Opening Up to Inequity

Finance & Development, March 2016, Vol. 53, No. 1

Davide Furceri and Prakash Loungani

After countries remove restrictions on capital flows, inequality often gets worse

In June 1979, shortly after winning a landmark election, Margaret Thatcher eliminated restrictions on “the ability to move money in and out” of the United Kingdom, which some of her supporters regard as “one of her best and most revolutionary acts” (Heath, 2015). The Telegraph wrote that “in the economic dark ages that were the 1970s” U.K. citizens could “forget about buying a property abroad, purchasing foreign equities or financing a holiday . . . The economic impact was devastating: companies were reluctant to invest in the U.K. as it was tough even for them to move money back to their home countries.” Thatcher abolished “all of these nonsensical rules and liberalized the U.K.’s capital account.”

But Thatcher’s critics had a different view. They regarded this same liberalization as starting a global trend whose “downside . . . proved to be painful” (Schiffrin, 2016). In their view, while the free mobility of capital across national borders confers many benefits in theory, in practice liberalization has often led to economic volatility and financial crisis. This in turn has adverse consequences for many in the economy, particularly for those who are not well off. Liberalization also affects the relative bargaining power of companies and workers (that is, of capital and labor, respectively, in the jargon of economists) because capital is generally able to move across national boundaries with greater ease than labor. The threat of being able to move production abroad reduces labor’s bargaining power and the share of the income pie that goes to workers.

In studying such distributional effects of capital account liberalization we found that after countries take steps to open their capital account, an increase in inequality in incomes within countries follows (Furceri and Loungani, 2015). The impact is greater when liberalization is followed by a financial crisis and in countries where there is low financial development—that is, where financial institutions are small and access to these institutions is limited. We also find that the share of income going to labor declines in the aftermath of liberalization. Thus, like trade liberalization, capital account liberalization can lead to winners and losers. But while the distributional effects of trade have long been studied by economists, the distributional impacts of opening the capital account are just starting to be analyzed.

The push toward liberalization

At its annual meeting in October 1997 in Hong Kong SAR, the IMF put forward its arguments why countries should keep moving toward full capital account liberalization—that is, the elimination of restrictions on the movement of funds in and out of a country. The IMF’s then-first deputy managing director, Stanley Fischer, called liberalization “an inevitable step on the path of development which cannot be avoided and should be embraced.” Fischer, now vice chairman of the U.S. Federal Reserve Board, noted that liberalization ensures that “residents and governments can borrow and lend on favorable terms, and domestic financial markets become more efficient as a result of the introduction of advanced financial technologies, leading to better allocation of both saving and investment” (Fischer, 1998). While acknowledging that liberalization “increases the vulnerability of the economy to swings in [market] sentiment,” Fischer argued that the potential benefits of opening up the capital account outweigh the costs.

Persuaded by similar calculations, many governments have relaxed restrictions on foreign capital flows. Thatcher’s move was followed by similar ones by Germany in 1984 and by other European countries over the subsequent decade. Among emerging market economies, Chile was an early mover toward liberalization, followed by several other Latin American countries in the 1990s and then by emerging market economies in Asia.

This push toward liberalization is widespread. An index of capital account openness constructed from annual IMF reports on cross-border financial transactions (IMF, various) shows a steady increase, signifying that restrictions on cross-border transactions have been progressively lifted.

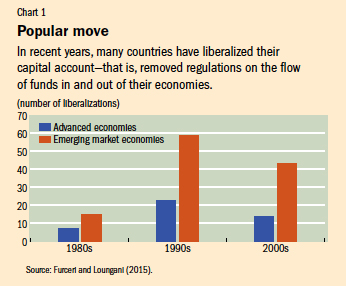

We focused on episodes of large changes in this index, because such episodes are more likely to represent deliberate policy actions by governments to liberalize their capital accounts. According to this criterion, capital account liberalization picked up steam during the 1990s, with nearly 23 episodes of large changes in advanced economies and 58 in emerging market economies (see Chart 1). Of course, most emerging market economies started with a much more restricted capital account. As a result, even after steps toward liberalization, they remain, on average, less open than the advanced economies.

Liberalization and inequality

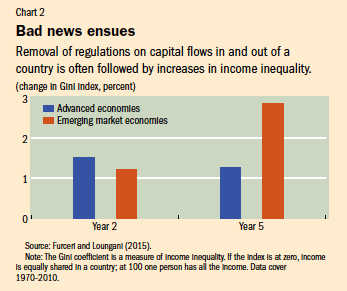

These episodes of capital account liberalization were followed by increases in income inequality. A commonly used measure of inequality is the Gini coefficient, which takes the value zero if all income is equally shared within a country and 100 if one person has all the income. In both advanced and emerging market economies, the Gini coefficient increases—in other words, inequality grows—following a liberalization. The short-term impact after two years is similar in both advanced and emerging market economies, but in the medium term, after five years, inequality widens much more in emerging markets (see Chart 2).

