Man versus Mother Nature

Finance & Development, March 2014, Vol. 51, No. 1

Nicole Laframboise and Sebastian Acevedo

In the battle against natural disasters, forward-thinking macroeconomic policy can help countries prepare for and mitigate the eventual blow

IMAGES of destruction and grief following Typhoon Haiyan, which hit the Philippines in November 2013, are still fresh in our minds. They summon up similar scenes of devastation following the great south Asian tsunami of 2004 and Hurricane Katrina, which hit the United States in 2005. And the damages are not limited to immediate effects.

The New York Times ran a heartbreaking front-page story in November 2013, describing the plight of a young man in the Philippines who sustained a simple leg fracture after Typhoon Haiyan (Bradsher, 2013). He lay on a gurney in a makeshift hospital, surrounded by his children, for five days awaiting treatment, only to die from an infection.

Not surprisingly, disasters have long-lasting psychological consequences. In addition to the immediate direct human cost, natural disasters often exacerbate poverty and undermine social welfare. Developing economies—and their most vulnerable populations—are especially at risk.

Are there more natural disasters today and are they more severe? Or are we simply better informed thanks to modern real-time, round-the-clock media coverage? What about our response? Have we figured out—with technology and sophisticated communications—how to prepare and respond in a way that saves lives and limits economic damage?

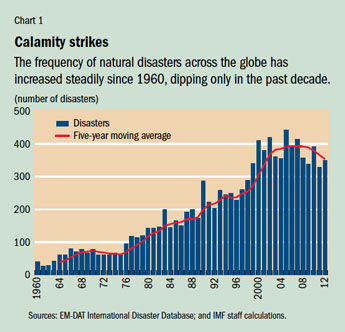

Over the past 50 years, the frequency of natural disasters has indeed increased (see Chart 1). Reporting of disasters has improved dramatically, but there has also been a documented rise in the number and intensity of climatic disasters and more people and physical assets are concentrated in at-risk areas. Interestingly, in the past decade the number of reported disasters dipped, but the number of people affected and the related costs continued to rise.

The poor more at risk

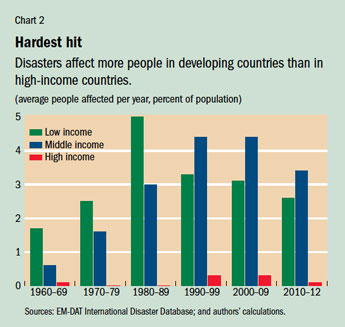

Natural disasters are more common and affect more people in developing economies (all low- and middle-income countries as defined by the World Bank) than elsewhere (Laframboise and Loko, 2012) (see Chart 2). Since the 1960s, about 99 percent of the people affected by natural disasters lived in developing economies (87 percent middle income, 12 percent low income), and 97 percent of all disaster-related deaths occurred there (64 percent middle income, 32 percent low income). Weighted by land area and population, small island states suffer the highest frequency of natural disasters. In the eastern Caribbean, a large natural disaster with damage equivalent to more than 2 percent of GDP can be expected every two to three years.

Advanced economies are better equipped to absorb the cost of disasters because they have recourse to private insurance, higher domestic savings, and market financing. They also allocate more resources to reducing vulnerabilities—for example, by developing and enforcing building codes.

The dollar value of disaster damage is much larger in advanced economies because of the amount and concentration of capital, but as a percentage of national wealth and output, the damage is usually much greater in developing economies. For example, the direct costs of the large earthquake in Japan in 2011 were estimated at about 3.6 percent of GDP; in Haiti the direct cost of the 2010 earthquake far exceeded total GDP that year.

People in developing economies are more likely to live in high-risk areas, and those countries tend to have a weak infrastructure. Developing economies rely more on sectors such as agriculture and tourism that depend on the weather. Moreover, their economic sectors are more interconnected—which makes these countries’ economies more vulnerable to shocks in other sectors, including through infrastructure and cross-sector-ownership linkages. Yet they lack adequate emergency coping mechanisms.

The most vulnerable members of society, both in high- and low-income countries, are the major victims of natural disasters. They have little, if any, savings to fund current consumption, and divesting any limited capital stock, such as livestock, lowers their productive capacity and lifetime earnings. They have limited labor skills and opportunity for mobility, and indirect effects such as inflation hurt them disproportionately. (Inflation often rises after a disaster, when shortages of essential goods and services generate demand pressure.) These all add up to permanent welfare losses.

Economic toll

In the short term, economic output shrinks and the fiscal deficit worsens after a disaster. Countries’ export potential suffers as well, which leads to larger deficits in trade and services with the rest of the world. The impact can be alleviated by foreign aid and investment, but after large disasters the growth and income effects usually persist. A country’s growth drops by an average 0.7 percent in the first year after a disaster, with a cumulative output loss three years after the disaster of about 1.5 percent over and above the immediate direct losses. Per capita real GDP falls by about 0.6 percent on average and by 1 percent in low-income countries. Droughts have the broadest impact, except in small island states (for example, in the Caribbean; see box), where hurricanes are the most damaging.

