Back to Basics

What Is LIBOR?

Finance & Development, December 2012, Vol. 49, No. 4

The London interbank rate is used widely as a benchmark but has come under fire

Every weekday at about 11 a.m., 18 large banks, under the auspices of the British Bankers’ Association, report the rate at which they believe they can borrow a “reasonable” amount of dollars from each other in the so-called London interbank market. They report rates for 15 borrowing terms that range from overnight to one year. The financial news agency Thomson Reuters gathers the reported rates on behalf of the bankers’ group, throws out the four highest and four lowest, and averages the rest. It then announces that average rate at which banks say they can borrow dollars for each of the 15 maturities.

The process is carried out for nine other currencies as well. The average—often referred to in the singular even though there are 150 rates—is called the London interbank offered rate (LIBOR). It is one of the best known and most important interest rates in the world.

But it is not important because banks actually transact business with each other at the announced rate—although that can happen. Rather, LIBOR’s importance derives from its widespread use as a benchmark for many other interest rates at which business is actually carried out. According to a recent U.K. Treasury report, $300 trillion in financial contracts are tied to LIBOR—and that doesn’t include rates on uncounted tens of billions of dollars of adjustable rate home mortgages and other consumer loans around the globe in which LIBOR, in one way or another, is referenced.

Because the U.S. dollar is the most important of the world’s currencies, U.S. dollar LIBOR rates are probably the most widely used and cited. Other panels—ranging in size from 6 banks to 16—report daily what it would cost them to borrow Australian dollars, British pounds sterling, Canadian dollars, Danish kroner, euros, Japanese yen, New Zealand dollars, Swedish kronor, and Swiss francs short term in the London interbank market.

Much is likely to change, though, as a result of controversy over how some banks report the rates at which they “believe” they can borrow and because of some underlying problems with the LIBOR concept. In late September the U.K. government announced proposals to bring the setting and maintenance of this important benchmark under government purview, base it on actual transactions, and eliminate most of the 150 separate rates.

A recent innovation

Although banks in London have been lending to one another for centuries, LIBOR is a relatively new idea. It has its roots in the sudden growth in the early 1980s use of futures contracts to hedge against interest rate risk. Good benchmark rates were needed to settle those contracts. Markets turned to the banking industry trade group and the Bank of England to provide such a rate. The British Bankers’ Association launched LIBOR in 1986—initially with only three currencies—the dollar, the yen, and the pound sterling.

LIBOR was established as a standardized benchmark for the pricing of floating-rate corporate loans. However, its introduction coincided with the growth of new interest rate–based financial instruments—such as forward rate agreements and interest rate swaps—that also require standardized and transparent interest rate benchmarks.

LIBOR is supposed to reflect reality—an average of what banks believe they would have to pay to borrow a “reasonable” amount of currency for a specified short period. That is, it represents the cost of funds—although a bank may not actually have a need for the funds on any given day.

But LIBOR has long been dogged by perceptions that the method for setting the rates is flawed and prone to distorted results during periods of market stress when banks stop lending to each other across the full maturity spectrum, from overnight to one year.

A more direct challenge to its authenticity came from attempts to manipulate LIBOR (and other benchmark rates) by the big British bank Barclays, for which it agreed in June 2012 to pay fines totaling about $450 million to regulators in the United Kingdom and the United States. Other banks are also under investigation for misreporting LIBOR rates, with bank equity analysts estimating that fines and lawsuits could total almost $50 billion.

But even before the controversy over manipulation called into question its accuracy, LIBOR was often called a “convenient fiction” because of the disconnect between the LIBORs used as benchmarks and actual borrowing in the London interbank market. Most banks loan each other money for a week or less, so most LIBORs for longer maturities are set on the basis of educated guesses. Yet almost 95 percent of transactions that reference one of the LIBORs—from interest rate derivatives to home mortgages—are indexed to rates for maturities three months or longer. The U.S. three-month maturity period (or “tenor,” as the maturity period is called) is the most popular, according to the U.K. Treasury. A further hint that unsecured term lending has become a fiction was the decision by ICAP, a large London broker-dealer, to stop publishing its one- and three-month New York Funding Rate (NYFR) indices, an alternative to LIBOR, due to a lack of data from New York–based banks.

Nevertheless, LIBORs have been found to be reasonably accurate, most of the time tracking closely similar benchmarks that are tied to actual unsecured bank funding rates such as those for commercial paper.

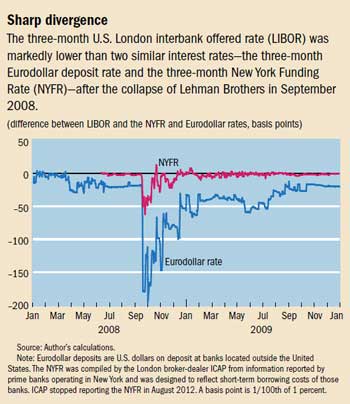

The glaring exception was the period immediately after the September 2008 failure of the New York investment banking firm Lehman Brothers, which triggered the global financial crisis. The three-month U.S. LIBOR diverged from two publicly available similar short-term rates—the ICAP NYFR and the three-month rate on Eurodollar deposits, which are U.S. dollar–denominated deposits at banks located outside the United States.

LIBOR was lower than the Eurodollar rate during early 2008 but was markedly lower in the period immediately following the Lehman collapse. LIBOR appears to track the NYFR very closely, except in the immediate aftermath of the Lehman failure, when it too was decidedly lower (see chart).

In part, LIBOR may have been lower after the Lehman failure because of an unintended consequence of a British Bankers’ Association rule meant to ensure that banks reported their borrowing costs truthfully: immediate publication of individual banks’ reports. While normally this would encourage honesty, in 2007–08 this safeguard may have backfired. Banks were reportedly loath to suggest that they were having trouble obtaining funds by reporting a rate higher than other banks were being charged. So to mask its liquidity problems, a bank with funding problems had an incentive to report lower rates than it really believed it would be offered. Indeed, a number of studies have suggested that banks submitted lowball rates after the collapse of the investment bank Bear Stearns in March 2008 as well as after the Lehman collapse six months later.

Other studies have found situations that suggest a bank was not reporting accurately. But studies that looked for bank-specific signs of collusion have been generally inconclusive.

Following the scandal there were some calls to eliminate LIBOR. But because it is so important and pervasive as a benchmark, the British government decided it could not be junked and should be saved.

First, the British government proposed to take over supervision of LIBOR from the bankers’ group, which Martin Wheatley, managing director of the U.K. Financial Services Authority, said, “clearly failed to properly oversee the LIBOR setting process.” Wheatley outlined the government’s proposed changes in a report published in late September.

Under the proposed reform, LIBOR would still be set daily based on reports to a U.K. regulator by panels of banks. But the banks would be required to provide data to show that the rates they submit are an accurate reflection of their borrowing costs. And although the government would still report the submitted rates publicly, it would do so with a three-month lag so that banks would not have an incentive to lie about their costs during a period of stress. Moreover, Wheatley said, the government proposes to impose criminal sanctions on banks that misreport.

And to focus the production of LIBORs on interest rates that matter—and for which there are verifiable funding costs—the Australian, Canadian, Danish, New Zealand, and Swedish currencies would be phased out and four maturities eliminated. The number of LIBORs would drop from 150 to the 20 that are most important to market participants.

Nevertheless, many of the rates would still be unsupported by actual interbank transactions. So the Wheatley report encourages market participants to rethink their use of LIBOR as a benchmark and consider the need for a backup plan if the rates are no longer produced. ■