Fair Share

Finance & Development, December 2012, Vol. 49, No. 4

Francesca Bastagli, David Coady,

and Sanjeev Gupta

Fighting income inequality with redistributive social spending has been more effective in advanced than in developing economies

Rising income inequality is at the forefront of public debate both in advanced and in developing economies. Globalization, labor market reforms, and technological advances—all of which tend to favor higher-skilled workers—are important drivers of this divergence of fortunes.

Policymakers and commentators alike have expressed deep concern about the economic and social consequences of the persistent, and often sharp, increase in the share of income captured by higher-income groups. Many think reducing income inequality is crucial to promoting more widespread access to economic, social, and political opportunities.

Some inequality is necessary as an incentive for investment and growth, but there is evidence that when the disparity is too great it can stymie growth (see “Equality and Efficiency,” F&D, September 2011). Recently, a number of prominent experts have argued that rising income inequality was an important driver of the financial crisis.

How can public policy address high inequality? In a recent IMF study, we examined global trends in income inequality and the role fiscal—government spending and taxation—policies can play in reducing it.

In advanced economies, fiscal policy has done much to reduce inequality, but protecting its redistributive role is likely to become harder with prolonged fiscal adjustment over the coming decades as many countries try to reduce public debt to sustainable levels.

On the other hand, fiscal policy has done little to redistribute income in developing economies, which do not have the resources to finance redistributive public spending. To reduce inequality, governments in these economies must raise more revenue and develop more redistributive spending instruments, such as public pensions and targeted transfers.

The path of income inequality

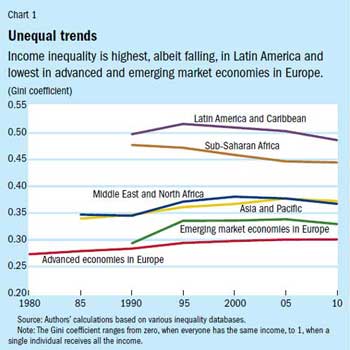

To study global trends in income inequality we assembled a comprehensive database on disposable income (that is, how much people have to spend, including social benefits and minus income taxes) in 150 advanced and developing economies between 1980 and 2010. We used the most common indicator of income inequality, the Gini coefficient, to assess changes in income distribution. (The Gini coefficient ranges from zero, when everyone has the same income, to 1, when a single individual receives all the income.)

We found that inequality in disposable income increased in most advanced and many developing economies over recent decades (Chart 1) and that inequality is substantially higher in developing than in advanced economies.

Data are available for a large sample of advanced and developing economies for 1990 to 2005. During this period, inequality increased in 15 of 22 advanced economies and in 20 of 22 emerging market economies in Europe. In Latin America and the Caribbean—the region that already had the least equitable income distribution—inequality increased in 11 of 20 countries, although it has since decreased in most countries. In Asia and the Pacific, inequality increased in 13 of 15 countries, as it did in 9 of the 12 countries in the Middle East and North Africa. In sub-Saharan Africa, the only region in which average inequality decreased over the period, it still increased in 10 of 26 countries.

Another striking trend is the sharp increase in the share of income captured by the very rich since the early 1980s (see “More or Less,” F&D, September 2011). The evidence has focused on the share of market income (income before taxes and social transfers) captured by the richest segments of the population.

For example, in the United States, the richest 10 percent earned 30 percent of market income in 1980 and 48 percent in 2008. There was a similar trend in other advanced economies, as well as in India and China, but it was much less pronounced in Scandinavian and southern European countries and was almost nonexistent in other continental European countries and Japan.

Reducing advanced economy inequality

Taxes and public transfers have played a significant role in offsetting the increase in inequality in nearly all advanced economies. Over the past two decades, fiscal policy reduced inequality by about one-third in Organization for Economic Cooperation and Development (OECD) countries. Fiscal policy has also tended to have a larger redistributive impact in countries with higher market income inequality. In 2005, for example, fiscal policy reduced income inequality, as measured by the Gini coefficient, by 20 or more points in Belgium, France, Germany, Italy, and Portugal—all of which had some of the highest market income inequality among advanced economies, with Gini coefficients between 0.48 and 0.56.

