Will the Renminbi Rule?

Finance & Development, March 2012, Vol. 49, No. 1

PDF version

![]() IMF podcast: China Rising

IMF podcast: China Rising

The Chinese currency is on track to become more important globally, but is unlikely to challenge the dollar anytime soon

THE Chinese economy is now the world’s second largest and a key driver of global growth. It amounts to between 10 percent and 15 percent of world GDP (depending on how it is measured) and, in 2011, accounted for about one-quarter of world GDP growth. But among the currencies of the six largest economies in the world, China’s renminbi is the only one that is not traded easily and accepted worldwide—that is, it is not a hard currency.

China’s government has taken steps recently to promote the international use of the renminbi, even though it has not been willing to open up its economy to the free flow of capital and allow its exchange rate to be flexible. Nevertheless, given the sheer size of China’s economy and its rising shares of global output and trade, these steps portend a rising role for the renminbi in international finance and trade. But a compelling question is whether the renminbi’s global stature will rise to match that of the Chinese economy—perhaps approaching the U.S. dollar.

The answer to that question depends on three related but distinct concepts about the currency:

•Internationalization: its use in denominating and settling cross-border trade and financial transactions—that is, as an international medium of exchange;

•Capital account convertibility: how much a country restricts inflows and outflows of financial capital—a fully open capital account has no restrictions; and

•Reserve currency: whether it is held by foreign central banks as protection against balance of payments crises.

A country’s currency can be used internationally even if its capital account is not fully open. And even in the absence of restrictions on capital flows, a country’s currency may be used little or not at all internationally. But both international use and an open capital account are necessary for a currency to become an international reserve currency.

This article evaluates the current state of and prospects for the renminbi in each of these three dimensions in terms of the balance and sustainability of China’s economic development and the associated implications for the global monetary system.

Becoming a reserve currency

Given China’s size and growth prospects, it is widely seen as inevitable that the renminbi will eventually become a reserve currency. To gauge the likelihood and timing, it is necessary to consider the typical attributes of a reserve currency and evaluate China’s progress in each of these dimensions. The factors that generally affect a currency’s reserve status include

•Economic size: A country’s GDP and its shares of global trade and finance are important, although not crucial, determinants of a country’s reserve currency status.

•Macroeconomic policies: Investors in a country’s sovereign assets must have faith in the ability of its economic policies, especially its commitment to low inflation and sustainable public debt, to protect the value of the currency from erosion.

•Flexible exchange rate: Reserve currencies are typically traded freely and their external value is market determined, although this does not entirely preclude central bank intervention in foreign exchange markets. An open capital account is not synonymous with a freely floating exchange rate.

•Open capital account: Reserves must be acceptable as payments to a country’s trade and financial partners, which requires that the currency be easily tradable in global financial markets. This is difficult if a country imposes restrictions on capital flows and if its foreign exchange markets are thin and subject to the government’s direct control.

•Financial market development: A country must have deep and liquid financial markets—that is, markets, especially in government bonds, with many buyers and sellers to provide “safe” assets that can be held by international investors and central banks from other countries. Turnover (trading volume) in these bond markets, which is a measure of liquidity, is also important.

There is no hard-and-fast rule that dictates which of these factors are important or even essential. For instance, the Swiss franc is a global reserve currency even though Switzerland’s shares of global GDP and trade are small. Moreover, many major reserve currency economies—the euro area, Japan, and the United States, for example—have large and rising public debt, which casts doubt on their macroeconomic stability but has not affected their currencies’ reserve status, at least so far. Some analysts have in fact extrapolated from the U.S. experience to argue that China will have to run large current account deficits if it wants to provide reserve assets to the rest of the world. But that is not the case. The currencies of Japan and Switzerland have achieved reserve status despite those countries’ consistent current account surpluses.

How the renminbi fits in

China’s size and importance in world trade are well known. It now accounts for 10 percent of global trade in goods, up from 4 percent a decade ago, and is extensively connected with other economies through trade linkages. Whether China’s fiscal and monetary policies anchor long-run inflation expectations and foster macroeconomic stability is an open question. China has a moderate level of explicit public debt and a small government budget deficit relative to the major reserve currency economies. Moreover, despite its tightly managed exchange rate, which has compromised the independence of monetary policy, China has had a relatively stable inflation rate in the recent past.

The next question is whether China is opening up its capital account. Although China still has extensive capital controls in place, they are being selectively and cautiously dismantled. As a result, gross inflows have risen sharply over the past decade, reflecting China’s attractiveness as a destination for foreign investment. Outflows other than foreign exchange reserves, including investments abroad by Chinese corporations and institutional investors such as pension funds, have also grown substantially, albeit from a low base. In short, China’s capital account is becoming increasingly open in actual terms, although even by this measure it remains less open than those of the reserve currency economies—the euro area, Japan, Switzerland, the United Kingdom, and the United States.

