Land for Sale

Finance & Development, December 2011, Vol. 48, No. 4

Raghuram Rajan and Rodney Ramcharan

![]() Rajan on Fault Lines

Rajan on Fault Lines

![]() Rajan on the role of government

Rajan on the role of government

Clues to whether easy credit causes booms and busts in asset prices can be found in U.S. farmland prices a century ago

DOES easy credit inflate into asset price bubbles and hurt the rest of the economy when the bubbles pop?

Policymakers are asking these questions in light of the recent boom and bust in house prices in the United States and elsewhere. Concerned that easy bank credit may have led to the recent financial crisis, many countries are seeking to tighten lending rules to keep their banks from taking excessive risks. The idea that central banks should “lean against the wind” to resist asset price and credit booms—rather than solely manage inflation—has gained greater currency.

Indeed, policymakers in some commodity-exporting countries today are facing such a quandary about what approach to take. Commodity prices have risen sharply during the past decade, and many commodity producers have experienced concomitant upsurges in credit and asset prices—a joint credit and asset price boom. Credit growth and property prices in Brazil have skyrocketed, for example, and some argue that farmland prices in the United States have entered bubble territory, despite the otherwise weak U.S. economy.

How then should policymakers approach the possible connection between credit availability, which governments can affect, and asset price booms and their similarly sharp aftermaths, busts? There is burgeoning research into this question driven by the recent nationwide boom and bust in house prices, but a look back at the most recent nationwide land boom in the United States in the early part of the previous century offers valuable historical context. Regulatory features of the time also help uncover the potential role of credit in shaping asset price fluctuations.

Credit availability

Students of financial panics have long argued that credit availability may play a causal role in booms and busts, citing experiences as varied as the Dutch tulip mania of the 1630s and the Japanese real estate bust of the 1990s (Kindleberger and Aliber, 2005). Research inspired by the Great Depression of the 1930s also points to the interaction between credit availability and asset prices. An initial positive shock to an asset such as land—say an increase in the price of the crops grown on that land—raises a borrower’s net worth, which enhances the landowner’s ability to borrow and amplifies the demand for land. On the way down, perhaps because of a drop in commodity prices, lower land prices mean lower net worth, less collateral, a reduced ability to borrow, and a significant contraction in demand for land. The price decline is further amplified by fire sales, which depress prices (Fisher, 1933; Bernanke and Gertler, 1989; Kiyotaki and Moore, 1997).

The incentives for banks to lend or not also affects the boom-bust cycle. When credit is expanding, banks may be unwilling either to stop renewing bad loans (often called evergreening) or to hold back on new lending for fear of realizing losses or signaling a lack of lending opportunities—which would also reveal their earlier failure to assess properly the quality of the loans they were making (Rajan, 1994). As a result, good times can lead to excessive credit. In contrast—because loan losses are more likely in bad times and creditworthy lending opportunities are more limited—all banks have an incentive to take advantage of this more forgiving environment to cut back on credit, blaming losses on economic conditions rather than their inadequate assessment ability. Thus expanded credit may follow cycles that amplify real shocks, both positive and negative, especially in areas where banks are more competitive.

Theory and practice

That is the theory. In practice, though, there is still considerable uncertainty surrounding the role of credit availability in inflating asset prices beyond their apparent fundamental value—an asset price bubble. After all, asset price booms and busts often center on changes in fundamentals or beliefs, and more credit is likely to flow to entities with better fundamentals. This fact also makes it difficult for policymakers to react to periods of rapid asset price inflation and credit expansions. Raising interest rates or otherwise restricting credit growth may prevent asset prices from fully reflecting positive fundamentals. Yet credit that is too easily available may itself cause asset prices to overshoot fundamentals, laying the foundation for a bust.

For example, the house price boom of the past decade was driven in part by the widespread belief that house prices would always appreciate. And this belief in turn may have made it easier for banks to justify their large expansion of mortgage credit and more difficult for policymakers to judge in advance whether households had overborrowed and whether house price growth was excessive. Similarly, there are many reasons for the current boom in commodity prices; a common narrative points to unprecedented structural change. In the case today, the industrialization of such emerging markets as China and India, and the threat of global warming along with uncertainty over global agricultural production, are the narratives that have helped underpin the current boom in U.S. agricultural commodities and farmland prices.

