Finance & Development, June 2011, Vol. 48, No. 2

Nicoletta Batini and Giovanni Callegari

PDF version

The costs of benefits for current retirees fall more on future Americans than on future Italians

WE MAY BE HAPPY that we are living longer, but as populations age, organized societies discover two large drawbacks to longer lives.

WE MAY BE HAPPY that we are living longer, but as populations age, organized societies discover two large drawbacks to longer lives.

The first is financial. Health care and retirement costs rise as the number of people over 65 grows faster than the working-age population. This increase in the so-called old-age dependency ratio (OADR) means fewer working-age people to pay for the health and pension benefits of a growing older population. Recently, the growing OADR has been aggravated by sharply rising health care and drug prices, which are expected to continue soaring worldwide at rates well above the expected growth in nominal income.

The second drawback has to do with equity across generations. Aging distorts the net contributions that younger and older citizens make to a country’s coffers. As the percentage of elderly goes up, the likelihood grows that current workers and their children (and their as-yet unborn children) will pay increasing amounts of their lifetime incomes to today’s seniors, while the probability decreases that they will enjoy similar benefits when they get old.

Traditional analysis of the costs of age-related spending has tended to focus on its financial aspects and the exploding debt-to–gross domestic product scenarios that accompany them. Less attention has been paid to the implications of aging for generational equity. A key reason is the difficulty of computing the cost of the increase in age-related spending for each generation. Such calculations are hard to make because a large part of a country’s spending liabilities consists of commitments to future transfers (under entitlement programs), which can change. As a result, traditional fiscal indicators such as the current imbalance between a country’s revenue and spending or the stock of government debt cannot measure whether future generations will have a fiscal burden equal to current or past generations.

Measuring generational equity

It is possible to compute how much each member of past, living, or future generations gains or loses through a country’s spending and taxing system by calculating the difference between all taxes paid by that individual during his or her life and all the government transfers that he or she has received and will receive. The methodology is called “generational accounting,” a concept originally developed by Laurence J. Kotlikoff, Alan J. Auerbach, and Jagadeesh Gokhale in 1991, and assumes that taxes and benefits are unchanged for current generations for the rest of their lives and that someone (that is, future generations) must eventually pay for the country’s excesses (that is, the country never goes into default).

These generational accounts can be used to assess the fiscal burden current generations are placing on future generations, and represent an alternative to using the federal budget deficit to gauge intergenerational policy. Generational accounts can also be used to calculate the policy changes required to achieve a generationally balanced—and therefore sustainable—fiscal (spending and taxing) policy, one that imposes equal lifetime net tax rates on today’s newborns and future generations.

Calculating generational accounts starts with the idea that the sum of future government consumption spending has to be equal to all future net taxes (that is, taxes minus transfers, all adjusted to reflect the value of future payments in current terms) plus current government net wealth. Using data from official surveys, it is possible to compute individual generational accounts—that is, the value in today’s dollar terms of individual taxes minus transfers for each current and future generation. Accounts for men usually differ markedly from those for women because men tend to earn more money, pay proportionally higher taxes, and receive fewer transfers targeted at children. Men also tend to live shorter lives and be sick more often than women. These income and health differences affect benefits received during old age, especially health care benefits, and give rise to different profiles of the incidence of taxes and transfers across gender and age. The last step in the calculation of the generational accounts requires transforming these profiles into per capita terms. To do that, population projections are combined with long-term tax and transfer projections to generate per capita lifetime net tax burdens by age and gender.

This article uses generational accounting methodology—relying on estimates from the U.S. Congressional Budget Office and the Italian National Statistics Office—to look at the United States and Italy, two countries at similar levels of development but with different degrees of population aging. For example,

• To date, Italy has undergone a considerably stronger demographic change than the United States. Projections from the United Nations indicate that the OADR in the United States, now 0.22, is projected to be 0.38 in 2050; Italy’s current OADR, by contrast, is 0.33 and will grow to 0.66 by 2050.

• In the United States, the generational imbalance is deepened by the continuing drop in government revenues. Because this is not being matched by a reduction in spending, it portends a redistribution of taxes from current to future generations. The situation is aggravated by the rapid increase (both actual and projected) in health care costs.

