Cashing In on the Digital Revolution

Finance & Development, June 2016, Vol. 53, No. 2

Njuguna Ndung’u, Armando Morales, and Lydia Ndirangu

Digitization makes finance accessible, lowers costs, and creates opportunity

It is the topic du jour for policymakers in almost every developing economy—especially in sub-Saharan Africa. Financial inclusion makes saving easier and enables accumulation and diversification of assets, boosting economic activity in the process. As its economies continue to grow, the region must take one crucial step if it wants to escape the poverty trap, and even more so now as commodity exporters face a downward terms-of-trade trend: deliver more financial services to people and institutions.

Yet access to financial services for the poor has been limited. Minimum bank balance requirements, high ledger fees (costs for maintaining micro accounts), and the distance between poor people’s homes and bank outlets hinder their access to financial services and credit. Moreover, unaffordable “collateral technology” (the system of fixed assets required for loan approval) raises costs more than anything else, and the financial products available are often not suitable for customers with low and irregular income.

Banks have had to bear high costs to provide financial services to the poor. Market segmentation, low technological development, informality, and weak regulation increase the costs of doing business. In Kenya, and in Africa more broadly, markets are heavily segmented according to income, niche, and location, and their sophistication, level of development, and formality or informality reflect that segmentation.

High customer-monitoring costs, perceived higher risk, and a lack of transparent information have been almost insurmountable challenges for banks, and microfinance and other specialized institutions have not been able to fill the gap.

A new landscape

The global financial crisis changed the landscape. Foreign banks scaled back their activities in some African countries, while new local banks increased their presence. The relative success of microfinance institutions in some countries (especially those that introduced a new technological platform to manage micro savings and deposit accounts) encouraged domestic banks to expand their networks. At the same time, nonbank financial institutions, such as savings and loans and cooperatives, formalized their activities. In response, regulators began introducing alternative models that helped cut intermediation costs. For example, agency banking allowed banks to locate nontraditional outlets in remote areas where brick-and-mortar branches and outlets are not financially feasible. Bank representatives at such outlets can perform authorized tasks, such as opening bank accounts, processing loan applications and loan repayments, and so forth.

These changes were driven by demand. Market participants pressured regulators to build their capacity to cope with innovations and to develop institutions to support financial sector growth. Greater credit information sharing and the development of information for market participants, deposit insurance, and financial intelligence units generated a virtuous circle.

But these changes pale compared with the transformation introduced by the emergence and low cost of digital financial services. In Kenya, mobile-phone-based technology (M-Pesa) for the delivery of financial services lowered transaction costs significantly and started a revolution in the payment system. M-Pesa is an electronic money transfer product that allows users to store value on their mobile phone or mobile account in the form of electronic currency. This currency can be used for a number of purposes, including transfers to other users, payments for goods and services, and conversion to and from cash.

Suddenly, businesses did not have to give their employees time off to take money to their villages to care for relatives or small farms. Employees no longer had to travel long distances carrying cash and exposing themselves to robbery and other dangers. Relatives back home did not have to make long trips and risk assault or blackmail by local criminals who tracked the frequency of their travels. The digital revolution allowed people to make financial transactions and money transfers from the comfort of their homes. The lower cost left them with more disposable income, and they now had a secure way to store cash, even those working in the informal economy.

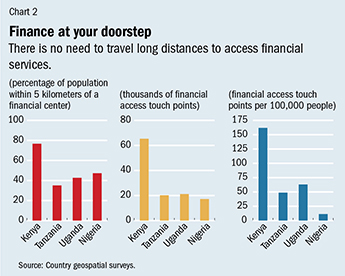

Kenya: a four-step virtuous process

Kenya still enjoys the advantages of an early start in pushing the frontier of financial inclusion through digital financial services. Geospatial surveys show how much financial institutions have responded to an increasingly welcoming environment (see chart). In Kenya a much larger share of the population is within 5 kilometers of a “financial access touch point” and had many more such touch points per person than was true in other countries in the region.

Kenya stands out for its people’s use of mobile-phone-based money—in less than 10 years the share has grown from zero to more than 75 percent of the adult population. Banks have worked closely with telecommunications companies, which has allowed them a higher market presence there than in many emerging markets. In recent years, the insurance sector has expanded as well, targeting Kenya’s emerging middle class, and group-financing programs have also grown. This virtuous circle—facilitated by adaptive and flexible regulatory frameworks, reforms in financial infrastructure, and rapid improvements in skills and capacity—can be divided into four phases:

Expansion of the mobile-phone technological platform for person-to-person transfers, payments, and settlements (products such as M-Pesa): In Kenya, the value of these transactions has reached the equivalent of 4.5 percent of annualized GDP a day.

