A Cushion for the Poor

Finance & Development, December 2011, Vol. 48, No. 4

Evan Tanner and Jorge Restrepo

Commodity-exporting governments can reduce debt and still protect their least well off citizens

PRICES for many primary commodities in world markets posted substantial gains over the past decade—even after taking into account the declines during the global crisis. For countries that rely heavily on commodity revenues, such price booms are a bonanza that their governments can either spend or save and use to reduce debt.

Spending this revenue, although tempting, is fraught with danger. If commodity prices fall at a later date, spending may also have to be cut—perhaps sharply. By basing its spending on commodity revenues, a government essentially introduces global volatility into the domestic economy.

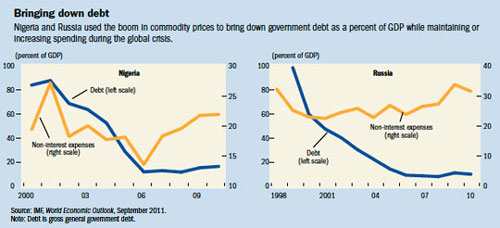

A seemingly more prudent path would be for governments to use the revenue windfall to reduce their debt and add to their assets. Some countries have taken this approach. For example, oil-exporting Norway and copper-exporting Chile have cut the link between short-term commodity price fluctuations and government spending. Both countries have used a fiscal rule—a restriction on spending and/or taxes, often legally mandated—to maintain discipline and reduce volatility. Other countries have chosen a similar path. In the past decade oil exporters Nigeria (see chart, left panel) and Russia (see chart, right panel) have reduced their government debt from about 100 percent of GDP to about 10 percent. Debt reduction helped them weather the recent crisis: both governments were able to maintain or increase noninterest government expenditures (including social spending) without jeopardizing their debt sustainability over the long run.

Although saving rather than spending commodity revenue seems the better policy for a country’s finances, does it mean citizens will truly be better off? Economists have long recognized that the best way to assess economic policies is to evaluate their impact on economic well-being, or welfare. We examine the welfare implications of alternative fiscal policies for a country that exports a primary natural resource—oil or minerals. We use what is called a dynamic general equilibrium model (see box). Such a model allows us to use actual economic information to simulate how an economy is affected by different policies or by external factors (called shocks). As is the case in some countries, we assume that the government owns the company that exports the commodity, which ties public revenues directly to the fortunes of the commodity. External shocks that affect a country’s export prices, then, will also have a direct impact on the government’s budget.

The dynamic general equilibrium model

In our model there are two kinds of consumers: optimizing (often called Ricardian), who have access to capital markets and are able to borrow and save, and hand-to-mouth, who do not enjoy such access. Hand-to-mouth consumers spend all their disposable income and are more vulnerable to market volatility than are their Ricardian counterparts.

Members of both kinds of households work in firms that produce intermediate products (which require further processing) and final consumption goods. Because the market environment is imperfectly competitive, firms earn a markup margin over their costs. Firms may readjust their wage and price schedules only when they receive a signal to do so (Calvo, 1983). These staggered wage and price changes give rise to fluctuations in output and employment in the short run. When the government spends its export revenue, it purchases goods and services from the same firms that employ household labor. In this indirect way, the government transfers export revenues to its constituents. If the government makes its expenditures in an uneven way, the Ricardian households (but not the hand-to-mouth ones) can neutralize such publicly induced volatility by borrowing and lending.

We find that the most prudent path is a fiscal rule that links government spending to long-run circumstances. But we also find that the best way to shield the poor from economic volatility is with a rule under which the government accumulates, up to a point, assets that may be tapped to aid poorer households during economic downturns. We call this a structural surplus rule.

Boom-and-bust spending cycles

In our model, we assume that when the government spends its commodity revenues, it purchases goods and services from the private sector. The government, then, is a conduit for the transfer of the export revenues to private agents through its purchases of goods and services and must choose when to spend these revenues—that is, how the export proceeds should be distributed over time.

In one policy option in the model, the government simply spends the commodity revenue when it receives it. That policy results in cycles of fiscal booms followed by fiscal busts: spending rises when commodity prices climb, only to be cut when those prices fall. Under such a policy, the government essentially brings global volatility into the domestic economy.

This volatility does not affect all households in the same way. The poorer households without access to financial services are the most vulnerable to economic volatility. We assume that poor households that live paycheck to paycheck (or even more precariously) cannot smooth out their consumption because they are unable to borrow and they have not accumulated enough savings to tide them over if their income is disrupted. Indeed even in better times some poor households must rely on assistance from the government. Such households can suffer dramatic cuts in their standard of living during a recession—especially if their income falls at the same time the recession forces the government to reduce benefits to the poor and unemployed.

