Bankers on the Beach

Finance & Development, June 2011, Vol. 48, No. 2

Maria Gonzalez and Alfred Schipke

Financial flows to offshore financial centers, when properly managed, can contribute to economic growth

OFFSHORE FINANCIAL centers (OFCs)—which specialize in supplying financial services to nonresident companies and individuals in exchange for low taxes, stability, and secrecy—are under scrutiny, whether they like it or not.

Host countries see such activities as a source of growth and a legitimate area for economic diversification. For critics, OFCs are a stark reflection of the severe problems—including tax evasion and money laundering—triggered by the lack of transparency and regulation that comes with unfettered globalization. For this reason, several international bodies, including the Financial Stability Board (FSB), the Financial Action Task Force (FATF), and the Global Forum/Organization for Economic Cooperation and Development (OECD), have launched or reinvigorated initiatives to strengthen the tax and financial regulatory policies under which OFCs operate.

Broad reach

Many OFCs attract large foreign financial flows, and OFCs’ financial sectors often exceed the size of their respective host economies. OFCs’ financial services operate through a variety of instruments, ranging from international banking and insurance to the structured investment vehicles that were at the center of the 2008–09 global economic and financial crisis (see Box 1; Lane and Milesi-Ferretti, 2010; and Hines, 2010).

Box 1. At your service

Offshore financial centers (OFCs) offer a menu of financial services.

International banking: Individuals and corporations in politically or economically unstable countries protect their assets by placing them overseas and avoiding scrutiny.

Headquarters services: For certain types of firms, there are legal and tax advantages to incorporating in an OFC. According to the U.S. Government Accountability Office (GAO, 2008), about 732 companies trading on U.S. stock exchanges, including Coca-Cola, Oracle, and Seagate Technology, reported to the U.S. Securities and Exchange Commission that they are incorporated in the Cayman Islands. Some firms opt to locate their head office in an OFC, with onshore activities being conducted by affiliates of the offshore headquarters.

Foreign direct investment: OFCs play an important role in the internal organization of multinational firms. For instance, the financial management and treasury operations of multinationals typically include offshore affiliates that support certain transactions, such as new acquisitions or mergers, or that permit foreign direct investment to be financed with debt rather than equity.

Structured finance: Before the 2008–09 economic crisis, many banks and hedge funds used OFCs for off-balance-sheet activities such as the so-called special purpose vehicles or structured investment vehicles. These vehicles were typically funded in onshore financial markets and purchased onshore assets.

Insurance: Commercial operations may establish an insurance company in an OFC to manage risk and minimize taxes, or onshore insurance companies may establish an offshore company to reinsure certain risks and reduce the onshore company's reserve and capital requirements.

Collective investment schemes: OFCs have participated in the hedge fund industry by housing feeder funds that gather clients' contributions, which are then managed by onshore master funds. In addition, leveraged feeder funds may borrow from offshore and onshore banks.

OFCs need to compete with onshore institutions. On the one hand, to attract business, they tend to offer low- or zero-taxation schemes that appeal to firms seeking to cut their tax bills. To some degree, this tax competition can facilitate better resource allocation. These efforts are sometimes supported by international tax treaties. On the other hand, OFCs are cost competitive, because they frequently operate under relatively weaker regulatory and supervisory financial standards—standards that are set by the host jurisdictions. This lax operational environment translates into lower administrative and operating costs but may not be fully consistent with international best practices.

Explicit secrecy rules and weak legal and administrative frameworks—which implicitly offer identity discretion to investors—have also attracted business from those seeking outright tax evasion and money laundering, raising strong concerns in the international community.

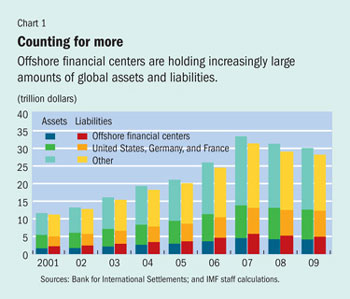

OFCs’ attractive financial and tax features have allowed them to capture a large and growing part of global financial flows. Indeed, 40 countries and territories hosting OFCs (Rose and Spiegel, 2007) held assets and liabilities of about $5 trillion at the end of 2009 (see Chart 1). To put this in perspective, cross-border assets and liabilities held by the United States, Germany, and France combined amounted to $8 trillion.

