The Truth about Banks

Finance & Development, March 2016, Vol. 53, No. 1

Michael Kumhof and Zoltán Jakab

Banks create new money when they lend, which can trigger and amplify financial cycles

Problems in the banking sector played a critical role in triggering and prolonging the two greatest economic crises of the past 100 years: the Great Depression of 1929 and the Great Recession of 2008. In each case, insufficient regulation of the banking system was held to have contributed to the crisis. Economists therefore faced the challenge of providing policy prescriptions that could prevent a repeat of these traumatic experiences.

The response of macroeconomists—those who study the workings of national economies—in the 1930s was strikingly different from attitudes today. Then, there were two leading contenders for radical banking reform in the United States: the proposals that would eventually become the Glass-Steagall Act—which separated commercial and investment banks, created the deposit insurance program, and allowed greater branching by national banks—and proposals for 100 percent reserve banking, under which each dollar deposited by a bank customer must be backed by a dollar of cash in bank vaults or of bank reserves in the central bank.

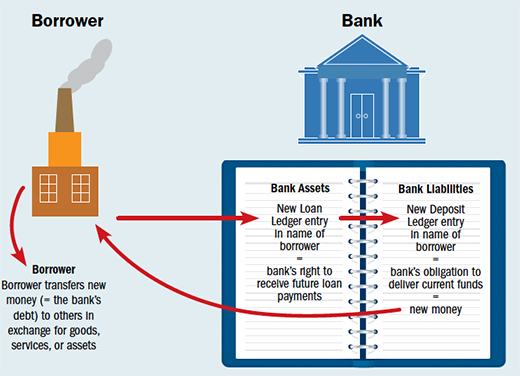

Most leading U.S. macroeconomists at the time supported 100 percent reserve banking. This includes Irving Fisher of Yale and the founders of the so-called Chicago School of Economics. One of the main reasons they supported 100 percent reserve banking was that macroeconomists had, just before the Great Depression, come around to accepting some fundamental truths about the nature of banking that had previously eluded the profession, specifically the fact that banks fund new loans by creating new deposit money (Schumpeter, 1954). In other words, whenever a new loan is made to a customer, the loan is disbursed by creating a new deposit of the same amount as the loan, and in the name of the same customer. This was a critical vulnerability of financial systems, it was thought, for two reasons.

First, if banks are free to create new money when they make loans, this can—if banks misjudge the ability of their borrowers to repay—magnify the ability of banks to create financial boom-bust cycles. And second, it permanently ties the creation of money to debt creation, which can become problematic because excessive debt levels can trigger financial crises, a fact that has since been corroborated using modern statistical techniques (Schularick and Taylor, 2012).

The proposals for 100 percent reserve banking were therefore aimed at taking away the ability of banks to fund loans through money creation, while allowing separate depository and credit institutions to continue to fulfill all other traditional roles of banks. Depository institutions would compete to give customers access to an electronic payment system restricted to transactions in central-bank-issued currency (some of which could bear interest); credit institutions would compete to attract such currency and lend it out once they had accumulated enough.

In Benes and Kumhof (2012) we found support for the claimed advantages of the 100 percent reserve proposal, using modern quantitative tools. To be clear, this article does not advocate 100 percent reserve banking; we mention its history here only as critical to the debate over the nature of banks.

In the 1930s the less radical Glass-Steagall reforms won the day, and eventually the U.S. financial system stabilized. But a by-product of this victory was that critical pre-war lessons about the nature of banking had, by the 1960s, been largely forgotten. In fact, around that time banks began to completely disappear from most macroeconomic models of how the economy works.

Unprepared for the Great Recession

This helps explain why, when faced with the Great Recession in 2008, macroeconomics was initially unprepared to contribute much to the analysis of the interaction of banks with the macro economy. Today there is a sizable body of research on this topic, but the literature still has many difficulties.

We find that many of these difficulties reflect the failure to remember the lessons of the 1930s (Jakab and Kumhof, 2015). Specifically, virtually all recent mainstream neoclassical economic research is based on the highly misleading “intermediation of loanable funds” description of banking, which dates to the 1950s and 1960s and back to the 19th century. We argue instead for the “financing through money creation” description, which is consistent with the 1930s view of economists associated with the Chicago School. These two views have radically different implications for a country’s macroeconomic response to financial and other shocks. This in turn has obvious relevance for key policy choices today.

In modern neoclassical intermediation of loanable funds theories, banks are seen as intermediating real savings. Lending, in this narrative, starts with banks collecting deposits of previously saved real resources (perishable consumer goods, consumer durables, machines and equipment, etc.) from savers and ends with the lending of those same real resources to borrowers. But such institutions simply do not exist in the real world. There are no loanable funds of real resources that bankers can collect and then lend out. Banks do of course collect checks or similar financial instruments, but because such instruments—to have any value—must be drawn on funds from elsewhere in the financial system, they cannot be deposits of new funds from outside the financial system. New funds are produced only with new bank loans (or when banks purchase additional financial or real assets), through book entries made by keystrokes on the banker’s keyboard at the time of disbursement. This means that the funds do not exist before the loan and that they are in the form of electronic entries—or, historically, paper ledger entries—rather than real resources.

