Back to Basics

What Is Monetarism?

Finance & Development, March 2014, Vol. 51, No. 1

Sarwat Jahan and Chris Papageorgiou

Its emphasis on money’s importance gained sway in the 1970s

Just how important is money? Few would deny that it plays a key role in the economy.

But one school of economic thought, called monetarism, maintains that the money supply (the total amount of money in an economy) is the chief determinant of current dollar GDP in the short run and the price level over longer periods. Monetary policy, one of the tools governments have to affect the overall performance of the economy, uses instruments such as interest rates to adjust the amount of money in the economy. Monetarists believe that the objectives of monetary policy are best met by targeting the growth rate of the money supply. Monetarism gained prominence in the 1970s—bringing down inflation in the United States and United Kingdom—and greatly influenced the U.S. central bank’s decision to stimulate the economy during the global recession of 2007–09.

Today, monetarism is mainly associated with Nobel Prize–winning economist Milton Friedman. In his seminal work A Monetary History of the United States, 1867–1960, which he wrote with fellow economist Anna Schwartz in 1963, Friedman argued that poor monetary policy by the U.S. central bank, the Federal Reserve, was the primary cause of the Great Depression in the United States in the 1930s. In their view, the failure of the Fed (as it is usually called) to offset forces that were putting downward pressure on the money supply and its actions to reduce the stock of money were the opposite of what should have been done. They also argued that because markets naturally move toward a stable center, an incorrectly set money supply caused markets to behave erratically.

Monetarism gained prominence in the 1970s. In 1979, with U.S. inflation peaking at 20 percent, the Fed switched its operating strategy to reflect monetarist theory. But monetarism faded in the following decades as its ability to explain the U.S. economy seemed to wane. Nevertheless, some of the insights monetarists brought to economic analysis have been adopted by nonmonetarist economists.

At its most basic

The foundation of monetarism is the Quantity Theory of Money. The theory is an accounting identity—that is, it must be true. It says that the money supply multiplied by velocity (the rate at which money changes hands) equals nominal expenditures in the economy (the number of goods and services sold multiplied by the average price paid for them). As an accounting identity, this equation is uncontroversial. What is controversial is velocity. Monetarist theory views velocity as generally stable, which implies that nominal income is largely a function of the money supply. Variations in nominal income reflect changes in real economic activity (the number of goods and services sold) and inflation (the average price paid for them).

The quantity theory is the basis for several key tenets and prescriptions of monetarism:

• Long-run monetary neutrality: An increase in the money stock would be followed by an increase in the general price level in the long run, with no effects on real factors such as consumption or output.

• Short-run monetary nonneutrality: An increase in the stock of money has temporary effects on real output (GDP) and employment in the short run because wages and prices take time to adjust (they are sticky, in economic parlance).

• Constant money growth rule: Friedman, who died in 2006, proposed a fixed monetary rule, which states that the Fed should be required to target the growth rate of money to equal the growth rate of real GDP, leaving the price level unchanged. If the economy is expected to grow at 2 percent in a given year, the Fed should allow the money supply to increase by 2 percent. The Fed should be bound to fixed rules in conducting monetary policy because discretionary power can destabilize the economy.

• Interest rate flexibility: The money growth rule was intended to allow interest rates, which affect the cost of credit, to be flexible to enable borrowers and lenders to take account of expected inflation as well as the variations in real interest rates.

Many monetarists also believe that markets are inherently stable in the absence of major unexpected fluctuations in the money supply. They also assert that government intervention can often destabilize the economy more than help it. Monetarists also believe that there is no long-run trade-off between inflation and unemployment because the economy settles at long-run equilibrium at a full employment level of output (see “What Is the Output Gap?” in the September 2013 F&D).

