Reconfiguring Growth

Finance & Development, December 2012, Vol. 49, No. 4

Bergljot Barkbu and Jesmin Rahman

To stimulate growth, the euro area must combine aggressive structural reform and policies to promote demand

European policymakers have long known that the EU economy needs fundamental structural changes. Aware that Europe was lagging the United States, the European Union launched the Lisbon Strategy in 2000 to make the region “the most competitive and dynamic knowledge-based economy in the world, capable of sustainable economic growth with more and better jobs and greater social cohesion” by 2010.

Well before the current crisis, Jean-Claude Trichet, then head of the European Central Bank, wrote, “There are four key priorities for reform in Europe, namely, getting people into work, increasing competition, unlocking business potential, and supporting an innovative environment” (OECD, 2005).

Indeed, according to our research, the long-term gains from product and labor market reforms are substantial and offer a much-needed opportunity to increase Europe’s growth potential. Moreover, a simultaneous EU-wide push for reform could lead to positive spillovers across countries.

The ongoing euro area crisis underlines the importance of reforms—but also increases the complexity of achieving them. Without an independent exchange rate, structural reforms must take the lead when it comes to delivering relative price adjustment for individual countries. But reforms often take time to bear fruit, and the need for growth is immediate. As a result, to generate growth and jobs now, longer-term structural changes must be combined with shorter-term measures to support demand. To anchor these efforts and restore confidence in the viability of the currency union, the euro area should move toward a more complete union.

European policymakers have taken unprecedented action in response to the crisis, both at the central and individual country level. The elements of a solution are there, but further implementation is needed.

What caused the problem?

Lack of growth in some parts of the euro area stems both from severe imbalances in trade and capital flows that built up after the adoption of the common currency and from weaknesses caused by lack of competitiveness, particularly on the labor front, reinforced by higher price increases and labor costs in southern countries since the beginning of the monetary union.

Problems with the labor market are well known. They include, for example, hiring and firing difficulties, high minimum wages, centralized wage bargaining, and restricted access to jobs and certain markets.

To lift growth, policymakers must tackle both imbalances and weak competitiveness.

During the past decade, euro area countries have gone in different directions in pursuit of growth. Exports drove growth in northern euro area countries like Germany and the Netherlands, while southern countries, such as Greece and Spain, relied on domestic demand. Not surprisingly, current account balances and relative prices, including nominal wages, have progressed differently in what are effectively two subregions—North and South. Demand in southern countries was financed largely by borrowing from the northern countries. The southern countries had big current account deficits, while the northern countries ran surpluses.

Once the crisis struck, the southern countries were hit in two ways. They had to begin reducing their accumulated imbalances as private capital flows and credit growth slowed, hurting growth. At the same time, markets started differentiating between surplus and deficit countries—pushing up private and public sector borrowing costs in countries with deficits.

A large share of new employment in southern euro area countries was in cyclical sectors, such as real estate, which rode the wave of rapid credit growth that accompanied the economic boom.

As credit dried up and the economic boom gave way to deep recession, unemployment surged in the southern euro area countries. The disparate growth strategy in the euro area has left southern countries with large imbalances, an unsustainable debt burden, and limited space for policy adjustment. Although these countries reversed some of their imbalances and competitiveness gaps in past years, the improvement was achieved largely through labor shedding. More relative price adjustment is needed. Unemployment remains at unprecedented levels and market access is severely limited. As a result, growth prospects are dismal (see Chart 1).

These are not simply short-term difficulties: they are fundamental barriers to long-term growth in the euro area. For example, Italy’s energy prices are among the highest in Europe, reflecting limited competition and inadequate infrastructure; in Spain, reforms of the goods and service markets would not only help raise its growth potential, it would also accelerate employment recovery.

These structural flaws prevented the euro area from keeping up with other major economies—particularly the United States—over the past three decades, even though EU growth has been relatively inclusive. Falling trend growth in the euro area reflects for the most part declining productivity growth, especially in southern countries. In addition, lower labor utilization (or productive hours worked)—a structural aspect of many European economies—explains much of the difference in the GDP per capita level between the euro area and the United States.

Will deep reforms make a difference?

Because many of the euro area’s underlying problems are fundamental in nature, fixing them requires structural reform—action to correct long-brewing problems that emanate from certain underlying features of the economy.

For example, studies of Europe find that strong employment protection, longer and more generous unemployment benefits, and collective bargaining systems that favor wages over employment have held down productivity, in turn keeping growth low. To make employers more amenable to hiring, certain structural aspects of the labor market must be changed, including moderating minimum wages, decentralizing collective bargaining, phasing out closed professions, relaxing job protection, and increasing job training. These actions are different from macroeconomic policies, which involve monetary or fiscal policy instruments, such as reducing the interest rate or bringing the budget into balance.

