What Ails South Africa

Finance & Development, December 2011, Vol. 48, No. 4

Plagued by high unemployment and closely tied to Europe, South Africa struggles

SOUTH Africa, the largest economy on the continent, should be a driving force behind African development.

But, in the wake of the global financial crisis, while much of Africa has escaped with relatively modest bruises and has seen economic growth recover, South Africa’s performance remains anemic.

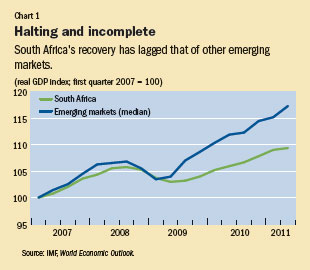

After fairly strong growth between 2003 and early 2008, the country slumped into recession during 2008–09 and, unlike in most other large emerging markets (see Chart 1), its recovery has been hesitant and in some important ways incomplete.

Private investment and exports, for example, remain well below precrisis levels. Worse still, the country lost an astonishingly high number of jobs—akin to job losses in the countries at the epicenter of the global crisis. And only a small fraction of these lost jobs have been recovered more than two years after the recession. The effect has been to worsen the country’s already high level of unemployment and inequality.

Lest it need stressing, the country’s economic revival matters not only for its 50-odd-million population, but also for the rest of sub-Saharan Africa. Its economic weight in the region resembles that of Germany in the euro area. Beyond this, South African companies have extensive investments in sub-Saharan Africa in sectors such as finance, retail, and telecommunications that are important drivers of economic activity.

Three factors—shocks, policies, and institutions—explain this weak and hesitant economic recovery.

Not one but three shocks

In the past few years, South Africa was hit by a string of shocks. The global financial crisis and subsequent worldwide economic slowdown was the third—and by far the most damaging—in a series of blows, but the other two were hardly trivial.

The first of the adverse shocks was the electricity shortages that started in 2007. Mainly because of failure to invest in new generating capacity, coupled with temporary supply disruptions, many parts of the fairly rapidly expanding economy were abruptly forced to slow down. The sudden nature of the shock did not give companies time to adjust. Moreover, it soon became clear that the effects of this shock would be long lasting. It would take higher electricity tariffs to pay for new generation capacity, and until this new capacity was up and running, it would be difficult to expand investment, particularly in energy-intensive activities such as mining.

Around the time the electricity shortages began, global food and fuel prices surged, and inflation soared to well above the South African Reserve Bank’s (SARB’s) inflation target range of 3–6 percent. To combat the increase in prices, the SARB raised its policy interest rate quite sharply—by some 5 percentage points between 2006 and 2008. This was a second factor that contributed to slow growth in 2008 and 2009.

The global financial crisis, the third and final shock to the economy, was particularly damaging to South Africa for at least two reasons. It hit an economy that was already reeling, and the crisis and subsequent slowdown engulfed countries in Europe and the United States—the destination for most of South Africa’s higher value–added exports.

These multiple shocks and their severity thus go some way to explaining South Africa’s current travails, but could better macroeconomic policy management have cushioned the blow? Alternatively, did institutions—particularly, labor and product markets and the inflation-targeting frameworkm— aggravate the shocks’ impact?

Got policies right

It is difficult to see how fiscal policy could have been more supportive. South Africa’s fiscal accounts swung from a surplus of 1 3/4 percent of GDP in 2007/08 to a deficit of 6 1/2 percent of GDP in 2009/10. And the fiscal deficit has remained fairly elevated since then, resulting in a significant, albeit manageable, increase in the debt burden.

Admittedly, much of the widening deficit reflects a drop in tax revenues rather than increases in discretionary spending. Still, even by passively accommodating the fall in revenues, the government left more resources for private sector consumption and investment, thus supporting economic activity. Further, scaling up public investment quickly, as elsewhere in the world, has proved difficult.

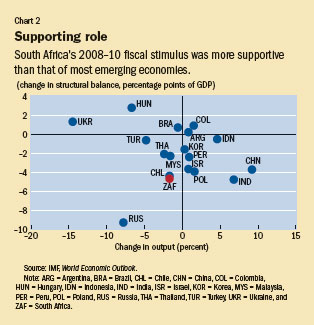

Comparing the change in structural fiscal balances (the fiscal balance adjusted for the impact of the business cycle) to the drop in output (see Chart 2) is another way to measure the fiscal policy response. This measure, too, indicates that the fiscal stimulus in South Africa during this period was among the most aggressive among a group of comparable countries.