The great debate

Although monetarism gained in importance in the 1970s, it was critiqued by the school of thought that it sought to supplant—Keynesianism. Keynesians, who took their inspiration from the great British economist John Maynard Keynes, believe that demand for goods and services is the key to economic output. They contend that monetarism falters as an adequate explanation of the economy because velocity is inherently unstable and attach little or no significance to the quantity theory of money and the monetarist call for rules. Because the economy is subject to deep swings and periodic instability, it is dangerous to make the Fed slave to a preordained money target, they believe—the Fed should have some leeway or “discretion” in conducting policy. Keynesians also do not believe that markets adjust to disruptions and quickly return to a full employment level of output.

Keynesianism held sway for the first quarter century after World War II. But the monetarist challenge to the traditional Keynesian theory strengthened during the 1970s, a decade characterized by high and rising inflation and slow economic growth. Keynesian theory had no appropriate policy responses, while Friedman and other monetarists argued convincingly that the high rates of inflation were due to rapid increases in the money supply, making control of the money supply the key to good policy.

In 1979, Paul A. Volcker became chairman of the Fed and made fighting inflation its primary objective. The Fed restricted the money supply (in accordance with the Friedman rule) to tame inflation and succeeded. Inflation subsided dramatically, although at the cost of a big recession.

Monetarism had another triumph in Britain. When Margaret Thatcher was elected prime minister in 1979, Britain had endured several years of severe inflation. Thatcher implemented monetarism as the weapon against rising prices, and succeeded in halving inflation, to less than 5 percent by 1983.

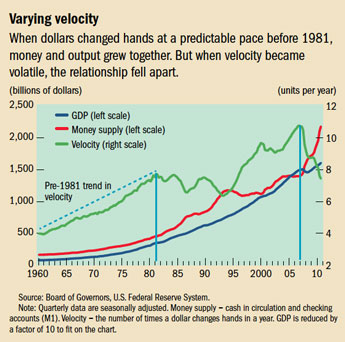

But monetarism’s ascendance was brief. The money supply is useful as a policy target only if the relationship between money and nominal GDP, and therefore inflation, is stable and predictable. That is, if the supply of money rises, so does nominal GDP, and vice versa. To achieve that direct effect, though, the velocity of money must be predictable.

In the 1970s velocity increased at a fairly constant rate and it appeared that the quantity theory of money was a good one (see chart). The rate of growth of money, adjusted for a predictable level of velocity, determined nominal GDP. But in the 1980s and 1990s velocity became highly unstable with unpredictable periods of increases and declines. The link between the money supply and nominal GDP broke down, and the usefulness of the quantity theory of money came into question. Many economists who had been convinced by monetarism in the 1970s abandoned the approach.

Most economists think the change in velocity’s predictability was primarily the result of changes in banking rules and other financial innovations. In the 1980s banks were allowed to offer interest-earning checking accounts, eroding some of the distinction between checking and savings accounts. Moreover, many people found that money markets, mutual funds, and other assets were better alternatives to traditional bank deposits. As a result, the relationship between money and economic performance changed.

Relevant still

Still, the monetarist interpretation of the Great Depression was not entirely forgotten. In a speech during a celebration of Milton Friedman’s 90th birthday in late 2002, then-Fed governor Ben S. Bernanke, who would become chairman four years later, said, “I would like to say to Milton and Anna [Schwartz]: Regarding the Great Depression, you’re right. We [the Fed] did it. We’re very sorry. But thanks to you, we won’t do it again.” Fed Chairman Bernanke mentioned the work of Friedman and Schwartz in his decision to lower interest rates and increase money supply to stimulate the economy during the global recession that began in 2007 in the United States. Prominent monetarists (including Schwartz) argued that the Fed stimulus would lead to extremely high inflation. Instead, velocity dropped sharply and deflation is seen as a much more serious risk.

Although most economists today reject the slavish attention to money growth that is at the heart of monetarist analysis, some important tenets of monetarism have found their way into modern nonmonetarist analysis, muddying the distinction between monetarism and Keynesianism that seemed so clear three decades ago. Probably the most important is that inflation cannot continue indefinitely without increases in the money supply, and controlling it should be a primary, if not the only, responsibility of the central bank. ■