This process, financing, is of course the key activity of banks. The detailed steps are as follows. Assume that a banker has approved a loan to a borrower. Disbursement consists of a bank entry of a new loan, in the name of the borrower, as an asset on its books and a simultaneous new and equal deposit, also in the name of the borrower, as a liability. This is a pure bookkeeping transaction that acquires its economic significance through the fact that bank deposits are the generally accepted medium of exchange of any modern economy, its money. Clearly such transactions—which one of us has personally witnessed many times as a corporate banker—involve no intermediation whatsoever. Werner (2014), an economist with a banking background, provides a much more detailed description of the steps involved in a real-world loan disbursement.

We use the term “bank deposit” very broadly here to include all nonequity bank liabilities—that is, everything from checking accounts to long-term debt securities—because these liabilities can all be considered forms of money, albeit with highly varying degrees of liquidity. While the initial deposit is always created as a checking account, the ultimate holders of the new bank liability will as a rule demand a positive interest rate, with the level depending on how much they value liquidity over financial returns.

Two misconceptions could arise in this context. First, the newly created deposit does not “go away” as soon as the borrower uses it to purchase a good or an asset. It may leave the borrower’s bank if the seller of the good or asset banks elsewhere, but it never leaves the banking system as a whole unless the underlying loan is repaid. This highlights the great importance of thinking about banks as part of an interconnected financial system, rather than thinking about one bank in isolation. Second, there is no reason to assume that such a loan will be repaid immediately. To the contrary, a loan is extended precisely because the funds are to be used to support additional economic activity, which in turn generates additional demand for liquidity and thus for bank deposits. If the funds are used to support relatively unproductive economic activity, it will give rise to relatively more goods or asset price inflation and less additional output. But this type of distinction is precisely what our new conceptual framework allows us to quantify.

Financing through money creation

This “financing through money creation” function of banks has been repeatedly described in publications of the world’s leading central banks—see McLeay, Radia, and Thomas (2014a, 2014b) for excellent summaries. What has been much more challenging, however, is the incorporation of these insights into macroeconomic models. Our research therefore builds examples of economic models with “financing through money creation” banks and then contrasts the models’ quantitative predictions with those of otherwise identical “intermediation of loanable funds” models.

We should add here that the financing through money creation view is well known in the post-Keynesian economic literature, which however differs from our approach in two ways. First, it does not feature the optimizing households and firms of modern neoclassical theory, which have become de rigueur in mainstream economics, including at most policy institutions. Second, it tends to model credit and money as fully demand determined, with banks playing a very passive role. The added value of our work is the assumption of a more realistic world in which credit risks limit banks’ credit supply, and liquidity preferences limit nonbanks’ demand for money.

In simulations that compare how these models behave, we assume that, in a single quarter, the likelihood of borrowers missing payments increases very significantly. Under the realistic assumption that banks had to set their lending interest rates before this shock, and are committed to these rates for some time under existing loan contracts, banks suffer significant loan losses. They respond by writing new loan contracts that take into account the increased risk and the erosion of their capital buffers. This forces them to make fewer new loans and charge higher interest on the ones they do make. However, hypothetical “intermediation of loanable funds” banks would choose very different combinations from real-world “financing through money creation” banks.

Intermediation of loanable funds banks would not, in aggregate, be able to reduce their balance sheets quickly during a crisis. Aggregate deposits of loanable funds could at best fall gradually over time, if depositors, in response to a recession, were to accumulate smaller savings than before. The only other theoretically feasible way for bank balance sheets to shrink would be for depositors to acquire private debt or equity securities from banks during the crisis. But empirical evidence shows that, during crises, holdings of nonbank debt or equity by the nonfinancial sector do not grow significantly. Moreover, this explanation says nothing about how banks’ loan books (as opposed to their securities books) could shrink during a crisis.

Therefore, banks in the intermediation model, with the size of their balance sheets changing slowly, would keep lending to riskier borrowers. To compensate for this risk, they would dramatically increase their loan rates to ensure continued profitability.

On the other hand, financing through money creation banks can instantly and massively reduce the quantity of their lending if they think it will improve profitability. To reiterate, this flexibility is possible because deposits represent monetary purchasing power that can—through bookkeeping entries—be destroyed as fast as it was created, rather than representing real savings, which can decline only through reduced production or increased consumption of resources. Banks in the money creation model can immediately demand repayment (or refuse rollover) of a large share of existing loans out of existing deposits, causing an immediate, simultaneous, and large contraction of bank loans and bank deposits, while intermediation banks would experience almost no initial change.

