Older and Smaller

Finance & Development, March 2016, Vol. 53, No. 1

Benedict Clements, Kamil Dybczak, and Mauricio Soto

The fiscal consequences of shrinking and aging populations threaten advanced and emerging market economies alike

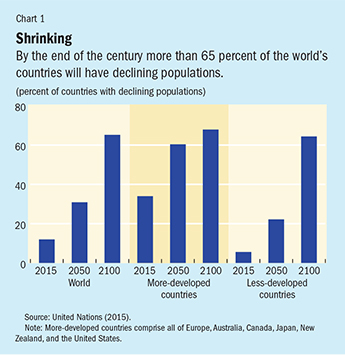

With fertility rates falling across the globe, population declines will become more widespread over the next few decades. According to the latest projections from the United Nations (2015), the world’s population will peak around 2100 and begin to shrink soon thereafter. Populations are already shrinking in several countries, and by the end of the century, nearly 70 percent of more-developed and 65 percent of less-developed countries will have shrinking populations (see Chart 1).

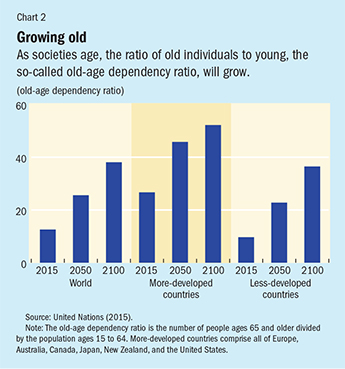

As a result there will be a gradual increase in the ratio of old individuals to young. The global old-age dependency ratio (the number of people ages 65 and older divided by the population ages 15 to 64) will triple over the next 85 years, driven by rapid aging in less-developed countries (see Chart 2). In China and Kenya, for example, the United Nations (UN) projects that the old-age dependency ratio will increase fivefold between 2015 and the end of the century. In more-developed countries, the ratio will double over this period, which is in line with the expected developments in the European Union, Japan, and the United States. The United Nations defines more-developed countries to include all of Europe, Australia, Canada, Japan, New Zealand, and the United States.

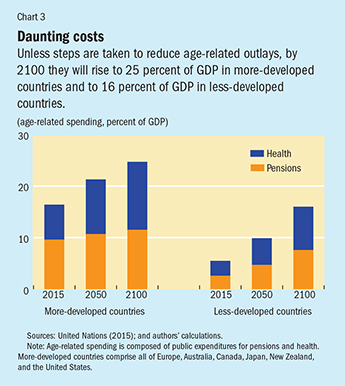

The combination of declining and aging populations portends large and growing fiscal burdens for both more- and less-developed countries. Unless steps are taken to deal with the issue, age-related spending as a percentage of GDP could rise to unmanageable levels—to a quarter of all economic output in more-developed countries. Less-developed countries would also experience a sharp rise in spending.

Unprecedented spending pressure

To assess the long-term implications of this shrinking and aging of the global population, we projected spending for age-related programs (pensions and health) for more than 100 countries between 2015 and 2100. Many studies have looked at long-term spending increases in selected countries through the middle of the century. We were one of the first to look at spending increases for such a large number of countries and extend the analysis to the end of the century. Such a long period is necessary to capture the full effects of the demographic transitions, including shrinking populations, expected in many countries.

Population aging increases government spending because it usually leads to a higher share of the population receiving public pensions and to more use of health care services. The methodology we use incorporates expected changes in the size and age structure of the populations based on recently updated UN demographic projections, the expected evolution of pension benefits under current law, health care spending patterns of various age groups, and growth projections for health care costs.

Our results suggest that countries around the world will face a tremendous fiscal challenge. Under current policies, age-related spending in more-developed countries will reach 25 percent of GDP by the end of the century, representing an increase of 8½ percentage points over today’s levels. In the United States, the expected increase is projected to be more than 11 percentage points, to 32 percent of GDP. In the European Union and Japan, spending increases in the neighborhood of 7 to 7½ percentage points of GDP (to 24 percent and 28 percent, respectively) are expected. These increases will be driven mainly by health care costs. Pension spending will remain relatively contained as a result of pension reforms that have lowered the expected rise in these outlays.

The fiscal consequences of this upward spike in age-related outlays are potentially dire. Such spending increases could lead to unsustainable public debt, require sharp cuts in other spending, or necessitate large tax increases that could stifle economic growth. In less-developed countries, spending is expected to rise to 16 percent of GDP from about 5½ percent today (see Chart 3), but with substantial variation across countries. In China, for example, age-related spending is projected to increase by 13 percentage points of GDP, rising to 20 percent of GDP. In Africa, spending increases will be lower, reflecting a younger population. In Kenya, for instance, these outlays will climb to 9 percent of GDP, an increase of 6 percentage points of GDP over today’s rate.

