Emerging Markets Come of Age

Finance & Development, December 2010, Vol. 47, No. 4

M. Ayhan Kose and Eswar S. Prasad

These vibrant middle-income countries survived the global recession, but face bumps as they seek to solidify their place in the world economy

THE superlative performance of emerging market economies, a group of middle-income countries that have become rapidly integrated into global markets since the mid-1980s, has been the growth story of the past decade. After being beset by various crises during the 1980s and 1990s, emerging markets came into their own during the 2000s, recording remarkable growth rates while keeping inflation and other potential problems largely under control.

Before the global financial crisis of 2008–09, there was a growing sense among investors and policymakers that emerging economies, with their new economic might, had become more resilient to shocks originating in advanced economies. Indeed, empirical evidence indicates that over the past two decades there has been a convergence of business cycles among emerging markets and a convergence among advanced economies, but a gradual divergence of cycles between the two groups—referred to as decoupling. Fluctuations in financial markets have become more correlated across these two sets of countries, but that has not translated into greater spillovers into the real economy, which produces goods and services.

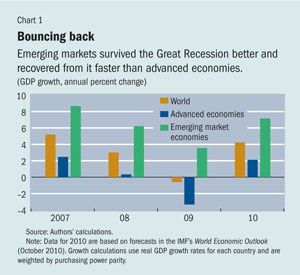

Yet the global financial crisis seemed to put to rest such notions of decoupling. It cast a shadow over the ability of emerging markets to insulate themselves from developments in advanced economies. Still, once the worst of the crisis began to wear off, it became apparent that as a group emerging economies had weathered the global recession better than advanced economies. In many emerging markets, growth rates have bounced back briskly during the past year, and as a group these economies seem poised to record high growth over the next few years (see Chart 1).

This is not to say that all emerging economies did equally well during the global recession. There is significant variation in the degree of resilience they displayed during the financial crisis. And therein lie some important lessons regarding the future growth paths of these economies and the issues they might face.

As emerging markets grow, they will continue to gain importance in the world economy. That economic ascendance will enable them to play a more significant role in improving global economic governance, so long as they employ good policies and intensify reforms that contributed to their resilience during the global recession. All told, emerging markets are in control of their own destiny.

Changing drivers of global growth

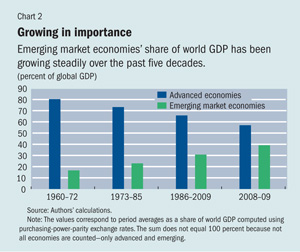

The past five decades have witnessed substantial changes in the distribution of world gross domestic product (GDP) across different groups of economies. During 1960–85, advanced economies on average accounted for about three-quarters of global GDP measured in current dollars adjusted for differences in purchasing power parity across countries. This share has declined gradually over time—by 2008–09, it was down to 57 percent. In contrast, emerging markets’ share has risen steadily from just about 17 percent in the 1960s to an average of 31 percent during the period of rapid global trade and financial integration that started in the mid-1980s. By 2008–09, it was close to 40 percent (see Chart 2).

The rising importance of emerging markets becomes even more apparent when their contribution to world output growth is considered.

During 1973–85, advanced economies accounted for about 60 percent of the 3.4 percent annual world GDP growth. Emerging markets contributed a third (the remainder is accounted for by other developing economies). Growth of world GDP averaged 3.7 percent a year during the period of globalization—1986–2007—and the contribution of emerging markets grew to about 47 percent. Advanced economies’ share fell to about 49 percent.

During the two years of the financial crisis there was a stunning shift in these relative contributions. Emerging markets became the lone engine of world GDP growth during 2008–09, while advanced economies experienced a deep contraction. The direct contribution of emerging markets to global growth has continued to increase over time and was further accentuated during the financial crisis, while the reverse has been true for advanced economies.

Diverging performance

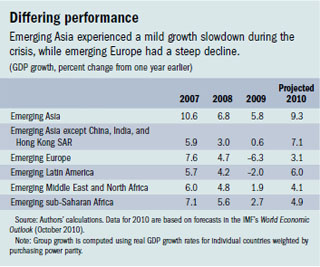

Although emerging economies as a group performed well during the global recession of 2009, there were sharp differences among them and across regions. The economies of emerging Asia had the most favorable outcomes, surviving the ravages of the global crisis with relatively modest declines in growth rates. China and India, the two largest economies in emerging Asia, maintained strong growth during the crisis and played an important role in the region’s overall record. When India and China are excluded, emerging Asia’s overall performance is less impressive (see table).

