Role Reversal

Finance & Development, December 2011, Vol. 48, No. 4

![]() India's Economy: The Road Ahead

India's Economy: The Road Ahead

Emerging economies are less dependent on debt, less vulnerable to volatile investment sentiment, and are rethinking the role of capital flows

TIMES have changed for emerging economies.

In a break from past patterns, a majority of middle-income emerging market economies have bounced back relatively quickly and sharply from the global economic crisis, while advanced economies continue to experience deep and prolonged downturns.

Moreover, unlike in days past when global financial turmoil would lead domestic and international investors to rush for the exits, precipitating meltdowns, emerging economies today appear more resilient to the volatility of capital flows. Few major emerging markets still depend heavily on foreign financing. Some, like Turkey and a few emerging markets in eastern Europe, still do—and are vulnerable to shifts in foreign investors’ sentiments. But they are exceptions rather than the norm. Indeed, even countries like Brazil and India that have more money going out than coming in (that is, are running current account deficits) have large stocks of foreign exchange reserves that help them deal with capital flow volatility. Many emerging markets have in fact faced the curse of plenty—surges in capital inflows in recent years.

Underlying these developments are fundamental changes in the nature of international capital flows that will reverberate for a long time. These changes will reshape the debate about the benefits and risks of global financial integration. For emerging economies, international capital flows had come to be seen as a destructive force, increasing volatility and setting off devastating crises, rather than as promoting growth or helping diversify risk by increasing investment opportunities. The shifts documented in this article suggest that emerging economies may now be in a better position to reap the benefits—but they face a new set of risks—from capital flows.

Tighter financial linkages

In a process that started in the mid-1980s, picked up pace over the past decade, and was only briefly affected by the crisis, emerging markets have substantially increased their integration into global financial markets. This is evident from their rising stocks of international assets and liabilities.

Rising stocks portend greater risks even for a country whose assets and liabilities are balanced. If a country has large holdings of international assets and liabilities, currency fluctuations and even modest portfolio rebalancing of international investors can result in greater volatility of net flows (the difference between capital entering and capital leaving a country). If an economy comes under pressure, inflows can stop and outflows rise simultaneously, leading to a double blow in terms of net flows.

The magnitude of these effects depends on the shares of liabilities and assets that are in the form of debt versus those that have an equity component—either direct, where the foreign investor has a durable stake in the asset, or portfolio, where the investor is seeking only a financial return. Where an equity component is involved, there is more sharing of risk between domestic and foreign investors. Although rising total positions clearly have a major impact, a closer examination of the structure of external assets and liabilities is warranted because of its implications for both growth and volatility.

Balance sheet transformation

The international investment position (IIP) is essentially a country’s balance sheet in relation to the rest of the world. One side of the balance sheet contains a country’s total foreign assets, the other its external liabilities. The types of assets and liabilities are broken down on each side of the balance sheet. An analysis of changes in the IIPs of major economies reveals large shifts in the structure of global finance.

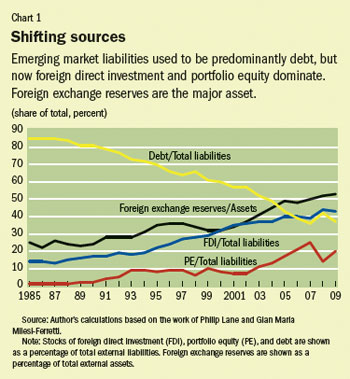

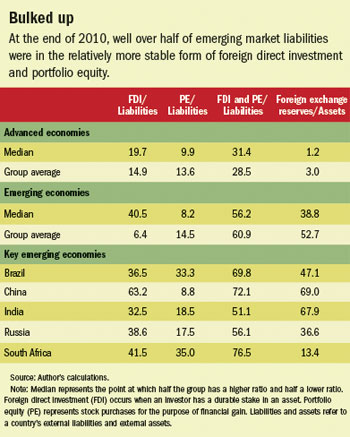

The external liabilities of emerging economies once were mainly debt. Now foreign direct investment (FDI) and portfolio equity combined predominate (see Chart 1). In 2010, FDI and portfolio equity accounted for more than half of the total liabilities of emerging economies (see table). This pattern held for the five major emerging markets known as the BRICS (Brazil, Russia, India, China, South Africa). For Brazil, China, and South Africa, FDI and portfolio equity account for about two-thirds of external liabilities. By contrast, in advanced economies, portfolio debt (such as bonds issued by corporations) and bank loans together still constitute the major share of external liabilities.