Additional risks

There is a considerable chance that spending increases could be even higher if demographic developments are less favorable than UN projections. Demographic forecasts are uncertain. In making projections, the United Nations takes into account past demographic trends and country-specific characteristics, relying on state-of-the-art statistical techniques, expert judgment, and all available information. Nevertheless, these projections must be viewed with caution—future fertility, mortality, and migration could differ substantially from predicted levels, and the experts do not all agree. For example, Lutz and others (2014) suggest that world population could peak as early as 2070, reflecting steeper declines in fertility than envisaged by the United Nations, particularly in Africa. Under this scenario, the world population might be significantly lower and older than the United Nations projects.

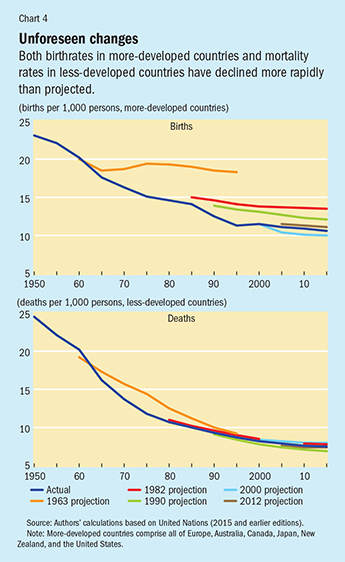

Comparing past projections and actual outcomes serves to illustrate the difficulties involved in forecasting demographic variables. Past “medium” variants of the UN population projections (the median of thousands of country projections using different trajectories of fertility, mortality, and migration assumptions) have proved to be upwardly biased, mainly because fertility rates declined faster than expected (Gros and Alcidi, 2013). For example, the projections from the 1960s to the 1990s assumed a more gradual decline in birthrates than occurred. In contrast, the 2000 projection seems to have overestimated the recent decline (see Chart 4). To some extent, the rapid decline in mortality rates was also not foreseen. For example, for the less-developed countries, the 1963 projection failed to predict the rapid drop in mortality rates observed between 1960 and 1980. Death rates are affected by a diverse set of factors, such as innovations in agriculture, advances in medicine, and improvements in public health management. All in all, birth and mortality rates are affected by factors that can be difficult to predict.

If fertility and mortality turn out to be lower than forecast, the impact on fiscal variables could be dramatic. For example, lower fertility alone could (by increasing dependency rates) raise age-related spending by 8 percentage points of GDP in more-developed countries and 4½ percentage points in less-developed countries by the end of the century. Any larger-than-forecast increases in longevity would further aggravate fiscal problems. With lower fertility, there would be some offsetting reduction in education spending—but its magnitude would be modest: in the more-developed countries, for example, the decline would be about 1½ percent of GDP, and in the less-developed countries, ½ percent of GDP.

Policy reforms

The stark magnitude of the challenges posed by rising age-related expenditures calls for a multipronged approach to mitigate the impact on government budgets. That approach could encompass entitlement reform (which results in direct savings in pension and health spending); policies that affect demographics—for example on immigration and labor markets (which can help increase the share of the population that is working); and efforts to improve tax systems and enhance the efficiency of public spending (which leads to offsetting savings in other areas of the government budget).

Entitlement reform: If changes in eligibility and benefits are to succeed, they should be implemented soon to help spread the burden across generations and reduce the risk of policy reversals.

Containing the growth of health care spending is an urgent priority. For example, if growth in health care costs per capita are kept in line with growth in GDP per capita, we estimate a decline in public health care spending of 4½ percentage points of GDP by 2100 in more-developed countries and of 3 percentage points of GDP in less-developed countries. Countries could pursue health care spending reforms in a number of ways: by increasing competition among insurers and service providers, improving the provider payment system to control costs, paying more attention to primary and preventive health care, and making more effective use of health information technology (Clements, Coady, and Gupta, 2012).

Another important reform is increasing retirement ages to match longevity gains. Many countries have enacted public pension reforms over the last decade, including some increases in retirement ages; however, these may not prove sufficient to sustain pension systems over the long run (Clements, Eich, and Gupta, 2014). We estimate that increasing the retirement age by five years by 2100 has the potential to yield savings on pension spending of about 2 percentage points of GDP in both more- and less-developed countries. Increases in retirement ages should be accompanied by adequate provisions for the poor (Clements and others, 2015), whose life expectancy tends to be shorter than that of the average population (Chetty and others, 2015).

Policies that affect demographics and labor markets—including migration: Higher fertility rates could offset the effects of population aging, but experience shows that public policies have a limited ability to influence birthrates. Still, public policies may have a positive impact on the willingness of mothers to return to paid work or enter the job market. This suggests the need for policies that encourage mothers to rejoin the labor force (for example, through tax credits or subsidized access to child care) and to avoid untargeted child allowances, which have little effect on the birthrate but are costly.

