Harbingers of Recessions

Finance & Development, March 2014, Vol. 51, No. 1

John C. Bluedorn, Jörg W. Decressin, and Marco E. Terrones

Changes in asset prices are good predictors of economic downturns

There are two views about the relationship between changes in asset prices and business cycles, particularly recessions. One view contends that asset price corrections often precede or coincide with a recession. The 1929 stock market crash and the Great Depression, the early 1990s asset price collapse and the ensuing recession in Japan, and the 2008 global crash in asset prices and the Great Recession are some of the most vivid cases of recessions foreshadowed by asset price corrections.

The other view argues that asset prices may fluctuate too widely to be useful predictors of recessions. The sharp collapse in the stock market in 1962 did little to unsettle the economic recovery in the United States. Likewise, the stock market crash of October 1987 did not significantly affect U.S. economic activity, despite predictions of a severe recession in 1988. Proponents of this view contend that asset price changes often reflect overly optimistic or pessimistic changes in investors’ expectations and are therefore poor indicators of the business cycle.

These two views raise some important questions about the relationship between asset prices and the business cycle. What does the theory say? Are these implications borne out by the data? Are asset price corrections useful in predicting the start of a recession? To shed light on these questions, we first describe economic theory’s predictions about the relationship between asset prices and the business cycle and examine whether they are supported by data for the Group of Seven (G7) advanced economies (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) over the past four decades. Next, we assess whether the prices of two key assets—equities and houses—are useful predictors of recession starts in these economies and explore the effect on the explanatory power of these prices when other variables commonly thought to be associated with the cycle are included in the analysis.

Asset prices and output fluctuations

In theory, there are many reasons why asset price movements could be associated with the business cycle. First, asset prices affect households’ net wealth and their ability to borrow, which can have important effects on households’ consumption plans. Second, according to standard Tobin’s q-theory, investment should move in the same direction as q, which is the ratio of the market value of capital to its replacement cost. Therefore investment should be high when asset prices—which are directly associated with the market value of capital—are high, and vice versa. Third, asset price changes can affect firms’ balance sheets, hurting or helping their collateral and creditworthiness and thus increasing or decreasing their willingness and ability to invest. Asset price movements may also affect banks’ balance sheets, inducing them to adjust their capital and lending activities. These effects can be amplified through financial markets when there are differences in the information available to borrowers and lenders and borrowers are limited in their ability to commit to repayment.

Last, according to the basic asset-pricing equation in finance, an asset price should equal the discounted value of its current and expected future returns. In the case of equities, dividends are the relevant returns; for houses, it is rent. To the extent that returns move together or ahead of economic conditions, asset prices should be useful in forecasting economic activity. Movements in the discount rate (that is applied to the stream of future returns to derive present value) accentuate this relationship if they reflect investors’ search for yield—during economic expansions investors take on more risk, lowering the discount rate and bidding up the price of unchanged dividend or rent flows, while in economic contractions they do just the opposite.

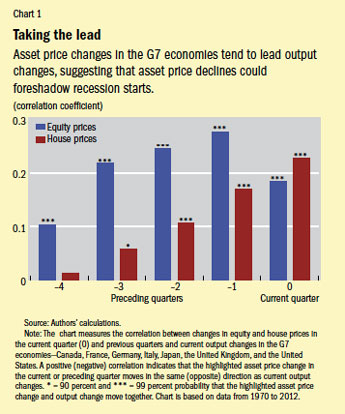

From this discussion, we derive two important implications about the relationship between asset prices and the business cycle. First, asset prices should move in tandem with real output (that is, they should be procyclical). Second, asset prices should lead the business cycle. Are these two features borne out by the data? We explore this issue using data for the G7 economies over the period 1970 through 2012. Chart 1 shows the average contemporaneous and lead cross-correlation coefficients for changes in real asset prices and output growth across these economies.

Two important results stand out. First, asset prices are indeed procyclical—that is, they move together with output, as the theory predicts. The contemporaneous correlations between real asset price changes and output growth are positive (that is, they move in the same direction) and significantly different from zero (in other words, they are statistically significant). The low correlation coefficients, however, indicate that equity and house prices are only weakly procyclical. Second, asset prices lead output by up to one year. The highest lead cross-correlation with output growth for equity price and house price changes is observed one quarter ahead. However, these cross-correlation coefficients differ significantly from zero at every horizon only for equity price changes up to four quarters ahead of a change in output. These two results suggest that asset prices could indeed be useful coincident and leading indicators of the business cycle, as the theory suggests.

Predicting recession starts

We next examine the ability of asset price changes to predict the start of recessions with a logistic regression model, which is commonly used to investigate the behavior of binary dependent variables. These are variables that can take one of two possible values. In our analysis, the value is 1 if a recession starts in the next quarter—output per capita peaks in the current quarter—and zero otherwise. In these models, the predicted value will fall between zero and 1 and can be interpreted as the chance that a recession will start in the next quarter. A rise in the predicted value would indicate that the chances of a recession have grown according to the model. Our focus on when a recession starts rather than just on whether or not an economy is in recession in a given quarter is a notable departure from many earlier studies. As such, the statistical model we developed is a kind of early-warning indicator for the start of a recession, which typically is called with a delay of several quarters.

