The Toll of Terrorism

Finance & Development, June 2015, Vol. 52, No. 2

Subhayu Bandyopadhyay, Todd Sandler, and Javed Younas

Terrorists not only exact a direct human cost, they can cause innumerable economic problems too

New technology has lowered transportation costs and increased trade and capital flows across nations. But the same technology that has fostered international economic growth has also allowed terrorism to spread easily among countries whose interests are tightly interwoven. Terrorism is no longer solely a local issue. Terrorists can strike from thousands of miles away and cause vast destruction.

The effects of terrorism can be terrifyingly direct. People are kidnapped or killed. Pipelines are sabotaged. Bombers strike markets, buses, and restaurants with devastating effect. But terrorism inflicts more than human casualties and material losses. It can also cause serious indirect harm to countries and economies by increasing the costs of economic transactions—for example, because of enhanced security measures to ensure the safety of employees and customers or higher insurance premiums. Terrorist attacks in Yemen on the USS Cole in 2000 and on the French tanker Limburg in 2002 seriously damaged that country’s shipping industry. These attacks contributed to a 300 percent rise in insurance premiums for ships using that route and led ships to bypass Yemen entirely (Enders and Sandler, 2012).

In this article we explore the economic burden of terrorism. It can take myriad forms, but we focus on three: national income losses and growth-retarding effects, dampened foreign direct investment, and disparate effects on international trade.

Disrupting production

Economic researchers have found, perhaps unsurprisingly, that rich, large, and diversified economies are better able to withstand the effects of terrorist attacks than small, poor, and more specialized economies.

If terrorism disrupts productive activities in one sector in a diversified economy, resources can easily flow to another unaffected sector. In addition, richer economies have more and better resources to devote to counterterrorism efforts, which presumably reduces the number of terrorist activities with which they must cope.

In contrast, small developing economies, which are specialized in a few sectors, may not have such resilience. Resources such as labor or capital may either flow from an affected sector to less productive activities within the country or move to another country entirely. Moreover, developing economies are likely to lack specialized resources—such as surveillance equipment or a technologically advanced police force or army—that can be employed in counterterrorism. This allows the terrorist threat to persist, which can scare away potential investors. A terrorist attack against such a nation is likely to impose larger and more lasting macroeconomic costs.

The dramatic attacks on the United States on September 11, 2001, for example, caused an estimated $80 billion in losses. Large as they were, however, the losses were a tiny fraction (less than 0.1 percent) of the nearly $10.6 trillion 2001 U.S. GDP. Similarly, Blomberg, Hess, and Orphanides (2004) found rather modest effects on average in 177 nations from transnational terrorist attacks during 1968–2000. Per capita GDP growth was reduced by 0.048 percent on an annual basis.

But the effects are more dire in smaller nations, such as Colombia and Israel, and regions, such as the Basque Country in Spain, where terrorism-related damage has been much more significant. For example, terrorism cost the Basque Country more than 10 percent in per capita GDP losses from the mid-1970s to the mid-1990s, when the problem was acute (Abadie and Gardeazabal, 2003). Moreover, terrorism affects economies differently, depending on their stage of development. Gaibulloev and Sandler (2009) divided a sample of 42 Asian countries into 7 developed and 35 developing economies. Their estimates suggest that terrorism did not significantly hamper growth in the developed economies, but they show that each additional transnational terrorist incident (per million people) reduced an affected developing economy’s growth rate by about 1.4 percent. These findings further support the notion that smaller developing economies are more economically vulnerable to terrorism than those that are richer and diversified.

Scaring off investors

Increased terrorism in a particular area tends to depress the expected return on capital invested there, which shifts investment elsewhere. This reduces the stock of productive capital and the flow of productivity-enhancing technology to the affected nation.

For example, from the mid-1970s through 1991, terrorist incidents reduced net foreign direct investment in Spain by 13.5 percent and in Greece by 11.9 percent (Enders and Sandler, 1996). In fact, the initial loss of productive resources as a result of terrorism may increase manyfold because potential foreign investors shift their investments to other, presumably safer, destinations. Abadie and Gardeazabal (2008) showed that a relatively small increase in the perceived risk of terrorism can cause an outsized reduction in a country’s net stock of foreign direct investment and inflict significant damage on its economy. We analyzed 78 developing economies over the period 1984–2008 (Bandyopadhyay, Sandler, and Younas, 2014) and found that on average a relatively small increase in a country’s domestic terrorist incidents per 100,000 persons sharply reduced net foreign direct investment. There was a similarly large reduction in net investment if the terrorist incidents originated abroad or involved foreigners or foreign assets in the attacked country. We also found that greater official aid flows can substantially offset the damage to foreign direct investment—perhaps in part because the increased aid allows recipient nations to invest in more effective counterterrorism efforts.

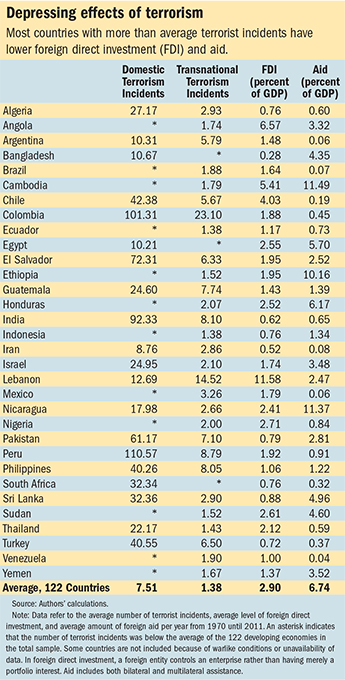

Most countries that experienced above-average domestic or transnational terrorist incidents during 1970–2011 received less foreign direct investment or foreign aid than the average among the 122 in the sample (see table). It is difficult to assess causation, but the table suggests a troubling association between terrorism and depressed aid and foreign direct investment, both of which are crucial for developing economies.