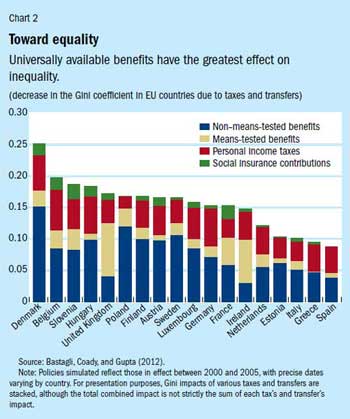

Most of this redistribution was achieved through expenditures—especially transfers that citizens receive regardless of their income, such as public pensions and universal child care benefits. These transfers are distributed much more equally than market income and account for fiscal policy’s relatively larger redistributive impact in Austria, Belgium, Hungary, Poland, and the Scandinavian economies. On average, the redistribution achieved by these transfers is twice as large as through taxes (see Chart 2).

Income taxes are another key redistributive tool. In fact, in most economies, income taxes redistribute wealth better than means-tested transfers (based on the recipient’s income) though not as well as non-means-tested transfers.

The redistributive impact of fiscal policy is even greater when in-kind transfers, such as public education and health spending, are included. These transfers lower the Gini coefficient for disposable income by as much as 6 percentage points and reflect universal access to education and health services. More equal access to education also has the added benefit of reducing the inequality of market incomes.

Limits on developing economies

The increase in inequality in advanced economies over recent decades pales in comparison with the gap between developing and advanced economies.

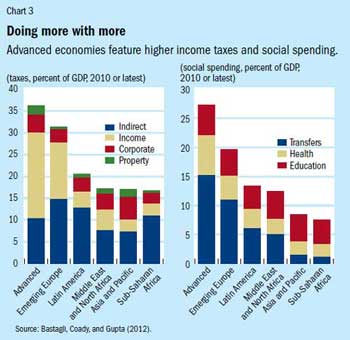

Substantially higher inequality in developing economies stems largely from limited redistributive fiscal policy in these countries. This, in turn, reflects their lower levels of taxation and public spending and the use of less progressive tax and spending instruments.

Taxes in advanced economies, on average, exceed 35 percent of GDP, but in developing economies (excluding emerging Europe) they are generally much lower, at 15 to 20 percent of GDP (see Chart 3). Consequently, government spending is also substantially lower in developing economies, especially in Asia and the Pacific and in sub-Saharan Africa, where lower transfer spending explains most of the difference.

For example, in a study of the early 2000s, almost three-quarters of the difference in disposable income inequality between Latin America and advanced European economies can be explained by fiscal policy. In six Latin American countries (Argentina, Brazil, Chile, Colombia, Mexico, Peru), fiscal policy reduced the average Gini coefficient by only about 2 percentage points, from 0.52 to 0.50. In 15 European economies the decrease was about 20 percentage points—from 0.46 to 0.27. But there is some evidence that the more recent decrease in inequality in Latin America is in part a result of more redistributive fiscal policy.

Less impact in advanced economies

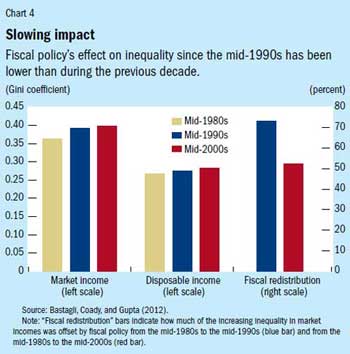

A worrisome trend is the diminishing redistributive impact of fiscal policy since the mid-1990s in many advanced economies. Chart 4 shows how market- and disposable-income inequality for working-age households has changed since the mid-1980s; the difference represents the redistributive impact of fiscal policy in each period.

