Shaping Globalization

Finance & Development, September 2014, Vol. 51, No. 3

Done wisely, it could lead to unparalleled peace and prosperity; done poorly, to disaster

Globalization is the big story of our era. It is shaping not just economies, but societies, polities, and international relations.

Many assume it is also, for good or ill, an unstoppable force. History, however, suggests this is not so. We can neither assume globalization will persist, nor that it will be desirable in all respects. But one thing we must assume: it is ours collectively to shape.

If globalization is done wisely, this century could prove an unparalleled era of peace, partnership, and prosperity. If it is done badly, it might collapse as completely as pre–World War I globalization between 1914 and 1945.

Globalization is the integration of economic activity across borders. Other forms of integration—above all, the spread of people and ideas—accompany it. Three interacting forces—technology, institutions, and policy—shape it.

Over the broad sweep of history, technological and intellectual innovation is the driving force behind globalization. It has lowered the cost of transportation and communication, increasing opportunities for profitable economic exchange over greater distances. In the long run, such opportunities will be exploited.

Even before the industrial revolution, mankind’s ability to navigate the seas in sailing vessels facilitated the birth of global empires, transoceanic movement of people, and an expansion in worldwide commerce. But technological change accelerated after the industrial revolution, creating new opportunities.

Driving the globalization of the late 19th and early 20th centuries were the steam locomotive, the steamship, and the telegraph. Driving the globalization of the present era are the container ship, the jet aircraft, the Internet, and the mobile phone.

The integration of communications and computing is the technological revolution of our era. By 2014, the world had 96 mobile-phone subscriptions and 40 Internet users for every hundred inhabitants. Twenty years earlier neither was significant. Information is increasingly digital and the world increasingly interconnected. This is a revolutionary transformation.

Institutions also matter. Historically, empires facilitated long-distance commerce. That was true before modern times and, still more, with the European maritime empires from the 16th to the 20th centuries. Today, the institutions that facilitate long-distance commerce are treaties and multilateral organizations: the World Trade Organisation (WTO), the International Monetary Fund, and regional clubs, such as the European Union.

Semipublic and purely private institutions also matter. Think of the chartered trading company, notably the British East India Company, and then, since the 19th century, the limited liability joint-stock company. Also important are organized markets, notably financial markets, which developed from simple beginnings into the 24-hour, around-the-globe networks of today.

While technology’s arrow has moved in one direction—toward opportunities for economic integration—institutions have not. Empires have come and gone. When the European empires disappeared after World War II, most of the newly independent countries turned away from international commerce, judging it exploitative.

This brings to mind the third driver—policy. The movement of newly independent developing countries toward self-sufficiency was a policy reversal. The most important reversal of all was the worldwide collapse in globalization that followed the two world wars and the Great Depression. The monetary order then disintegrated, and trade became increasingly restricted.

After World War II, a limited liberalization, largely of trade and the current account, spread across the high-income economies, under U.S. auspices. Then, in the late 1970s and in the 1980s and 1990s, domestic market liberalization, opening of international trade, and loosening of exchange controls spread across the world.

Crucial steps on this journey were China’s adoption of “reform and opening up” in the late 1970s under the leadership of Deng Xiaoping; the election of Margaret Thatcher as U.K. prime minister in 1979 and Ronald Reagan as U.S. president in 1980; the launch of the European Union’s “single market” program in 1985; the Uruguay Round of multilateral trade negotiations, which began in 1986 and ended eight years later; the collapse of the Soviet empire between 1989 and 1991; the opening up of India after its foreign exchange crisis of 1991; the 1992 decision to launch a European monetary union; the creation of the WTO in 1995; and China’s entry into the WTO in 2001.

Embrace of markets

Underlying these changes was a rejection of central planning and self-sufficiency and an embrace of markets, competition, and openness. This is not a global empire. For the first time in history, an integrated world economy connects activities located in a large number of independent states with the shared goal of prosperity.

It worked, albeit imperfectly. According to the McKinsey Global Institute (2014), flows of goods, services, and finance rose from 24 percent of global output in 1980 to a peak of 52 percent in 2007, just before the Great Recession. Between 1995 and 2012, the ratio of trade in goods to world output rose from 16 to 24 percent.

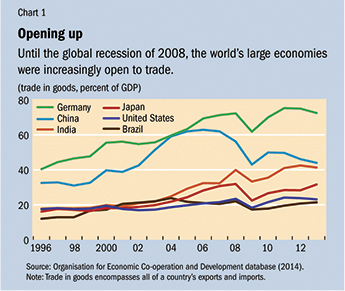

Virtually all economies became more open to trade. The ratio of trade in goods (exports plus imports) to GDP in China rose from negligible levels in the 1970s to 33 percent in 1996 and 63 percent in 2006, before plunging during the financial crisis. The ratio of India’s trade to GDP rose from 18 percent in 1996 to 40 percent in 2008 (see Chart 1).