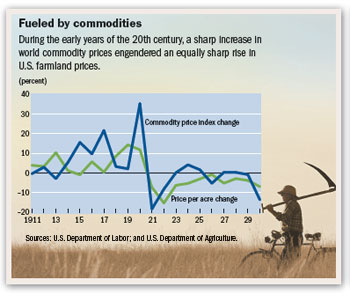

To better understand the potential impact of credit availability on asset price booms and busts, we turned to the most recent, if long past, nationwide boom and bust in land prices in the United States—1900–30. The United States was the hot new emerging market at the turn of the 20th century, and America’s rapid industrialization helped precipitate a boom in world commodity prices. Demand for rubber, oil, and agricultural goods rose sharply, along with incomes in the United States and Europe and the widespread adoption of new technologies such as the automobile (Blattman, Hwang, and Williamson, 2007; Yergin, 1991). As it has today, this rise in world commodity prices also engendered an equally sharp rise in farmland prices in the United States (see chart).

Banks burgeon

Banks in turn proliferated throughout the country, and credit became increasingly available and less costly—with some practices reminiscent of those during the most recent housing boom. Borrowers could put down only 10 percent of the price, borrowing 50 percent from a bank and taking out a second or junior mortgage for the remainder. Loan repayments were typically “bullet” payments—that is, borrowers paid only interest until the loan matured, when the entire principal was due. As long as refinancing was easy, borrowers did not worry about principal repayment. And the long history of rising land prices gave lenders confidence that they would be able to sell repossessed land easily if the borrower could not pay. So they lent willingly: mortgage debt per acre increased 135 percent from 1910 to 1920. World War I and the Russian Revolution disrupted the supply of many commodities—especially wheat and oil—which added to global uncertainty and further intensified the commodity boom and land price inflation.

But as abruptly as it began, World War I ended. And desperate for hard currency, the new government in Russia quickly resumed exports. European agriculture also recommenced much faster after the war than was anticipated. As a result, world commodity prices plummeted in 1920, declined annually throughout the 1920s, and crashed again during the Great Depression. Farmland prices in the United States followed a similar trajectory and did not increase again until World War II—some two decades after the initial bust. Throughout the 1920s, the United States also experienced about 6,000 bank failures—or about 20 percent of the existing banks at the peak of the boom in 1920. This was the depression before the Depression.

Fundamental divergences

We used detailed county-level data on the price of land, the acreage of crops grown, and the structure of the local banking system. Such a fine level of disaggregation helps identify more precisely the interaction between local fundamentals—in this case the prevailing value of the underlying commodities grown in the county, the dividend yield on the land—and credit availability emanating from local bank competition. Our evidence points to the dual nature of credit availability in shaping asset prices.

Credit availability did indeed help land prices align better with fundamentals during the boom. In areas with banks and credit access, land prices were better able to reflect local fundamentals—measured as an index composed of changes in the world price of seven commodities weighted by the acreage in the county devoted to production of each commodity. Moreover, because land purchases are large-ticket items, credit availability may have led to more efficient allocation of land, with more productive farmers better able to obtain credit to buy more.

However, there is also evidence that in areas with a large number of banks—and, presumably, the most intense competition among local banks—land prices became increasingly detached from local fundamentals (at least with the benefit of hindsight). This is consistent with the idea that, in an environment of expanding credit, banks may be unwilling to stop evergreening bad loans or to hold back on new lending for fear of realizing losses or losing market share in competitive areas. Thus, very competitive banking systems could lead to excess credit, amplifying real shocks on asset prices.

Although the data are relatively detailed, and we were able to control for a number of geographic and demographic variables that may determine both land prices and the location of banks, the evidence rests on statistical correlations that may allow other explanations for the relationship between bank competition and land prices. For example, the number of banks in a county may reflect aspects of fundamentals that are not captured by the value of the crops per acre, the size of the commodity price shock in the county, or the other observables included in the various specifications.

More convincing evidence

However, an interesting feature of credit markets in the 1920s allows us to offer more convincing evidence that the availability of credit had an independent effect on land prices. Interstate bank lending was prohibited in the United States in the early 1920s. If the number of banks reflects primarily fundamentals associated with land, then the number of banks in neighboring counties should affect land prices in a county the same way, regardless of whether the neighboring counties are within or out of the state—counties on either side of a state border tend to have similar geographic fundamentals.

If, however, the number of banks reflects the availability of credit, then banks in neighboring counties within a state should affect land prices much more (because they can lend across the county border) than banks in equally close neighboring counties that are outside the state (because they cannot lend across the county border).

Similarly, the difference in land prices across a county border should correlate positively with the difference in the number of banks across the border, but more so when the border is also a state border, because banks cannot lend across the border to equalize price differences. We find evidence for the above-predicted effects, implying that the availability of credit did affect asset prices, over and above any effect of the change in fundamentals themselves.

