Sino-Spending

Finance & Development, September 2012, Vol. 49, No. 3

Steven Barnett, Alla Myrvoda, and Malhar Nabar

![]() Global downturn contributes to China slowdown

Global downturn contributes to China slowdown

![]() China: The road to sustainable growth

China: The road to sustainable growth

China must boost household consumption even further to make its growth more inclusive

Time for a pop quiz. In 2011, which country contributed the most to global consumption growth? Answer: China. Yes, the economy where consumption is almost universally considered to be too low contributed more to global consumption growth last year than the traditional front-runner in this category, the United States (see Chart 1).

This is a stunning development. But is it enough to reassure those who have long stressed that China should increase consumption to make its spectacular growth even more inclusive—which would also put the global economy on a more stable and sustainable path of expansion?

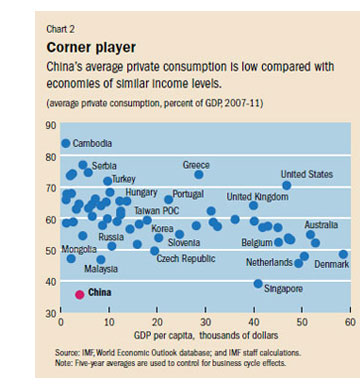

Low for long

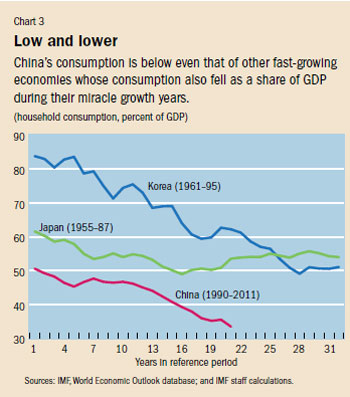

The short answer is no. The fretters still have a point. Household consumption—the ultimate driver of self-sustaining growth—continues to remain low as a share of China’s GDP (see Chart 2). China’s ratio is well below that of countries at a similar income level and of other Asian economies. It is also low relative to the historical experience of other fast-growing economies, such as Korea and Japan, where consumption fell as a share of GDP during the early part of their miracle years. What’s different about China, though, is that household consumption as a share of the national economy was relatively low to begin with and has continued to decline further (see Chart 3). China’s large contribution to world consumption growth therefore results from its aggregate economy growing faster than that of other major economies, which are still working off the excesses of the pre–financial crisis binge, and not from an increase in China’s household consumption as a share of its own economy.

Much of the drop in China’s consumption-to-GDP ratio can be traced to the decline in household disposable income as a share of GDP (Aziz and Cui, 2007). As the economy has become more capital intensive during the period of rapid growth, corporate earnings have risen and household disposable income as a share of GDP has dropped. Importantly, the low consumption ratio is well explained by attributes of China’s economy, including the relatively low level of service sector development, financial underdevelopment, and low real interest rates compared with other economies (Guo and N’Diaye, 2010).

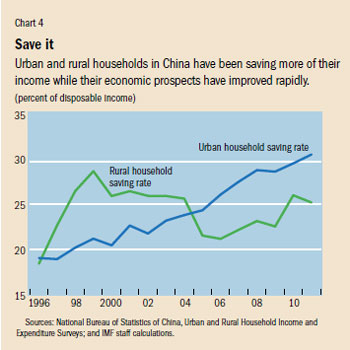

Playing it safe

The consumption decline also reflects a rise in household saving rates. In the mid-1990s, the urban household saving rate was less than 20 percent of disposable income. Last year, it passed 30 percent. The rural household saving rate has risen over this period as well, but to a lesser extent than the urban rate (see Chart 4).

What explains this rise in saving rates? There are several dimensions to it. First, precautionary motives have influenced saving decisions (Barnett and Brooks, 2010). Since the 1990s, households have borne a larger burden of education and health expenditures as the state dismantled the “iron rice bowl” welfare system. As state-owned enterprises were restructured, the public services traditionally provided and financed by these entities were reduced. These profound changes to the delivery of welfare services had a substantial impact on households of all ages. Young households increased their savings to finance education expenditures for their children, while older households saved more to provide a buffer against uncertain health expenditures and lower retirement benefits (Chamon and Prasad, 2010; Chamon, Liu, and Prasad, 2010).

