Adding Value

Finance & Development, December 2013, Vol. 50, No. 4

Companies have split the production of goods and services among many countries, creating supply chains that reduce overall costs

The average car has thousands of components that are produced by hundreds of suppliers located in dozens of countries. For example, a Volkswagen might have an engine made in Germany, Mexico, or China; a wiring harness from Tunisia; and an exhaust filter system from South Africa.

Declining trade, transport, and communication costs have allowed companies to splinter their production lines geographically. Not only does each stage of production occur in a different facility, but each facility is often in a different country. This type of production, which results in the movement of goods and services from country to country through a supply chain, is a major reason that global trade in goods and services has grown so fast. Since 1950, the volume of world trade in goods and services has grown 27-fold, to about $20 trillion, three times faster than global GDP. Much of that growth has been in intermediate products and services that move from country to country in a company’s international supply chain. Value is added to a product in each of the countries that are part of the chain (a process called vertical trade or vertical specialization). By locating activities and tasks in different countries according to their comparative advantages, the total costs of production can be reduced.

Developing countries in Asia, transition economies in Europe, and a number of other countries, such as Mexico, have become active participants in supply-chain trade—not only for cars, but for such products as computers, cell phones, and medical devices. Overall, the share of manufactured goods in the total exports of developing economies has increased from 30 percent in 1980 to more than 70 percent today, with parts and components representing a substantial portion of the increase.

Supply-chain trade can bring great benefits but also new risks and policy challenges, as seen in 2008 when the volume of international trade collapsed during the financial crisis. The dramatic reduction in credit and demand caused by the crisis disproportionately hurt countries that were heavily dependent on supply-chain trade. An unexpected shock in a country that processes products used by plants in economies located “downstream” may have major negative repercussions—floods in Thailand in 2011, for example, affected a wide range of products, such as electronics, cars, and shoes.

Helps poorer economies

The supply chain allows poor countries to engage in manufacturing for the global market, because firms can locate labor-intensive and low-skill tasks in those economies—for example, the assembly of laptop computers and cell phones in Cambodia or Vietnam.

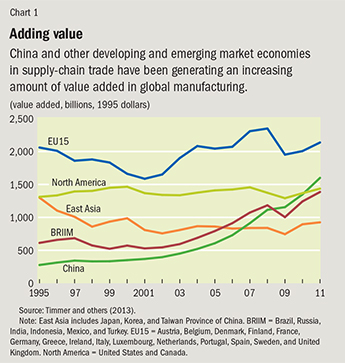

Although the share of the value of a product that is added by the processing activities in a low-income country will generally be small, the employment and income that are created can generate significant benefits. Over time, as countries increase their engagement in such trade, they may be able to increase the share of total value that is generated locally. China and other developing economies that are big players in supply-chain trade have been generating an increasing share of global manufacturing value added (see Chart 1).

Most of Africa and much of Latin America and the Middle East have not shifted toward the vertical specialization and supply-chain trade that have helped drive trade growth in east Asia, North America, and Europe. Fostering greater participation in such trade by more developing economies is important. Supply-chain trade offers countries the opportunity to exploit their comparative advantages without having to develop vertically integrated industries that provide the producers of final goods with the intermediate inputs they need.

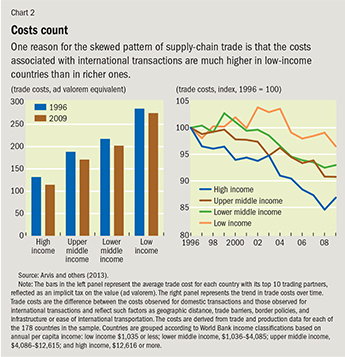

One reason for the skewed pattern of supply-chain trade is that the costs associated with international transactions—such as transportation, infrastructure, trade barriers, and border policies—are much higher in low-income countries than in richer ones (see Chart 2). In part, this reflects geography, but in many cases it is also a result of policies—such as product regulation—that raise trade costs. Reducing trade costs and improving connections to regional and global markets are preconditions for expanding investment in supply-chain activities and involve not just trade facilitation (such as reducing delays at border crossings), but also improving transport-related infrastructure services and the operation of regional transit regimes (WEF, Bain &Co., and World Bank, 2013; Arvis and others, 2012).

Supporting supply-chain trade

The expansion of supply-chain trade and the associated flows of foreign direct investment in production facilities have greatly reduced countries’ incentives to use trade policy instruments like tariffs. Supply-chain specialization requires that firms be able to import products and services that they then process and export. Significant levels of import protection would increase costs and make firms uncompetitive.

The fear of losing competitiveness helps explain the trend toward lower import tariffs in supply-chain–intensive countries and the differences in the participation in supply-chain trade across countries. Many of the countries that participate much less in this type of specialization have higher barriers to trade—reflected not only in average tariff levels, but also in the use of measures to restrict exports of natural resources that are “upstream” inputs into global value chains. More generally, however, domestic policies that increase trade costs may hurt the efficiency of supply chains or impose costs on firms in other countries that are located either upstream or downstream along the supply chain and preclude supply-chain investment in a country.

