Data Spotlight

G7 Borrowing from Abroad

Finance & Development, June 2012, Vol. 49, No. 2

As a share of GDP, the United Kingdom tops the list

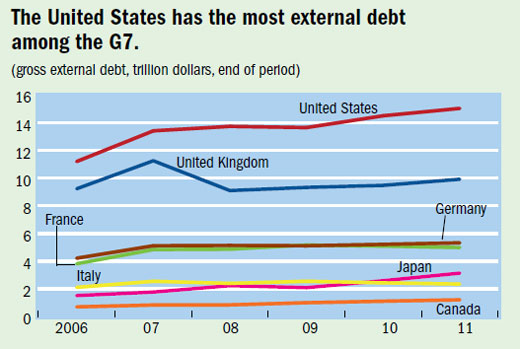

THE UNITED STATES has the most external debt of the world’s richest countries (the Group of Seven major industrial countries, or G7), but as a share of GDP, the United Kingdom tops the list. The gross external debt (that held by foreigners) of the United Kingdom exceeded four times its GDP in 2011, mainly because of its role as an active financial center. France, Germany, and Italy all had ratios over 100 percent.

The U.S. external debt—$15 trillion in 2011—was equal to its GDP. That number has risen significantly over the past five years (from $11 trillion in 2006), in part to finance a high fiscal deficit.

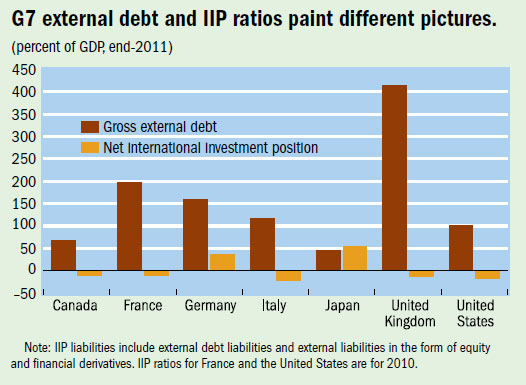

But gross external debt, by itself, does not give a full picture of a country’s financial circumstances. The level of external debt may change due to a reallocation of existing liabilities from domestic to foreign residents. Also, an important factor in a country’s ability to withstand adverse shocks is the level of its external assets. International financial centers like the United Kingdom have high levels of both external debt and external assets.

To assess a country’s financial strength, one must look at a country’s international investment position (IIP). The net IIP—the difference between external assets and external liabilities—shows net borrowing from (or net lending to) the rest of the world. The ratios of total external assets and liabilities in the G7 countries paint a significantly different picture of external positions. In 2010, Japan and Germany were net creditors, whereas the other five G7 countries were net borrowers.

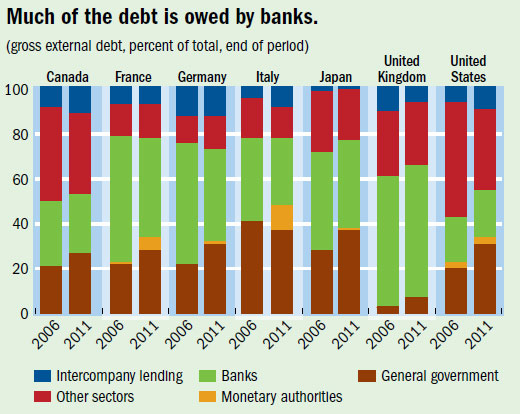

As for the composition of external debt in 2011, the largest share in France, Germany, Japan, and the United Kingdom was owed by banks. In the United States and Canada, the largest share was “other sectors” (mainly nonbank financial corporations and nonfinancial corporations), followed by general government debt. Between 2006 and 2011, the share of general government external debt increased in every G7 country except Italy. This increase was partly due to the financial crisis, which resulted in increased borrowing for social spending and reduced business borrowing and spending. The decline in Italy’s share was due to an increase in borrowing by its monetary authorities under the currency swap lines established with the European Central Bank to address its liquidity needs.

About the database

The data are drawn from the joint IMF–World Bank Quarterly External Debt Statistics (QEDS) database. The QEDS database provides detailed data on gross external debt for 109 economies, of which 67 subscribe to the Special Data Dissemination Standard. The QEDS database is available at www.worldbank.org/qeds

Prepared by Tamara Razin, Marcelo Dinenzon, and Martin McCanagha of the IMF’s Statistics Department.