Privatization of the urban housing stock was another important development in the 1990s. Home ownership in urban areas has grown rapidly since the initial transfer of the housing stock to private ownership by urban residents. Home purchases are still largely financed by personal savings. As young families aspire to home ownership, their saving rates have increased (Chamon and Prasad, 2010).

Finally, Chinese households have, in recent years, been making spending and saving decisions in an environment defined by rapid change. Social safety net reforms, changes in job opportunities, and new housing objectives—all have influenced the way households make their decisions. Without adequate access to consumer loans or insurance that would help them smooth expenses and protect them from major financial loss, Chinese households have self insured: their savings serve as a buffer against future declines in income or health. A fall in the real return on savings induces households to save even more to build that buffer and reach their saving goals. So the decline in real interest rates on savings in the past decade has pushed up urban household saving rates (Nabar, 2011).

Reversing the trend

The fact that China was the largest contributor to global consumption growth in 2011 offers a glimpse of the potential for China’s consumption to act as an important source of global final demand. But for this to happen in a durable, self-sustaining way, China must find ways to accelerate its transformation to consumption-based growth.

The good news is that consumption is already growing rapidly in China—a crucial but often overlooked fact. Real final consumption expenditure has increased since 1995 at an average annual pace of about 8½ percent (see Chart 5). This is an impressive and enviable record, but it just so happens that real GDP growth averaged an even more striking 10 percent. Consumption is growing fast, just not as fast as GDP. The rapid consumption growth goes hand in hand with China’s success in reducing poverty—by more than 400 million people since 1992—and boosting living standards.

But more work remains to be done. Moving China decisively toward consumption-based growth requires progress on the following fronts:

• Boost household income by reducing barriers to entry to labor-intensive service sector jobs; accelerating financial reform to raise returns on savings; and limiting the incentives to pursue capital-intensive growth by raising the cost of capital and reforming energy, water, land, and pollution pricing.

• Improve the social safety net and curb precautionary motives by expanding public health insurance to cover chronic and catastrophic illness, and by strengthening the pension system (especially improving portability).

• Reduce the need to accumulate savings by expanding social housing, improving access to mortgage financing, and tamping down speculative pressures, all to make housing more affordable.

These reforms are in line with China’s 12th Five-Year Plan. If the reforms are diligently implemented, China could successfully transition into an economy driven by private consumption. This would help secure sustainable and inclusive growth in China and, in turn, contribute to strong and balanced global growth. That, no doubt, is the right answer for China and the global economy. ■

Steven Barnett is a Division Chief, Alla Myrvoda is a Research Officer, and Malhar Nabar is an Economist, all in the IMF’s Asia and Pacific Department.

References

Aziz, Jahangir, and Li Cui, 2007, “Explaining China’s Low Consumption: The Neglected Role of Household Income,” IMF Working Paper 07/181 (Washington: International Monetary Fund).

Barnett, Steven, and Ray Brooks, 2010, “China: Does Government Health and Education Spending Boost Consumption?” IMF Working Paper 10/16 (Washington: International Monetary Fund).

Chamon, Marcos, Kai Liu, and Eswar Prasad, 2010, “Income Uncertainty and Household Savings in China,” IMF Working Paper 10/289 (Washington: International Monetary Fund).

Chamon, Marcos, and Eswar Prasad, 2010, “Why Are Saving Rates of Urban Households in China Rising?” American Economic Journal: Macroeconomics, Vol. 2, No. 1, pp. 93–130.

Guo, Kai, and Papa N’Diaye, 2010, “Determinants of China’s Private Consumption: An International Perspective,” IMF Working Paper 10/93 (Washington: International Monetary Fund).

Nabar, Malhar, 2011, “Targets, Interest Rates, and Household Saving in Urban China,” IMF Working Paper 11/223 (Washington: International Monetary Fund).