Empirical evidence shows that product market reforms, such as reducing barriers to competition and improving the business environment, can lift growth substantially. Labor market reforms, in addition to raising growth and employment in the long term, can help achieve price realignment and restore some countries’ lost competitiveness by giving employers more flexibility in hiring and firing and keeping wage growth under control.

Holding down nominal wages and using taxation to adjust relative prices between consumption and labor—technically known as fiscal devaluation—can help accelerate this rebalancing process. Reallocation across sectors could be supported by more active policies at the central EU level, including targeting investment and leveraging EU-wide funding resources.

Europe’s experience shows that structural reform can yield a strong payoff (see Box 1), and most empirical studies point to labor and product market reforms’ positive long-term effects on productivity, growth, and employment.

Box 1. Payoff from reform

The Netherlands in the 1980s and Sweden in the 1990s are examples of how reforms can turn poor economic performance around.

Before the reforms, both countries experienced a prolonged period of subpar performance. When the malaise was further exacerbated by a deep recession (Netherlands, 1980–82) or a banking crisis (Sweden, 1990–92), policies shifted course, and over a decade, extensive macroeconomic policy and supply-side reforms were implemented. The public expenditure–to-GDP ratio was lowered significantly, allowing a reduction in both the high fiscal deficit and high taxes; labor markets were made more flexible, and the incentives to work increased; and product markets were reformed to boost competition. Sweden has experienced two decades of rapid growth, and the Netherlands is renowned for its employment miracle.

What are the lessons of these experiences for other countries?

First, reforms are country specific. In the Netherlands, reforms focused on increasing the very low employment rate (the result of too rapid wage increases); in Sweden, reforms focused on boosting dismal productivity growth (which was held back by outdated industries and excessive regulation). In Sweden, large downward adjustment in the real effective exchange rate resulting from currency depreciation helped jump-start the economy. Reforms in both countries, however, had common elements—reducing the role of the government in the economy, increasing competition, and changing incentives.

Second, reforms need to adapt over time, as bottlenecks change. In the Netherlands, the problem initially was a lack of demand for labor, so policies focused on reducing wage costs. As employment expanded, reforms shifted to boosting labor supply.

Third, the full impact of reforms builds up over time.

Box 2. The model

The Global Integrated Monetary and Fiscal model (GIMF) is a general equilibrium model that is used extensively inside the IMF, and at a small number of central banks, for policy and risk analysis involving a number of countries.

The traditional strength of the GIMF is its usefulness in fiscal policy analysis and the study of macrofinancial linkages.

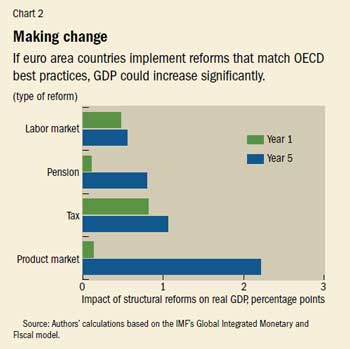

To compare short- and long-term impacts, we simulated the effects of individual structural reforms on output using the IMF’s Global Integrated Monetary and Fiscal model (GIMF—see Box 2). The Organization for Economic Cooperation and Development (OECD) has identified best practices in labor and product markets and pension policies. Our study found that if euro area countries made changes that close by 50 percent the gap between their labor market and pension policies and OECD best practices, GDP would rise on average by almost 1½ percent over a five-year period. The gains increase by another 2¼ percent if product market reforms are also pursued (see Chart 2).

Other analyses reach similar conclusions. For example, the OECD found that comprehensive and ambitious reforms would add 1 percentage point a year to GDP growth for 10 years in most euro area countries (OECD, 2012).

These potential gains are substantial, but the effort required to implement them is also large and the payoff is modest in the very short run, particularly for product market reforms, which take time to put in place. Because product markets lag best practice more than labor markets, focusing reform in that area appears to yield a considerably higher return.

Our simulation results also point to sizable mutually reinforcing effects from a broad spectrum of reform. For example, a country that works to close only the gap in its labor market is expected to experience a smaller growth payoff than one that makes an effort to close the gap in its product markets as well.

Moreover, reforms in one country can also help other countries, mainly through increased trade and productivity spillovers. If Spain reforms its labor market, that has a positive effect on growth in the rest of the euro area. Generally speaking, the analysis shows that southern euro area countries would gain more from reforms in northern countries than northern countries would benefit from reforms in the south. That’s because the northern euro area countries have bigger economies and higher productivity levels.

