Data Spotlight

Looking under the Hood

Finance & Development, June 2011, Vol. 48, No. 2

José M. Cartas and Ricardo Cervantes

Bank capital ratios have improved since the crisis, but mainly because banks are lending less

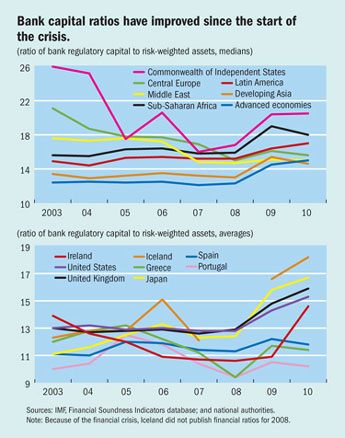

SINCE the start of the global financial crisis in 2008, the health of the banking sector, as measured by capital adequacy ratios (CARs), has rebounded in all regions.

From 2003 to 2010—even during the crisis—all regions show CARs comfortably above the minimum 8 percent set by the Basel Accords, which established international banking rules on how much capital banks need to set aside. Before the crisis, capital ratios remained stable in most regions—in advanced economies, developing Asia, Latin America, and sub-Saharan Africa—and showed a declining trend (from relatively high levels) in central Europe, the Commonwealth of Independent States, and the Middle East. After the financial crisis, CARs increased steadily in all regions except the Middle East and central Europe.

How was this achieved? In most advanced economies, while there was some increase in equity, banks improved CARs by limiting credit to their customers and shifting the composition of their portfolios to low-risk assets such as government securities. Other regions show an increase in both the capital base and banks' exposure.

Looking at national averages, the deterioration of banking system solvency is evident for countries hit particularly hard by the crisis, with averages for Greece and Portugal barely above the minimum 8 percent in 2008. The CAR for Iceland—an early victim of the financial crisis—hovered slightly above 12 percent until 2007, when the financial crisis wiped out more than 80 percent of that country's banking system assets. After the restructuring of Iceland's financial system, the ratio increased to more than 18 percent in 2010. CARs for the United States, the United Kingdom, and Japan show a similar pattern to that of the advanced country group—that is, stable values until 2008 followed by a steady increase.

Tuning up CARs

Capital requirements are designed to ensure that banks hold enough resources to absorb shocks to their balance sheets. A standard measure of the health of individual banks is their capital adequacy ratio (CAR). Introduced in 1988 with the Basel I Accord, the CAR is calculated as the total regulatory capital of a bank divided by its risk-weighted assets. The Basel II revision refined the calculation of risk weights and incorporated three major components of risk: credit, operational, and market risk.

Because the CAR is designed to gauge the solvency of individual institutions, country averages may hide outliers facing financing difficulties. Furthermore, risk might be underestimated by both the financial institutions and the supervisors, resulting in CARs that overvalue the soundness of the banking system. Other factors, such as liquidity or foreign exchange risks, may also impair the viability of financial institutions.

About the database

The CARs were calculated from the financial soundness indicators (FSIs) submitted by countries for dissemination on the IMF's website (http://fsi.imf.org) and from data collected from official websites. The entire data set for the years 2005–10 was published as Table 1 of the FSIs accompanying the April 2011 Global Financial Stability Report (http://0-fsi-imf-org.library.svsu.edu/fsitables.aspx). Countries are grouped by regions according to the classification in the IMF's World Economic Outlook.