Governments may not necessarily be aware of the effect of policies on investment incentives and operations. Existing trade agreements and similar forms of international cooperation usually are not designed with supply-chain trade in mind. But dealing with policies that affect such trade has implications for the design of trade agreements and trade cooperation—for both advanced and developing economies. Policies that raise the cost of international flows of goods, services, knowledge, and professionals—all core elements of supply-chain trade—are increasingly of a regulatory nature. Among them are product safety and health regulation, licensing requirements, and assessment procedures. It is hard to achieve international cooperation on regulatory policies because regulators worry that such efforts will impede regulatory objectives. Matters are complicated further because many agencies may have a role in setting and enforcing product and process regulations that, generally, were designed without consideration of how they might affect supply-chain incentives.

From the perspective of supply-chain trade, international trade negotiations are less effective than they could be in facilitating trade because they deal with specific policy areas—such as product standards, customs valuation, and import licensing—in isolation. But for a supply-chain operation, what matters are all the regulatory policies that affect the chain as a whole. An item-by-item approach may leave some important policy areas unaddressed, suggesting that trade officials should do more to “think supply chain” when designing trade agreements (Hoekman and Jackson, 2013).

Public-private partnerships

A first step to putting in place a broader approach would be to select a half dozen or so supply chains and create a mechanism—a supply-chain “council”—that brings together businesses, regulators, and trade officials from the countries concerned to identify the policy constraints that most hurt their operations. Active involvement and participation by businesses is critical because regulators and officials generally will not understand how a supply chain works and how policies affect it.

Regulatory policies presumably have a rationale, such as ensuring human health and safety. But it may be that there are redundancies in the regulations and overlapping requirements from different agencies that do not communicate with each other. For example, a chemical company that imports acetyl—used in making aspirin and paracetamol (also called acetaminophen)—into the United States must, on average, comply with similar regulations from five different agencies that often fail to coordinate and communicate effectively with one another. As a result, one out of three shipments is delayed—at a cost to the company of $60,000 for each day of delay (WEF, Bain &Co., and World Bank, 2013). By focusing on the supply chain, the council could help identify such redundancies and possibilities for consolidation.

A key task for supply-chain councils would be devising a plan to address the most detrimental policies. The participation of the relevant regulatory bodies and those in government responsible for economic policy is necessary for the council to decide what can be done to reduce compliance costs for business without derailing regulatory objectives. The business community can help identify potential solutions.

These public-private supply-chain partnerships should establish a policy performance baseline for each supply chain to allow monitoring of the effect of changes in policies. This baseline would be based on data on specific outcomes—such as delays, variability in clearance times, and the use and efficiency of dispute-resolution mechanisms. Measurement is important because removing one source of duplicative or redundant regulatory cost may not help if other policies continue to impose excess costs. Businesses must contribute the data needed for performance monitoring.

A number of issues must be addressed to make these suggestions work.

• Firms may not want to provide relevant data because of competitive concerns and generally will be disinclined to incur additional costs associated with collecting data that they do not already compile. Thus, the more the performance indicators build on data that firms already gather, the more straightforward it will be for supply-chain councils to monitor outcomes over time.

• Governments may not trust data provided by firms, while enterprises may worry about providing information that could be used by competitors. This calls for aggregating data so that individual businesses cannot be identified as the source of information. There are good models—such as those that have been developed for firm and household surveys—that can be used to address such concerns. The data must be compiled and processed by an organization that is technically competent and independent of industry.

Supply-chain trade offers new opportunities for low-income countries to become part of the “global factory.” Facilitating such trade requires more than reducing domestic trade costs, although that is a critical precondition for participation in many types of such trade. International cooperation is needed to reduce the trade-impeding effects of duplicative regulatory policies. Whether in the context of the World Trade Organization, regional trade agreements such as the Transatlantic Trade and Investment Partnership being negotiated by the European Union and the United States, or agreements involving developing economies, a new approach that is based on closer partnership between the public and private sectors can help enhance the relevance of trade cooperation in supporting supply-chain trade. ■

Bernard Hoekman is a Professor in the Robert Schuman Centre for Advanced Studies at the European University Institute.

References

Arvis, Jean-François, Monica Alina Mustra, Lauri Ojala, Ben Shepherd, and Daniel Saslavsky, 2012, “Connecting to Compete, 2012: Trade Logistics in the Global Economy” (Washington: World Bank).

Arvis, Jean-François, Yann Duval, Ben Shepherd, and Chorthip Utoktham, 2013, “Trade Costs in the Developing World: 1995–2010,” Policy Research Working Paper 6309 (Washington: World Bank).

Hoekman, Bernard, and Selina Jackson, 2013, “Reinvigorating the Trade Policy Agenda: Think Supply Chain!” VoxEU, January 23.

Timmer, Marcel P., Abdul Azeez Erumban, Bart Los, Robert Stehrer, and Gaaitzen J. de Vries, 2013, “Slicing Up Global Value Chains,” GGDC Research Memorandum 135 (Groningen, Netherlands: Groningen Growth and Development Centre).

World Economic Forum (WEF), Bain &Co., and World Bank, 2013, “Enabling Trade: Valuing Growth Opportunities,” (Geneva: WEF).