Introduction of virtual savings accounts using a digital financial services platform complemented by virtual banking services to manage micro accounts: in other words, digital financial services entered the core of banking intermediation.

Use of transaction, saving, and financial operations data from the digital financial services platform to generate credit scores and evaluate and price microcredit risk: This data analysis has helped overcome the so-called collateral technology hurdle, which has long been the main obstacle to financial access by the poor and has hindered the development of credit markets in Africa.

Expansion of digital financial services for cross-border payments and international remittances: Regional cross-border payments and international remittance transfers are starting to come on board. The Kenyan example shows that once the process reaches this phase, demand for regulations to cope with innovations and more intensive use of technology to monitor this market can even discourage money laundering and the financing of terrorism.

Immediate impact

Traditional financial institutions were initially skeptical: it was hard to fathom how financial services, especially banking services, could be provided through a mobile phone. They soon saw the advantages of linking communication and transactions in real time. M-Pesa allows transactions to take place across different segments of the market using the same platform. Commercial banks eliminated the extra costs charged to high-risk potential customers, because M-Pesa’s real-time settlement platform does not require traditional risk assessment. There was an unbundling effect: payments and liquidity distribution took place outside the halls of banking, allowing banks to tailor their products to small-scale demand (Klein and Mayer, 2012). In a sense, commercial banks and microfinance institutions saw that investing in a technological platform suited to handling micro accounts was an opportunity to expand their deposit base and market share. Moreover, they realized that greater capacity and higher intermediation would encourage microsavers to deposit even more in the banking system.

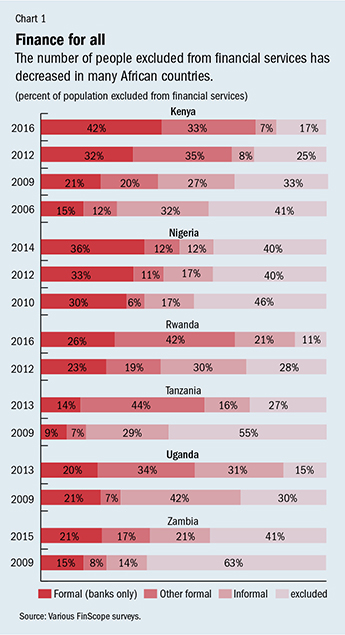

The impact was immediate: total access to financial services of all kinds has increased steadily in recent years in several African countries, despite some decline in the reach of informal lenders (see Chart 1). FinScope surveys conducted by the Financial Sector Deepening Trust (with networks throughout Africa) show a dramatic decline in the share of the “excluded” population. For example, in Rwanda, 89 percent of the population had some kind of financial access in 2016. This was made possible by the expansion of activities of savings and credit cooperatives and growth in digital financial services supported by online government services (Rwanda FinScope, 2016).

The drop in exclusion is also remarkable in Kenya (25 percentage points in the past 10 years), explained by entrance into markets of supervised institutions, including banks (accessibility grew from 15 to 42 percent of the population between 2006 and 2016). Progress in Tanzania and Uganda up to 2013 was also notable (28 and 15 percentage point reduction in exclusion, respectively, between 2009 and 2013), mainly explained by growing activities of nonbank institutions (see Chart 2).

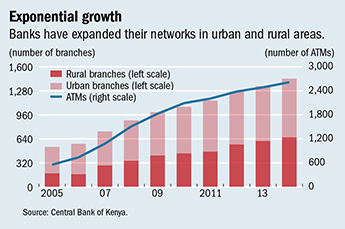

The Kenyan example shows that financial inclusion is more about opening financial services to the poor than just providing affordable financing. Banks’ bet on expanding the infrastructure for greater financial presence has been largely successful. More bank branches (especially in rural areas), automated teller machines in growing urban centers, and bank agents in remote locations have all paid off in new and highly profitable business opportunities. And Kenyan banks are now exporting their redefined business models to the rest of Africa, supported by their expanded deposit base. Some 11 Kenyan banks now have more than 300 branch outlets in east Africa (including South Sudan).