Differences in bank regulations across states can also help determine whether the relationship between banks and prices reflects credit availability or some unmeasured factor. Some states had deposit insurance systems in place. Well-known arguments suggest that poorly designed deposit insurance programs can induce banks to finance riskier investments and extend credit more widely than warranted—especially in areas where banks operate under deposit insurance and face stiff local competition. Consistent with these ideas, the data suggest that the impact of credit availability on land prices may have been particularly strong during the boom in counties located in deposit insurance states relative to counties in states without such insurance. These differences in the relationship between banks and prices across deposit insurance systems appear significant even in the case of counties located at the border of states with and without deposit insurance, where presumably counties share similar economic characteristics and grow similar crops.

Commodity price collapse

The collapse in world commodity prices after World War I wreaked havoc on the banking system in general. But the bank failure rate during the 1920s was highest in areas that began the decade with the most banks and in areas that grew commodities with the biggest price run-up during World War I. Of course, the evidence that credit availability was important for the boom does not necessarily mean that it would exacerbate the bust. Easier availability of credit in an area could in fact have cushioned the bust. But the rise in asset prices and the buildup in associated borrowing were so high that there were significantly more bank failures (resulting from farm loan losses) in areas with greater credit availability before the bust. Taken together, these results suggest that credit availability driven by competition among banks may have amplified the impact of the positive commodity price shock on land prices and borrowing. Once the boom proved evanescent, the rise in borrowing may have led to more bank failures in areas with greater credit availability.

Thus, with the benefit of hindsight, restricting credit could have averted much of the subsequent damage. But regulators do not have the luxury of hindsight. Moreover, it would be too simple to argue that credit availability should have been restricted across the entire country during the boom. After all, credit did help prices align better with fundamentals in many areas. And expectations of land price increases may well have been rational given the uncertainties surrounding the timing of the end of World War I, the pace of resumption of European agriculture, and the willingness of the Russians to resume exports.

A more reasonable interpretation is that greater credit availability tends to make the financial system and asset prices more sensitive to all fundamental shocks, whether temporary or permanent. Prudent risk management might then suggest that regulators could lean against the wind, using more targeted supervisory tools in areas where the perceived shocks to fundamentals are seen to be extreme, so as to dampen the fallout if the shock happens to be temporary.

A corollary to this interpretation is that prudent risk management requires careful monitoring of the overall banking system, including the so-called shadow banking system—hedge funds and large nonbank financial firms that extend credit. A reading of the contemporary literature in the 1920s suggests that regulators had only a limited appreciation of the run-up in land prices or the extent of bank competition at the peak of the boom in 1920. Even during the ensuing banking collapse of the 1920s, information on bank failures was relatively scarce, and it was heavily fragmented among national and state bank regulators in the United States. For example, in one study from the time, it took regulators a year to collect data from a sample of banks in just one region of the United States (Upham and Lamke, 1934). This lack of information may have paved the way for policy mistakes—for example, encouraging the rapid sale of failed bank assets, which may in turn have further depressed land prices and exacerbated the crisis. ■

Raghuram Rajan is the Eric J. Gleacher Distinguished Service Professor of Finance at the University of Chicago, and Rodney Ramcharan is an Economist at the Federal Reserve Board. These views do not necessarily reflect those of the Board of Governors of the Federal Reserve System.

This article is based on “The Anatomy of a Credit Crisis: The Boom and Bust in Farm Land Prices in the United States in the 1920s.”

References

Bernanke, Ben, and Mark Gertler, 1989, “Agency Costs, Net Worth and Business Fluctuations,” American Economic Review, Vol. 79 (March), pp. 14–31.

Blattman, Christopher, Jason Hwang, and Jeffrey Williamson, 2007, “Winners and Losers in the Commodity Lottery: The Impact of Terms of Trade Growth and Volatility in the Periphery 1870–1939,” Journal of Development Economics, Vol. 82 (January), pp. 156–79.

Fisher, Irving, 1933, “The Debt-Deflation Theory of Great Depressions,” Econometrica, Vol. 1 (October), pp. 337–57.

Kindleberger, Charles, and Robert Z. Aliber, 2005, Manias, Panics, and Crashes: A History of Financial Crises (Hoboken, New Jersey: Wiley Investment Classics).

Kiyotaki, Nobuhiro, and John Moore, 1997, “Credit Cycles,” Journal of Political Economy, Vol. 105 (April), pp. 211–48.

Rajan, Raghuram G., 1994, “Why Bank Credit Policies Fluctuate: A Theory and Some Evidence,” The Quarterly Journal of Economics, Vol. 109 (May), pp. 399–441.

Upham, Cyril B., and Edwin Lamke, 1934, Closed and Distressed Banks: A Study in Public Administration (Washington: Brookings Institution).

Yergin, Daniel, 1991, The Prize: The Epic Quest for Oil, Money and Power (New York: Simon & Schuster).