The Cost of Tying One’s Hands

Finance & Development, June 2014, Vol. 51, No. 2

Atish R. Ghosh, Mahvash S. Qureshi, and Charalambos G. Tsangarides

There are benefits to pegging the exchange rate—but without a flexible rate, external adjustment can be tough

Meeting in Mexico City in November 2012, the Group of Twenty finance ministers and central bank governors declared that “the weak pace of global growth also reflects limited progress towards sustaining and rebalancing global demand. . . . In this regard, we reiterate our commitments to move more rapidly toward more market-determined exchange rate systems and exchange rate flexibility to reflect underlying fundamentals. . . .”

The importance of exchange rate flexibility in facilitating the adjustment of current account imbalances has long dominated international policy debates. Before the global financial crisis, the debate focused on global imbalances and how exchange rate policies of several large Asian and oil-exporting countries with external surpluses perpetuated those imbalances. Since the crisis, the challenges confronting many emerging market and advanced economies in Europe have rekindled interest in the relationship between exchange rate flexibility and external adjustment—on both the deficit and surplus sides.

Is there a connection between exchange rate flexibility and external adjustment? Writing in the heyday of the Bretton Woods system of monetary management, the influential economist Milton Friedman (1953) argued that under flexible exchange rates “changes in [the exchange rate] occur rapidly, automatically, and continuously and so tend to produce corrective movements before tensions can accumulate and a crisis develop.”

Thus, in deficit countries, the currency would depreciate, restoring competitiveness and narrowing the deficit; in surplus countries, the currency would appreciate, shrinking the surplus. Under fixed exchange rates, by contrast, the burden of adjustment in deficit countries would fall entirely on downwardly rigid goods and factor prices, while surplus countries would face no compelling adjustment mechanism. A direct corollary of this argument is that external imbalances (current account surpluses or deficits) are less persistent under floating than under fixed exchange rates, reducing the likelihood that dangerous imbalances will build up and eventually precipitate a crisis.

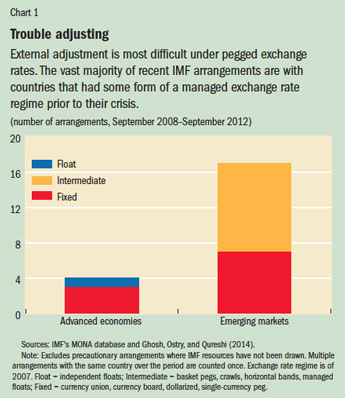

The emerging market financial crises of the 1990s (which all occurred under some form of pegged regime), the large current account deficits in eastern European countries in the run-up to the global financial crisis, and the ongoing efforts of some euro area countries, such as Greece, Portugal, and Spain, all bespeak delayed and more difficult external adjustment under pegged exchange rates. In fact, it is striking that the majority of recent IMF arrangements are with countries that had some form of managed exchange rate regime on the eve of the crisis in 2007 (see Chart 1).

This pattern is consistent with the findings in several empirical studies of a strong association between pegged exchange rates and vulnerability to crises, abrupt reversals of the current account, and growth collapses (for example, Milesi-Ferretti and Razin, 1996; Ghosh, Ostry, and Qureshi, 2014). A natural inference is that the inflexibility of the nominal exchange rate prevents timely external adjustment until large imbalances build up, precipitating a crisis.

While this argument seems compelling, formal evidence that pegged exchange rates impede—and floating exchange rates facilitate—external adjustment is surprisingly scant and contradictory. For example, in a large cross-country study, Chinn and Wei (2013) find no empirically strong or robust relationship between the exchange rate regime and the rate at which current account imbalances are reversed. Focusing on the euro area countries, Berka, Devereux, and Engel (2012) argue that real exchange rate movements within the euro area have been at least as compatible with efficient external adjustment as those for the floating rate countries outside the euro area.

