Spill Over

Finance & Development, September 2015, Vol. 52, No. 3

Jiaqian Chen, Tommaso Mancini-Griffoli, and Ratna Sahay

The Federal Reserve’s recent unconventional monetary policies seem to have affected emerging markets more than traditional policies

When the United States sneezes, the saying goes, the rest of the world catches a cold. This adage is not mere folklore. The recent global financial crisis drove home the importance of the United States to the world economy—for both good and bad.

On the positive side, the crisis helped illustrate the power of U.S. monetary policy to prevent a global depression. But those same policies also had important side effects, especially raising asset prices and flooding emerging market economies with capital inflows. Policymakers in these economies expressed concern about the so-called spillover effects of U.S. policy, which increased market volatility and exacerbated related financial stability risks.

We will examine these spillover effects, with a view to gauging what policies best mitigate the risks of destabilizing spillovers.

Unconventional policies needed

The global economy would likely have suffered more had central banks not followed so-called unconventional monetary policies that relied on such innovations as buying nongovernment bonds (widely dubbed “quantitative easing”) to pump up the economy when traditional policies, such as cutting interest rates, were no longer feasible. Nominal interest rates were brought to nearly zero early in the global recession—and have been kept at that minimum level since (the so-called zero bound). Unable to lower rates further, central banks resorted to asset purchase programs that massively increased central bank balance sheets.

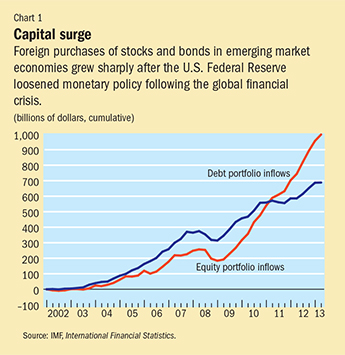

As the period of accommodative monetary policy continued, policymakers in emerging markets began to voice concerns. They claimed that the monetary expansion in advanced economies had spilled over into their economies, causing a surge in capital inflows, especially into debt instruments such as bonds (see Chart 1). Their currencies appreciated and their asset prices rose rapidly. Emerging markets’ policymakers worried about painful adjustments imposed by large shifts in the exchange rate on exporters and on firms that compete with imports. They worried about growing liabilities in temporarily cheaper foreign currencies that risked suddenly becoming a lot more expensive (called balance sheet mismatches). Vulnerabilities to financial systems also stemmed from rapidly rising asset prices, a buildup of credit bubbles, and heavy and rising corporate borrowing. Many policymakers recalled earlier episodes of surging capital inflows, when attempts to dampen bubbles by raising interest rates to increase the cost of borrowing failed because the higher rates attracted more capital inflows and stoked currency appreciation.

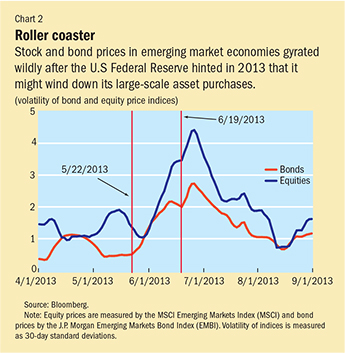

An even sharper wave of criticism from emerging market policymakers erupted after the Federal Reserve, the U.S. central bank, dropped hints that it was considering reducing the pace of asset purchases (or “tapering” in the jargon). When former Fed Chairman Ben Bernanke mentioned this possibility in May 2013, there was a spike in market volatility in emerging markets (see Chart 2) as asset prices dropped sharply.

Crucial questions

There are three important questions concerning spillovers themselves and policies aimed at containing and coping with them:

● Do unexpected changes in U.S. monetary policy affect capital flows to and asset prices in emerging markets and by how much?

● Do these effects differ depending on the phase of U.S. monetary policy—whether interest rate policy was used during the conventional phase preceding the global financial crisis or assets were purchased massively during the unconventional phase (called quantitative easing) after the onset of the crisis? Monetary policy was eased a number of times before the global financial crisis without evoking such strong reactions. It is important, therefore, to distinguish between these two phases to understand better the concerns of emerging market economies.

● Do the effects of sudden changes in U.S. monetary policy vary with the domestic economic conditions of emerging market economies? That is, do the characteristics and policy choices of recipient countries determine the impact of changes in U.S. monetary policies on their economies?