An important driver of trade expansion was the availability of low-cost workers in emerging economies. Before World War I, the big opportunity was to incorporate undeveloped land, particularly in the Americas, into production for the global market. This time, the biggest opportunity is incorporating billions of previously isolated people as workers and then consumers and savers.

Trade involving emerging economies duly exploded. In 1990, 60 percent of trade in goods was among the high-income economies, another 34 percent was between high-income and emerging market economies, and just 6 percent was among emerging market economies. By 2012, these ratios were 31 percent, 45 percent, and 24 percent, respectively.

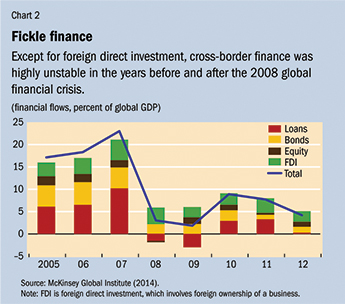

Global companies are central players. This is shown by, among other things, the growth of foreign direct investment (FDI), which results in cross-border ownership of businesses. In 1980, FDI was negligible. Today, it is not just a large flow (averaging 3.2 percent of global output between 2005 and 2012) but a stable one. It has proved triply helpful—as a source of knowledge transfer, a vehicle for promoting cross-border economic integration, and a stable form of finance.

Other areas of finance have been far less stable. Total cross-border financial flows peaked at 21 percent of global output in 2007, before collapsing to 4 percent in 2008 and 3 percent in 2009. A modest recovery ensued. But cross-border lending, bond issuance, and portfolio equity flows had not recovered to precrisis levels even by 2012. Cross-border lending, predominantly from banks, was particularly volatile, as is usual in crise s (see Chart 2).

While trade, finance, and communication have grown rapidly, this is not so true of movements of people. Although, international travelers and foreign students increased markedly, migrants grew at virtually the same rate as the global population—despite huge gaps in real wages. Trade and capital flows are, to an extent, a substitute for movement of people. Yet great pressure for movement of people from poor countries to richer ones persists, particularly across the Rio Grande and the Mediterranean Sea.

Globalization, then, has meant growing cross-border economic activity. But the story is more complex when it comes to prosperity.

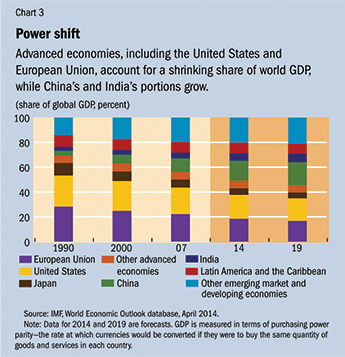

The age of globalization has driven rapid shifts in the location of economic activity. In 1990, the share of the high-income economies in global output at purchasing power parity (or PPP, the rate at which currencies would be converted if they were to buy the same quantity of goods and services in each country) was 70 percent, with the European Union contributing 28 percent and the United States 25 percent. By 2019, according to the IMF, this total will be down to 46 percent.

Over the same period, China’s share is forecast to rise from 4 percent to 18 percent and India’s from 3 percent to 7 percent. The rapid growth of the most successful emerging market economies, which caused this shift, would not have occurred without the access to trade and know-how provided by globalization (see Chart 3).

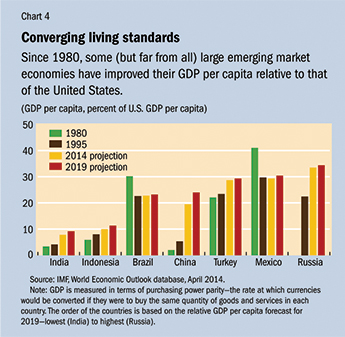

A degree of convergence in standards of living has also occurred (see Chart 4). China’s GDP per capita, relative to the United States, is forecast to rise from 2 percent in 1980 to 24 percent in 2019. This is an extraordinary performance by any standard. China has become a middle-income country with a GDP per capita at PPP forecast to be higher than Brazil’s by 2019. India, too, has registered convergence, though on a more modest scale. Indonesia and Turkey have also done quite well. But Brazil and Mexico are forecast to be poorer relative to the United States in 2019 than they were back in 1980. Seizing the opportunities afforded by globalization turns out to be hard.

Decline in mass poverty

The age of globalization has brought an extraordinary decline in mass poverty, again largely due to China. In east Asia and the Pacific, the proportion of the population living on less than $1.25 a day (at PPP) fell, astonishingly, from 77 percent in 1981 to 14 percent in 2008 (World Bank, 2014). In south Asia, the proportion in extreme poverty declined from 61 percent in 1981 to 36 percent in 2008. In sub-Saharan Africa, however, the share of people in extreme poverty was 51 percent in 1981 and still 49 percent in 2008.

Finally, globalization has been associated with complex shifts in the distribution of incomes across and within countries. The World Bank’s Branko Milanovic (2012) suggests that the degree of inequality among individuals across the globe has stayed roughly constant in the era of globalization, with rising inequality within most economies offsetting the success of some large emerging economies in raising their average incomes relative to those in rich countries. He also shows that the top 5 percent of the global income distribution enjoyed large increases in real income and the top 1 percent very large increases between 1988 and 2008. Those in the 10th to the 70th percentiles from the bottom also did quite well.

