Global Aspirations

Finance & Development, September 2015, Vol. 52, No. 3

Islamic financing is transcending its traditional geographic boundaries and branching out with sukuk and other financial products

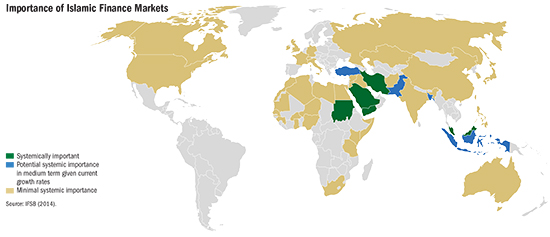

British Prime Minister David Cameron announced at the 2013 World Islamic Economic Forum that he wanted London to become “one of the greatest centers of Islamic finance anywhere in the world.” For people following financial developments, the prime minister’s remarks came as no surprise. In recent years, Islamic banks have begun operating in such countries as Denmark, France, Luxembourg, Nigeria, Switzerland, South Africa, and the United Kingdom. In addition, a number of large European and American banks, such as Citibank and HSBC, have opened Islamic banking windows.

The United Kingdom has five banks dedicated to Islamic finance, more than 20 banks offering Islamic products, and 25 law firms with Islamic finance units. There is $38 billion in sukuk—the Islamic equivalent of bonds—listed in London, primarily issued by businesses and banks based in the Middle East. And an issue of £200 million worth of sovereign sukuk in June 2014 was the first such offering outside the Islamic world.

Since then, Hong Kong SAR, South Africa, and Luxembourg have issued sovereign sukuk.

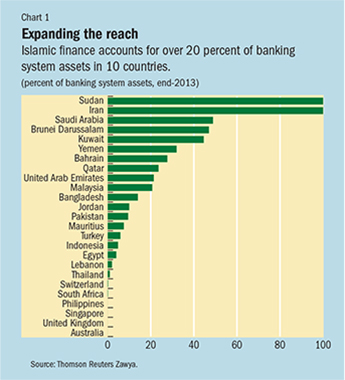

Islamic finance is one of the fastest growing segments of the financial industry, and not just in the Middle East. The growth of Islamic banking outpaced conventional banking over the past decade and now accounts for more than 20 percent of banking system assets in 10 countries: the Islamic Republic of Iran and Sudan, which have full-fledged Islamic financial centers, as well as Bangladesh, Brunei Darussalam, Kuwait, Malaysia, Qatar, Saudi Arabia, the United Arab Emirates, and Yemen (see Chart 1).

Globally, Islamic finance assets grew at double-digit rates in the past decade to reach an estimated $1.8 trillion at the end of 2013, with further growth expected (Ernst & Young, 2014; IFSB, 2014; Oliver Wyman, 2009). This growth reflects demand from large and relatively unbanked Muslim populations seeking to deposit money or invest in sharia-compliant banks and financial products—those that are acceptable under Islamic law (see box). It also represents relatively rapid growth in many countries where these populations reside, as well as the large pool of savings in oil-exporting economies looking for sharia-compliant investment opportunities.

What is Islamic finance?

Islamic finance is the provision of financial services in accordance with Islamic ethical principles and law (sharia). Islamic law requires that financial transactions be geared toward supporting productive economic activity and that funding providers share in both the risk and the profit of the investments they finance. Islamic finance therefore encourages parties in a financial transaction to share the risk and the profit. Tansactions are asset backed or asset based—investors have a claim on the underlying assets. Islamic finance bans the payment of interest (because earning profit from the exchange of money for money is considered immoral), prohibits financial products that involve excessive uncertainty (including short sales and gambling), and rules out financing of activities considered harmful to society.

Distinct qualities

The absence of fixed interest rates and the asset-backed nature of lending of course mean that Islamic banks operate differently from conventional banks. Islamic banks are typically funded by current accounts, which do not receive interest, and profit-sharing investment accounts, on which investors receive a return determined by the eventual profitability of the bank or the pool of assets financed by these accounts. The bank uses these funds to purchase assets—for example, homes in the case of a mortgage or industrial equipment in the case of a business loan—that the bank then sells or leases to the borrower. The financial gain is related to the underlying profitability or rental value of the asset. The bank also engages in equity-like financing of economic projects, sharing both profits and risks with entrepreneurs.

Sukuk operate in a similar way. The investor provides funds used to purchase assets that are then sold or leased to the borrower, with payments made gradually over time. The principal amount is typically not guaranteed, and the return is linked to the underlying purchase price of the asset and the profits it earns, which are then used to compensate the investors. Investors may also engage in partnerships with the issuer on a profit- and loss-sharing basis.

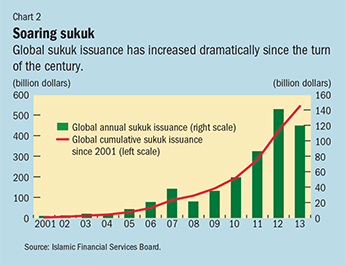

Banking dominates Islamic finance, accounting for about four-fifths of the sector in 2013. But the sukuk market is growing fast (see Chart 2). Its assets equal about 15 percent of the industry, which includes leasing, equity markets, investment funds, insurance, and microfinance.

