Slow Trade

Finance & Development, December 2014, Vol. 51, No. 4

Cristina Constantinescu, Aaditya Mattoo, and Michele Ruta

Part of the global trade slowdown since the crisis has been driven by structural, not cyclical, factors

What’s up with world trade growth?

After bouncing back in 2010 from the

historic low of the Great Recession,

it has been surprisingly sluggish.

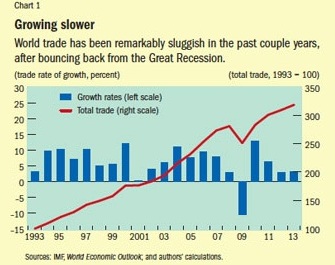

Trade grew by no more than 3 percent in 2012 and 2013, compared with the precrisis average of 7.1 percent (1987–2007; see Chart 1). For the first time in over four decades, trade has grown more slowly than the global economy. Economists wonder whether this global trade slowdown is a cyclical phenomenon that will correct itself with time or is attributable to deeper and more permanent (that is, structural) determinants—and what the answer means for the future of world trade and income growth.

Cyclical or structural

Many economists argue that the global trade slowdown is mostly a cyclical phenomenon, driven by the crisis that has afflicted Europe in recent years. This view has some empirical support. The European Union (EU) accounts for roughly one-third of total world trade volumes because, by convention, trade between EU countries is counted in world trade totals. The crisis depressed import demand across Europe. Imports in the euro area—the epicenter of the crisis—declined by 1.1 percent in 2012 and increased by a mere 0.3 percent in 2013. From this point of view, if European economies recover, world trade growth should pick up again.

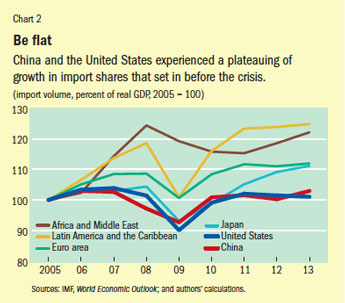

Cyclical components such as the crisis in Europe, however, are only part of the story. A look at the ratio of imports to GDP over the past 10 years suggests that there are longer-term components of the current trade slowdown. Although most economies recorded a stable ratio of imports to GDP after the crisis, this flatness in import shares appears to predate the crisis for China and the United States. For these two countries, import volumes as a share of real GDP have been roughly constant since 2005: a “Great Flatness” seems to have set in before the Great Recession, pointing to the presence of longer-term determinants of the global trade slowdown (see Chart 2).

Indeed, this prolonged flatness reflects something deeper: a structural change in the relationship between trade and income in the 2000s compared with the 1990s. In a recent paper (Constantinescu, Mattoo, and Ruta, 2014), we analyze this relationship for the past four decades and find that the responsiveness of trade to income—what economists call the long-term trade elasticity to income—rose significantly in the 1990s but declined in the 2000s to the levels of the 1970s and early 1980s. In the 1990s, a 1 percent increase in global income was associated with a 2.2 percent increase in world trade.

But this tendency for trade to grow more than twice as fast as GDP ended around the turn of the century. In the 2000s, a 1 percent increase in world income has been associated with only a 1.3 percent increase in world trade. Our research confirmed that there was a statistically significant change in the trade-income relationship in the 1990s compared with before and after that period.

These results suggest that since the global financial crisis, trade has been growing more slowly not only because world income growth is lower but also because trade itself has become much less responsive to income growth. The trade slowdown has roots deeper than the cyclical factors that are affecting world GDP growth. Indeed, analysis of the long- and short-term components of trade growth shows that, in contrast to the trade collapse of 2009, the current global trade slowdown is mostly driven by structural rather than short-term factors (see Chart 3).

A drunk and his dog

Studying the relationship between global trade and income is like analyzing the behavior of a drunk and his puppy dog: neither is walking in a straight line, but we nevertheless expect them to remain fairly close to each other. After all, the world is a closed economy and the magnitude of exchanges of goods and services must be related to the economic activity that takes place within it.

But the relationship between trade and income changes over time; a number of factors sometimes bring them closer together and sometimes push them farther apart. There are several possible explanations for the lower responsiveness of trade to income:

• changes in the structure of trade associated with the expansion or contraction of global supply chains (see “Chained Value,” F&D, March 2014);

• changes in the composition of world trade, such as the relative importance of goods versus services;

• changes in the composition of world income, such as the relative importance of investment and consumption; and

• changes in the trade regime, including the rise of protectionism leading to the fragmentation of the global marketplace.

Our analysis shows that the changing relationship between trade and income at the world level is driven primarily by changes in supply-chain trade in the two largest trading economies, the United States and China, rather than by protectionism or the changing composition of trade and income.