The changing structure of emerging market balance sheets was striking in the years leading up to the recent financial crisis. Over the period 2000–07, changes in FDI liabilities alone accounted for nearly half of the increase in overall liabilities. FDI and portfolio liabilities together account for about 70 percent of the increase.

Short-term external debt denominated in foreign currencies once was the scourge of emerging markets. These countries faced not only the risk of being unable to refinance the debt if they fell out of favor with international investors but also further trouble if their currencies depreciated, which increased the domestic currency cost of the debt. FDI and portfolio equity are far more desirable forms of capital, and the external debt of these countries is increasingly denominated in their own currencies. When the value of these investments falls either in domestic terms or because of a currency depreciation (or both), foreign investors bear part of the capital and currency risk.

There are interesting developments as well in the asset positions of emerging markets, which are increasingly dominated by foreign exchange reserves. These assets are mostly held in government bonds issued by the four major reserve currency areas (United States, euro area, Japan, United Kingdom). On average, reserves accounted for more than half the total external assets of emerging markets at the end of 2010 (see table). In China and India they accounted for about two-thirds of total external assets.

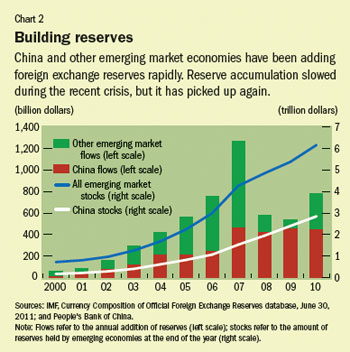

During 2000–07, reserve accumulation accounted for about half the overall increase in external assets of emerging economies. These results are not driven by China alone. A majority of emerging markets experienced an increase in the share of foreign exchange reserves in total external assets over this period. These countries build up reserves as a by-product of intervention in foreign exchange markets to keep their currencies from appreciating, which would reduce their trade competitiveness. But reserves also act as a rainy-day fund, providing self-insurance against capital flow volatility.

The recent global financial crisis, along with the rise in total asset and liability positions, has increased emerging economies’ demand for precautionary reserves. Indeed, reserve accumulation by these economies peaked in 2007 and slowed during the crisis, but has picked up again (see Chart 2). Meanwhile, the public debt burdens of advanced economies are rising steeply, putting the safety of these assets in jeopardy. As a result, the risk on emerging market external balance sheets has, paradoxically, shifted to the asset side.

Self-insurance gets expensive

The accumulation of reserves has been associated with a search by emerging markets for safe assets—typically government bonds of advanced economies. The supply of such bonds is driven by the trajectories of net government debt around the world.

The financial crisis triggered a sharp increase in global public debt levels. Advanced economies account for the bulk of the increase in global net public debt since 2007, both in absolute terms and relative to gross domestic product (GDP). Here are some striking statistics constructed using data and forecasts from the IMF (all at market exchange rates):

• Aggregate debt of advanced economies will grow from $18 trillion in 2007 to $30 trillion in 2011, and rise further to $41 trillion in 2016. The corresponding estimate for emerging markets is $7 trillion in 2016, up $2 trillion from the 2011 level.

• The ratio of aggregate debt to aggregate GDP for advanced economies will rise from 46 percent in 2007 to 70 percent in 2011 and to 80 percent in 2016. For emerging markets, the ratio is 21 percent in 2011, after which it will decline gradually.

• In 2007, emerging markets accounted for 25 percent of world GDP and 17 percent of world debt. By 2016, they are expected to produce 38 percent of world output and account for just 14 percent of world debt.

• In 2011, the four major reserve currency areas together account for 58 percent of global GDP and 81 percent of global debt.

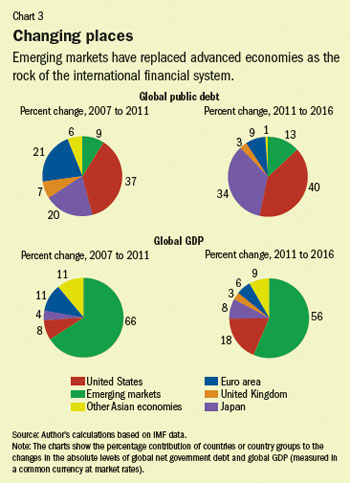

The contrast between advanced and emerging market economies is even sharper in terms of their contributions to the growth in world debt and world GDP (see Chart 3).

• Emerging markets account for 9 percent of the increase in global debt levels from 2007 to 2011 and are expected to account for 13 percent of the increase from 2011 to 2016. Their contributions to increases in global GDP over these two periods are 66 percent and 56 percent, respectively.