The growing reach of Islamic finance promises a number of benefits. The principles of risk sharing and asset-based financing can help promote better risk management by financial institutions and customers.

Moreover, Islamic finance institutions can increase the financial inclusion of underserved populations and improve access to finance for small and medium-sized enterprises. And sukuk are well suited for infrastructure financing, thereby supporting growth and economic development. According to a study by the International Finance Corporation (IFC, 2014) among nine countries—Egypt, Iraq, Jordan, Lebanon, Morocco, Pakistan, Saudi Arabia, Tunisia, and Yemen—there is a potential financing requirement of $8.6 billion to $13.2 billion for Islamic financing of small and medium-sized enterprises, with a corresponding deposit potential of $9.7 billion to $15.0 billion. Since many such enterprises refrain from borrowing from conventional banks for religious reasons, there is huge untapped potential for Islamic financing in these countries.

Unique challenges

While the expansion of Islamic finance is expected to support growth, it does pose challenges in terms of the regulation, supervision, and conduct of monetary policy. In addition to the overall supervisory mechanisms conventional finance requires, Islamic finance calls for protection of investment accounts, sharia governance, and certain aspects of capital adequacy requirements in relation to Islamic contracts and treatment of investment accounts. These regulatory and legal issues are particularly important because of the increasing complexity of transactions as they seek to circumvent the prohibition against interest. Risk management is thus equally important for Islamic banks as for conventional banks, although the approach differs in some aspects given the unique nature of underlying Islamic contracts—for instance, to recognize the profit- and loss-sharing characteristic.

Islamic finance has important implications for tax policy. Tax systems typically favor debt- over equity-based financing. Ensuring a level playing field for the tax treatment of Islamic financial transactions is essential or it will be at a competitive disadvantage. There are gaps in central bank instruments in managing the liquidity of Islamic banks. A key issue is to broaden the range of sharia-compliant instruments and build liquid markets. Underdeveloped safety nets, notably a lack of sharia-compliant deposit insurance and lender-of-last-resort facilities, plague Islamic financing. Low consumer literacy rates and the relative scarcity of sharia scholars also present challenges for the industry’s development.

These factors may weaken the scope for Islamic finance to enhance access to finance in jurisdictions where financial development is particularly important for growth. They may also imperil the safety and soundness of the industry. Continuous efforts are therefore needed to improve the way existing standards for Islamic finance are applied, both nationally and internationally.

The industry is still largely nascent, lacks economies of scale, and operates in an environment that does not take advantage of its special characteristics. To fulfill its potential for solid growth, Islamic finance must progress in a number of areas.

Standards have been defined by Islamic standard-setting bodies (including the Islamic Financial Services Board, based in Kuala Lumpur and established in 2002), but regulatory and supervisory practices in many jurisdictions still do not fully address the specific risk characteristics of Islamic banks. This can encourage institutions to capitalize on loopholes to circumvent unfavorable regulations in jurisdictions where Islamic banks operate side by side with conventional banks or across borders. A critical issue is how capital adequacy is defined. Islamic banking standards give supervisors the discretion to reduce capital requirements if an Islamic bank is funded by profit-sharing accounts that reflect the loss-absorbing nature of the transaction. But such discretion must be applied both transparently and without overestimating banks’ ability to impose losses on their account holders.

A critical gap facing Islamic banks and the monetary authorities in their jurisdictions is the relative dearth of sharia-compliant money market instruments and markets. This undermines Islamic banks’ scope for effective liquidity management, forcing them to hold greater cash balances than necessary and constraining their ability to deploy their deposits in the best interests of their depositors and their country’s macroeconomy. Similarly, without transactions in sharia-compliant money markets central banks have limited instruments available to achieve their monetary policy objectives, especially where Islamic banks represent a significant portion of the system. In such cases, an important priority is to encourage the development of shorter-term securities that can be used for transactions between Islamic banks and as collateral for monetary operations.

Islamic financial instruments also pose particular challenges in the areas of consumer and investor protection. For example, account holders in Islamic banks may not always be aware of their exposure to loss: these risks must be explained transparently. Moreover, governance arrangements for Islamic banks should provide an appropriate role for investment account holders, given the additional risks they bear. These difficulties argue for close attention to Islamic Financial Services Board standards.

Enforcing compliance

A growing concern is that responsibility for ensuring sharia compliance is too often left to sharia boards at individual banks, which can lead to inconsistency. To address this problem, a two-pronged approach is required: a strong sharia governance framework at the national level and a role for regulators in ensuring that bank-level sharia supervisory boards are independent and meet certain standards.

A key challenge in all financial systems is to establish frameworks to ensure that shocks to individual institutions and markets, when they occur, are contained and do not undermine confidence in the stability of the broader financial system. Among other things, this requires an effective deposit insurance system, frameworks for legal and bank-specific resolution in the event of financial crises, and the ability to provide emergency liquidity assistance when appropriate.