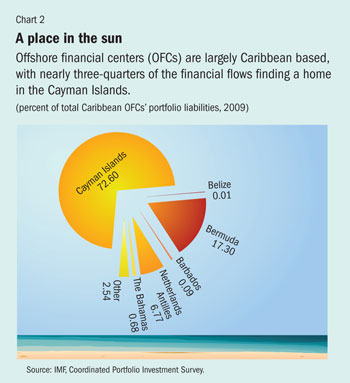

While OFCs are present in most parts of the world, those located in the Caribbean region account for more than half of all OFC financial transactions. And within the Caribbean, the largest OFCs are located in nonsovereign territories—in particular, the Cayman Islands, a British overseas territory (see Chart 2).

Sticking to the rules

The significant financial flows handled by OFCs have long attracted attention to their activities. Because of this, the international community—through bodies such as the Global Forum/OECD, FSB, or FATF—has increased pressure on OFCs by launching initiatives to improve their adherence to international standards. Indeed, since the late 1980s, the international community has stressed that OFCs should follow increasingly strict prudential and supervisory financial standards, prevent money laundering, and limit opportunities for tax evasion and aggressive tax minimization schemes.

The 2008–09 global economic crisis renewed the debate on OFCs and the perception that they too must abide by the rules. As policymakers become increasingly aware that financial regulatory loopholes can undermine the stability of the global financial system, there has been a push to ensure that OFCs adhere to international standards. As in the case of onshore Ponzi schemes (for example, the Bernard Madoff scandal in 2008) in G-20 countries, there are also prominent examples of financial scams operated through OFCs (such as the Allen Stanford fraud, which led to the collapse of the Bank of Antigua in early 2009) raising awareness about the need to strengthen regulatory systems operating in OFCs. In addition, policymakers in advanced economies have been trying to address their growing fiscal challenges by closing legal loopholes that facilitate tax evasion, including a variety of mechanisms that rely on OFCs (see Box 2).

Box 2. Avoiding the tax man

A company can avoid taxes by establishing an offshoot in a low-tax jurisdiction such as an offshore financial center and having the entity engage in transactions with headquarters. This can shift corporate income—which is usually taxable—into the low-tax jurisdiction.

Tax evaders use tax havens in three ways:

Hiding income: receiving income in cash or another nontraceable form, and depositing it in an account in a tax haven (or having the payer deposit the money directly into an offshore account), without declaring the income in the home country;

Hiding investment income: depositing legal money in an offshore account but not declaring the interest or other investment income that is derived from it; and

Shifting taxable income: setting up a company in a tax haven and making payments to this company for nonexistent services or purchases whose price is exaggerated—known as aggressive transfer pricing—to shift taxable income to the tax haven.

Current global initiatives on OFCs can be classified into four categories (see Chart 3):

reducing outright tax evasion, an initiative led by the Global Forum on Transparency and Exchange of Information and the OECD;

limiting legal tax avoidance, including a drive to establish global corporate tax policies led by individual advanced economies (G-20) and the OECD;

eliminating regulatory loopholes for financial institutions, which is spearheaded by the FSB; and

strengthening the fight against money laundering and financing of terrorism, led by the FATF with support from the IMF.

These four initiatives share many objectives—such as compliance with regulatory standards and transparency—but also have potentially adverse economic implications for OFCs. For example, reducing financial transactions could lower OFCs’ fiscal revenue, employment levels, and growth. This could happen for two main reasons. First, as OFCs update their regulations, they may become unable to offer secrecy arrangements or low-cost services. So changes that would have the unquestionable benefit of raising standards and reducing illegal activities performed through OFCs could also scare away some of their legitimate transactions. Second, a generalized “poor reputation effect” could spread across all OFCs, even those that are making efforts to comply with the international standards and attract legitimate business. The authorities in OFC-hosting jurisdictions are concerned that global action against the industry via mechanisms such as black/gray listings to reflect compliance with international standards (“naming and shaming” practices) or the application of sanctions could increase these risks.

Moreover, the intensified international push against the troublesome features of OFCs—while clearly critical to global financial and fiscal stability—has been gathering steam while some smaller jurisdictions hosting OFCs are still suffering from the 2008–09 financial crisis and facing a more challenging economic outlook. Indeed, because of a tepid recovery in OFCs’ key markets in Europe and the United States, tourism—an essential economic activity in most OFCs—has been lagging, and many countries that relied primarily on foreign visitors to fuel their economies are searching for new sources of growth. In this quest, OFCs continue to see the provision of offshore financial services as an important alternative for economic activity.

