Data Spotlight

Ballooning Balance Sheets

Finance & Development, December 2012, Vol. 49, No. 4

Ricardo Davico and Brian John Goldsmith

Major central banks have been injecting liquidity to contain the effects of the global financial crisis

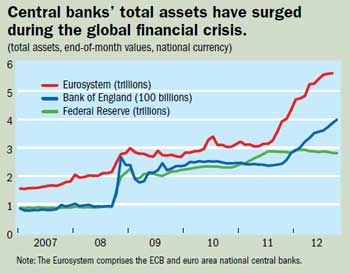

Since the onset of the financial crisis in 2007, there has been a dramatic expansion in the size of the balance sheets of the Bank of England (BOE), the European Central Bank (ECB), and the U.S. Federal Reserve (Fed). Central banks found themselves in a policy quandary. They had difficulty further lowering their policy interest rates to ward off the recession because the rates were already quite low. As a result, these central banks undertook unconventional policies aimed at stabilizing financial markets and fighting the recession by boosting  total demand.

total demand.

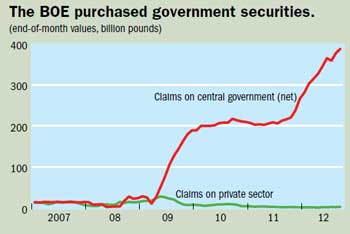

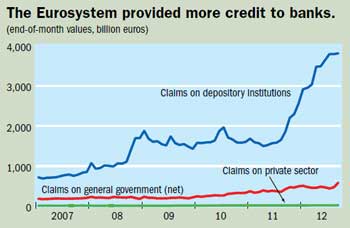

Although each of the central banks had a different approach, all three acted aggressively to inject liquidity into their economies and promote growth. The BOE engaged in a targeted quantitative easing policy that focused mostly on the purchase of government securities. Since March 2009, the BOE’s purchases of government securities (called gilts) have totaled 14 percent of GDP. The ECB

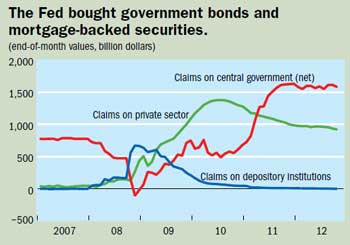

has conducted a range of measures, including long-term financing operations and a limited securities market program for sovereigns. The Fed’s quantitative easing used purchases of both government bonds and mortgage-backed securities to reduce long-term yields, especially on residential mortgage rates.

has conducted a range of measures, including long-term financing operations and a limited securities market program for sovereigns. The Fed’s quantitative easing used purchases of both government bonds and mortgage-backed securities to reduce long-term yields, especially on residential mortgage rates.

Despite their somewhat different focus, a common result has been a rapid  ballooning of all three central banks’ balance sheets. Since the onset of the subprime mortgage crisis in August 2007, the BOE’s balance sheet has grown 380 percent; the Eurosystem’s has mushroomed by 241 percent; and the Fed’s has grown 221 percent.

ballooning of all three central banks’ balance sheets. Since the onset of the subprime mortgage crisis in August 2007, the BOE’s balance sheet has grown 380 percent; the Eurosystem’s has mushroomed by 241 percent; and the Fed’s has grown 221 percent.

About the database

The data are derived from the International Financial Statistics database, which contains current statistics for 194 countries covering all aspects of international and domestic finance. The database is available at http://elibrary-data.imf.org