Financial market development in the home country is a crucial determinant of a currency’s international status. Historically, each reserve currency has risen to prominence under unique circumstances and spurred by differing motivations, but one constant is that this process has always required strong financial markets. The relevant aspects of financial market development include

•Breadth: the availability of a broad range of financial instruments, including markets for hedging risk;

•Depth: a large volume of financial instruments in specific markets; and

•Liquidity: a high level of turnover (trading volume).

Without a sufficiently large debt market, the renminbi cannot be credibly used in international transactions. If there is insufficient liquidity in markets for renminbi-denominated debt, the currency will not be attractive to foreign businesses. Both importers and exporters may be concerned about greater exchange rate volatility from an open capital account if they don’t have access to derivatives markets to hedge foreign exchange risk.

Where do things stand? China’s financial system remains bank dominated, with the government directly controlling most of the banking system. Total domestic credit provided by the banking sector outweighs the size of the equity and bond markets combined. The banking system’s size and structure, which protect banks’ profits by limiting competition, and regulatory barriers have stifled broader financial market development.

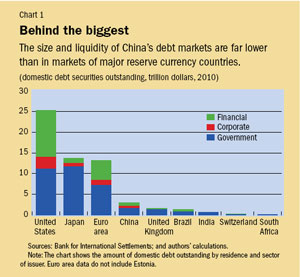

Debt markets in China lag far behind those of major reserve currency economies in size and liquidity (see Chart 1). The government debt market is reasonably large in absolute terms but turnover is low. Turnover is relatively high in China’s corporate bond market, which is still small. Analyzing the shares of international debt securities according to the currencies of issuance reveals a similar picture. The existing reserve currencies dominate; only a paltry 0.1 percent of international debt is denominated in renminbi.

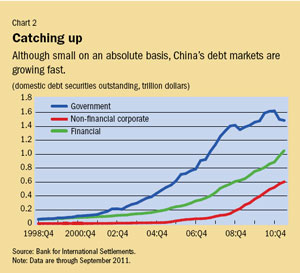

While the absolute size of the debt securities market in China is small from a cross-country perspective, it should not mask the rapid growth of these markets, which is consistent with the country’s intention to make the renminbi accepted as an international currency (see Chart 2). Nevertheless, reserve currency status for the renminbi is probably a much longer-term goal.

One area in which China has made significant progress is in the development of equity markets. Following reforms in 2005, market capitalization and turnover surged and have grown sixfold, while trading volume has climbed more than tenfold. However, Chinese stock markets are highly volatile and prone to concerns about corporate governance, so they may be of limited help in promoting the renminbi’s role as an international currency.

The pace of internationalization of China’s currency depends on its use in international financial transactions, not just trade. Foreign exchange market turnover is a good indicator of a currency’s potential as a vehicle currency for transactions involving cross-border trade in goods and financial assets. Currently, the renminbi accounts for less than 1 percent of all turnover in foreign exchange markets in 2010, but that understates reality. China uses Hong Kong SAR as an important financial center for settling foreign exchange transactions, and in 2010, Hong Kong SAR accounted for 5 percent of global foreign exchange market turnover. Hong Kong SAR provides a useful platform that puts the renminbi on a competitive footing relative to other emerging market currencies in terms of reaching international currency status.

Most derivatives markets in China are still nascent, but three of its commodity futures exchanges are among the top 20 derivatives exchanges in the world as measured by the number of futures and options contracts traded. From the perspective of promoting international use of a currency, however, a large commodity derivatives market is not as useful as more diverse and liquid financial derivatives markets.

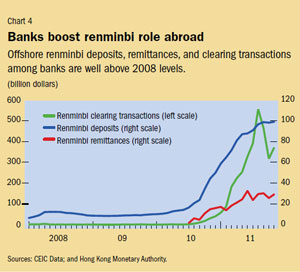

To some extent, policies that direct activity toward Hong Kong SAR are playing a role generally carried out by vibrant domestic financial markets. Both the amount of renminbi deposits and the number of institutions authorized to conduct renminbi business in Hong Kong SAR have risen sharply over the past year.

Policies to increase offshore renminbi use have effectively promoted its global role without risking the potentially deleterious effects of capital account liberalization. But the full potential of the Chinese currency’s international use cannot be realized without more active onshore development. Ultimately, it will be difficult to fully develop foreign exchange and derivatives markets without substantial capital account liberalization.

To sum up, there has been modest development of the breadth, depth, and liquidity of China’s financial markets over the past decade. But China still comes up short when it comes to the key dimensions of financial market development, and financial system weaknesses are likely to impede its steps to heighten the currency’s international role.

A rising international presence

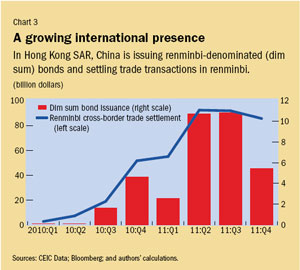

Despite the weak financial infrastructure supporting it, the renminbi is gaining an international presence (see Charts 3 and 4). China has been using Hong Kong SAR extensively as a testing ground for initiatives to promote the international use of the renminbi. Personal renminbi business was launched in Hong Kong SAR in 2004, when residents there were allowed to open deposit accounts denominated in renminbi. Other initiatives followed, such as cross-border settlement of trade transactions and renminbi bond issuance.