By contrast, some other studies—both of the euro area and more generally—find evidence that exchange rate flexibility does affect external adjustment. For example, for a set of central and eastern European countries, Herrmann (2009) finds that exchange rate flexibility significantly enhances the rate of current account adjustment. Similarly, for the euro area countries, Berger and Nitsch (2014) find that trade imbalances have widened and are more persistent since the introduction of the common currency. Focusing on a large panel of countries—including advanced, emerging market, and developing economies—Ghosh, Qureshi, and Tsangarides (2013) also find that exchange rate flexibility strongly matters for external adjustment.

It is fair to say, therefore, that the profession is far from a consensus on the role of flexible exchange rates in facilitating external adjustment.

Adjustment and exchange rate flexibility

So what gives? Why are existing studies unable to establish an unambiguous relationship between exchange rate flexibility and the ease of external adjustment? We conjecture that it’s because studies generally rely on aggregate or composite measures of exchange rate regimes that do not differentiate between the degree of exchange rate flexibility across various trading partners.

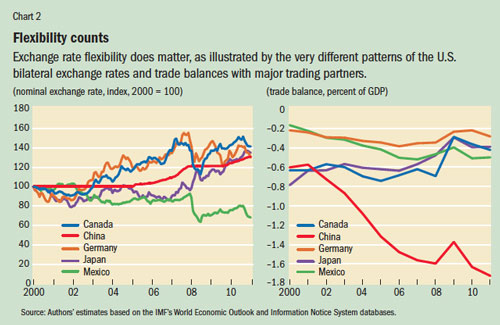

The problem is well illustrated by the case of the United States. Clearly, the U.S. dollar floats, and existing regime classifications categorize it as such. But its exchange rate against many of its major trading partners—which accounts for much of the U.S. trade balance—does not adjust freely.

For example, the exchange rate volatility between the United States and China, which accounts for about 15 percent of U.S. trade, has been less than 0.5 percentage point over the past decade, but about 2½ to 3 percentage points against some of its other top trading partners, such as Canada, Germany, Japan, and Mexico (see Chart 2, first panel). If exchange rate flexibility does matter, then the behavior of the U.S.-China bilateral trade balance should differ from that of other U.S. bilateral relationships. Indeed, this seems to be the case: U.S. deficits with other countries have tended to fluctuate, whereas the deficit with China has consistently worsened, almost tripling over the past decade (see Chart 2, second panel).

There are other examples too. For instance, euro area countries are classified in existing regime classifications either as having floating exchange rates (even though 60 percent of their trade is with each other) or fixed exchange rates (even though 40 percent of their trade is with countries against which they float). Countries that peg to an anchor currency are classified as having a fixed exchange rate, even though their exchange rates may fluctuate against those of their important trading partners. With such disparate relationships between various trading partners, it is hardly surprising that use of a single, composite exchange rate regime classification can yield misleading results.

To correctly identify the effect of pegged exchange rate regimes on external adjustment, it is therefore necessary to examine that relationship using data on trading partners against whose currency the country actually pegs. To this end, we fleshed out the exchange rate relationships across trading partners for 181 countries during 1980–2011 and examined the regime–external adjustment nexus through the prism of bilateral relationships between pairs of countries.

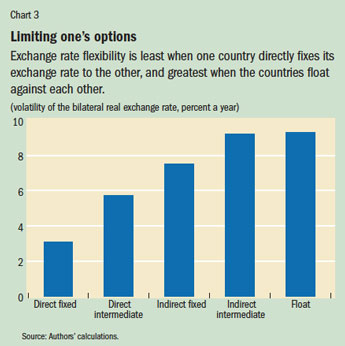

Our data set comprises a three-way bilateral exchange rate regime classification—fixed, intermediate, and floating—for each country vis-à-vis each of its trading partners (for more detail, see Ghosh, Qureshi, and Tsangarides, forthcoming). For fixed and intermediate exchange rate regimes (referred to collectively as “pegs”), we further differentiated between direct and indirect relationships between country pairs. Direct pegs are formed when one country pegs to another (anchor) country’s currency, while indirect pegs are formed between countries that either peg to a common anchor currency or to separate anchor currencies that are themselves pegged to a common anchor currency. Thus, for example, Lithuania is defined as having a direct pegged relationship with euro area countries since the anchor for its currency board arrangement is the euro, whereas it has an indirect peg with countries that also peg to the euro (for example, Bulgaria).