So are real asset prices useful in predicting recession starts? In a word, yes. We found a negative and statistically significant relationship between real (or inflation-adjusted) equity price changes and the chance that a recession will start in the next quarter. The negative association means that when real equity prices fall, the probability that a recession will start rises, and if real equity prices increase, the chance that a recession will begin falls. We also found that real house price changes exhibit a negative association with the chance that a recession will start, but unlike with equity price changes, this association is not significantly different from zero. When price changes for both assets are included simultaneously in the model, their coefficients and significance are similar to those in the models that take them separately. The in-sample performance of these models is very strong, as reflected by the large AUC statistics. The AUC statistic (technically, the “area under the receiver operating characteristic curve”) is designed to show, in this case, how well a model calls recession starts. It is about 0.8 when equity prices are included, which is significantly greater than the 0.5 benchmark achieved by flipping a coin (making random guesses). That said, the model is not perfect: recessions occur so infrequently that the model generates some false alarms.

To examine the role of other factors commonly thought to presage a recession, we introduced into the model the following variables: the term spread (the difference between the 10-year and three-month government bond yield); the implied price volatility of equities that make up the S&P 500 index in the United States (a common measure of global uncertainty and risk aversion); and changes in real oil prices. A reduction in the term spread (a proxy for tighter monetary policy), greater uncertainty and risk aversion (which negatively affect durable consumption and investment), and higher oil prices (which increase transportation and production input costs) are often cited as raising the probability of a recession start.

Even after including these additional explanatory variables, the negative and significant effect of real equity price changes remains unchanged. Interestingly, when the other variables are included, the estimated negative effect of real house price changes is larger than when house price changes are considered alone or only with equity prices. When considered with these other variables, house price changes are statistically significant. As anticipated, reductions in the term spread and increases in market uncertainty and risk aversion are associated with greater chances of a new recession. In contrast, real oil price changes do not appear to help predict recessions. This may be because rising oil prices can also reflect strong aggregate demand. The performance of this model when these other variables are included is about as strong as when only equity prices are considered, which suggests that these other variables have little effect on the model’s ability to predict recessions.

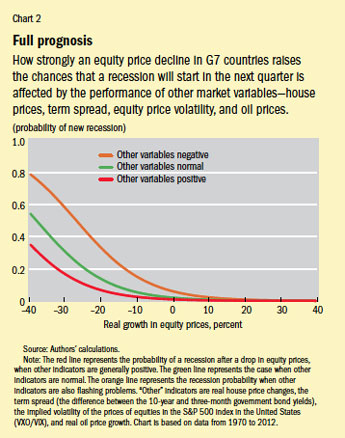

The overall picture then is that real equity price changes are one of the most useful predictors of recession starts. Chart 2 portrays this relationship. A drop in equity prices significantly raises the chance that a recession will start in the following quarter, as illustrated by the downward sloping lines. In contrast, higher equity prices tend to reduce the predicted chance. But because the baseline chance of a recession is already low (about 4 percent in any quarter), increases in equity prices have little practical effect on the prognosis. In other words, there is an inherent asymmetry in the predictive power of equity prices. When stock prices fall sharply, watch out! When they rise, the chances of a recession do not change much. The predictive power of asset prices also changes when the other real-time variables are flashing red—the orange line is everywhere higher than the green line. If a term spread inversion and falling house prices accompany a large equity price drop, the model indicates that a recession is very likely in the offing.

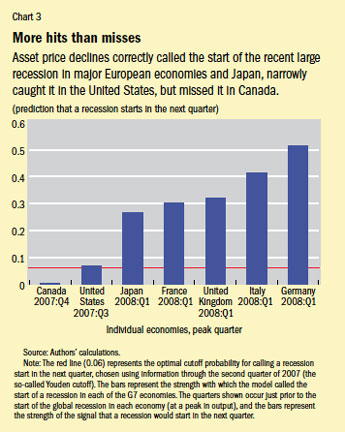

Finally, the model seems to have performed relatively well in predicting the starts of the most recent recessions in the G7 economies. Chart 3 shows the model’s forecast for recessions that start in the next quarter for each G7 economy in recent years. For the European G7 economies (France, Germany, Italy, and the United Kingdom) and Japan, it was a clear call. For the United States, a recession start was called, but it was close. However, for Canada it was a miss.

Useful predictors

Real asset price corrections are useful predictors of new recessions. In particular, large corrections in real equity prices are associated with significant increases in the chance that a recession will start in the following quarter. If at the same time, house prices collapse and the term spread becomes negative, the chance of a recession increases markedly. The message is clear: policymakers should be mindful of sharp asset price drops—especially if the declines are accompanied by narrowing term spreads. These developments are likely to signal trouble in the very near future. ■

John C. Bluedorn is an Economist and Jörg W. Decressin is a Deputy Director in the IMF’s European Department. Marco E. Terrones is an Assistant to the Director in the IMF’s Research Department.

This article is based on the authors’ 2013 IMF Working Paper 13/203, “Do Asset Price Drops Foreshadow Recessions?”