Given China’s rapidly expanding trade volume, promoting renminbi trade settlement is a logical first step toward the currency’s internationalization. Since it began in 2009, cross-border trade settlement in the Chinese currency has surged. In 2011, renminbi trade settlement amounted to about 8 percent of China’s total trade in goods and services. Monthly remittances of renminbi used for cross-border settlement in Hong Kong SAR rose to nearly $25 billion a month in 2011, more than double the 2010 average.

Issuance of renminbi-denominated bonds (known as dim sum bonds) in Hong Kong SAR is on the rise as well, tripling from 2007 to 2010 and hitting a high of about $10 billion in the second quarter of 2011. Fewer of these bonds were issued during the remainder of 2011, reflecting weaker global market conditions as the debt crisis in Europe continued to fester.

Another way to gauge offshore use of the renminbi is to look at transactions among banks. Such renminbi clearing transactions were virtually nonexistent until mid-2010, when financial institutions in Hong Kong SAR were allowed to open renminbi-denominated accounts. Since then, both the volume and value of transactions have increased dramatically. The total value of transactions hit a peak of more than $500 billion in August 2011.

Although still on a modest scale, the initiation and rapid expansion of various elements of the offshore renminbi market foretell the currency’s significant presence in trade and financial transactions in Asia. Some might argue, however, that dim sum bond issuance and cross-border settlement in renminbi are still narrow in scope, with most of the activity accounted for by Chinese mainland companies and their Hong Kong SAR subsidiaries. Some of this activity may also reflect attempts to circumvent capital controls. In short, even the influence of offshore renminbi use has some distance to go to reach its full potential.

On another front, China’s central bank is establishing and expanding local currency bilateral swap lines with other central banks around the world to facilitate and expand the use of the renminbi in international trade and financial transactions. The amounts of these bilateral agreements are small, but they indicate efforts to make other countries’ central banks comfortable and familiar with renminbi-denominated instruments and financial facilities.

The renminbi has also started to appear in a few central banks’ foreign exchange reserve portfolios. Malaysia and Nigeria first reported renminbi reserves in 2011. Chile’s central bank investment portfolio now has 0.3 percent of its assets in renminbi-denominated instruments. Other central banks are considering adding renminbi assets to their reserve portfolios. These holdings cannot in principle be counted as official reserves, given the renminbi’s lack of convertibility, but that does not seem to deter these central banks, which see renminbi-denominated assets—just like those of other major reserve currencies—as insurance against balance of payments pressures.

These moves are all modest in size but symbolically important in signaling the shift in perception about the renminbi’s stability and its future role in the international monetary system.

Taking on the dollar

Is the renminbi on a trajectory to usurp the U.S. dollar’s role as the dominant global reserve currency? Perhaps, but the day is a long way off. It is more likely that, over the next decade, the renminbi will evolve into a reserve currency that erodes but doesn’t end the dollar’s dominance.

About two-thirds of global foreign exchange reserves are now held in U.S. dollar–denominated financial instruments. Other indicators, such as the dollar’s shares of foreign exchange market turnover and cross-border foreign currency liabilities of non-U.S. banks, confirm the currency’s dominance in global finance. There are growing concerns about U.S. macroeconomic stability that might affect the dollar’s desirability. Although the U.S. central bank, the Federal Reserve, has strong worldwide credibility for its inflation-fighting credentials, rising public debt poses a serious concern. U.S. gross general government debt is about 90 percent of GDP, and IMF forecasts indicate that it could reach 110 percent of GDP, or nearly $21 trillion, by 2016. This is dangerous terrain for the world’s largest economy, but paradoxically—given the weaknesses in Japan and the euro area and emerging markets’ demand for so-called safe assets as they continue to accumulate foreign exchange reserves—rising U.S. debt may cement the dollar’s dominance in the global financial system.

Moreover, a gulf remains between China and the United States when it comes to the availability of safe and liquid assets such as government bonds. The depth, breadth, and liquidity of U.S. financial markets are unmatched. Rather than catching up to the United States by building up debt, the challenge for China is to develop its other financial markets and increase the availability of high-quality renminbi-denominated assets.

The renminbi is attaining more prominence in international trade and finance. While this importance is sure to grow, the renminbi is unlikely to become a prominent reserve currency—let alone challenge the dollar’s dominance—unless it can be freely converted and China adopts an open capital account. The challenge for the Chinese government is to back up its modest international policy actions with substantial domestic reforms. The renminbi’s prospects as a global currency will be shaped by a broader range of policies, especially those related to financial market development, exchange rate flexibility, and capital account liberalization. The path of China’s growth and the renminbi’s role in the global economy will depend on those policy choices. ■

Eswar Prasad is the Tolani Senior Professor of Trade Policy at Cornell University and New Century Chair in International Economics at the Brookings Institution. Lei Ye is a graduate student at Cornell University.

This article is based on a Brookings Institution study by the authors titled “The Renminbi’s Role in the Global Monetary System.”