Among the various bilateral exchange rate relationships we examined, both nominal and—assuming sticky prices—real exchange rate flexibility are expected to be lower under fixed exchange rates than under intermediate regimes (and, of course, floats), because the latter imply greater movement in the nominal exchange rate. Between direct and indirect pegs, exchange rate flexibility is expected to be greater under indirect pegs (because, for example, if direct pegs imply stabilizing parity within plus or minus 1 percent, an indirect peg between two countries that directly peg to the same anchor currency could move by plus or minus 2 percent). Overall, therefore, exchange rate flexibility should be the least when one country directly fixes its exchange rate to another and the greatest when the countries float against each other. This indeed appears to be the case empirically—under a direct fixed exchange rate regime, the volatility of the (bilateral) real exchange rate is the lowest, followed by a direct intermediate regime (see Chart 3). Real exchange rate flexibility is greatest when two countries have a floating relationship.

The upshot is that if Friedman’s hypothesis holds, external adjustment should be faster under a float than under a peg and faster when the peg is indirect than when it is direct (because indirect pegs allow relatively greater exchange rate flexibility).

What do the data say?

Combining the bilateral exchange rate relationships with information on bilateral trade balances, we obtained empirical results strongly consistent with Friedman’s hypothesis. Trade imbalances under both direct and indirect pegs adjust significantly more slowly than imbalances under floats. The speed of adjustment under indirect pegs is, however, faster than under direct pegs. Our results also reveal that

• Very large bilateral deficits and surpluses adjust significantly faster than smaller imbalances under floats, while pegs show no such tendency.

• The direction of the exchange rate movement under floats is consistent with the correction of imbalances. Thus, countries with bilateral trade deficits experience real depreciations of their bilateral exchange rate, while surplus countries experience real appreciations; but pegs show no such behavior.

• Greater capital mobility weakens the relationship between exchange rate flexibility and external adjustment since capital flows can sustain imbalances longer, even under flexible exchange rates. But the difference in the persistence of trade imbalances across exchange rate regimes remains statistically significant even for more financially open economies.

These results are supported by several “natural experiments”—cases of clearly exogenous changes in the exchange rate regime between countries and subsequent changes in their bilateral trade balance dynamics.

For example, when France adopted the euro in 1999, CFA franc area members automatically became pegged to all euro area countries. We find that the bilateral trade imbalances between CFA franc area and euro area members have since become more persistent.

Likewise, since Lithuania switched the anchor currency for its currency board arrangement in 2002 from the U.S. dollar to the euro, its trade imbalance with the United States has become less persistent but its imbalance with euro area countries has become significantly more so. Finally, even though the progression from the European Monetary System/Exchange Rate Mechanism to euro adoption did not usher in a substantial decrease in the volatility of these countries’ bilateral exchange rates, we do find some evidence that the persistence of their trade imbalances has increased.

Overall, our results—based on panel data as well as on the natural experiments—underscore that pegged exchange rates impede external adjustment. Our findings also highlight the richness and complexity of exchange rate relationships across countries, and this needs to be taken into account in any examination of exchange rate flexibility and the speed of external adjustment. So, for instance, even though the U.S. dollar, New Zealand dollar, and euro are all floating currencies, our analysis suggests that external adjustment will be faster for New Zealand than for the United States, which in turn can adjust faster than euro area countries. This is because none of New Zealand’s major trading partners pegs to its currency, but several U.S. trading partners peg to the U.S. dollar, and of course euro area countries—which trade extensively with each other—share a single currency.

