Age and Inflation

Finance & Development, March 2016, Vol. 53, No. 1

Mikael Juselius and Elöd Takáts

Baby boomers drove down inflation when they joined the workforce and will drive it up as they retire

Inflation was chronically high in the 1970s and seems to be chronically low now. Its shift coincided with the progress of the so-called baby-boom generation as it marched from adolescence through working age in many advanced economies.

Conventional economic wisdom says these two slow-moving trends are unconnected: the boomers should not affect inflation, because inflation is a monetary phenomenon that can be controlled by monetary policy. But our research found a strong link between trend inflation—the average rate at which prices increase over a several-year period—and the age structure of the population.

Specifically, we found that the larger the proportion of young and old in the total population, the higher inflation. Put another way, when the working-age population is larger, the effect is disinflationary. This link between age and inflation holds for a large number of countries across all time periods.

These effects are large enough to explain most of trend inflation. For instance, the baby boomers increased inflation by an estimated 6 percentage points in the United States between 1955 and 1975 and lowered it by 5 percentage points between 1975 and 1990, when they entered working life. Trend inflation is currently low and stable as the decreasing share of young people offsets the effects of the increasing share of old people in the population.

Given that inflation is a monetary phenomenon, why did central banks fail to offset the inflation pressure flowing from the changing age of the population? There are at least two natural explanations. First, political pressure may have impelled central banks to cater to the inflation preferences of dominant age groups. Alternatively, the inflation-age structure pattern could reflect the failure of central banks to anticipate movements in the equilibrium real interest rate—the rate that results in stable inflation. But neither of these two is a good explanation for what we see in the data.

It is not totally clear why an economy’s age structure affects inflation, but the relationship is strong and has some striking practical implications. For one, it weakens the argument that expectations play a major role in inflation formation, a thesis that arose from the inflationary experience of the 1960s and 1970s. Furthermore, the relationship between age structure and the rate of price increases does permit prediction of underlying trend inflation. Our estimates suggest that unless baby boomers work much longer than their parents did, their retirement will ultimately be inflationary.

Exploring inflation trends

Inflation puzzles have prompted economic insights in the past. For example, when inflation began to increase in the 1960s without a justifying change in activity, economists searching for an explanation postulated that expectations play a role in inflation formation. Forward-looking consumers or producers wouldn’t be forever fooled by monetary expansion designed to boost economic growth and would incorporate higher inflation expectations in, say, wage demands and loan contracts. Thus, a lasting monetary expansion would generate higher inflation but no lasting output gains. Overly lax monetary policy seemed to explain the increase in inflation, a view that was reaffirmed in the 1980s, when inflation began to fall after central banks started to combat it.

But inflation puzzles have a way of reappearing. Following the global financial crisis that began in 2008, inflation did not pick up when economies started to recover. Indeed, it seems that as early as the beginning of the century inflation was slowly falling below, rather than moving toward, central banks’ inflation targets. This low inflation is one reason central banks held down rates in the first half of that decade. But it also suggests that something other than monetary policy was in the background suppressing inflation.

The prolonged episode of low inflation came when populations in most advanced economies were getting older and baby boomers were in their peak earning periods. Age groups differ with respect to their consumption-saving decisions, which can affect long-run inflation pressure. For instance, people tend to borrow when they are young (or their parents do it on their behalf), save during their working life, and live off accumulated assets when they are old. It follows that inflation pressure is high when the share of young and old people (who consume but largely do not produce) is large compared with the working-age population (which produces more than it consumes) and vice versa. But conventional analysis suggests that central banks could, in principle, offset such pressure by raising or lowering interest rates. In such a scenario, aging would affect the real (after-inflation) equilibrium interest rate, but not inflation.

Some veteran central bankers have recently proposed why aging might matter for inflation—because of its effect on the conduct of monetary policy. For example, voter preferences influence a central bank’s inflation target, a position most forcefully argued by James B. Bullard, president of the St Louis Federal Reserve Bank (Bullard, Garriga, and Waller, 2012). Bullard says that the young, who are borrowers, prefer more inflation because it reduces the real burden of their debt, whereas the old prefer less inflation to preserve the value of their assets. If Bullard’s thesis is right and central banks succumb to such political pressure, inflation will be higher when the younger population dominates and lower when the population is older. An alternative view is put forth by Goodhart, Pradhan, and Pardeshi (2015), who suggest that the age structure can change the equilibrium real interest rate. If central banks ignore such changes, inflation can ensue.

The link

We estimated the effects of the entire age structure—not just aging—on inflation, using data from 22 advanced economies between 1955 and 2014, and found a robust relationship between inflation and the age structure.

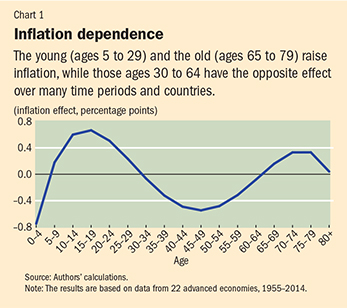

The effects of various age cohorts follow a U-shaped pattern: the young (ages 5 to 29) and the old (ages 65 to 79) are inflationary, whereas the prime-working-age cohorts are disinflationary (see Chart 1). This U-shaped pattern is robust and does not disappear when other variables that may be associated with inflation—such as output gaps, oil price inflation, real interest rates, population growth, and fiscal policy measures—are taken into account. The relationship also survives when global factors are controlled for, during different time periods and with different country samples. The effects of the small number of the very young (those under 5) and very old (those over 80), on the other hand, are less easy to pin down.