• Italy long ago embarked on widespread reforms of its entitlement programs, which has increased the nation’s ability to pay for them, but the United States has yet to change mandatory spending in ways that are conducive to fiscal solvency.

In a sense, then, the United States and Italy find themselves not just in different stages of the aging process but also in different phases of the solution to the problems aging brings. In the United States, aging issues (including rapid growth in health care costs) are expected to have their heaviest impact on future deficits. Italy, on the other hand, is already in the thick of things. Age-related spending in Italy is expected to stabilize in the short and medium term, about the time the United States should see its costs exploding.

Accounting for the United States

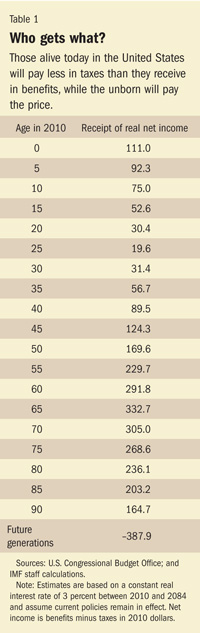

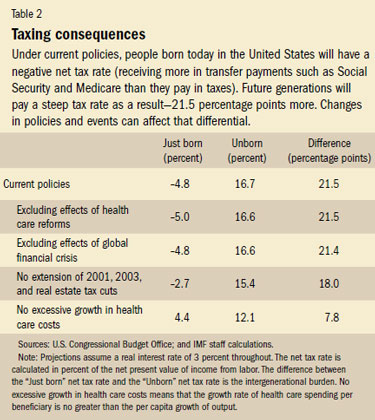

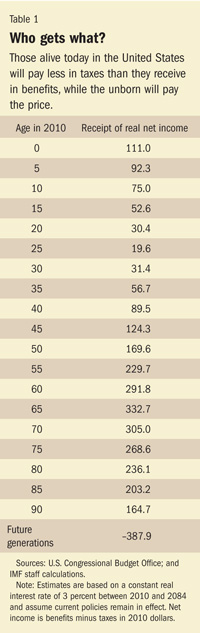

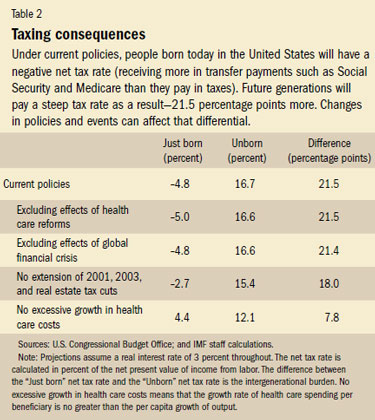

Applying the generational accounting methods to the United States (see Tables 1 and 2), we find several key messages (Batini, Callegari, and Guerreiro, 2011):

• Under current policies, the U.S. generational imbalance is large. Current generations are net receivers of public resources, while future generations of Americans are expected to foot the bill.

• The only way to reduce the burden on future generations is for Americans today to pay more in taxes and receive fewer entitlement benefits (such as Social Security payments). This would reduce the expected increase in the deficit and spread the adjustment equally across future generations. If these changes are not implemented soon, a typical American in the future might face net tax rates at least 21.5 percentage points higher than today. The longer changes are delayed, the bigger the needed adjustments.

• Under current conditions (assuming no changes in tax or entitlement law), the main drivers of the U.S. generational imbalance are the 2001 and 2003 tax cuts (recently extended until 2012) and the projected rapid increase in health care spending. The global financial crisis is estimated to have had a very limited impact on the imbalance. By contrast, the projected acceleration in the growth of entitlement spending and the reduction in tax revenues will be permanent unless laws change. The U.S. health care reform of 2010, while marginally altering the overall imbalance, creates a substantial redistribution to today’s working generations because it increases costs for young people and future generations.

These results show a substantial increase in the burden on future generations compared with previous estimates of U.S. generational accounts (for example, Gokhale, Page, and Sturrock, 1999), mostly because of the deterioration in U.S. public finances following the 2001, 2003, and 2010 tax cuts and the 2006 extension of Medicare benefits to include prescription drugs.