Policy choices

For countries that want to maintain a pegged exchange rate for economic or political reasons, what policy choices are available to adjust and maintain competitiveness?

When nominal exchange rates are fixed, real exchange rate movement requires price flexibility. The key is therefore to remove structural rigidities in labor and product markets (for example, by introducing greater competition, and through fiscal reforms that encourage work) and to pursue prudent monetary and fiscal policies to help prevent overvaluation of the real exchange rate in the first place.

For countries with substantial external imbalances and external financing difficulties that urgently seek to restore their competitiveness, the choice is between “external” and “internal” devaluation of the exchange rate. External devaluation refers to a change in the nominal exchange rate parity (for example, the CFA franc area’s devaluation in 1994) that attempts to correct the relative prices of exports and imports, yielding an immediate depreciation of the real exchange rate. Internal devaluation, by contrast, mimics the effects of nominal exchange rate devaluation on the real exchange rate but through a decrease in the domestic price level (for example, the strategy pursued by Latvia and some euro area countries during the recent crisis). This is achieved through changes in the tax structure (by shifting taxes from labor to consumption, for example) or by lowering production costs (through wage reductions, for example).

External devaluation may be particularly challenging in the presence of “balance sheet” effects—large amounts of foreign currency–denominated debt held by the public or private sector—which could undermine economic recovery and ultimately force a country off its peg. And adjustment under internal devaluation is likely to be slow and painful, especially if the private sector is highly indebted and financially constrained.

Either way the choice is difficult. It calls for careful evaluation of benefits, risks, and policy options before tying one’s hands in a pegged exchange rate regime. ■

Atish R. Ghosh is an Assistant Director, Mahvash S. Qureshi is an Economist, and Charalambos Tsangarides is a Senior Economist, all in the IMF’s Research Department.

References

Berger, Helge, and Volker Nitsch, 2014, “Wearing Corset, Losing Shape: The Euro’s Effect on Trade Imbalances,” Journal of Policy Modeling, Vol. 36, No. 1, pp. 136–55.

Berka, Martin, Michael Devereux, and Charles Engel, 2012, “Real Exchange Rate Adjustment In and Out of the Eurozone,” American Economic Review, Vol. 102, No. 3, pp. 179–85.

Chinn, Menzie, and Shang-Jin Wei, 2013, “A Faith-based Initiative Meets the Evidence: Does a Flexible Exchange Rate Regime Really Facilitate Current Account Adjustment?” Review of Economics and Statistics, Vol. 95, No. 1, pp. 168–84.

Friedman, Milton, 1953, “The Case for Flexible Exchange Rates,” in his Essays in Positive Economics (Chicago: University of Chicago Press), pp. 159–203.

Ghosh, Atish R, Mahvash S. Qureshi, and Charalambos Tsangarides, 2013, “Is the Exchange Rate Regime Really Irrelevant for External Adjustment?” Economics Letters, Vol. 118, No. 1, pp. 104–09.

———, forthcoming, “Friedman Redux: External Adjustment and Exchange Rate Flexibility,” IMF Working Paper (Washington: International Monetary Fund).

Ghosh, Atish R., Jonathan D. Ostry, and Mahvash S. Qureshi, 2014, “Exchange Rate Management and Crisis Susceptibility: A Reassessment,” IMF Working Paper 14/11 (Washington: International Monetary Fund).

Herrmann, Sabine, 2009, “Do We Really Know That Flexible Exchange Rates Facilitate Current Account Adjustment? Some New Empirical Evidence for CEE Countries,” Deutsche Bundesbank Research Centre Discussion Paper Series 1, Economic Studies No. 22/2009 (Frankfurt).

Milesi-Ferretti, Gian Maria, and Assaf Razin, 1996, “Sustainability of Persistent Current Account Deficits,” NBER Working Paper 5467 (Cambridge, Massachusetts: National Bureau of Economic Research).