Beyond Retirees

Finance & Development, June 2011, Vol. 48, No. 2

Philippe Karam, Dirk Muir, Joana Pereira, and Anita Tuladhar

How countries change their pension systems and whether they do it in tandem have major implications for global economic health

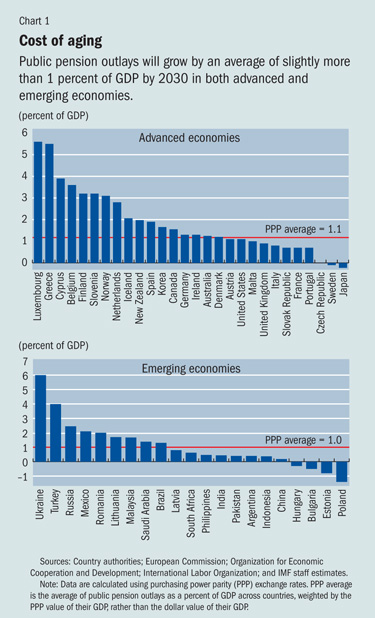

SINCE 1990, public pension spending has increased in an amount equal to 1¼ percent of gross domestic product (GDP) in the advanced economies in the Group of 20 (G-20). And a continuously aging population will cause further increases averaging about 1 percent of GDP in both advanced and emerging economies over the next 20 years (see Chart 1). Advanced economies that have not substantially changed their traditional pay-as-you-go pension systems are projected to experience larger spending increases than advanced economies that have legislated pension reform.

Among emerging economies, those with relatively high spending in 2010 are projected to experience the steepest increase in outlays over the next 20 years. In countries that do not cover a large segment of the elderly, such as China and India, the projected increase is much less severe, but could rise more rapidly if their systems expand to cover a larger share of the population. Moreover, advanced economies are experiencing sharp growth in the aged population now, but that will change after 2030, when emerging economies will experience a faster pace of aging.

A number of countries have already reformed their pension systems, and spending pressures seem sure to force more to do so. Globally, the number of people over 65 relative to the working-age population (the old-age dependency ratio) is projected to double between 2009 and 2050, putting enormous strains on public pension systems, largely pay-as-you-go plans that are financed by current workers, who expect future generations to fund their retirement.

Further reforms appear inevitable. How and when countries implement reforms, then, is not only a matter of fairness to current and future retirees. The choice will significantly affect economies—nationally and globally. Moreover, whether countries make those reforms individually or in coordination with other nations is also important to macroeconomic performance, given cross-border trade and investment linkages.

What can be done

There are three major ways countries can change pension systems to reduce costs:

• Raise the retirement age: Lifetime benefits paid to retirees are reduced. This encourages workers to remain in the labor force longer, which means they earn more over their lifetime. The increase in lifetime income could lead workers to save less and consume more during their working years. In addition, the increased fiscal savings from reduced pension payments will have long-term positive effects on GDP growth by lowering the cost of capital and encouraging investment.

• Reduce pension benefits: To avoid a sharp reduction in income and consumption in retirement, workers would likely boost savings. Consumption would fall in the short to medium term, but investment would increase over the long term.

• Increase workers’ contribution rates: Because higher rates reduce income, households might be less motivated to work, which could depress economic activity in both the short and long term.

We use the IMF’s Global Integrated Monetary and Fiscal Model (GIMF) to quantify the effects of reforms to pay-as-you-go public pension systems worldwide. The model contains two types of households—those that are liquidity constrained and live paycheck to paycheck and better-off optimizers that have savings—and assumes that households with savings plans have a 20-year horizon (see box). Because the model counts debt issued by the government as savings, it allows for a meaningful discussion of the short- and long-term macroeconomic implications of the various reform options. We group the world into five broad regions: the United States, the euro area, Japan, emerging Asia (including China, India, and Korea), and the rest of the world.

A look at the model

The Global Integrated Monetary and Fiscal Model (GIMF) is widely used at the IMF as a framework for analyzing the short- and long-term effects of public pension reform (Kumhof and others, 2010). The GIMF is constructed in a way that permits researchers to analyze how government policies must be adjusted to achieve fiscal sustainability in countries facing demographic changes. It identifies meaningful medium- and long-term effects of government debt on private investment and captures important life-cycle income patterns, including age-dependent labor productivity.

The multicountry structure of the GIMF allows economists to analyze global interdependence and spillover effects. In this model, the world consists of the United States, the euro area, Japan, emerging Asia, and the rest of the world, and there are two major sources of international linkages. First, there is a full accounting of trade between each region. Second, the flow of goods allows the model to determine current accounts, which are simply the flows of global savings and investment, equilibrated in the long run by the global interest rate. Each region has:

• Two sets of households: "Liquidity constrained" households have little if any savings and can consume only out of their current labor income. In the advanced economies, about 25 percent of households fall into this category; in the rest of the world up to 50 percent are among these poorer households. "Optimizing" households can save and choose their working hours and level of consumption (and by extension, their saving rate). These households are assumed to plan for a 20-year horizon on average and, furthermore, face declining labor productivity as they age. For the current generation, government debt is wealth—they are not concerned with saving for future generations to pay off government debt accumulated today. This means that increasing government debt will reduce global savings, which, in the long run, affects the world savings and investment balance and increases world interest rates.