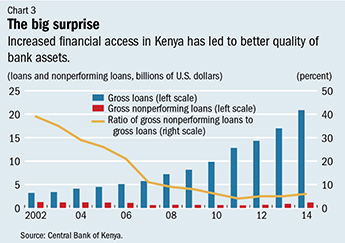

At the same time, contrary to common belief, increased financial access has led to improved quality of bank assets when accompanied by better financial oversight. The recent drop in the share of nonperforming loans in total loans reflects mainly better credit appraisal—thanks to measures such as the 2010 Credit Information Sharing regulation, which helped reduce the disparity in information between lenders and prospective small-scale borrowers (see Chart 3).

Welfare gains

Kenya is a good example of the potential benefits of financial inclusion. Based on a model by IMF economists Dabla-Norris and others (2015), we estimated the reduction in transaction costs and the impact on Kenya’s growth from financial inclusion. First, it generates additional funds channelled to entrepreneurs. Second, lower transaction costs help improve the efficiency of contracts. Finally, more efficient allocation of funds in the financial system allows talented people without resources to become entrepreneurs.

All these channels are expected to be significant in Kenya given that country’s substantial increase in access to credit by small and medium-sized enterprises—from 25 percent to 33 percent between 2006 and 2013 (World Bank Enterprise Surveys). Our preliminary results show a reduction in transaction costs of 65 percent during 2006–13, with an annual contribution to GDP growth of about 0.45 percentage point (Morales and others, forthcoming).

This boost to credit access took place even though it was partly offset by the rollout of stronger financial regulations, which raised monitoring costs and collateral requirements. This implies that financial inclusion through adequate policies could complement efforts to strengthen the financial regulatory framework, by helping banks expand their lending base while enhancing their soundness. The dramatic reduction in transaction costs spurred by digital financial services has clearly played a key role in this achievement.

Digital financial services not only contribute to financial development, they also support financial stability. With less need for cash for transactions, more economic agents can send and follow financial market signals, contributing to a more solid and vibrant financial system. The environment for monetary policy improves as a result.

In addition to these benefits, there are other reasons why proactive policies enhance financial inclusion:

- Achieving inclusive growth without fast progress in financial inclusion in low-income countries is very difficult. According to World Bank Enterprise Surveys, in most African countries, small and medium-sized enterprises still report lack of access to financial services as their main obstacle to conducting business. These enterprises are a key sector of the economy because of their potential for employment generation and reduction of the informal sector.

- For low-income countries with some degree of financial intermediation, there is a clear correlation between financial inclusion and human development (IMF, 2014), which points to a need to improve the regulatory technology.

- Successful financial inclusion discourages policies that constrain market development. In several African countries initiatives still focus on specialized institutions, such as development banks or other institutions that lend to particular sectors—in agriculture or to small and medium-sized businesses—or on initiatives to introduce interest rate controls, despite overwhelming evidence against their effectiveness. As more and more citizens benefit from financial inclusion, the case for inappropriate measures will weaken.

In addition to lowering the costs of transactions, financial inclusion opens the door for potentially game-changing opportunities: innovative pension plan support and government-targeted social protection, expansion of regional payment systems within regional blocks, enforcement of policies to stop money laundering and the financing of terrorism, and a better environment for forward-looking monetary policy to replace years of financial repression and reactive policies. ■

Njuguna Ndung’u is an associate professor of economics at the University of Nairobi and was previously Governor of the Central Bank of Kenya. Lydia Ndirangu is the Head of the Research Centre at the Kenya School of Monetary Studies. Armando Morales is the IMF Resident Representative in Kenya.

References

Dabla-Norris, Era, Yan Ji, Robert Townsend, and D. Filiz Unsal, 2015, “Identifying Constraints to Financial Inclusion and Their Impact on GDP and Inequality: A Structural Framework for Policy,” IMF Working Paper 15/22 (Washington: International Monetary Fund).

FinScope Surveys, various issues (Midrand, South Africa: FinMark Trust).

International Monetary Fund (IMF), 2014, Regional Economic Outlook: Sub-Saharan Africa—Fostering Durable and Inclusive Growth (Washington, April).

Kimenyi, Mwangi S., and Njuguna S. Ndung’u, 2009, “Expanding the Financial Services Frontier: Lessons from Mobile Phone Banking in Kenya” (Washington: Brookings Institution).

Klein, Michael, and Colin Mayer, 2012, “Mobile Banking and Financial Inclusion: The Regulatory Lessons,” World Bank Policy Research Working Paper 5664 (Washington).

Morales, Armando, Lydia Ndirangu, Njuguna Ndung’u, and Fan Yang, forthcoming, “Measuring the Impact of Financial Inclusion in Kenya,” IMF Working Paper (Washington: International Monetary Fund).

World Bank Enterprise Surveys, various issues.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.