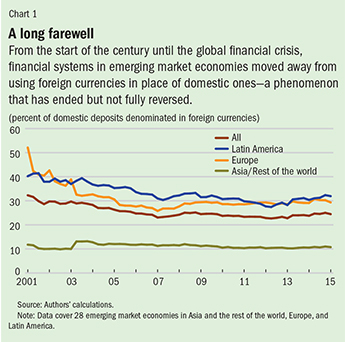

An examination of 28 emerging market economies over the past 15 years found moderately high financial dollarization in Europe and Latin America but relatively little in Asia and the rest of the world (see Chart 1). There are two common and diverging trends. The first is the persistent decline in dollarization (bank deposits in dollars or euros as a percentage of total deposits) from the beginning of the century until the eve of the global financial crisis in 2007; the second is the increase in dollarization in emerging Europe and a turnaround in dedollarization in Latin America starting in 2012.

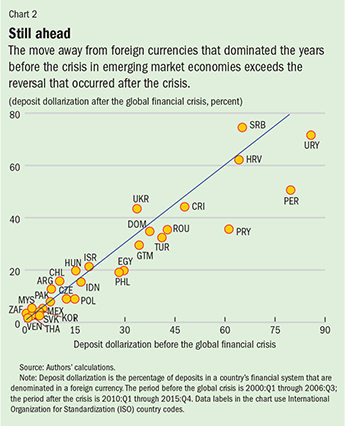

Yet the regional averages mask considerable variation across countries. To unearth some of those differences, in Chart 2 we plotted the country-by-country breakdown before and after the global crisis. Countries that experienced increases in financial dollarization sit above the 45-degree line; those with declines sit below it. Most countries sit below the line, meaning that the dedollarization that occurred immediately after the crisis still exceeds any reversal after 2012.

Moreover, although there was little change in either the level or dispersion of dedollarization in Europe and Asia and the rest of the world in the seven years before 2007 and the period after the crisis—2010 through 2015—this is not true in Latin America. Dedollarization continued there in the years after the global financial crisis, mainly because of continuing and sizable dedollarization in Paraguay, Peru, and Uruguay. These three countries were highly dollarized before the 2000s and experienced remarkable dedollarization in the run-up to the crisis. We will examine the experience of Peru, where the pace of financial dedollarization has been especially noteworthy.

Curbing Peru’s dollar addiction

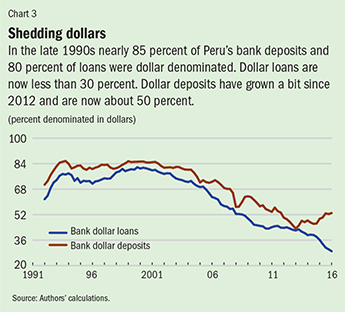

Peru’s high dollarization in the 1990s was surpassed only by countries such as Ecuador and El Salvador that officially replaced their domestic currencies with the dollar. As shown in Chart 3, nearly 85 percent of bank deposits and 80 percent of bank loans in Peru were denominated in dollars by the late 1990s. Although bank deposits in dollars were consistently higher than bank loans, both types of dollarization showed similar trends until about 2000. Then dedollarization proceeded spectacularly fast. By 2012, dollar-denominated bank deposits fell below 50 percent and dollar-denominated loans below 45 percent. Loan dollarization has continued to fall and reached 30 percent by the end of 2015, although dollar-denominated deposits have increased somewhat.

The important question for policymakers interested in engineering reduced dollar dependence in their countries is how to accomplish it. In the case of Peru, which can be used as a guide, we found four main factors in the dedollarization process: the introduction of inflation targeting, the implementation of regulations that make it more expensive for banks to manage dollar deposits and make dollar loans, persistent real exchange rate appreciation, and favorable external conditions, such as high global commodity prices and low global risk aversion (Catão and Terrones, 2016).

Peru introduced inflation targeting in early 2002 in an attempt to control domestic inflation when much of the country’s monetary aggregates was dollar denominated. The approach was to target inflation by setting a short-term policy interest rate for the domestic currency (the sol) while using unconventional instruments to control overall credit (much of which was dollar denominated) and dampen exchange rate volatility—which can be especially destabilizing in highly dollarized economies such as Peru’s. Tax and spending (fiscal) policy was consistent with the implementation of these policies. Inflation targeting has done much to reduce loan dollarization in Peru because it helped bring low and stable inflation. Inflation averaged about 3 percent during the period 2002 to 2015 compared with 55 percent from 1991 to 2001. With adjustable interest rate loans, debt repayment in domestic currency is then more predictable than in foreign currency because inflation targeting is aimed at domestic inflation, not inflation in dollars. By the same token, to the extent that inflation targeting allows greater exchange rate volatility with respect to changes in inflation, it discourages foreign borrowing by firms whose revenue is not denominated mainly in dollars.