• The major advanced economies will make a far greater contribution to the rise in global debt than to the rise in global GDP. The United States will account for 37 percent of the increase in global debt from 2007 to 2011 and 40 percent from 2011 to 2016. Its contributions to the increases in global GDP over those two periods will be 8 percent and 18 percent, respectively.

These figures paint a sobering picture. The major reserve currency economies face daunting trajectories of public debt burdens and weak growth prospects that look worse in light of their low levels of population growth, rapidly aging populations, and rising costs of health care and other entitlement programs.

Reserve currency economies issue sovereign debt in their own currencies, transferring currency risk to the foreign purchasers of their sovereign debt. Moreover, high and rising debt levels imply crowding out of private investment and lower productivity growth in advanced economies relative to emerging markets. These productivity differentials imply that emerging market currencies will eventually appreciate against those of advanced economies, resulting in a significant wealth transfer from poorer to richer countries.

This wealth transfer presents an intriguing paradox—the accumulation of foreign reserves by emerging economies searching for self-insurance is driving up the costs of such insurance, funding advanced economies’ fiscal profligacy, and worsening risks worldwide by perpetuating global current account imbalances. In the United States, for instance, foreign investors, both official and private, finance about half of the buildup of net public debt.

Just how safe are advanced economy sovereign assets? Rising debt levels, particularly in “safe haven” economies such as the United States, raise serious concerns about the safety of these bonds from the perspective of emerging market investors. The U.S. Treasury bond market is, of course, very large and has high turnover. That means that the rush into U.S. Treasury bonds in response to instances of global financial turmoil may be more a flight to liquidity and depth than a flight to safety.

The path ahead

Traditionally, emerging markets were exposed to risks through their dependence on capital inflows and the structure of their external liabilities. But today, few significant emerging economies depend heavily on foreign financing, and most have large stocks of international reserves. The problem of short-term, foreign currency–denominated debt has diminished substantially. Flexible exchange rate regimes adopted by many emerging markets have also made currency crashes less of a concern (see Kose and Prasad, 2010)

Greater integration of emerging economies into world financial markets does imply that emerging markets are subject to more danger from policy spillover and transmission of shocks from abroad. But these risks are modest relative to domestic ones. Indeed, many emerging economies face a problem of plenty because their strong growth prospects tend to fuel surges in capital inflows and place pressure on domestic inflation, asset prices, and exchange rates.

The major risks emerging economies face as a result of openness to foreign capital are now mainly the tendency for capital flows to magnify domestic policy conundrums. Capital inflows can add fuel to domestic credit booms and asset bubbles that then turn into busts. Inflows and the resulting pressure for currency appreciation also affect income distribution, heightening inequality by feeding into inflation and hurting industrial employment growth.

The solution to a lot of these problems involves financial market development, especially a richer set of financial markets that would improve the ability of emerging economies to absorb capital inflows and manage volatility. For instance, corporate bond markets—which are still minuscule in major emerging markets such as China and India—can provide investment opportunities that would help absorb inflows and effectively channel them into productive rather than speculative activities. The imposition of capital controls, on the other hand, often simply adds economic distortions and is of little lasting value in stemming the tide of inflows.

It is in the self-interest of emerging economies as a group to foster financial market development and broaden domestic access to their formal financial systems. This will allow them to invest more among themselves rather than financing debt buildups in advanced economies. More flexible exchange rate regimes would also reduce reserve accumulation and free up monetary policy to control inflation.

Rather than relying on good policies in advanced economies, emerging economies should focus on managing their own economic destinies. Through their policy choices, they could set an example for advanced economies, which need to swallow the medicine of macroeconomic and structural reforms they have so long prescribed for others. ■

Eswar S. Prasad is a Professor at Cornell University, a Senior Fellow at the Brookings Institution, and a Research Associate of the National Bureau of Economic Research.

This article is based on “Role Reversal in Global Finance,” NBER Working Paper No. 17497, forthcoming in Proceedings of the 2011 Jackson Hole Symposium, from the Federal Reserve Bank of Kansas City.

References

Kose, M. Ayhan, and Eswar S. Prasad, 2010, Emerging Markets: Resilience and Growth Amid Global Turmoil (Washington: Brookings Institution).

Lane, Philip R., and Gian Maria Milesi-Ferretti, 2007, “The External Wealth of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970–2004,” Journal of International Economics, Vol. 73, No. 2, pp. 223–50. (Databases are updated regularly by the authors.)