But reforms are unlikely to deliver a sufficient boost to short-run activity during the current economic slump. And implementing them during a downturn may be more difficult than in better times. Structural reforms such as those of product and labor markets are geared toward improving competition and productivity, thereby enhancing an economy’s supply side, and may yield no payoff in the short run if aggregate demand is weak and there is excess capacity.

For example, adapting employment protection may not stimulate hiring in the short term, but might in fact increase unemployment as employers shed excess workers without penalty. Similarly, reducing unemployment insurance or raising the retirement age would reduce the disposable income of those induced to seek work who do not find it. But these changes are critical to reinvigorate trend growth.

Policy options

So what can be done? Against a backdrop of low trend growth, competitiveness problems in several countries, and the need for fiscal consolidation to reduce unsustainable debt and large deficits, the euro area must take a multipronged approach. But trying to grow out of the crisis with a precrisis growth model based on vibrant domestic demand in southern countries would be an illusion. It proved to be an unsustainable strategy.

First, structural reforms should be put in place quickly because they take time to deliver their full potential. Some countries, particularly in the south, have made noteworthy progress in the past couple years, but there are still significant gaps between actual and potentially growth-maximizing benchmarks. Barkbu, Rahman, and Valdés (2012) discuss progress so far and lay out concrete and country-specific reform priorities for all euro area countries.

In the southern euro area, structural policies must improve the efficiency of tradable goods production to help restore competitiveness. Elsewhere, policy must open up business opportunity in the service sector to boost potential growth.

Labor market reforms should be country specific, targeted toward relative price adjustment in the south and increased labor force participation in the north.

Second, to avoid unduly harsh contractions that are very hard to reverse, these reforms should be complemented by policies that boost aggregate demand in the short run. This is not a recommendation for simple fiscal stimulus, but a way to counteract factors that make reform more difficult. It is consistent with rapid fiscal consolidation where market pressure is severe and gradual consolidation elsewhere, allowing automatic stabilizers to work and for adjustment to be as growth-friendly as possible.

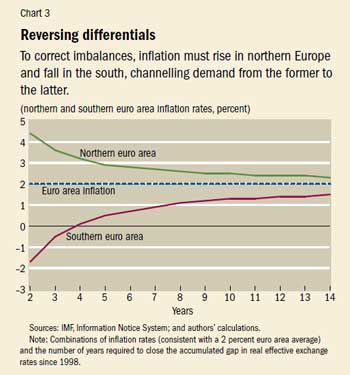

Reducing the imbalances within Europe will be less disruptive to economic activity if relative prices adjust further.

Since the beginning of the monetary union, southern euro area countries’ more rapid increases in prices and labor costs have rendered those countries noncompetitive. Some of this competitiveness gap has been reversed over the past few years, but more is needed to channel additional external demand to the south and preserve the common currency.

Prices in southern Europe must increase less than prices in the north, which calls for nominal wage restraint in the south and wage growth in line with productivity in the north (see Chart 3).

Third, the euro area needs to move unequivocally toward a more complete union (see IMF, 2012). To build on recent policy progress, which has helped reduce risks, Europe needs to deliver on commitments already made to move toward more supportive pan-European policies and repair the broken monetary transmission mechanism.

The first building blocks of a banking union agreed at the June 2012 EU summit—a single supervisory framework—must be implemented and complemented with a euro-area-wide deposit insurance program and bank resolution mechanism with adequate common backstops.

To reduce the tendency for economic shocks in one country to imperil the euro area as a whole, greater fiscal integration—combining stronger central governance with more risk sharing—must accompany the banking union.

In addition, any sensible strategy must acknowledge that some of the current poor performance is unavoidable as a number of countries correct the excesses of the past. The region must repair its balance sheets and reduce excessive borrowing, with its negative short-term implications for economic activity. Bank deleveraging—a necessary unwinding of the precrisis credit boom—higher private sector saving, and unavoidable fiscal consolidation to reduce debt and deficits are continued powerful headwinds to growth.

Combined with structural and selective demand policies to boost growth and correct the competitiveness gap, firm commitments by policymakers to a more solid union will lift confidence and support the recovery. ■

References

Barkbu, Bergljot, Jesmin Rahman, Rodrigo Valdés, and a staff team, 2012, “ Fostering Growth in Europe Now,” IMF Staff Discussion Note 12/07 (Washington: International Monetary Fund).

International Monetary Fund (IMF), 2012, Euro Area Policies: 2012 Article IV Consultation, IMF Country Report 12/181 (Washington).

Organization for Economic Cooperation and Development (OECD), 2005, OECD Observer (Paris).

———, 2012, OECD Economic Surveys: Euro Area (Paris).