Fringe benefits

Higher capital inflows to OFCs can contribute to higher economic growth in the host jurisdiction as well as other benefits such as fiscal revenues and employment. Offshore institutions sometimes pay taxes and fees for activities such as registration and renewal operating license fees that can help sustain the public finances of their hosts, although this practice varies widely across hosting jurisdictions, which often forgo taxes and fees to attract OFCs. More important are the direct employment opportunities for local labor as well as spillovers to other sectors, including services such as tourism and infrastructure—OFCs often require upgrading of telecommunication and transportation.

Our research confirms that higher inflows to OFCs have a small positive impact on hosts’ economic growth (Gonzalez and others, forthcoming). These results hold whether or not the host is classified by the OECD as a tax haven.

Capital likes rules

High regulatory standards have a positive impact on capital inflows. There is some evidence that countries/jurisdictions that applied stronger regulatory standards (measured by the World Bank’s Worldwide Governance Indicators) benefited from higher portfolio investment flows in 2000–08. Thus, jurisdictions seeking to rely on offshore sectors as part of their development strategy are well advised to adopt strong regulatory standards. Being a tax haven alone does not guarantee capital flows; strong regulations that inspire confidence are a crucial factor.

Countries or territories that do not comply with international standards (particularly, those singled out by the OECD Global Forum on Transparency and Exchange of Information covering the availability, access, and exchange of information) were less successful in attracting flows during 2008–09. Initially, these standards required OFCs to sign a minimum of 12 bilateral tax agreements to exchange tax information. Evidence suggests that countries that were black- or gray-listed as part of the global initiative, for example, enjoyed a lower share of global total capital flows than those that were compliant, or white-listed (see Box 3). In other words, those OFCs that worked hardest to quickly align their regulations and laws with international standards benefited from their positive reputation.

Box 3. Black and white

To foster compliance with international tax standards, the Global Forum/OECD in 2009 used "naming and shaming"—classifying countries based on whether or not they were deemed to be complying with internationally agreed-on tax standards. If a country received a clean bill of health it was put on a white list. A country that had committed to the tax standards but had not yet implemented them found itself on a gray list. Countries that did not even commit to the standards ended up on a black list. Following the publication of the list, countries could move from the gray to the white list by signing at least 12 tax information and exchange agreements with other countries/jurisdictions. Both the FATF and the FSB might employ this approach in the future.

Many countries or territories hosting OFCs have moved forcefully to demonstrate their commitment to the international standards set by the ongoing global initiatives. For instance, while many of the Caribbean countries and territories were initially black- or gray-listed, all but one had by May 2011 signed the 12 tax information and exchange agreements required by the Global Forum/OECD to be moved to the white list. And OFCs are making efforts to increase compliance in other areas too.

OFCs might want to consider moving up the value chain by specializing in skills and regulation to retain or even increase flows—and hence their economic benefits. At the same time, jurisdictions with significant or expanding OFC activities should proactively ensure compliance with international standards. Because complying with increasingly higher standards is costly, countries and territories might want to evaluate the benefits and costs of providing OFC services. The smallest and most resource-constrained jurisdictions might want to take advantage of economies of scale and collaborate among themselves or create a regional body to provide accurate information about changing global standard requirements and technical assistance. ■

Maria Gonzalez is the IMF's Resident Representative to Argentina and Uruguay, and Alfred Schipke is a Division Chief in the IMF's Western Hemisphere Department.

References

Gonzalez, M., U. Khosa, P. Liu, A. Schipke, and N. Thacker, forthcoming, Offshore Financial Centers: Opportunities and Challenges for the Caribbean, IMF Working Paper (Washington: International Monetary Fund).

Government Accountability Office (GAO), 2008, “Cayman Islands: Business and Tax Advantages Attract U.S. Persons and Enforcement Challenges Exist,” Report to the Chairman and Ranking Member, Committee on Finance, U.S. Senate (Washington).

Hines, James R., Jr., 2010, “Treasure Islands,” Journal of Economic Perspectives, Vol. 24, No. 4, pp. 103–26.

Lane, Philip, and Gian Maria Milesi-Ferretti, 2010, “Cross-Border Investment in Small International Financial Centers,” IMF Working Paper 10/38 (Washington: International Monetary Fund).

Rose, Andrew K., and Mark M. Spiegel, 2007, “Offshore Financial Centres: Parasites or Symbionts?” Economic Journal, Vol. 117, No. 523, pp. 1310–35.

World Bank, Worldwide Governance Indicators (Washington)