A Move South

Finance & Development, March 2016, Vol. 53, No. 1

Rabah Arezki, Frederick van der Ploeg, and Frederik Toscani

A growing number of large resource finds are in the developing world, reflecting growing openness in their economies

High-income countries have long been the main users and suppliers of natural resources.

It could be bauxite, copper, and iron ore across much of Europe—not to mention coal, lead, mercury, zinc, and oil and natural gas. English and Belgian coal deposits fueled the Industrial Revolution.

When the United States achieved independence in the late 18th century it was widely thought of as a country with “an abundance of land but virtually no mining potential.” (O’Toole, 1997). But a century later, after the rebellious colonies had developed into a stable country, the United States not only became a high-income country in today’s parlance but it overtook Europe to become the world’s major resource producer.

Today, though, the high-income-country share of global resource deposits has fallen, driven by growth in discoveries in other, less-developed parts of the world.

We document a major shift in resource exploration and extraction from high-income regions, or the “North,” to emerging market and developing economies, or the “South.” This shift in resource discovery and extraction is associated with efforts in emerging market and developing economies to open up to foreign investment and/or improve their institutions— including through more stable government and stronger rule of law. That North-South shift mirrors on a global scale what happened in the United States after independence.

The new policies that have sparked a move south in global resource exploration and extraction operate over and above other forces that affect natural resource exploitation, such as rising global demand, especially from emerging markets, and depletion of deposits in the North. That shift has important implications both for the welfare of individual countries and for our global understanding of the balance of forces shaping commodity markets. Moreover, the increasing number of finds in developing economies puts to rest concerns that the world will soon run out of mineral and oil resources.

North to South shift

The data on known reserves of subsoil assets suggest that developing economies have much more oil, metals, and minerals to discover. There is an estimated $130,000 worth of known subsoil assets beneath the average square kilometer of advanced and emerging market Organisation for Economic Co-operation and Development (OECD) member countries. That is much more than the roughly $25,000 in known assets in Africa (Collier, 2010; McKinsey Global Institute, 2013).

But it is unlikely that such differences in asset value can be explained by variations in geological formations between advanced and developing economies. It is much more likely that the difference is largely the result of more exploration in the OECD countries. The amount of resources a country knows it has and can get out of the ground changes as investment in exploration finds new deposits—and as technology increases the amount of deposits that can be extracted.

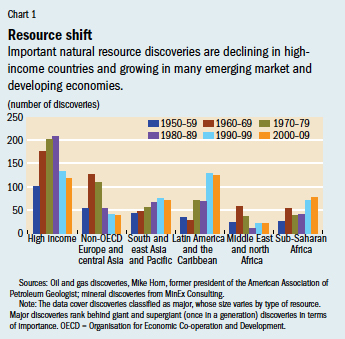

That there are many deposits yet to be found in emerging market and developing economies seems to be borne out by developments over the past few decades. We have developed a data set that covers major discoveries between 1950 and 2012 in 128 countries for 33 natural resources—including oil, metal ores, and minerals. While the total number of annual discoveries has remained broadly constant globally, where those discoveries occur has changed (see Chart 1). OECD countries accounted for 37 to 50 percent of all discoveries between 1950 and 1989, but for only 26 percent in the past decade, with sub-Saharan Africa and Latin America doubling their shares, to 17 percent and 27 percent, respectively. Latin America has had the most mineral and oil discoveries in the past two decades. Data on major oil and natural gas discoveries come from Mike Horn, a former president of the American Association of Petroleum Geologists. Data on major mineral discoveries were obtained from MinEx Consulting.

Resource discoveries and institutions

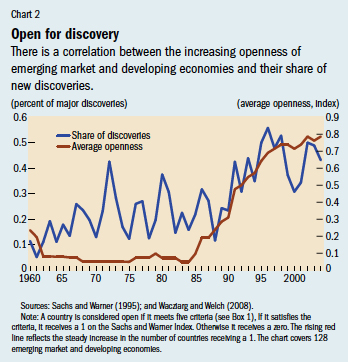

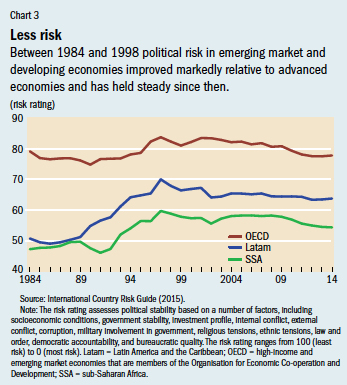

Differences in the quality of property rights and political stability (that is, the institutional environment) between advanced and developing economies can help explain why historically there have been relatively fewer exploration efforts in developing economies—and as a result fewer assets have been discovered. But this is changing. A widely used measure of market orientation (see Box 1) suggests that the rapid improvement in the institutional environment in many developing economies in the 1990s coincided with the increase in the share of oil and mineral discoveries in Latin America and Africa (see Chart 2). The evolution of principles such as the rule of law (see Box 2) over the past decades also shows a North-South convergence as various emerging market and developing economies adopted standards already prevalent in the North (see Chart 3).