Two groups, however, did relatively badly—the bottom 10 percent, the world’s poorest, and those in the 70th to the 95th percentiles from the bottom, who are the middle- to lower-income groups in high-income countries. Thus, a globally beneficial rise in real incomes was associated with rising inequality within many high-income countries. The explanations are complex, but globalization was surely among them.

What might lie ahead?

Technology will continue to drive integration. Soon, almost every adult and many children are likely to own a smart mobile device that offers instant access to all the information available on the World Wide Web. It will make the transmission of everything that can be digitized—information, finance, entertainment, and much else—essentially costless. An explosion of exchange is certain.

While some areas of technology are making leaps, others, such as the cost of transporting goods and people, are not falling to any significant degree. This suggests that technological advances will open up far greater opportunities for trade in ideas and information than in goods or people.

The future of institutions and policy is more doubtful.

Perhaps the most obvious institutional and policy failure has been in liberalized and globalized finance. There were 147 banking crises between 1970 and 2011 (Laeven and Valencia, 2012), some of global significance—particularly the Asian crisis of 1997–98 and the Great Recession of 2008–09—and the subsequent crisis in the euro area. These shocks have had huge economic and fiscal costs. Despite efforts to make the financial system more robust and regulation and supervision more effective, success remains uncertain.

Floating currencies

Closely related to the financial disorder is the monetary system. Since 1971, the global regime has been one of floating currencies, with the U.S. dollar dominant. This has proved workable. But it has also been quite unstable. Many complain that it has permitted the United States to adopt policies that cause unpredictable and unmanageable shifts in capital flows to and from hapless outsiders. Nevertheless, the unloved floating dollar standard is likely to endure, because no other currency and no other global arrangement have any hope of commanding the needed consent, at least in the near future.

Trade policy has been relatively robust, with backsliding into protectionism remarkably well contained in high-income economies. Yet the effort to complete the Doha Round of multilateral trade negotiations has essentially failed, and the future of ambitious (and controversial) plans for plurilateral trade agreements is uncertain. The high tide of trade liberalization may have passed. The growth of world trade in goods may also have slowed permanently.

Some governments are seeking to control the Internet. But the likelihood is that this effort will not halt the flow of commercial activity, though it may restrict the ability of citizens to access politically uncomfortable opinions. Meanwhile, restrictions on movement of people are likely to increase rather than fall in the years ahead.

While economies have become more interconnected, governments continue to supply security, implement laws, regulate commerce, and manage money. Where commerce flows freely, more than one jurisdiction is affected and, by definition, all involved must agree to the legal and regulatory frameworks within which transactions occur.

This contrast between the economic and political dimensions of our globalizing world is a source of unpredictability. The more commerce is to flow, the more states must agree to deep coordination of their institutions and policies, as is evident in the European Union. Such integration can also cause tension, as the euro area crisis showed. For many countries today, a comparable degree of integration remains unthinkable.

For these reasons, globalization is sure to remain somewhat limited. People trade more with fellow citizens than with foreigners. This is in part a result of distance. But it is also a matter of trust and transparency. Borders matter and will continue to do so.

Ultimately, governments must consent to openness. In doing so, they will take into account the domestic political realities. In a world of sluggish growth and rising inequality in many countries, notably high-income ones, the durability of such consent cannot, alas, be assumed. Human beings remain tribal and states remain rivals.

In 1910, at the apogee of pre–World War I globalization, British politician and journalist Norman Angell wrote The Great Illusion, which argued that war would be economically futile. He was right. Intellectually, the leaders of almost all countries now agree: conflict cannot enhance the prosperity of their nations. Yet, as the events of 1914 proved, the fact that war is ruinous does not guarantee it will be avoided, though nuclear weapons have raised the cost of conflict to unimaginable heights.

Even if peace among the great powers is maintained, the cooperation needed to secure an ever more integrated and prosperous global economy may not be. Foremost among the challenges ahead is managing the declining power of the West and the rise of China and other emerging markets. History teaches that neither technology nor economics guarantees globalization’s future in the short to medium term; only political choices do. The onus on us all is to manage the opportunities offered by globalization wisely. ■

References

Laeven, Luc, and Fabián Valencia, 2012, “Systemic Crises Database: An Update,” IMF Working Paper 12/163 (Washington: International Monetary Fund).

McKinsey Global Institute, 2014, Global Flows in a Digital age: How Trade, Finance, People, and Data Connect the World Economy (Seoul, San Francisco, London, Washington).

Milanovic, Branko, 2012, “Global Income Inequality by the Numbers: In History and Now—An Overview” World Bank Policy Research Working Paper 6259 (Washington). http://elibrary.worldbank.org/doi/book/10.1596/1813-9450-6259

World Bank, 2014, World Development Indicators (Washington). http://data.worldbank.org/news/release-of-world-development-indicators-2014