Higher reserve requirements

The second important element in dedollarization is regulation. Financial dollarization can be discouraged by taxing dollar lending and dollar deposits. One way to do that is to differentiate between dollar- and sol-denominated deposits and increase the amount of funds banks must maintain with the central bank (reserve requirements) for deposits in dollars. Because reserves generally earn below-market interest from the central bank, requiring banks to maintain them is equivalent to imposing a tax on these institutions equal to the interest forgone. On the lending side, regulations can also require banks to put aside more reserves to provide for losses from dollar-denominated loans than for those in domestic currency. The higher loan-loss provisions raise the marginal cost of dollar loans and should decrease new lending in dollars.

An economic analysis of the 1990 to 2014 period indicates that higher reserve provisions for dollar loans in Peru were especially effective at reducing both deposit and loan dollarization; in contrast, marginal reserve requirements on dollar deposits played a smaller, though still significant, role. In 2015, the Peruvian central bank pursued an aggressive program of loan dedollarization, including not only an additional increase in the marginal reserve requirements on dollar deposits but limits on car and mortgage loans in dollars as well. Those limits help explain the continuous decline in dollar loans relative to dollar deposits that started in 2015.

Third, allowing real exchange rate appreciation appears to be an important step in reducing reliance on dollars, particularly when justified by economic fundamentals. To be sure, the decrease in dollarization as a result of appreciation of the local currency may be simply arithmetic: the ratio of dollars to total deposits tends to shrink when the exchange rate of the local currency appreciates. But there are likely some economic factors at work too. When the real exchange rate appreciates, the prices of goods that are traded internationally fall relative to prices of goods that are not tradable. Since nontradable goods earn revenue in domestic currency, purveyors of those goods typically prefer to borrow in local currency. This is not always the case, though, in emerging market economies, where an increase in the relative price of nontradable goods can lead to more dollar loans to the nontradable sector—real estate, for instance. But as inflation targeting stabilizes domestic inflation it becomes less attractive for banks to index those loans to the dollar.

We found that some of the Peruvian dedollarization of the 2000s was fostered by long-term appreciation of the real exchange rate. The reversal of deposit dedollarization observed since the end of 2014 is attributable in part to the depreciation of the Peruvian currency and to strong depreciation expectations in anticipation of normalization of monetary policy in the United States.

External forces

The fourth set of factors that mattered in Peruvian dedollarization concern external forces, such as higher commodity prices, which encouraged a shift to local currency loans and deposits for a variety of reasons. These include the boost that higher commodity prices give to economic growth. That boost to growth stimulates loan demand from the nontradable goods sector as it seeks to expand operations and also encourages confidence in domestic policies. In a nutshell, domestic firms and consumers feel more confident about holding domestic currency.

But other external forces weigh against dedollarization. For example, bouts of risk aversion in world capital markets and higher external interest rates tend to be associated with an increase in financial dollarization. The prod for increased dollarization from such higher risk aversion is to be expected and works against the confidence engendered by high commodity export prices. To the extent that these global factors explaining dedollarization in Peru in the 2000s are also observed in other countries, they help shed light on the common emerging market trend since 2000 and the global slowdown in dedollarization after the crisis.

The significant positive effect of world interest rates on dollarization, however, is more puzzling. By lowering the cost of borrowing in dollars, the current low interest rate environment might be expected to boost the supply of dollar loans at home. But lower interest rates abroad might motivate firms that buy and sell tradable goods to borrow abroad rather than domestically, reducing demand for domestic dollar borrowing and lowering dollarization. In theory, the net effect of higher world interest rates on both deposit and loan dollarization is ambiguous. It depends on how high dollarization is to begin with and on the marginal costs of administering dollar and local currency accounts (Catão and Terrones, 2000). In a country like Peru, where initial dollarization was high, a reversal might be expected as global interest rates decline. Our economic analysis suggests that this effect has dominated in recent years.

The Peruvian experience highlights the importance of four factors in dedollarization—inflation targeting, regulatory requirements that make it more expensive for banks to take dollar deposits and make dollar loans, persistent real exchange rate appreciation, and favorable external factors, such as high global commodity prices and low global risk aversion. While some factors are particular to Peru, others seem to have broader significance (Garcia-Escribano and Sosa, 2011; Mecagni and others, 2015). This evidence should be valuable to the design of policies aimed at reducing the dependence of a country’s financial sector on foreign currency. ■

Luis A.V. Catão is a Senior Economist and Marco E. Terrones is a Deputy Division Chief, both in the IMF’s Research Department.

Reference

Catão, Luis A.V., and Marco E. Terrones, 2000, “Determinants of Dollarization: The Banking Side,” IMF Working Paper 00/146 (Washington: International Monetary Fund).

———, 2016, “Financial De-Dollarization: A Global Perspective and the Peruvian Experience,” IMF Working Paper 16/97 (Washington: International Monetary Fund).

Garcia-Escribano, Mercedes, and Sebastián Sosa, 2011, “What Is Driving Financial De-Dollarization in Latin America?” IMF Working Paper 11/10 (Washington: International Monetary Fund).

Mecagni, Mauro, and others, 2015, “Dollarization in Sub-Saharan Africa: Experience and Lessons,” IMF Departmental Paper (Washington: International Monetary Fund).

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.