Increasing migration from younger, less-developed countries to older, more-developed ones would relieve spending pressures—at least until migrants age and retire. For example, we estimate that the continuation of historic migration trends from less- to more-developed countries would reduce age-related expenditures by about ½ percentage point of GDP by 2050 and by 2 percentage points of GDP by 2100 in more-developed countries. Increasing migration should not, however, be seen as a substitute for more fundamental reforms of entitlements—migration alone does not alter the balance between public benefits received and taxes paid by individuals over their lifetime. Nevertheless, migration can give countries time to implement needed age-related reforms.

Countries could also consider measures that raise labor force participation rates—especially of women and older workers—to help mitigate the impact of aging. These include addressing gender differences in property rights, inheritance claims, and property titling; enhancing women’s ability to pursue a profession, obtain a job, and open a bank account; and enacting laws that give women the right to initiate legal proceedings, sign a contract, and head a household (Gonzales and others, 2015). In addition, it is crucial to eliminate fiscal disincentives that might deter women from participating in the labor market, such as taxation of household (rather than individual) income, which can raise marginal rates for second earners (Boz and others, 2015). Japan has lately embarked on such a policy reform.

Better tax systems and more efficient public expenditure: Many countries will find it impossible to offset fully the effect of demographics on age-related spending. These countries will have to strengthen their tax systems and generate efficiencies in public spending programs outside of pensions and health.

On the tax side, this could include broadening the base for value-added taxes, strengthening taxation of multinational corporations, greater use of energy taxation to get energy prices right and account for environmental and other costs of energy use, better use of opportunities for recurrent property taxation, and strengthening tax compliance (IMF, 2013).

On the spending side, countries could improve efficiency by reducing energy subsidies, improving public investment management, and rationalizing public sector wage bills, including in education (IMF, 2014).

Addressing the fiscal challenges of shrinking populations will require bold reforms. Countries are likely to choose different solutions depending on their social preferences and vision of the role of government. Nevertheless, countries must urgently rethink, in a fundamental way, what they can and cannot afford when it comes to age-related spending over the longer term. By undertaking reforms now, countries can address these issues in a more gradual and more politically palatable way. ■

Benedict Clements is a Division Chief, and Kamil Dybczak and Mauricio Soto are Economists, all in the IMF’s Fiscal Affairs Department.

This article is based on 2015 IMF Staff Discussion Note 15/21, “The Fiscal Consequences of Shrinking Populations,” by Benedict Clements, Kamil Dybczak, Vitor Gaspar, Sanjeev Gupta, and Mauricio Soto.

References

Boz, Emine, Dirk Muir, Selim Elekdag, and Joana Pereira, 2015, “Women in the Labor Market and the Demographic Challenge,” in Germany: Selected Issues, IMF Country Report 15/188 (Washington: International Monetary Fund).

Chetty, Raj, Sarah Abraham, Shelby Lin, Benjamin Scuderi, Michael Stepner, Nicholas Turner, Augustin Bergeron, and David Cutler, 2015, The Relationship between Income and Life Expectancy in the United States,” 17th Annual Joint Meeting of the Retirement Research Consortium (Washington).

Clements, Benedict, David Coady, and Sanjeev Gupta, eds., 2012, The Economics of Public Health Care Reform in Advanced and Emerging Economies (Washington: International Monetary Fund).

Clements, Benedict, Frank Eich, and Sanjeev Gupta, eds., 2014, Equitable and Sustainable Pensions: Challenges and Experience (Washington: International Monetary Fund).

Clements, Benedict, Ruud Mooij, Sanjeev Gupta, and Michael Keen, 2015, Inequality and Fiscal Policy (Washington: International Monetary Fund).

Gonzales, Christian, Sonali Jain-Chandra, Kalpana Kochhar, and Monique Newiak, 2015, “Fair Play: More Equal Laws Boost Female Labor Force Participation,” IMF Staff Discussion Note 15/02 (Washington: International Monetary Fund).

Gros, Daniel, and Cinzia Alcidi, eds., 2013, http://europa.eu/espas/pdf/espas-report-economy.pdfThe Global Economy in 2030: Trends and Strategies for Europe (Brussels: Centre for European Policy Studies).

International Monetary Fund (IMF), 2013, Fiscal Monitor: Taxing Times (Washington, October).

———, 2014, Fiscal Monitor: Public Expenditure Reforms: Making Difficult Choices (Washington, April).

Lutz, W., W.P. Butz, S. K.C., W. Sanderson, and S. Scherbov, 2014, “Population Growth: Peak Probability,” Science, Vol. 346, No. 6209, p. 561.

United Nations, 2015, World Population Prospects: 2015 Revision (New York).