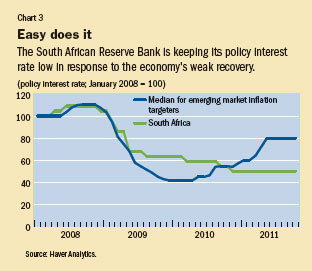

It is not as easy to assess how appropriate monetary policy has been. We now have the full benefit of knowing how output and inflation evolved, but the SARB had to rely on projections when it came to setting interest rates. One way to judge the response is to compare South Africa’s monetary policy to that of other countries. As with fiscal policy, the SARB’s policy easing has been comparable to that of other similar large emerging markets (see Chart 3). And consistent with the weaker recovery that eased inflation pressures in South Africa, while other emerging market central banks tightened monetary policy, the SARB has kept the policy rate low for an extended period of time.

Overall, then, both fiscal and monetary policies turned accommodative when the recession struck and appropriately have remained in that vein since. Because the interest cycle eased more gradually in South Africa it may appear that there was more scope to cut rates earlier on, but inflation and wage growth had been stubbornly high, which supports the central bank’s more gradual easing approach.

Debate over wider framework

The hesitant recovery in South Africa has triggered debate over the broader parameters of economic policy. The macroeconomic framework in particular, and especially the inflation-targeting regime, as well as the structure of the labor and product markets, have come in for criticism. It is generally hard to ascribe short-term fluctuations in output to slowly changing factors such as institutional frameworks, but the interaction between shocks and institutions can nonetheless influence economic outcomes.

The inflation-targeting framework has been implemented in a flexible manner, and, as noted, the SARB reduced interest rates at least as much as other countries did when the crisis hit. Admittedly, the policy rate at the start of the easing cycle was somewhat higher in South Africa, but inflation in South Africa was also higher and has persisted at higher levels since. Moreover, forthcoming research by the IMF’s African Department shows that when the recession hit, the central bank placed markedly more weight on output relative to inflation.

But could South Africa have enjoyed still lower interest rates without the inflation-targeting framework? This is inherently a difficult question to answer but it seems that it would have been unlikely. In recent months, the policy rate has been at its lowest in more than 30 years—even lower than the rates that prevailed before the introduction of inflation targeting in 2000.

South Africa’s labor and product markets are of greater concern. Even before the crisis, it was clear that the labor market was dysfunctional, with unemployment well above 20 percent even in the strong growth years. Many of South Africa’s goods and service markets are also highly concentrated and lack competition for complex and historical reasons.

In the case of the labor market, a host of structural factors, such as an apartheid-induced geographic mismatch between population and economic activity centers, coupled with skills shortages, play a role. And the product market problems are partly policy induced—for example, regulatory entry barriers—but also partly natural (geographic).

Still, even allowing for this, it seems that more efficient labor and product markets would have muted the shocks that hit South Africa. Unfortunately, these markets have functioned poorly: since the onset of the recession collective bargaining has emphasized wages over productivity, and real wage increases have outstripped productivity gains, which has led to a marked decline in employment in many of the sectors where this was the case; and with their captive product market, firms’ pricing power and profit margins have not been affected much.

But this view that high real wage growth has contributed to the country’s unemployment problem is not universally accepted.

The unions point to the decline of the labor share in national income—from 50 percent in 1999 to about 43 percent in 2007. They argue that the recent partial reversal of this trend—on account of both real wage growth and the contraction in GDP in 2009—needs to be seen in a broader context. But the declining share of labor in total income could in part reflect a preference for capital- over labor-intensive production, reflecting the increase in the relative cost of labor.

The declining labor share may also indirectly reflect the impact of rising commodity prices over the past decade, which is benefiting sectors that depend relatively less on labor, including for technological reasons. Lastly, the decline in the labor share since 2000 is not unique to South Africa, and in sectors subject to international competition, such as manufacturing, the labor share in South Africa has actually increased markedly.

Taking action

South Africa’s current economic predicament, then, is partly on account of exogenous factors, but its sclerotic labor and product markets have also played a role—and their ineffectiveness has not gone unnoticed by policymakers. With an eye to addressing these issues and with job growth its central objective, the government launched a new development strategy in late 2010, the New Growth Path, which recognizes the need to better align productivity and wage increases. The government has also already started efforts to tackle anticompetitive practices in key industries. Much rests on the success of the new strategy. ■