Box 1. Market orientation

To measure market orientation, we use data on opening economies from 133 countries between 1950 and 2001. The measure was first designed by Sachs and Warner (1995) and extended by Wacziarg and Welch (2008). To be classified as open, a country must meet five criteria: the average tariff rate on imports is less than 40 percent; nontariff trade barriers affect less than 40 percent of imports; the economy is not socialist (where the state largely owns the means of production); the state does not have a monopoly on the major exports; and any black market premium for the currency is lower than 20 percent. If a country in any given year satisfies all five criteria it is classified as open and receives a score of 1. If it does not, it receives a zero.

Box 2. Rule of law

There are two aspects to the rule of law (ICRG, 2015). The first relates to the strength and impartiality of the legal system. The second encompasses the notion of “order,” that is, how well the laws are followed. A country can have a highly rated judicial system but an overall low rating if it has a very high crime rate or if its citizens routinely ignore laws with impunity.

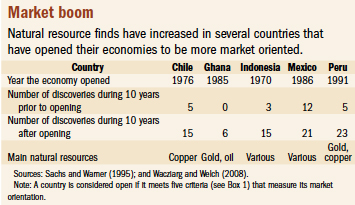

There is solid anecdotal evidence of a link between better institutions and more discoveries across continents and types of natural resources (see table). The increase in discoveries after countries open up to the global economy tends to be quite stark. In Peru, for example, discoveries more than quadrupled, in Chile they tripled, and in Mexico they doubled. These discoveries not only occurred when commodity prices were high, but also when commodity prices were at historical lows.

Researchers such as Cust and Harding (2014) have already shown that institutions have a substantial effect on oil and gas exploration. They did so by identifying how differences in institutions affect exploitation of oil deposits that sit on both sides of a border. They found that there is twice as much oil drilling on the side that has better institutions, as measured for example by the level of constraint on the executive (which has been shown to reduce expropriation). However, while Cust and Harding looked exclusively at oil, we include minerals in our analysis and believe that we are the first to document the North to South shift in global resource extraction, which is especially pronounced for minerals.

The theoretical literature on exhaustible resource exploitation and exploration dates back to a paper by Robert S. Pindyck, in which he demonstrated how a planner can maximize the value of social benefits from consumption of oil and how the reserve base can be replenished through exploration and discovery of new fields (1978). We expanded Pindyck’s model to take into account that much of the exploration and development is carried out by multinational companies under a contract with an emerging market or developing economy. In addition to the physical cost of extraction multinational corporations incur, they can also face political risks and other institutional problems not present in the North. We included a “tax” in our model to capture costs not found in the North.

Of course, other factors affect exploration and extraction—such as the cost of discoveries and the demand for natural resources. To see how well our institution-focused model reflected reality, we developed predictions from the model and tested them against the data set of 128 countries. We included country, year, and geographic location and controlled for global common shocks and technological progress. To account for institution quality we included the generic measure of market orientation mentioned above.

The empirical analysis is consistent with our model’s predictions and with anecdotal information about individual countries. That is, a country’s market orientation is associated with a statistically and economically significant increase in the likelihood of resource discovery. In all situations we found that countries discover more natural resources after they adopt market-based institutions, especially when they improve the investment climate and government stability—for example, when contracts are strengthened or expropriation risk is reduced. A country’s proven resource endowment is thus in part determined by its institutions.

Our analysis suggests that if all of Latin America and sub-Saharan Africa were to adopt the same quality of institutions as the United States, the number of discoveries worldwide would increase by 25 percent, all else equal.

Institutions can affect discoveries in many ways. A stronger rule of law may reduce the risk perceived by potential foreign investors, making them more willing to undertake the long-term investments usually required in resource exploration and extraction. This could make it easier for a country to adopt better technology, if, for example, stronger contracts make the prospect of costly investments in technology more attractive. The institutional changes could also improve the quality of the labor force and in turn affect the number of discoveries if they stimulate public investment in education. The quality and quantity of U.S. mining schools, for example, is seen as key to the many natural resource discoveries there in the late 19th century. We did not attempt to determine which of these elements was the most important way better institutions foster exploration and extraction; we merely document that better institutions are associated with more discovery and development of resources.