In many jurisdictions where Islamic banks operate, such frameworks are not yet in place, and where they are, they have yet to be adapted to Islamic finance. In the case of deposit insurance, for example, it is important to clarify how much coverage extends to profit-sharing investment accounts and to ensure that insurance premiums collected from Islamic banks are not commingled with those collected from conventional banks. And the roles of the resolution authority and the sharia board in bankruptcy need to be clarified.

The recent global financial crisis highlighted the importance of policymakers in responding systemwide to risks to financial stability. Islamic finance is often touted as inherently less risky than traditional banking, because lending is asset based and a large share of the financing is in the form of profit- (and loss-) sharing accounts. However, these potential advantages have not been fully tested and may be at least partly offset by Islamic bank balance sheets’ heavy investment in sectors relatively vulnerable to cyclical booms and busts, such as real estate and construction. This argues for improved capacity to monitor the buildup of systemic risk and the development of regulatory and other macroprudential instruments to respond if necessary.

Different tax treatment of debt and equity and higher taxation from multilayered transactions may put Islamic finance at a disadvantage, which calls for balancing measures in jurisdictions where Islamic finance operates alongside a conventional financial system. For example, most corporate tax systems permit the deduction of interest payments from taxable income; to ensure comparability would require similar treatment of the profit payments associated with sharia-compliant contracts. And there are additional complexities associated with the application of certain indirect taxes—such as stamp duties levied on legal documents and other transaction taxes—given that sharia-compliant financial transactions often involve multiple steps. The growing cross-border reach of Islamic finance has brought such issues to the fore and argues strongly for close adherence to best practices.

A growing market

Global issuance of sukuk has grown significantly since 2006, albeit from a low base, and reached $120 billion in 2013: outstanding sukuk totaled $270 billion at the end of that year. Although this represents only about ? percent of global bond markets, and issuance is still concentrated in Malaysia and the Gulf Cooperation Council countries, there is growing interest in Africa, east Asia, and Europe. The demand is driven by a range of entities—sovereigns, multilateral institutions, and multinational and national corporations from developed and emerging market economies—that desire to broaden the range of economic activities and development projects they finance.

Demand for sukuk from Islamic finance institutions, which have few other options for sharia-compliant instruments, is natural. But there is also strong interest from the conventional financial world, thanks to the opportunity these instruments present for diversification. And the development of sovereign sukuk means the ability to establish benchmark yields that will facilitate sharia-compliant funding by private sector entities.

Financing of infrastructure

Sukuk have demonstrated a strong track record in financing infrastructure upgrades. Malaysia has used them for airports, marine ports, and roads. And Queen Alia International Airport in Jordan and the Hajj Terminal, King Abdulaziz International Airport Project in Saudi Arabia are just two examples of Islamic-financed public-private partnerships. The risk-sharing aspect of sukuk gives them an advantage as a funding instrument for infrastructure projects: their design resembles that of public-private partnerships through which investors finance and own the assets, leading to true securitization. Sukuk are designed from the outset to spread risk more broadly because all investors share uniformly, and more flexibly over time because payments are tied to underlying returns rather than to fixed schedules. Moreover, experience shows that sukuk can help countries tap a growing, dedicated, and globally diversified investor base and close countries’ infrastructure gaps. The sukuk market is expected to continue to expand very rapidly, and its development will give Islamic banks access to the high-quality liquid assets needed to comply with international liquidity standards. Deepening this market calls for development of the legal and regulatory framework, strengthening the infrastructure, stepped-up sovereign issuance with diversified maturity to manage public debt under a strong public financial management framework, and secondary market development. International standards for accounting and statistical treatment of sukuk are also a key ingredient.

As Prime Minister Cameron suggested, there is enormous potential for Islamic finance to foster inclusive growth, finance infrastructure, and promote stability, if policies are put in place that take its unique characteristics into account. ■

Ananthakrishnan Prasad is a Deputy Division Chief in the IMF’s Middle East and Central Asia Department and coauthor of The Macroeconomics of the Arab States of the Gulf.

This article is based on a recently published IMF Staff Discussion Note, “Islamic Finance: Opportunities, Challenges, and Policy Options,” by Alfred Kammer, Mohamed Norat, Marco Piñon, Ananthakrishnan Prasad, Christopher Towe, Zeine Zeidane, and an IMF staff team.

References

Ernst & Young, 2014, World Islamic Banking Competitiveness Report 2013–14: The Transition Begins (London).

International Finance Corporation (IFC), 2014, Islamic Banking Opportunities across Small and Medium Enterprises in MENA (Washington).

Islamic Financial Services Board (IFSB), 2014, Islamic Financial Services Industry Stability Report (Kuala Lumpur).

Oliver Wyman, 2009, The Next Chapter in Islamic Finance: Higher Rewards but Higher Risks (New York).