Tailored tools

To investigate these questions it is essential to capture the surprise (or the unexpected) component of U.S. monetary policy announcements. It is these announcements, after all, that set off the spillovers.

Not all announcements are alike. Some are perfectly anticipated by market participants, others not at all. If an announcement corresponds perfectly to what the market expected, it should have no effect on asset prices or portfolio allocations, because these will have been determined in advance based on the expected announcement. That does not mean, though, that monetary policy is ineffective, only that there is not sufficient information to judge its effectiveness. Other examples are also possible. If the central bank announced an increase in interest rates (of, say ? of 1 percent) that was smaller than what markets anticipated (of perhaps ? of 1 percent), then asset prices should increase. But it is not necessarily true, based solely on the observed policy move, that tighter policy (in the sense that rates were hiked by 1/4 of 1 percent) was good for asset prices. The correct interpretation is that because the policy was less tight than anticipated (looser with respect to expectations) asset prices rose. It is essential, then, to capture (in the economists’ lingo, “control for”) the surprise component of monetary policy announcements—that is, the extent to which an announcement differed from what markets expected. Only then can the effects of monetary policy announcements be compared equally, on what might be called “per unit of surprise” terms.

A second dimension of announcements is also important: their informational content. Announcements can provide information about future policy intentions of the central bank relative to the level of policy rates. This is referred to as the signal component of announcements. This component is essential for monetary policy; in fact, it is the primary means through which monetary policy has any bite. A one-time increase or decrease in the policy rate will have little impact on the economy. It is only by signaling future changes in policy rates that the central bank is able to affect the longer-term rates relevant for such economic decisions as investment, hiring, and consumption.

But monetary policy announcements can contain other information as well, which we call the market component of announcements. Through their communication, central banks can relate information about the availability of bonds to private investors (due to the evolving size of the central bank’s balance sheet) and risks to (or uncertainties about) growth and inflation, as well as changes in central bank preferences (for example, on how quickly to bring inflation back to target) and objectives.

Both dimensions of announcements—their surprise and informational content—can be observed in bond prices immediately following monetary policy announcements (in this study, for a one-day window). On one hand, surprises related to the signal component of announcements should affect shorter-term bonds. That is because central banks can only commit to following a course of policy over a period of approximately three years, a period for which they can reasonably forecast the economy. Anything beyond that would be discarded by markets as cheap talk. On the other hand, surprises related to the market component of announcements should affect the premium to hold longer-term bonds. A so-called principal component statistical method is used to extract movements in shorter- and longer-term bond yields on announcement days: the first are taken to represent signal surprises and the second market surprises.

The final step is to measure changes in asset prices and capital flows in emerging markets in response to monetary policy surprises in the United States. This is done following a so-called event study methodology, which examines market reactions in emerging market economies immediately following a monetary policy announcement in the United States. The method is particularly useful in establishing causality, because the dominant shock on announcement days is likely the result of the monetary policy announcement. In addition, the impact on financial markets in emerging markets is assumed to be felt immediately or at least within two days. On average, then, changes in asset prices and capital flows within this time frame can be attributed to U.S. monetary policy shocks.

Spillovers have grown

We examined the reaction of 21 emerging market economies—Brazil, Chile, China, Colombia, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Peru, the Philippines, Poland, Romania, Russia, Singapore, South Africa, Taiwan Province of China, Thailand, and Turkey—to 125 U.S. monetary policy announcements between January 2000 and March 2014 and found that U.S. monetary policy surprises have an immediate (at least over a two-day window) effect on capital inflows and asset price movements in emerging market economies.

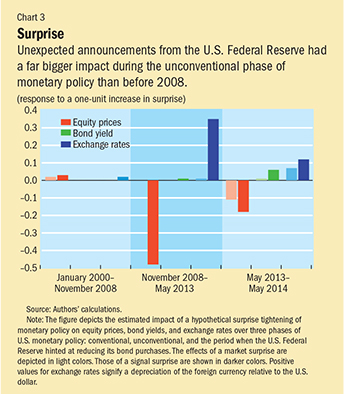

But when we separately examined the periods before the crisis (during the conventional monetary policy phase) and after November 2008 (when large-scale asset purchases started), we found that spillover effects “per unit” of U.S. monetary policy surprise were different and stronger during the unconventional phase. For many assets, spillovers were even larger when the United States began to discuss the tapering of its asset purchases (May 2013 to March 2014). In general, across all phases of monetary policy, spillovers were greatest when announcements surprised markets with information on the future course of policy rates (signal surprises), as opposed to market surprise information that affected longer-term U.S. bond yields (see Chart 3).