Many researchers, such as Acemoglu, Johnson, and Robinson (2001), have found a close relationship between the quality of institutions and overall economic development. Our research supports those findings, at least insofar as resource development can be considered part of overall economic development. We found systematic evidence that policies geared toward economic liberalization and/or improvement in institutions lead to major natural resource discoveries that increase the level of known resources and eventually push those countries toward extractive activities.

What consequences for the South?

From a policy standpoint, the North-South shift in the frontier of resource exploitation is likely to have important, mainly beneficial, consequences for individual economies with newly found natural resources. Indeed, these discoveries expand the list of resource-rich countries. They also portend positive economic developments. New mines mean more investment and jobs, especially in the resource sector, and increased government revenues, which if spent properly can increase the health and welfare of the people. The new production has fostered new trade routes from Latin America and Africa to emerging Asia—such as China-Ghana and China-Chile—multiplying commodity trade alone on those routes by more than 20 times since the 1990s.

However, these newly found resources pose challenges for policymakers in developing economies, not the least of which is ensuring that countries do not squander their natural resources—the so-called natural resource curse. Income from the new resource discoveries must be spent on high-quality, growth-enhancing investment to ensure that the whole country benefits. Better knowledge of what lies beneath their soil is important, but it is equally important for authorities to negotiate with multinational corporations to find the just middle ground between giving incentives to exploration and ensuring that resource income will further development.

Doomsday unlikely

The gradual improvement in institutions and, during the last 13 years, high commodity prices have led to a scramble for natural resources. However, the recent dramatic plunge in oil and other commodity prices will reduce the incentive to open mines and drill fields, which will hamper the move from discoveries to natural resource production.

From a broader perspective, while demand for natural resources from emerging markets has been a key driver of recent global commodity market developments, progress in the quality of institutions has helped increase the supply of commodities and diversified the sources of those commodities. Our findings puncture doomsday scenarios such as the peak oil hypothesis, which predicted that global oil production would peak in the year 2000.

Of course, exploration and development have not increased only in countries with newly improved institutions. The North has also benefited from new technologies that enhance exploration and allow recovery of resource deposits that could not be extracted using older techniques. In effect, investment in technology can increase resource endowment. For example, new so-called unconventional technology in the United States permits extraction of oil from tight rock formations once thought unsuitable for drilling. As a result, oil production in the United States has grown significantly in the past five years. The reemergence of U.S. oil production suggests that technology, depending on how and where it is adopted, could to some degree attenuate the North-South shift in the frontier of resource extraction. That said, as the South continues to develop an environment that encourages investment, the move of resource exploration and extraction to emerging market and developing economies will continue. ■

Rabah Arezki is the Chief of the Commodities Unit in the IMF’s Research Department, Frederick van der Ploeg is a Professor of Economics at the University of Oxford, and Frederik Toscani is an Economist in the IMF’s Western Hemisphere Department.

This article is based on the authors’ forthcoming IMF Working Paper, “Shifting Frontiers in Global Resource Extraction: The Role of Institutions.”

References

Acemoglu, Daron, Simon Johnson, and James A. Robinson, 2001, “The Colonial Origins of Comparative Development: An Empirical Investigation,” American Economic Review, Vol. 91, No. 5, pp. 1369–401.

Collier, Paul, 2010, The Plundered Planet: Why We Must—And How We Can—Manage Nature for Global Prosperity (Oxford, United Kingdom: Oxford University Press).

Cust, James, and Torfinn Harding, 2014, “http://www.oxcarre.ox.ac.uk/files/OxCarreRP2013127(2).pdfInstitutions and the Location of Oil Exploration,” OxCarre Working Paper 127 (Oxford, United Kingdom: Oxford University Centre for the Analysis of Resource Rich Economies).

International Country Risk Guide (ICRG), 2015, PRS Group (Syracuse, New York).

McKinsey Global Institute, 2013, “Reverse the Curse: Maximizing the Potential of Resource-Driven Economies.

O’Toole, Kathleen, 1997, “Economic Historians Ask: How Natural Were American Natural Resources?” Stanford University News Service.

Pindyck, Robert S., 1978, “The Optimal Exploration and Production of Nonrenewable Resources,” Journal of Political Economy, Vol. 86, No. 5, pp. 841–61.

Sachs, Jeffrey D., and Andrew Warner, 1995, “Economic Reform and the Process of Global Integration,” Brookings Papers on Economic Activity: 1, Economic Studies Program, Brookings Institution, pp. 1–118.

Wacziarg, Romain, and Karen Horn Welch, 2008, “Trade Liberalization and Growth: New Evidence,” World Bank Economic Review, Vol. 22, No. 2, pp. 187–231.