The Elusive Revival

Finance & Development, September 2013, Vol. 50, No. 3

The expected boost in growth from natural resource booms is not yet happening

Global prices of crude oil, hydrocarbon products, and minerals have surged over the past decade. Metals are up 66 percent, crude oil 159 percent. Major deposits of natural resources have been discovered in developing countries: gold in Burkina Faso; offshore petroleum in Ghana; and copper, gold, and coal in Mongolia. Many expect growth to follow. If institutions in these countries are sound and the resources are invested at home in infrastructure and health and education, the assumption is that growth will happen.

But the old natural-resource curse—the paradox that countries and regions with an abundance of natural resources tend to have less economic growth and worse development outcomes than those with fewer natural resources—casts a shadow over this optimism. Expectations were also high in the 1970s, yet countries rich in resources experienced significantly lower growth than other countries during the 1970s and 1980s.

However attractive the vision of a resource-led revival, it is unfortunately proving elusive. The key to understanding the longer-term trends is to look at the economy outside the natural resource sector. Although overall growth rates are positive, underlying nonresource growth rates are much lower.

Nevertheless, pessimism is not the right conclusion. Sure, some problems associated with resource riches are rooted in basic economic forces over which countries have little control. But there is much over which they do have control, principally public investment decisions. Given the continued poor performance and inefficiency of public investment in both resource-rich and resource-poor economies, there is probably great scope for improvement and an opportunity to counteract whatever other dark forces are associated with great natural resource wealth. But to do so governments must fundamentally change how they make these decisions.

The curse continues

There is a lively debate about whether the natural-resource curse still exists. Some claim it is over, pointing to the fast growth of mineral-rich economies: Ghana grew 7.1 percent in 2012; Mongolia, 12.3 percent; Burkina Faso, 6.4 percent; and the United Arab Emirates, 4.4 percent.

But these numbers are distorted by the booming resource sector. A better metric of whether an economy is developing the ability to grow after a boom is activity in the rest of the economy.

Over the past five years, real per capita growth in Mongolia’s nonresource sector has been essentially nil, at 0.23 percent a year. Ghana’s is doing better, at 4.2 percent, but the United Arab Emirates (–3.4 percent) and Burkina Faso (1.9 percent) saw negative or unremarkable growth.

This phenomenon of slow growth in the nonresource part of the economy, even during boom periods, is not unusual. In my research, I examined boom periods in 20 economies other than those mentioned above and found that only 3 of 20—Angola, Equatorial Guinea, and Mozambique—achieved significant positive growth. Of the rest, 13 suffered negative growth in the nonresource part of the economy.

These results challenge commonly used economic models that assume countries will automatically grow whenever public capital investment increases. There has certainly been a rise in public capital investment in booming economies, yet the GDP growth data hint at negative returns. Despite huge resource revenues and significant domestic investment outside the natural resource sector, growth has been disappointing in resource-rich countries.

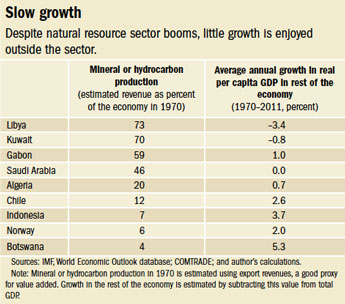

Some will argue that we need to give it more time, but the record in countries that had booms many years ago is no less disappointing. After large windfall booms in oil or gas revenues in the 1970s in Algeria, Gabon, Kuwait, Libya, and Saudi Arabia, growth in the nonresource sector was not impressive (see table).

Chile, Indonesia, Norway, and Botswana are often cited as counterexamples to the proposition that resource intensity harms growth. But Chile, Indonesia, and Norway are not in the same league as the mineral-rich economies of the Middle East and Africa. Chile’s and Norway’s shares have fluctuated around 10 percent, and although Indonesia’s resource share temporarily reached 20 percent in the 1980s, it was still a far cry from the shares of Saudi Arabia (68 percent in 1976), Qatar (62 percent), and Libya (71 percent in 2006).

Botswana is a special case. Through the mid-1990s, growth outside the mineral sector was not especially rapid. Diamond production increased so much that, between 1970 and 1996, 70 percent of Botswana’s increase in GDP was thanks to the increase in diamond-generated GDP alone. Since 1996, the economy has continued to grow rapidly, becoming one of the few mineral-rich countries to show fast growth after a resource boom.

The two major explanations for slow growth in resource-intensive economies are poor institutions and “Dutch disease”—the harmful consequences of large increases in a country’s income (see “Dutch Disease: Wealth Managed Unwisely,” in F&D’s compilation of Back to Basics columns—www.imf.org/basics). Neither explanation, however, is particularly helpful for suggesting solutions.

One problem with the first is that the concept of institutions is too broad. Poor institutions can mean anything from inadequately articulated or enforced laws to lax administration, weak safeguards against corruption, or poor economic policies. So the policy advice is too general. And although many have in mind inadequate safeguards against corruption when they cite poor institutions, straightforward seizure of resource wealth cannot alone explain the negative growth in economic activity observed in some resource-intensive economies.