We presume that the larger spillover effects during the unconventional phase were likely mostly structural, the result of the bond purchases introduced in the unconventional monetary policy phase and the liquidity that was created. Spillovers per unit of surprise do not seem to depend on the size of the shocks, whether they were associated with loosening or tightening of policy, or whether they came at a turning point in the policy stance (a first attempt to tighten policy, for instance, after an uninterrupted sequence of cuts).

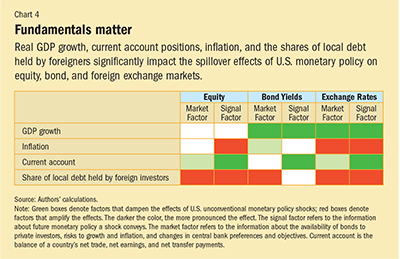

But we also found that spillovers were affected by a country’s economic situation. Countries with stronger fundamentals experienced smaller spillovers. That is, higher real GDP growth and stronger current account positions, as well as lower inflation and smaller shares of local debt held by foreigners, significantly dampened spillover effects, especially during the period of unconventional monetary policy. Some have argued that the effect of fundamentals became stronger over time, as investors began differentiating between countries. But this study finds that fundamentals mattered even in the initial responses to U.S. monetary policy announcements. The green boxes in Chart 4 show the domestic factors that helped dampen the shocks, while the red boxes show those that amplified them.

We also examined whether larger markets and/or more liquid markets (those with many buyers and sellers) exhibited larger spillovers. In theory, the effects of market size alone are ambiguous. This is because there are two opposing forces at play. Larger markets attract more foreign investors, which increases volatility, while at the same time these markets tend to be more liquid, which should dampen volatility. Indeed, in practice, market size alone is not a significant amplifier or dampener of spillovers. However, once we control for market liquidity, there is some evidence that larger markets face bigger spillovers. The effects of market liquidity are clearer—more liquid markets dampen the effect of spillovers, as expected. Thus, as long as markets remain liquid as they grow, risks of spillovers should be contained.

Policy implications

It is not surprising that U.S. monetary policy spills over to the rest of the world, given its dominance in global markets. But we found that especially large spillovers are mostly a recent phenomenon, dating from the global financial crisis.

That spillovers seem larger during the unconventional policy phase underscores a cost of interest rates hitting zero. Hence if large spillovers are to be avoided, proper policies need to be adopted in good times to minimize risks of hitting the zero lower bound in bad times. These policies could include other macroeconomic areas, such as spending and taxation, to stabilize the relationship between debt and GDP and maintain fiscal room to support the economy in downturns. Even structural reforms in, say, labor markets or education to boost growth and employment could come into play. To maintain financial stability, prudential policies should also be used. Such prudential policies could include imposition of capital or liquidity requirements on lenders and loan-to-value or debt-service-to-income limits on borrowers.

There is also a lesson for emerging market economies. Because the adverse effects of spillovers from U.S. monetary policy are related to the economic conditions of the recipient country—that is, better fundamentals and more liquid markets help dampen the effects of U.S. monetary policy shocks—emerging market economies should improve their fundamentals as much as possible. Other policies, such as foreign exchange intervention, or even capital flow management measures, can be used during periods of turmoil or crisis to deal with excess volatility and disorderly market conditions, but should not be viewed as a substitute for good overall economic policies.

Spillovers are more prevalent and larger if they are the result of signal surprises. This is good news, because the signaling channel is better understood by central banks, and can be better managed through clear communication about immediate and future policy intentions. The Federal Reserve and other influential central banks should, therefore, be able to contain the source of shocks that lead to global spillovers.

At the same time, even though market surprises have smaller spillovers, their effects are less differentiated across countries and more unpredictable. To mitigate the effects of market surprises, advanced economy central banks should focus on minimizing shocks to long-term bond yields when the central banks reduce or end their reliance on unconventional monetary policies. They could do this, for instance, by letting the assets they have accumulated mature rather than selling them. If they do choose to sell them, they should do so in a very predictable manner. ■