Disaster impact in the Caribbean

The Caribbean region is one of the most disaster-prone areas in the world. In terms of disasters per capita and disasters per square kilometer, Caribbean countries are ranked among the top 50 riskiest places in the world (Rasmussen, 2006). More than 400 disasters afflicted the region between 1950 and 2012, including 267 tropical cyclones (usually hurricanes) and 113 floods. On average there is a 14 percent probability that a Caribbean country will be hit by a tropical storm in any given year, and in most countries the probability exceeds 10 percent.

The effect of natural disasters in the Caribbean on growth and debt are sizable. Strobl (2012) finds that the average hurricane reduces a country’s output by nearly 1 percent; Acevedo (2013) finds similar results for severe storms and floods, and a smaller impact from moderate storms (0.5 percent). Growth typically follows a standard recovery path: activity rebounds shortly after a disaster thanks to rehabilitation and reconstruction. But this rebound is usually short lived and smaller than the initial impact, with a negative cumulative effect on GDP.

The impact on debt is even more dramatic. In the Eastern Caribbean Currency Union, the debt-to-GDP ratio rises by almost 5 percentage points on average the year a storm strikes (Acevedo, 2013). Viewed more broadly, however, Caribbean floods increase debt but storms do not. In part, this is because hurricanes attract more global media coverage, which drives aid and debt relief (Eisensee and Strömberg, 2007), whereas floods’ impact is more local.

After a major disaster, policymakers must decide whether to finance emergency spending by reducing or diverting existing spending or by borrowing. If the shock is deemed temporary—that is, physical recovery will take less than a year—it makes sense to borrow to support the domestic economy and offset the adverse effects of the shocks. This also helps maintain the incomes of those hardest hit and support the most vulnerable. If the effects of a disaster are long lasting, the economy must slowly adjust to a new equilibrium, and the government must smooth the transition and preserve macroeconomic stability.

In small island states and low-income countries, natural disasters often drive up public debt. Even with external assistance and remittance flows, public debt tends to rise. In the eastern Caribbean, this disaster-related increase has been significant. Take for example Hurricane Ivan, which hit Grenada in 2004. Ivan killed 39 people, displaced 60,000, and caused damages estimated at $890 million (150 percent of GDP). Output collapsed and the debt-to-GDP ratio rose by 15 percentage points in just one year, to 95 percent. Grenada underwent a debt restructuring in 2005 and continues to struggle with high debt today.

The impact of natural disasters depends on many things, including the size and structure of the economy, the concentration of people in high-risk areas, per capita income, and financial system development. Recent studies find that higher skills, better institutions (for example, local governments, health services, police, rule of law), more openness to trade, and higher government spending help lower the economic costs of a natural disaster (Noy, 2009). Better institutions and a better-educated population help ensure a capable and efficient disaster response, good allocation of foreign aid, and proper enforcement of such structural measures as building codes and zoning laws, which helps reduce damages when they hit. In addition, countries with healthy foreign exchange reserves and constraints on capital outflows can better withstand the capital flight that often follows a natural disaster.

Countries with deeper financial systems—that is, where more people have bank accounts and more households and businesses have bank loans—suffer less after a disaster. Countries with well-developed financial systems generally run up fiscal deficits but lose less in output. Deeper credit markets provide quicker access to local financing to fund recovery, minimizing the need for foreign borrowing, which can take longer to access or even be completely out of reach. Countries with deep financial systems and high insurance coverage fare the best, because the risk is transferred to outsiders (even in the case of local insurers through reinsurance policies), so investment and reconstruction place little or no extra fiscal burden on the state. Two large earthquakes in New Zealand in 2010 and 2011, for example, caused major damage—estimated at 10 percent of GDP—but insurance coverage (6 percent of GDP) transferred much of the cost of rehabilitation abroad. Activity did not contract, and growth in fact rose subsequently with reconstruction.

In general, the government policy response could be a combination of new financing and reserves drawdown, as well as macroeconomic adjustment in the form of current spending cuts or higher taxes. The IMF contributes at this stage, including as a catalyst for other lenders and by helping governments maintain macroeconomic stability and design the right policy response to lay the foundation for recovery.

Managing risk

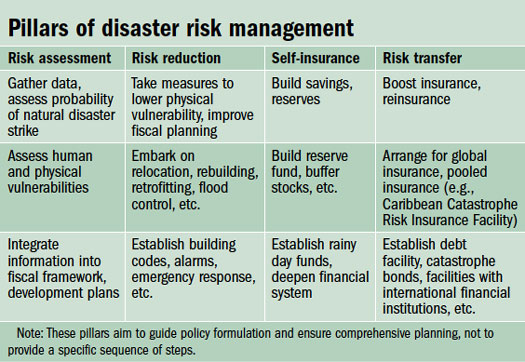

While most natural disasters cannot be prevented, our research finds that more could be done to reduce their human and economic costs and minimize welfare losses. We found that there are steps the government can take before a disaster to mitigate the impact on people and output, particularly in countries very prone to disasters for geophysical or meteorological reasons. In such regions, a policy framework that explicitly takes into account the risks and costs of disasters would allow the government to better prepare for, and respond to, natural disaster shocks. Such preparation falls under the key pillars of risk assessment and reduction, self-insurance, and risk transfer (see table).