These effects are quantitatively significant. Gini coefficients change slowly over time: changes in the Gini have a standard deviation of 2 percent (that is, nearly 70 percent of the time, when the Gini index changes, it does so by less than 2 percent). The effects shown in Chart 2 are therefore quite large relative to the standard deviation; in simple terms, episodes of capital account liberalization can lead to big increases in inequality.

The impact of capital account liberalization on inequality holds even after several other determinants of inequality—such as openness to trade, changes in the size of government, and regulation of product, labor, and credit markets—are accounted for.

Why is liberalization followed by inequality? There are two possible reasons. First, as even Fischer acknowledged, opening up to foreign capital flows can be a source of volatility—with large capital inflows followed by outflows and vice versa. Critics of liberalization insist that this volatility is a source of crisis. Dani Rodrik, for instance, noted that in 1996, five Asian economies received nearly $100 billion in inflows but experienced an outflow of over $10 billion the following year.

“Consequently,” Rodrik wrote, three of those economies (Indonesia, Korea, Thailand) “were mired in a severe economic crisis” (1998). Rodrik argues that this is not an “isolated incident” and that “boom-and-bust cycles are hardly a sideshow or a minor blemish in international capital flows; they are the main story.”

Second, liberalization should, in theory, expand the access of domestic borrowers to sources of capital. In practice, the strength of domestic financial institutions may play a crucial role in determining the extent to which this takes place. But in many countries, financial institutions do not offer a wide range of services, and large numbers of people do not have access to credit (Sahay and others, 2015). In these circumstances, liberalization may bias financial access in favor of those who are well off, which increases inequality.

We find evidence in favor of both channels: the impact of liberalization is greater when it is followed by a crisis and where financial depth and inclusion are low.

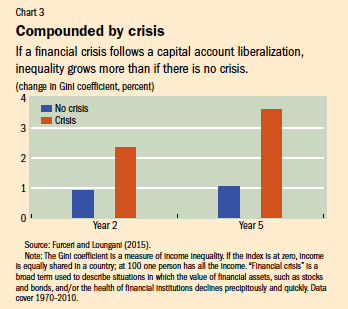

To study the first channel, we separated cases in which capital account liberalizations were followed by a financial crisis from cases in which no crisis ensued. The impact of openness on inequality differs markedly between the two cases, as shown in Chart 3. In particular, when there was a crisis, there was a medium-term increase in inequality of 3.5 percent, compared with a 1 percent increase in cases when no crisis ensued.

The evidence thus suggests that the combination of capital account liberalization and financial crisis leads to a significant impact on inequality. It is worth noting that not all financial crises lead to increases in inequality because there are offsetting effects (Otker-Robe and Podpiera, 2013). On one hand, financial crises may reduce inequality because bankruptcies and falling asset prices generally have a greater impact on those who are better off. On the other hand, financial crises associated with long-lasting recessions may disproportionately hurt the poor—and increase inequality.

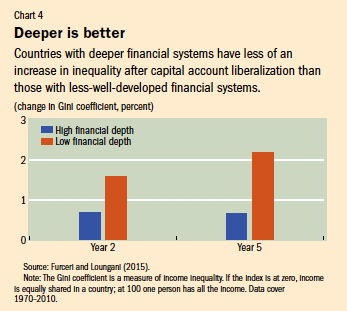

The effect of liberalization on inequality also differs by financial depth and inclusiveness. We separate countries where financial markets are not very deep from others using a composite indicator from the Fraser Institute, a Canada-based think tank. In the medium term, inequality increases by over 2 percent in countries with low financial depth, four times the increase in countries with high financial depth (see Chart 4).

Labor’s income share shrinks

In the textbook model of perfect competition, each factor of production—capital and labor—gets its just reward based on its contribution to a company’s profits. But a more realistic description of the world is one of imperfect competition, where the division of the economic pie is based not just on the relative contributions of capital and labor to the bottom line but on their relative bargaining power. In his 1997 book, Has Globalization Gone Too Far?, Rodrik argued that capital account liberalization tilts the playing field in favor of capital, the more mobile of the factors of production. Because companies can move their operations abroad, workers’ bargaining power can erode and they may lose some of their share of income.