• Firms that are managed in accordance with the preference of their owners: they are forward-looking, but plan only for the next 20 years.

• A government that includes a central bank, which most often pursues some sort of price stability and, perhaps, employment stability, by controlling the interest rate. The government also tries to target a certain level of debt in the long run, while trying to stabilize the economy during the business cycle by allowing the deficit to fall as GDP grows more strongly (and vice versa).

Raising the retirement age

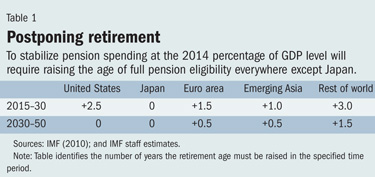

In this scenario, countries raise the retirement age enough to stabilize pension spending over the next three to four decades at the same share of GDP as in 2014 (see Table 1). Differences in required retirement age increases stem from two sources: projections of the gap between the funding available and what is needed for public pensions and the spending and taxing measures required to stabilize debt-to-GDP ratios so that interest payments will not absorb large amounts of government revenues. Japan will not require additional reforms.

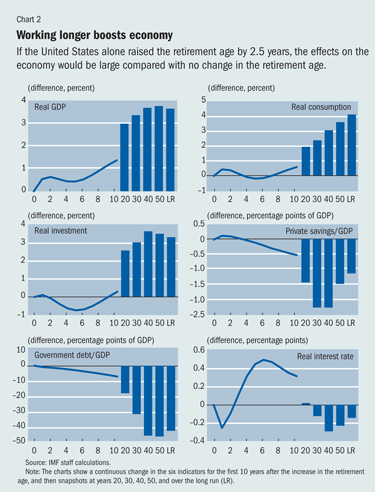

Chart 2 illustrates some of the effects on the United States, including concurrent government spending reductions, if that nation were the only one to increase the retirement age. First, a delay in retirement means people will work longer. This leads to higher household income, which puts upward pressure on consumption. Moreover, the higher level of available labor increases the productive capacity of the economy, leading to higher GDP in the long run.

Second, the government’s budget deficit improves markedly, by close to 3 percentage points of GDP after 30 years and 2.2 percentage points in the long run. That means the debt-to-GDP ratio declines by roughly 43 percentage points in the long run. The savings supply increases globally, leading to lower investment costs, represented by the real world interest rate. Investment is stimulated worldwide, and global productive capacity rises.

Third, workers and their families reduce their savings and demand for assets during their working years, while increasing consumption. There are some offsetting effects. The lower government debt is perceived as a decline in net wealth for households that save, and the decline in benefits depresses consumption. Taken in combination with the upward pressure of higher income, consumption is only slightly higher than before the reforms were implemented.

When reform is undertaken in each of the three other regions that have notable challenges to their pension systems—the euro area, emerging Asia, and the rest of the world—the results are similar. However, effects vary depending on how much the working age must be extended, the savings achieved by the government as it reduces its pension spending, and the effect of the increase in public savings on the amount of savings available worldwide, with a dampening effect on the global real interest rate.

Reducing benefits

If governments opt to reduce pension benefit payments, the economic rewards would unfold over time—after the short-term initial toll of fiscal tightening on aggregate demand. Although in the United States consumption drops about 1 percent in the short term, this is largely outweighed by the persistent benefits of lower real interest rates and a rise in GDP, which settles at a higher level in the long run, by almost 0.5 percent.

The reduction in benefits has a direct negative effect on consumption. It is immediate for the households with little or no savings, because they consume out of current income. Even the better-off households that save are affected, but more gradually, because their expected stock of lifetime wealth is lower. These households will reduce consumption accordingly.

By reducing benefits, the government lowers its deficit, which also implies an increase in global net savings. Therefore, real world interest rates decline moderately, beginning in the 10th year, before they hit a trough at close to –0.4 percentage point after 40 years. The reduction in the global real interest rate means that all countries experience stronger investment and a permanent increase in GDP.

As with the increase in the retirement age, when the other three regions carry out the same reform, they achieve the same results, but to differing degrees, depending on how much impact a given reduction in benefits in a region has on the global real interest rate.