Because this cutback in lending, relative to the intermediation model, reduces existing corporate bank borrowers’ ratios of loans to collateral assets, and therefore the riskiness of their outstanding loans, banks initially increase interest rate spreads on these remaining loans far less than in the intermediation model. Much of their response is therefore in the form of quantity rationing rather than changes in interest rate spreads. This is also evident in the behavior of bank leverage, a key balance sheet ratio defined as the ratio of bank assets to net worth. In the intermediation model, bank leverage increases on impact, because losses and thus the decrease in net worth far exceed the gradual decrease in loans. In the money creation model, leverage either remains constant or drops, because the rapid decrease in loans is at least as large as the change in net worth. Finally, the contraction in GDP in the money creation model is typically far larger than in the intermediation model, mainly as a result of severe credit rationing and the ensuing shortages of liquidity throughout the economy.

It is straightforward to demonstrate that these characteristics of money creation models are much more in line with the actual data. Most important, bank lending—both for individual banks and for national banking systems—exhibits frequent, large, and fast jumps. Contrary to typical intermediation models, and again in line with the data, money creation models predict bank leverage ratios that increase during booms and fall during contractions, as well as severe credit rationing during downturns.

The fundamental reason for these differences is that, according to the intermediation narrative, aggregate systemwide deposits must be accumulated through saving physical resources, which by its very nature is gradual and slow. On the other hand, the money creation narrative says that banks can create and destroy deposits instantaneously, because the process involves bookkeeping transactions rather than physical resources. Although deposits are essential to purchases and sales of real resources outside the banking system, they are not themselves physical resources and can be created at almost no cost.

Even though banks do not face technical limits to a quick rise in the quantity of their loans, they still face other restraints. But the most important limit, especially during the boom periods of financial cycles when all banks simultaneously decide to lend more, is their own assessment of their future profitability and solvency. The availability of savings of real resources does not constitute a limit to lending and deposit creation, nor does the availability of central bank reserves. Modern central banks pursue interest rate targets and must supply as many reserves as the banking system demands at those targets. This fact flies in the face of the still very popular deposit multiplier narrative of banking, which argues that banks make loans by repeatedly lending out an initial deposit of central bank reserves.

To summarize, our work builds on the fundamental fact that banks are not intermediaries of real loanable funds, as is generally assumed in the mainstream neoclassical macroeconomics literature. Rather, they are providers of financing, through the creation of new monetary purchasing power for their borrowers. Understanding this distinction has important implications for a host of practical questions. We will conclude with one example, but there are many others.

Practical implication

Many policy prescriptions aim to encourage physical investment by promoting saving, which is believed to finance investment. The problem with this idea is that saving does not finance investment, financing and money creation do. Bank financing of investment projects does not require prior saving, but the creation of new purchasing power so that investors can buy new plants and equipment. Once purchases have been made and sellers (or those farther down the chain of transactions) deposit the money, they become savers in the national accounts statistics, but this saving is an accounting consequence—not an economic cause—of lending and investment. To argue otherwise is to confuse the respective macroeconomic roles of real resources (saving) and debt-based money (financing). Again, this point is not new; it goes back at least to Keynes (Keynes, 2012). But it seems to have been forgotten by many economists, and as a result is overlooked in many policy debates.

The implication of these insights is that policy should place priority on an efficient financial system that identifies and finances worthwhile projects, rather than on measures that attempt to encourage saving, in the hope that it will finance desired investment. The “financing through money creation” approach makes it very clear that with financing of physical investment projects, saving will be the natural result. ■

Michael Kumhof is Senior Research Advisor at the Bank of England’s Research Hub, and Zoltán Jakab is an Economist in the IMF’s Research Department.

References

Benes, Jaromir, and Michael Kumhof, 2012, “The Chicago Plan Revisited,” IMF Working Paper 12/202 (Washington: International Monetary Fund).

Jakab, Zoltán, and Michael Kumhof, 2015, “Banks Are Not Intermediaries of Loanable Funds–And Why This Matters,” Bank of England Working Paper 529 (London).

Keynes, John Maynard, 2012, The Collected Writings of John Maynard Keynes, Volume 27, reprint of 1980 edition (Cambridge, United Kingdom: Cambridge University Press).

McLeay, Michael, Amar Radia, and Ryland Thomas, 2014a, “Money Creation in the Modern Economy,” Bank of England Quarterly Bulletin Q1, pp. 14–27.

———, 2014b, “Money in the Modern Economy: An Introduction,” Bank of England Quarterly Bulletin Q1, pp. 4–13.

Schularick, Moritz, and Alan M. Taylor, 2012, “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870–2008,” American Economic Review, Vol. 102, No. 2, pp. 1029–61.

Schumpeter, Joseph A., 1954, History of Economic Analysis (New York: Oxford University Press).

Werner, Richard A., 2014, “Can Banks Individually Create Money Out of Nothing? The Theories and the Empirical Evidence,” International Review of Financial Analysis, Vol. 36, pp. 1–19.