Dutch disease—a second, well-supported explanation for the slow growth of resource-intensive economies—occurs when resource booms increase demand, pushing up prices and undermining the growth of firms that use those products as inputs for exportation. Few resource-intensive economies have managed to grow their nonresource exports; and few developing countries have grown rapidly without significant growth in exports outside the natural resource sector. Although countries can mitigate the demand surge at the root of Dutch disease—for example, by spending the resource revenues on foreign goods—they are unlikely to escape it completely. Dutch disease will probably continue to plague resource-rich countries.

Aside from mitigating the effects of Dutch disease through spending restraint, two oft-proposed policy options to confront the resource curse and bolster growth are to invest in offshore assets or to invest in public capital goods in the domestic economy.

The choice between the two depends critically on the real returns to domestic public investment. The higher the returns to public capital in terms of domestic economic growth, the more attractive this option is compared with offshore investment. But this assessment cannot be made on the basis of wishful thinking and unexamined assumptions. Too often, advocates simply assert that returns to public investment must be high because the needs are great in developing countries. Yet evidence to this effect is surprisingly mixed.

The use of public investment to bolster growth has been tried many times, with limited success. A number of countries mounted major public investment drives in the 1970s. For example, in the Philippines, public investment rose from 1.6 percent of GDP to 7.2 percent between 1972 and 1982, and in Mexico public investment rose from 4.9 percent of GDP to 10 percent between 1971 and 1980. And virtually all countries with natural resource booms increased public capital investment. A notable example is Saudi Arabia, which expanded seaport capacity, electricity generation, paved highways, and construction of major new international airports.

Whatever else the investments accomplished—in Saudi Arabia, for example, health and education indicators improved markedly—they failed to boost economic growth over the long term. Saudi per capita GDP outside the hydrocarbon sector has not grown rapidly. And the Mexican and Philippine public investment drives in the 1970s were followed by economic slumps in the 1980s.

Some argue that state investments in infrastructure accelerated development in fast-growing economies such as Korea and Taiwan Province of China. But, in both these cases, public investment drives did not lead the growth process but rather commenced once growth was already under way. In Korea, President Park Chung-Hee announced a major expressway program in 1967, after the country had begun to grow rapidly in the early 1960s. And in Taiwan Province of China, the “Ten Major Construction Projects” campaign commenced in 1973, more than a decade after that economy first experienced rapid growth.

Making it work

Overall, it is hard to find clear-cut evidence that public investment drives will yield positive payoffs. There are many examples of countries that enjoyed natural resource booms and embarked on public investment drives but had little to show for it over the long run. There are also examples of public investment drives not financed by resource booms that had little impact. Clearly, either positive investment returns are absent, despite claims to the contrary, or governments are failing to identify efficient investments and implement effective policies.

What might underpin poor public investments and policy choices in resource-rich countries? The descriptions of public investment drives in Mexico, Bolivia, and the Philippines by Buffie (1990), Morales and Sachs (1990), and Dohner and Intal (1990) reflect, no doubt, the experiences of many other countries.

Morales and Sachs cite the near absence of rational economic decision making during Bolivia’s public investment drive. They point to universally overoptimistic assumptions and assessments of benefits, little serious cost-benefit analysis, and pervasive use of noneconomic objectives such as prestige or national security to justify investments. The Bolivian government was fragmented, each faction protecting its own favored investment, with little in the way of a central body to compare alternative investments and select the most effective.

It is clear from these accounts where the threats to good policy originate. When there is a lot of money on the table, government investment policy is especially vulnerable to capture by interest groups. The influential groups—construction firms, consultants, and almost any commercial interest associated with the investments—are those that profit from simply implementing investments regardless of their social value. Political and regional interests aggressively press their case for their favored investments. A culture of advocacy emerges that distorts objective analysis and a rational decision process.

Although more evidence would always be helpful, these accounts hint at how government could truly improve public sector decision making. They could, for example, focus specifically on the public investment decision process: create structures that can resist the distorting influence of vested interests, analyze alternatives rationally, measure the outcomes rigorously, and adjust policy if warranted. This would provide a much-needed focus to the general call to improve institutions in resource-rich countries.

Once an accurate picture of the scope for boosting growth through domestic public investments emerges, governments of resource-rich countries will be able to make better choices on other policy options, including investments in sovereign funds, welfare-enhancing social investments, and provision of natural resource dividends to the population. ■

Andrew Warner is a Resident Scholar in the IMF’s Research Department.

This article is based on two forthcoming IMF Working Papers by the author: “Economic Growth during Natural Resource Booms” and “Public Investment as an Engine of Growth.”

References

Buffie, Edward F., 1990, “Economic Policy and Foreign Debt in Mexico,” in Developing Country Debt and Economic Performance, Vol. 2: Country Studies—Argentina, Bolivia, Brazil, Mexico (Washington: National Bureau of Economic Research), pp. 393–547.

Dohner, Robert S., and Ponciano Intal, Jr., 1990, “The Marcos Legacy: Economic Policy and Foreign Debt in the Philippines,” in Developing Country Debt and Economic Performance, Vol. 3: Country Studies—Indonesia, Korea, Philippines, Turkey (Washington: National Bureau of Economic Research).

Morales, Juan Antonio, and Jeffrey D. Sachs, 1990, “Bolivia’s Economic Crisis,” in Developing Country Debt and Economic Performance, Vol. 2: Country Studies—Argentina, Bolivia, Brazil, Mexico (Washington: National Bureau of Economic Research), pp. 157–268.