Raising contribution rates

The third potential reform, increasing contribution rates, is equivalent to an increase in the labor income tax rate in our framework. Higher labor taxes reduce the income households have to spend. This spending reduction is heightened in regions where households with little or no savings constitute a larger share of the economy, because they consume solely out of their after-tax income. The better-off households that save can adjust their flow of income based on their pool of savings. The effect on income of raising contribution rates is similar to cutting benefits—in both scenarios household spending falls. However, labor income taxes also distort more fundamental decisions, such as how much households are willing to work. Tax increases make households less willing to work, which reduces the productive capacity of the economy, leading to lower real GDP.

Increasing contribution rates then produces a more severe short-term loss of real GDP than cutting benefits. For the United States, real GDP declines by about 0.7 percent by the 10th year. There are significant long-term losses because of the negative effect on potential output as a result of these taxes. Moreover, when governments raise contribution rates, the consequent decline in the real world interest rate does not play as effective a role in raising real GDP in the long run; real GDP falls by 0.4 percent rather than rising 0.4 percent when pension benefits are cut. The story is the same in the euro area, emerging Asia, and the other countries.

When reform happens everywhere

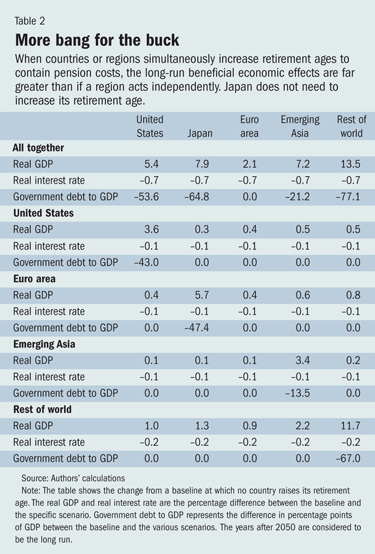

So far, we have considered reforms in each region of the world only in isolation. Although it is in each region’s interest to pursue reform regardless of what other regions do, there is a clear advantage to global policy cooperation. When individual countries act, the effects of their policy measures will often leak across their borders, which can benefit other regions but reduces the domestic impact. When all countries reform simultaneously, the leakages serve instead to magnify the effects of the reforms.

The magnified effects of simultaneous public pension reform in all regions are best illustrated by the case of increased retirement age. Table 2 shows the effect of reform on real GDP, the real interest rate, and the government debt–to-GDP ratio. The effects on all three are clearly better when policy action is cooperative (first set of rows) than when action is taken individually (second through fifth sets of rows).

When pension reform is simultaneous, the real world interest rate changes more over time than when regions engage in reform alone, which in the long run leads to greater effects on capital accumulation and potential and actual output levels. And the lower real interest rate is the key driver of improved global fiscal positions.

Our results depend on many assumptions about the nature of the reforms and the model itself. Here are three examples of different results we can generate:

• If there is a smaller increase in labor supplied in response to an increase in retirement age, the future increase in real GDP is also smaller.

• Had we assumed a shorter planning horizon for households, there would be a larger initial drop in consumption but a higher level of real GDP in the medium term, driven by a boost in investment resulting from an increase in labor.

• If the planning horizon is much longer, the global real interest rate becomes substantially less responsive to the level of savings. Neither short-term nor long-term consumption behavior changes significantly, and productive capacity, in turn, is less responsive. Lack of an interest rate response minimizes the fiscal benefits of a coordinated global policy.

Beneficial effects

The pension reform with the most positive long-term economic effects is one that extends people’s working years. Raising the retirement age effectively increases the size of the active labor force relative to the retiree population. It helps boost domestic demand in the short run but also eases the pressure on governments to cut pension benefits—which can lead to increased private savings and further depress fragile domestic demand in the short run—or to raise contribution rates—which can discourage work. We also find that the impact on real GDP of a cooperative approach to age-related fiscal reform is greater than when only one region undertakes reform. In terms of public finances, our results generally show that stabilizing the GDP share of age-related expenditures leads to a sizable decline in the debt-to-GDP ratio.

Bold action to reduce future age-related spending (preferably by raising the retirement age) can significantly improve medium-term fiscal sustainability, particularly if such reforms are enacted in a cooperative fashion. ■

Philippe Karam is Assistant to the Director in the IMF Institute, Dirk Muir is a Senior Economist in the IMF’s Research Department, Joana Pereira is an Economist in the IMF’s Western Hemisphere Department, and Anita Tuladhar is a Senior Economist in the IMF’s European Department.

References

International Monetary Fund (IMF), 2010, “From Stimulus to Consolidation: Revenue and Expenditure Policies in Advanced and Emerging Economies,” Departmental Paper 10/03 (Washington: International Monetary Fund).

Kumhof, Michael, Douglas Laxton, Dirk Muir, and Susanna Mursula, 2010, “The Global Integrated Monetary and Fiscal Model (GIMF)—Theoretical Structure,” IMF Working Paper 10/34 (Washington: International Monetary Fund).