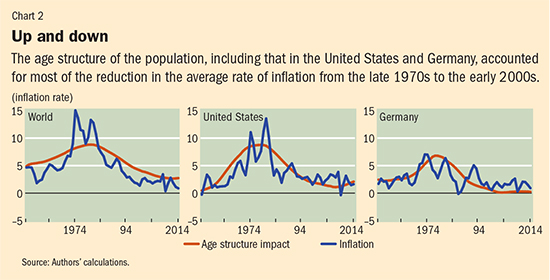

The age-structure effect explains the bulk of trend inflation and about a third of the overall variation in inflation. For each year, the effect is calculated by multiplying the values from the U-shaped pattern in Chart 1 by the share of population in the corresponding age groups. The effect is large: it explains, for example, about 5 percentage points of the reduction in the average rate of inflation across countries from the late 1970s to the early 2000s. This is most of the reduction in long-run inflation over the period (see Chart 2, left panel). Furthermore, demographic developments seem to explain country differences. For instance, the larger swings in trend inflation in the United States, compared with Germany, mostly reflect larger U.S. demographic changes (see Chart 2, middle and right panels).

Puzzle remains

After we established a robust link between age structure and trend inflation, we looked for evidence to support either the life-cycle spending or voter-preference explanations.

We found little to support either. The U-shaped pattern undermines one of the main premises of the voter-driven explanation. Not only do the young, many of whom are well below voting age, have a strong impact, we found that the old have an inflationary effect. This runs counter to existing political economy models, which view the old as disinflationary. Empirical results that found the old to be disinflationary mistakenly omitted the young from the analysis. The demographic effect is also visible in small euro area countries, where voter preferences are unlikely to sway area-wide monetary policy.

If the age-structure effect on inflation is not the result of political pressure on monetary policy, it could reflect a failure of central banks to fully appreciate the effects of life-cycle spending decisions on the equilibrium real interest rate. For instance, the equilibrium real interest rate may have risen in the 1960s and 1970s with the increased demand from the baby boomers—and if central banks did not raise nominal rates enough, the high inflation rate at the time may have been the result. However, if the age structure is a proxy for the equilibrium real interest rate, it should not itself affect inflation; only its deviations from actual rates would have an impact. Yet the inflation–age structure effect is present even when actual rates are left out. In other words, equilibrium real interest rates do not appear to explain why a population’s age structure is associated with periods of inflation and disinflation.

Practical implications

Although the origin of the age-structure effect is unclear, it is real and has direct practical implications. First, it reduces the importance of market-based expectations in inflation formation. Some of the inflation from the 1960s to the late 1970s and the disinflation that followed can be explained without reference to expectations. To put this finding to the test, we estimated the effects of the age structure on year-ahead inflation forecasts from Consensus Economics and found exactly the same U-shaped pattern as in Chart 1.

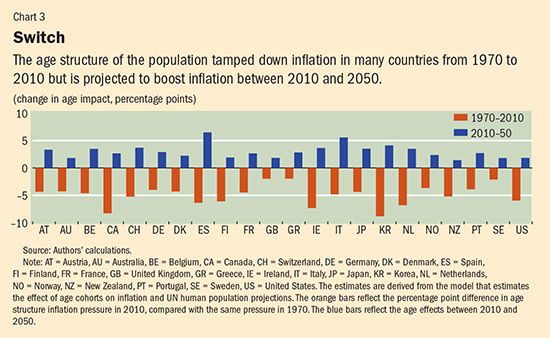

A second, related, implication is that trend inflation can be forecast just as the age structure itself can be forecast. Barring catastrophes, we know how many people will enter the labor market 20 years down the road, because these people have already been born. Our estimates, combined with demographic forecasts from the United Nations, imply that the age-structure effect will turn inflationary over the coming decades (see Chart 3) or that real interest rates must be higher to contain the pressure. We estimate that inflation will be about 3 percentage points higher on average 40 years from now due to the effects of aging, all else equal. While the magnitude differs from country to country, the change from disinflation pressure to inflation pressure is present in all of them.

The strong link between the age structure of the population and trend inflation presents a puzzle that no available theories can fully explain. Nevertheless, the puzzle must be solved. The earliest boomers have retired, and a big wave of them are nearing retirement. This could create a challenging inflationary environment in the coming years. ■

Mikael Juselius is a Senior Economist at the Bank of Finland, and Elöd Takáts is a Senior Economist at the Bank for International Settlements.

This article is based on a 2015 Bank for International Settlements working paper, “Can Demography Affect Inflation and Monetary Policy?”

References

Bullard, James, Carlos Garriga, and Christopher J. Waller, 2012, “Demographics, Redistribution, and Optimal Inflation,” Federal Reserve Bank of St. Louis Review, November/December, Vol. 94, No. 6, pp. 419–39.

Goodhart, Charles, Manoj Pradhan, and Pratyancha Pardeshi, 2015, “Could Demographics Reverse Three Multi-Decade Trends?” Morgan Stanley Global Research, September.