For another segment of society, though, volatile government spending may be a less pressing concern. Households with access to asset and credit markets—so-called optimizing consumers—are able to smooth out such volatility by themselves. But less affluent households must rely on public policy to shield them from volatility.

Winners and losers

There are alternatives to such a boom-and-bust regime. The government could link spending to a long-run (rather than current) level of export prices, which would shield the domestic economy from global volatility. That would mean more stable spending, in both bad times and in more prosperous ones.

Such a policy can be implemented through a fiscal rule that places limits on a government’s spending and/or borrowing. In some cases, a well-designed fiscal rule can support fiscal discipline and reduce volatility. But a fiscal rule cannot eliminate the fundamentals that often give rise to less disciplined fiscal policies—for example, shortsighted governments that curry favor with today’s voters and leave future generations to pay the bill. Several commodity-exporting countries have successfully implemented a fiscal rule similar in spirit to the one we propose. For example, Nigeria explicitly linked spending to a long-run reference price (Okonjo-Iweala, 2008). Russia’s framework mandates that revenues be placed in a stabilization fund, rather than consumed, when oil prices exceed a certain level (Balassone, Takizawa, and Zebregs, 2006). However, a rule like the one we consider would have to be tailored to fit an individual country’s circumstances. Moreover, our model takes into consideration one-off (temporary) shocks to the price of a resource whose supply is not expected to be exhausted anytime soon. The model would have to be modified in the case of a permanent change to the commodity’s price or a resource that will be exhausted in the foreseeable future.

A first step

But simply linking spending to a long-run commodity price may be only a first step toward cushioning citizens from economic volatility. To raise the welfare of their constituents, governments should do what individuals cannot do for themselves. To shield their most vulnerable people from economic volatility, governments should save and accumulate a precautionary cushion of assets on their behalf.

To this end, a government could adopt a structural surplus rule, under which it commits itself not only to smoothing out expenditures but to reducing its debt and accumulating assets. After such a rule is implemented, a debtor government’s financial position would steadily improve. At some point, the government ceases to be a debtor and becomes a creditor. Under the rule, government spending is also linked to asset holdings. As the government accumulates more assets, it also gradually spends more. Asset accumulation slows down over time and eventually stops, at which point, government assets will have reached their upper bound.

With such a bounded stockpile of assets, governments would have resources to fund expenditures during severe recessions—even if commodity prices fell dramatically and even if they were unable to sell bonds. Hence during recessions or commodity price busts, governments would not be forced to cut critical safety net expenditures. Instead, under the structural surplus policy, the government could safeguard its safety net with the accumulated assets. For these reasons, hand-to-mouth consumers are better off under a structural surplus rule than under other fiscal arrangements. The government helps them smooth their consumption stream through what is in essence a precautionary saving program on their behalf.

Optimizing households do not benefit from a structural surplus policy to smooth government expenditures. For these households—which can borrow on world capital markets if they need to and can accumulate their own cushion of precautionary assets—such efforts are redundant.

But optimizing households may even be made worse off under such a policy. Government expenditure levels rise steadily from an initial low level as the government accumulates assets. In the initial periods of this rising time profile, the government accumulates assets that optimizing households otherwise could have acquired. As a result, optimizing households have fewer resources to invest under the structural surplus rule than under other policies.

For this reason, society as a whole may be best off under a less extreme form of the structural surplus rule. To address the welfare of optimizers, the government may design a modified structural surplus that permits some of the external volatility to enter the economy by permitting government spending to grow slightly during a boom period and by adopting a somewhat more level long-term spending profile. ■

Evan Tanner and Jorge Restrepo are Senior Economists at the IMF Institute.

This article is based on “Fiscal Rules in a Volatile World: A Welfare-Based Approach,” by Carlos Garcia, Jorge Restrepo, and Evan Tanner, which appeared in the July–August 2011 Journal of Policy Modeling.

References

Balassone, Fabrizio, Hajime Takizawa, and Harm Zebregs, 2006, “Managing Russia’s Oil Wealth: An Assessment of Sustainable Expenditure Paths,” in Selected Issues, Russian Federation, IMF Country Report No. 06/430 (Washington: International Monetary Fund), pp. 3–43.

Calvo, Guillermo, 1983, “Staggered Prices in a Utility-Maximizing Framework,” Journal of Monetary Economics, Vol. 12, No. 3, pp. 383–98.

Okonjo-Iweala, Ngozi, 2008, “Nigeria’s Shot at Redemption,” Finance & Development, Vol. 45 (December), pp. 42–44.