Data Spotlight

Inclusive Africa

Finance & Development, March 2013, Vol. 50, No. 1

Luca Errico, Goran Amidzic, and Alexander Massara

The number of Africans with access to banking and other financial services is growing

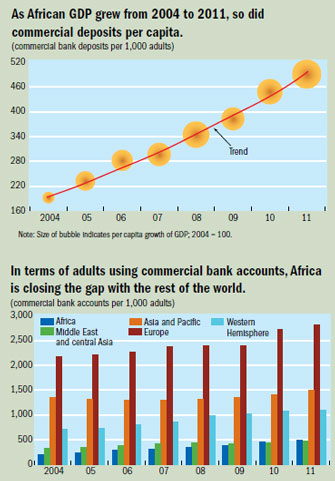

Africa has been among the world’s fastest growing regions during the past decade—the result of a prolonged commodities boom, favorable demographics, good economic policies, and generally improved political stability. Along with that economic growth came an increase in financial services to a growing number of Africans. Although major challenges to financial access remain, the relationship between the growth in per capita GDP and in access to depository services of commercial banks is striking.

Admittedly this process of financial inclusion started from a low base—and there is a huge difference in development across countries. But among all the world’s regions, from 2004 to 2011 Africa had the largest increase in access to depository services (as measured by the number of deposit accounts per 1,000 adults). Africa has caught up to the Middle East and central Asia in access to depository services, and the gap between Africa and the rest of the world is slowly narrowing.

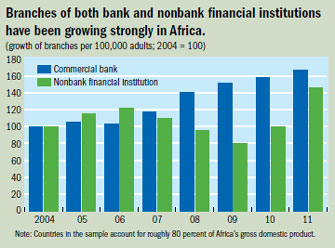

The number of branches of other types of financial intermediaries (which gather funds from savers and lend them to borrowers) also grew in the region during 2004–11. Those intermediaries include credit unions, financial cooperatives, microfinance institutions, rural banks, savings banks, money market mutual funds, investment companies, finance companies, and leasing companies.

Overall, although there are differences not only across countries but also within countries between cities and rural areas, the number of branches of both bank and nonbank financial institutions grew between 2004 and 2011. Commercial bank branches grew 70 percent over the period, and nonbank financial institutions’ branches expanded by close to 50 percent. There was a decline in nonbank branches during the 2007–09 global financial crisis, but growth rebounded in 2010.

About the database

The IMF's Financial Access Survey database (fas.imf.org) contains annual data and metadata for 187 jurisdictions, from 2004 to 2011. It is available to the public free of charge through the IMF eLibrary (www.elibrary.imf.org). The 2012 survey was conducted in collaboration with the International Finance Corporation and the Consultative Group to Assist the Poor. It has more than 40,000 time series that include basic consumer financial access indicators covering credit unions, financial cooperatives, and microfinance institutions. It separately identifies small and medium enterprises, households, and life insurance and non–life insurance companies. The Netherlands Ministry of Foreign Affairs and the Australian Agency for International Development provided financial support.