What Italians must pay

In Italy, the results indicate an elevated degree of intergenerational unfairness, based on 2006 data, the latest available. But there has been much less deterioration in Italian finances than in U.S. finances since 2006, and the financial crisis did not have a major effect on U.S. financial or generational balances. The data therefore point to an imbalance that is considerably smaller than that in the United States (Rizza and Tommasino, 2008):

• If we express the generational accounts in terms of implicit lifetime net tax rates, future generations in Italy will have to pay a rate that is 8.3 percentage points higher than what current generations pay, compared with the 21.5 percentage points in the United States.

• Unlike the United States, where most of the generational imbalance is explained by today’s relatively low tax revenues and the projected sharp increases in health care spending, in Italy the main driver of the imbalance is pension spending, mostly due to the rising OADR. In 2010 there were three Italians of working age for every older Italian. That ratio will shrink to 1.5 by 2050. There are currently 4.6 working-age Americans for every older American, and although this ratio too will decline, reaching 2.6 to 1 in 2050, it will be at a more sustainable level than in Italy. Although important in absolute terms, compared with the United States, health care costs are a relatively minor issue in Italy from a fiscal and generational point of view. Were it not for population aging, Italy would not have to raise taxes to achieve generational balance; in fact, a tax cut of 4.4 percent would be called for to ensure generational balance.

• The estimate of the generational imbalance in Italy has varied considerably over time. The required adjustment in the net tax rate fell considerably after the pension reforms adopted during the first half of the 1990s, which included an increase in the pension eligibility age, a return to a contribution-based system, and the introduction of voluntary private insurance systems. But that adjustment increased during the past decade because during the early 2000s the country missed some of its fiscal targets, making government debt fall more slowly than anticipated. There was also a delay in the implementation of pension reform.

Italy shows that much can be done to cope with age-related spending, even when a population is aging rapidly. Commitment to reform is a crucial part of the solution. Because pension reforms cross generations, policies to reduce the unfairness imposed on some generations by specific welfare systems must be embedded in strong institutional mechanisms. Those mechanisms can include fiscal rules that force the solvency of the pension system by accounting for population aging and independent institutions that guarantee the implementation of the reforms over time and changing legislatures. Italy’s experience shows that these mechanisms can weather changes in government and political powers, including those dictated by the change in the median voter age.

The internal debate over how to reform entitlement programs in a way that is economically sustainable and politically feasible is still in its infancy in the United States. The United States should heed the lessons learned by countries with older populations, such as Italy, and look to international best practices on how to contain health care spending for an aging population. Rising medical costs are an even more daunting issue and must be dealt with soon. Indeed, the analysis of the U.S. generational accounts shows that the cost of waiting for health care reforms could be very high. ■

Nicoletta Batini is a Senior Economist in the IMF’s Western Hemisphere Department, and Giovanni Callegari was an Economist in the IMF’s Fiscal Affairs Department at the time of writing.

References

Auerbach, Alan J., Jagadeesh Gokhale, and Laurence J. Kotlikoff, 1991, “Generational Accounts: A Meaningful Alternative to Deficit Accounting,” Tax Policy and the Economy, Vol. 5, ed. by David F. Bradford (Cambridge, Massachusetts: MIT Press).

Batini, Nicoletta, Giovanni Callegari, and Julia Guerreiro, 2011, “An Analysis of U.S. Fiscal and Generational Imbalances: Who Will Pay and How?” IMF Working Paper 11/72 (Washington: International Monetary Fund).

Gokhale, Jagadeesh, Benjamin Page, and John Sturrock, 1999, “Generational Accounts for the United States: An Update,” Generational Accounting around the World, National Bureau of Economic Research project report, ed. by Alan J. Auerbach, Laurence J. Kotlikoff, and Willi Leibfritz (Chicago: University of Chicago Press).

Rizza, Pietro, and Pietro Tommasino, 2008, “Will We Treat Future Generations Fairly? Italian Fiscal Policy through the Prism of Generational Accounting,” paper presented at the 20th meeting of the Italian Society for Public Economics, Pavia, Italy, September 25–26.

WE MAY BE HAPPY that we are living longer, but as populations age, organized societies discover two large drawbacks to longer lives.

WE MAY BE HAPPY that we are living longer, but as populations age, organized societies discover two large drawbacks to longer lives.