It is generally believed that there are higher risks in trading with a nation afflicted by terrorism, which cause an increase in transaction costs and tend to reduce trade. For example, after the September 11 attacks on New York City and the Washington, D.C., area, the U.S. border was temporarily closed, holding up truck traffic between the United States and Canada for an extended time. Nitsch and Schumacher (2004) analyzed a sample of 200 countries over the period 1960–93 and found that when terrorism incidents in a pair of trading countries double in one year, trade between them falls by about 4 percent that same year. They also found that when one of two trading partners suffers at least one terrorist attack, it reduces trade between them to 91 percent of what it would be in the absence of terrorism. Blomberg and Hess (2006) estimated that terrorism and other internal and external conflicts retard trade as much as a 30 percent tariff. More specifically, they found that any trading partner that experienced terrorism experienced close to a 4 percent reduction in bilateral trade.

But Egger and Gassebner (2015) found more modest trade effects. Terrorism had few to no short-term effects; it was significant over the medium term, which they defined as “more than one and a half years after an attack/incident.” Abstracting from the impact of transaction costs from terrorism, Bandyopadhyay and Sandler (2014b) found that terrorism may not necessarily reduce trade, because resources can be reallocated. If terrorism disproportionately harmed one productive resource (say land) relative to another (say labor), then resources would flow to the labor-intensive sector. If a country exported labor-intensive goods, such as textiles, terrorism could actually lead to increased production and exportation. In other words, although terrorism may reduce trade in a particular product because it increases transaction costs, its ultimate impact may be either to raise or reduce overall trade. These apparently contradictory empirical and theoretical findings present rich prospects for future study.

Of course terrorism has repercussions beyond human and material destruction and the economic effects discussed in this article. Terrorism also influences immigration and immigration policy. The traditional gains and losses from the international movement of labor may be magnified by national security considerations rooted in a terrorism response.

For example, a recent study by Bandyopadhyay and Sandler (2014a) focused on a terrorist organization based in a developing country. It showed that the immigration policy of the developed country targeted by the terrorist group can be critical to containing transnational terrorism. Transnational terrorism targeted at well-protected developed countries tends to be more skill intensive: it takes a relatively sophisticated terrorist to plan and successfully execute such an attack. Immigration policies that attract highly skilled people to developed countries can drain the pool of highly skilled terrorist recruits and may cut down on transnational terrorism. ■

Subhayu Bandyopadhyay is Research Officer at the Federal Reserve Bank of St. Louis and Research Fellow at IZA, Bonn, Germany. Todd Sandler is Vibhooti Shukla Professor of Economics and Political Economy at the University of Texas at Dallas. Javed Younas is Associate Professor of Economics at the American University of Sharjah, United Arab Emirates. The authors write in their personal capacity, and this article does not necessarily reflect the view of the Federal Reserve Bank of St. Louis or the Federal Reserve system.

References

Abadie, Alberto, and Javier Gardeazabal, 2003, “The Economic Costs of Conflict: A Case Study of the Basque Country,” American Economic Review, Vol. 93, No. 1, pp. 113–32.

———, 2008, “Terrorism and the World Economy,” European Economic Review, Vol. 52, No. 1, pp. 1–27.

Bandyopadhyay, Subhayu, and Todd Sandler, 2014a, “Immigration Policy and Counterterrorism,” Journal of Public Economics, Vol. 110, pp. 112–23.

———, 2014b, “The Effects of Terrorism on Trade: A Factor Supply Analysis,” Federal Reserve Bank of St. Louis Review, Vol. 96, No. 2, pp. 229–41.

———, and Javed Younas, 2014, “Foreign Direct Investment, Aid, and Terrorism,” Oxford Economic Papers, Vol. 66, No. 1, pp. 25–50.

Blomberg, S. Brock, and Gregory D. Hess, 2006, “How Much Does Violence Tax Trade?” The Review of Economics and Statistics, Vol. 88, No. 4, pp. 599–612.

———, and Athanasios Orphanides, 2004, “The Macroeconomic Consequences of Terrorism,” Journal of Monetary Economics, Vol. 51, No. 5, pp. 1007–32.

Egger, Peter, and Martin Gassebner, 2015, “International Terrorism As a Trade Impediment?” Oxford Economic Papers, Vol. 67, No. 1, pp. 42–62.

Enders, Walter, and Todd Sandler, 1996, “Terrorism and Foreign Direct Investment in Spain and Greece,” Kyklos, Vol. 49, No. 3, pp. 331–52.

———, 2012, The Political Economy of Terrorism (New York: Cambridge University Press, 2nd ed.).

Gaibulloev, Khusrav, and Todd Sandler, 2009, “The Impact of Terrorism and Conflicts on Growth in Asia,” Economics and Politics, Vol. 21, No. 3, pp. 359–83.

Nitsch, Volker, and Dieter Schumacher, 2004, “Terrorism and International Trade: An Empirical Investigation,” European Journal of Political Economy, Vol. 20, No. 2, pp. 423–33.