The composition of trade cannot fully explain the lower trade elasticity in the 2000s, because its components (that is, goods and services) have been remarkably stable in recent years. Similarly, the changing composition of demand is not an adequate explanation, because the long-term investment and consumption elasticity of trade are similar. And finally, the rise in protection has not been substantial, even in the aftermath of the financial crisis, suggesting that trade policies are playing a minor role in explaining the reduction in world trade elasticity.

A country-level analysis reveals that the United States and China both experienced significant declines in the responsiveness of trade to growth (a drop from 3.7 to 1.0 for the United States and from 1.5 to 1.1 for China). Europe, in contrast, saw virtually no change. Other regions experienced sizable changes in trade elasticity over time, but they account for a small share of global trade and hence explain little of the change in world trade elasticity.

Variations in the trade-income relationship at the regional and country level are related to the changing structure of international trade. China offers an example of the economic forces at play.

Changing chains

The increased elasticity of trade to income in the 1990s likely reflected the growing fragmentation of production across borders (Escaith, Lindenberg, and Miroundot, 2010). The information and communication technology shock of the 1990s led to a rapid expansion of global supply chains, with an increasing number of parts and components being imported, especially by China, for processing and reexportation. The resulting increases in back-and-forth trade in components led measured trade to race ahead of national income.

Conversely, the decline in China’s trade elasticity may well be a symptom of a further change in that country’s role in international production. There is some evidence that China's international supply chains may have matured in the early 2000s, resulting in lower responsiveness of Chinese trade to GDP. This development is reflected in a fall in the share of Chinese imports of parts and components in total exports, which decreased from its peak of 60 percent in the mid-1990s to the current share of about 35 percent.

All these changes do not mean that China is turning its back on globalization. The lower share of imported parts and components in total exports does reflect the substitution of domestic inputs for foreign inputs by Chinese firms, a finding that is corroborated by evidence of increasing domestic value added in Chinese firms (Kee and Tang, 2014). But the increased domestic availability of inputs has been linked to foreign direct investment. There may also be a geographical dimension to these changes, with China’s coastal regions beginning to source relatively more from the Chinese interior because the costs of transportation and communication with the interior have declined more sharply than those with the rest of the world. Trade integration may now be taking the form of greater internal trade than international trade, but official statistics usually capture only the latter.

The reduced responsiveness of trade to income for the United States mirrors in some ways developments in China. The United States was the primary source of the boom in Chinese and other emerging market economies’ imports in parts and components and was the major destination for their exports of assembled goods. In the 1990s, as U.S. firms increasingly relocated stages of production outside the United States, trade tended to respond more to changes in income. In recent years, even if there has been no retreat from offshoring, the pace of the international fragmentation process seems to have declined. U.S. manufacturing imports as a share of GDP have been stable at about 8 percent since the turn of the century, after nearly doubling over the preceding decade and a half.

In contrast to China and the United States, the responsiveness of trade to GDP in the euro area has remained high in the 2000s. This may be a result of the continuing expansion of supply chains to eastern and central Europe from euro area countries such as Germany.

Old and new engines

Will the global trade slowdown persist? Will it have implications for world growth and for countries seeking to use trade as an engine of growth? Our findings show that the 2012–13 slowdown was driven by a structural (and, hence, more durable) change in the trade-income relationship, indicating that the phenomenon is likely to persist in the coming years. This might affect the growth potential of the world economy because trade and income are not independent of one another.

But we must also recognize that the changing long-term relationship between trade and income underpinning the trade slowdown is a symptom of changing patterns of international production. The high responsiveness of trade to growth in the 1990s reflected the increasing fragmentation of production driven primarily by the United States and China. That particular engine appears to have exhausted its propulsive energy for now. But the scope for increasing international division of labor is still strong in Europe and could be important tomorrow for regions that have not yet made the most of global supply chains, such as south Asia, Africa, and South America. The trade agenda of the Group of Twenty advanced and emerging economies has a role to play in making sure that these opportunities are not missed.

Cristina Constantinescu is a Research Assistant and Michele Ruta is a Senior Economist, both in the External Sector Unit of the IMF’s Strategy, Policy, and Review Department, and Aaditya Mattoo is Research Manager, Trade and International Integration, at the World Bank.

References

Constantinescu, Cristina, Aaditya Mattoo, and Michele Ruta, 2014, “Global Trade Slowdown: Cyclical or Structural?” (unpublished; Washington: IMF and World Bank).

Escaith, Hubert, Nannette Lindenberg, and Sébastien Miroudot, 2010, “International Supply Chains and Trade Elasticity in Times of Global Crisis,” WTO Staff Working Paper ERSD–2010–08 (Geneva: World Trade Organization).

Kee, Hiau Looi, and Heiwai Tang, 2014, “Domestic Value Added in Exports: Theory and Firm Evidence from China” (unpublished; Washington: World Bank).