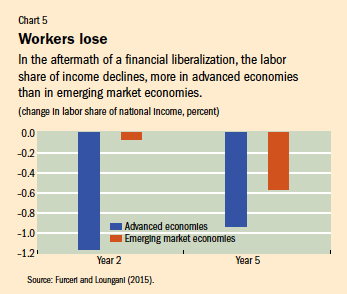

The evidence points to a clear decline in labor’s share of income following capital account liberalization (see Chart 5). Focusing on the medium-term impact, which can be estimated more precisely than short-term effects, labor’s share falls by about 1 percentage point in advanced economies and by about 0.6 percentage point in emerging market economies. As was the case with the Gini measure of inequality, these are big effects. The changes in the labor share have a standard deviation of 2.25 percentage points (that is, nearly 70 percent of the time, when the labor share changes, it does so by less than 2.25 percentage points). Hence, capital account liberalization is associated with large declines in labor shares.

The impact of the loss of bargaining power may be more severe for workers in advanced economies than in emerging market economies for two reasons. First, companies in advanced economies may be in a better position to make a credible threat to relocate abroad—where wages are lower. Second, in many emerging market economies capital is scarce relative to labor. The arrival of foreign investment capital can raise the demand for labor, mitigating some of the effects of the relative change in bargaining power due to the opening of the capital account.

Proceed with caution

The benefits of capital account liberalization posited by Fischer nearly two decades ago still echo in the IMF’s work, but there is a greater note of caution (Ostry and others, 2011). The IMF’s “institutional view” (IMF, 2012) notes that liberalization allows domestic companies access to pools of foreign capital, and often—through foreign direct investment—to the technology that comes with it. It also allows domestic savers to invest in assets outside their home country. At the same time, the institutional view recognizes that capital flows can be volatile and—particularly given their large size relative to domestic markets—can pose a risk to financial stability. It concludes that “capital flow liberalization is generally more beneficial and less risky if countries have reached certain levels or thresholds of financial and institutional development.” There is also greater acceptance of capital flow management measures (more commonly called “capital controls”) to deal with the volatility of capital flows (Ostry and others, 2010).

We found an additional reason for a cautious approach to opening up the capital account. Countries that make reduction in inequality an important policy goal may need to design liberalization in a manner that balances this consideration against the benefits of higher productivity and growth. We also find that the impact of liberalization on inequality is muted when countries are at higher levels of financial development or when no financial crisis ensues after liberalization. This lends further support to the view that the benefit-to-cost ratio of liberalization is higher for countries above a certain level of financial development and where countries have adequately strengthened financial regulations before liberalization. In such cases, the benefits to growth are more likely to materialize, the risks of crisis are smaller, and the distributional costs—in terms of higher inequality and a lower labor share—are also smaller. ■

Davide Furceri is an Economist and Prakash Loungani is a Division Chief, both in the IMF’s Research Department.

References

Fischer, Stanley, “Capital-Account Liberalization and the Role of the IMF,” 1998, in Essays in International Finance No. 207, Princeton University International Finance Section (Princeton, New Jersey).

Furceri, Davide, and Prakash Loungani, 2015, “Capital Account Liberalization and Inequality,” IMF Working Paper 15/243 (Washington).

Heath, Allister, 2015, “A Return to Capital Controls Would Be a Disaster for All of Us,” The Telegraph, February 20.

International Monetary Fund (IMF), 2012, “The Liberalization and Management of Capital Flows: An Institutional View” (Washington).

———, various, Annual Report on Exchange Arrangements and Exchange Restrictions (Washington).

Ostry, Jonathan D., Atish R. Ghosh, Karl Habermeier, Marcos Chamon, Mahvash S. Qureshi, and Dennis B.S. Reinhardt, 2010, “Capital Inflows: The Role of Controls,” IMF Staff Position Note 10/04 (Washington: International Monetary Fund).

Ostry, Jonathan, and others, 2011, “Managing Capital Inflows: What Tools to Use?” IMF Staff Discussion Note 11/06 (Washington: International Monetary Fund).

Otker-Robe, Inci, and Anca Maria Podpiera, 2013, “The Social Impact of Financial Crises: Evidence from the Global Financial Crisis,” World Bank Policy Research Working Paper 6703 (Washington).

Rodrik, Dani, 1997, “Has Globalization Gone Too Far?” Peterson Institute for International Economics paper (Washington).

———, 1998, “Who Needs Capital-Account Convertibility?” in Essays in International Finance No. 207, Princeton University International Finance Section (Princeton, New Jersey).

Sahay, Ratna, and others, 2015, “Financial Inclusion: Can It Meet Multiple Macroeconomic Goals?” IMF Staff Discussion Note 15/17 (Washington).

Schiffrin, Anya, 2016 “Capital Controls” (New York: Initiative for Policy Dialogue).