Letters to the Editor

Finance & Development, June 2012, Vol. 49, No. 2

Social spending in poor countries

We read with great interest “Are the Critics Right?” (December 2011). The answer, it appears, is a resounding “no”: IMF programs do not hurt social spending in poor countries, but, rather, reinforce it by bolstering fiscal space. These findings echo those reported by the IEO [IMF Independent Evaluation Office] in their 2003 report on the same topic.

If correct, these findings are welcome news and suggest the IMF has learned from its prior mistakes. We state as much in a 2006 article published in International Organization that revisited the IEO report, and identified the 1997 Guidelines on Social Expenditures as a possible break-point in the effect of IMF programs (this claim is consistent with the IMF’s finding that “spending-to-GDP ratios have accelerated since 2000”). But you do not address our main finding: that IMF program effects differ by the recipient country’s political regime type, and that the negative effect of IMF programs on social spending is particularly pronounced in developing democracies. Politics matters, and the IMF ignores this inexorable fact of social life to its own detriment.

Irfan Nooruddin

Fellow, Woodrow Wilson International Center for Scholars, Washington, D.C.

Joel W. Simmons

Associate Professor, Department of Political Science, The Ohio State University, Columbus, Ohio Assistant Professor, Department of Political Science, University of Maryland, College Park, Maryland

The authors respond

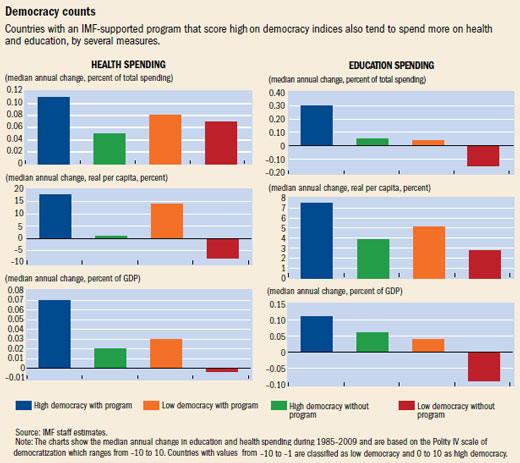

We agree with Professors Nooruddin and Simmons that political regimes can potentially affect social spending. Our results confirm that increases in social spending have been higher in low-income countries scoring higher on indices of democracy (see chart). At the same time, our results also indicate that increases in education and health spending as a share of GDP, as a share of government spending, and in real per capita terms have been higher in countries with IMF-supported programs.

We also assessed the effect of scores on democracy in our econometric model, using a formulation similar to that of the 2006 paper of Professors Nooruddin and Simmons that interacts the presence of an IMF program with an index score for democracy. The effect was statistically insignificant for education and health spending as a share of GDP and a share of government spending, except for the effect on health as a share of GDP, where it was positive. Thus, our analysis does not suggest that IMF-supported programs lead to lower increases in spending under democracies.

Masahiro Nozaki

Benedict Clements

Sanjeev Gupta

A caution on credit ratings

Panayotis Gavras’s “Ratings Game” (March 2012) covers many interesting aspects, except for, unfortunately, what really constituted the fundamental mistake of Basel regulators when using the credit ratings when determining capital requirements for banks.

Banks already account for perceived risks, like those included in credit ratings, by means of the interest rates, the amounts exposed, and the other general terms. And so, when regulators set the capital requirements also based on the same perceptions, they are double-dipping into perceptions, causing what is officially deemed as not risky to become even more attractive and what is officially deemed as risky to become even less attractive.

Any information, like risk-of-default information, becomes bad, even if it is perfect, if excessively considered.

The reason this has not been understood can perhaps be explained by the fact that almost everyone speaks about this crisis as a result of excessive risk-taking, even though the fact that all the problems are derived from excessive exposure to what was perceived as absolutely not risky—and that there is a lack of exposure to the officially “risky,” like to small businesses and entrepreneurs—would indicate our being more in the presence of a regulatory-induced and perverse excessive risk-averseness.

When regulators decided to play the risk-managers for the world, they forgot or ignored the fact that all bank crises have always resulted from excessive exposures to what was considered as safe, and never from excessive exposures to what ex ante was considered to be risky.

Per Kurowski

Former World Bank Executive Director (2002–04)