Between the mid-1980s and mid-1990s, the Gini coefficient for market income rose by 3 percentage points, while that for disposable income grew by only 0.8 of a percentage point. In other words, inequality between what people earned went up a lot, but the difference between what they had available to spend changed little.

Fiscal policy therefore offset 73 percent of the increase in market income inequality over this decade. Although the inequality of market income increased less over the subsequent decade, the redistributive impact of fiscal policy also diminished. As a result, during the two decades from the mid-1980s to the mid-2000s, fiscal policy offset only 53 percent of this increase, and market income inequality grew by twice as much as redistribution.

This decreasing impact of fiscal policy in recent decades is surprising since without policy reform, progressive tax-benefit systems tend to become increasingly redistributive as market-income inequality increases—for example, because of higher unemployment or rising incomes of higher-income groups. Evidence suggests that the blunting of fiscal policy reflects reforms that made the tax-benefit system less progressive overall. In many economies, reforms since the mid-1990s have cut social benefits, particularly unemployment and social assistance payments, while also reducing income tax rates, especially at higher income levels.

This deterioration in redistributive impact is even more worrisome because many advanced economies must cut back on spending and increase taxes over the coming decade to reduce high public debt. In the past, such fiscal cutbacks resulted in short-term increases in inequality due to increased unemployment—especially of unskilled laborers—and heavy reliance on expenditure cuts.

During the coming period of fiscal retrenchment, policy reforms must protect the redistributive role of taxation and spending.

In the short term, fiscal policy can lessen the adverse impact of fiscal retrenchment through what are known as automatic stabilizers, such as unemployment benefits. Expenditure cuts that increase inequality can be tempered by protecting the most progressive social benefits and targeting them better. This approach has been used in Denmark, Germany, Iceland, and Sweden. Reforms to less redistributive spending, such as military funding, subsidies, and public sector wages, can reduce the need for cuts in more redistributive social transfers. In addition, expanding active labor market programs such as job-search support, targeted wage subsidies, and training programs can help speed up employment when economic growth resumes.

On the tax side, progressive revenue measures can head off the need for large cuts in transfers, although the effectiveness of such measures is limited if taxes are already high. Removing opportunities for tax avoidance and evasion, which typically benefit mainly higher-income groups, can simultaneously improve both the efficiency and the distributional impact of the tax system, as can a greater reliance on progressive wealth and property taxes.

Enhancing redistribution in developing countries

The challenge in developing economies is to develop fiscal policy that enhances redistribution while promoting growth and maintaining fiscal sustainability. This will require both a strengthened capacity of governments to mobilize resources and more redistributive expenditure programs.

On the tax side, the focus should be on broadening tax bases rather than increasing tax rates. Expanding corporate and personal income tax bases by reducing tax exemptions, closing loopholes, and improving tax compliance would raise revenues to finance redistributive transfers. Expanding the consumption tax base—for example, through a value-added tax—would increase tax revenues. Such consumption taxes can be designed to avoid adverse distributional impacts—for example by exempting small businesses and applying excises to luxury goods.

But limited revenues and heavy demands on these resources to finance development mean public spending has to become more redistributive. This can be achieved through greater reliance on social expenditures that are targeted, rather than universal, and aim to protect at-risk households from poverty and to improve the education and health outcomes of poor households. Many countries can save a lot of money quickly by eliminating universal price subsidies, which are expensive and inefficient. Conditional cash transfer programs link benefits to household investment in the education and health of family members. These programs have been successful in many developing economies and should play a greater role in social protection strategies. Expanding coverage of public pension systems is another effective way to reduce inequality. Where such expansion faces short-term constraints in administrative and fiscal capacity, greater use of targeted “social pensions” may be warranted until pension coverage can be broadened. ■

Francesca Bastagli is a Research Fellow at the London School of Economics; David Coady is a Deputy Division Chief and Sanjeev Gupta is a Deputy Director, both in the IMF’s Fiscal Affairs Department.

This article is based on the authors’ IMF Staff Discussion Note 12/08, “Income Inequality and Fiscal Policy.”