There are several obstacles to a more holistic, preventive approach to coping with disasters. First, many low-income countries lack the budget resources and technical and human capacity to prepare for disasters or to build levees or retrofit offices and homes to withstand storms. Countries with large debt overhangs are particularly constrained. These factors impede the development of mechanisms to reduce risk or self-insure—that is, either save for a rainy day or take out insurance for that day.

Second, it is difficult to allocate scarce resources that would otherwise be spent on much needed social spending or infrastructure, particularly when there is always the chance that the next “big one” may not hit for a while. This is why efforts to assess the likelihood of disaster and key vulnerabilities should guide prevention and mitigation decisions.

Third, emergency aid and financing can be a strong but rational incentive for developing economies to underinvest in risk reduction. In fact, because such financing is offered at such low interest rates, it may not make sense to spend scarce resources before a disaster; the expense may not justify the expected return. Haiti, for example, received pledges of US$9.9 billion after the 2010 earthquake, 1.5 times the value of the country’s nominal GDP. The country could not have paid for equivalent insurance coverage.

Finally, it is possible that countries are underestimating how much the probability of disasters has increased over time, particularly of climate-related disasters.

Should we be talking dollars and cents in the face of human tragedy? The first imperative of public policy should be to save lives, but efforts to reduce economic costs, which carry other human and social costs that can last for generations, are also important. When the economic costs are lessened resources are freed up for disaster preparedness, resilience, and mitigation, which can save lives in the future. Policymakers must ask whether, from the top down, disaster risk management has received sufficient attention in the decision-making process.

Planning ahead

Our research draws some basic and not-so-basic lessons from recent case studies. It finds that good macroeconomic policies before and after shocks make a difference. Some of the more basic lessons are that room in the budget for emergency spending helps crisis mitigation and resolution, insurance coverage and low public debt bolster government spending flexibility if reconstruction needs arise, and public investment in risk reduction pays off over time.

Less obviously, but still important, there is considerable room for improvement in government policy frameworks to better manage risk and mitigate economic and social costs (see table). In at-risk regions, policymakers should estimate the probability of shocks and identify local vulnerabilities. They can then integrate this information into plans for contingencies, investing in risk reduction, insurance, self-insurance, and disaster response.

Tax and spending policies need to be flexible, to allow rapid redeployment of spending when needed.

Coordination with foreign partners before disaster strikes could mobilize external assistance for risk reduction, which is likely to earn a higher return than emergency help after the fact.

Better cooperation between foreign partners after natural disasters is also sorely needed, particularly in low-income countries and in those with limited administrative capacity.

Insurance is the best way to reduce the real costs of natural disasters without raising taxes or cutting spending. Some innovative instruments have surfaced in recent years, but the international community could do more to pool resources and ideas to help vulnerable countries. The Caribbean Catastrophe Risk Insurance Facility (CCRIF) is one such example and has recently supported immediate relief to Caribbean countries. However, strained fiscal positions have left countries underinsured in the CCRIF and still exposed to shocks.

These are practical top-down policy suggestions for consideration during the calm between the inevitable storms. Most countries wait for the next disaster and then try to pick up the pieces quickly. Instead, policymakers and their foreign partners should integrate new and better ways to manage risk and reduce costs ahead of time. This would save lives, reduce suffering, and save money. And that would prevent unnecessary casualties—like the young man with the broken leg in the Philippines. ■

Nicole Laframboise is a Deputy Division Chief and Sebastian Acevedo is an Economist, both in the IMF’s Western Hemisphere Department.

References

Acevedo, Sebastian, 2013, “Debt, Growth and Natural Disasters: A Caribbean Trilogy” (unpublished; Washington: The George Washington University).

Bradsher, Keith, 2013, “Death after the Typhoon: It Was Preventable,” The New York Times, November 15.

Eisensee, Thomas, and David Strömberg, 2007, “News Droughts, News Floods, and U.S. Disaster Relief,” Quarterly Journal of Economics, Vol. 122, No. 2, pp. 693–728.

Laframboise, Nicole, and Boileau Loko, 2012, “Natural Disasters: Mitigating Impact, Managing Risks,” IMF Working Paper 12/245 (Washington: International Monetary Fund).

Noy, Ilan, 2009, “The Macroeconomic Consequences of Disasters,” Journal of Development Economics, Vol. 88, No. 2, pp. 221–31.

Rasmussen, Tobias, 2006, “Natural Disasters and Their Macroeconomic Implications,” in The Caribbean: From Vulnerability to Sustained Growth, ed. by Ratna Sahay, David Robinson, and Paul Cashin (Washington: International Monetary Fund), pp. 181–205.

Strobl, Eric, 2012, “The Economic Growth Impact of Natural Disasters in Developing Countries: Evidence from Hurricane Strikes in the Central American and Caribbean Regions,” Journal of Development Economics, Vol. 97, No. 1, pp. 130–41.