While emerging Asia did well, emerging Europe performed poorly and had the sharpest fall in total output during 2009. Latin America was also hit hard. Both regions suffered because of their ties to advanced economies. But many of the emerging economies in Latin America bounced back relatively strongly—in contrast to earlier episodes of global financial turbulence, during which Latin American economies proved vulnerable to massive currency and debt crises.

The emerging economies of the Middle East and North Africa (MENA) region as well as those of sub-Saharan Africa weathered the crisis better than Latin America, with only small declines in output. The reason for the relatively good performance of sub-Saharan African and MENA countries may be their modest exposure to trade and financial flows from advanced economies—which limited the extent of spillovers of the global shock.

Why the resilience?

Many factors account for the relative resilience of emerging markets, as a group, during the global financial crisis. Some relate to policy choices made by these countries, while others are associated with underlying structural changes in their economies. These factors also help explain differences in degrees of resilience across different groups of emerging market economies.

• Better macroeconomic policies in most emerging markets succeeded over the past decade in bringing inflation under control through a combination of more disciplined fiscal and monetary policies. Indeed, many emerging markets have now adopted some form of inflation targeting—either explicit or implicit, soft or hard—along with flexible exchange rates, which help absorb external shocks. Prudent fiscal policies that resulted in low levels of fiscal deficit and public debt created room for emerging market economies to respond aggressively with countercyclical fiscal policies to offset the contractionary effects of the crisis. In addition, emerging economies with low inflation were able to employ expansionary monetary policies to stimulate domestic demand.

• Less dependence on foreign finance and changes in the composition of external debt reduced their vulnerability to swings in capital flows. As a group, emerging economies were net exporters of capital during the past decade. Asian emerging markets, especially China, have run significant current account surpluses in recent years. There are, of course, other emerging economies—especially those in Europe—that were running large current account deficits before the crisis. This latter group proved most vulnerable to the crisis because credit booms in these countries were financed largely through foreign capital rather than domestic savings (see “A Tale of Two Regions,” in the March 2010 issue of F&D). However, shifts in the nature of capital flows to emerging markets have reduced their overall vulnerability to sudden stops of capital inflows. During the past decade, disciplined macroeconomic policies have facilitated a shift toward more stable forms of capital inflows to a number of emerging markets, away from debt and toward foreign direct investment (FDI) and equity investment. FDI, in particular, tends to be less risky for the recipient country.

• Large buffers of foreign exchange reserves also insured against sudden reversals in investor sentiment. Following the Asian financial crisis of 1997–98, emerging markets around the world built large levels of foreign exchange reserves, partly as a result of export-oriented growth strategies and partly as a form of self-insurance against crises associated with sudden stops or reversals of capital inflows. Emerging economies have accumulated $5.5 trillion in foreign exchange reserves, nearly half of which is accounted for by China. These reserves came in handy during the crisis but, as we discuss later, their benefits have to be weighed against the costs of accumulating such reserves.

• Emerging markets have become more diversified in their production and export patterns, although this has been largely offset by vertical specialization—with some countries supplying parts and other intermediate products to the country that is the ultimate exporter. This specialization has led, particularly in Asia, to regional supply chains. Diversification offers only limited protection against large global shocks but, as long as the macro effects of shocks are not the same across the export markets of emerging economies, it can help them deal with the disruptions that occur over the normal business cycle.

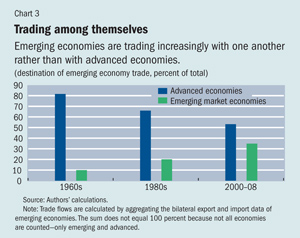

• Greater trade and financial linkages among the emerging economies have increased their resilience as a group (see Chart 3). Strong growth in the emerging markets has shielded commodity-exporting countries from slowdowns in the advanced economies. China’s continued rapid growth during the crisis, fueled by a surge in investment, has boosted the demand for commodities from emerging markets, such as Brazil and Chile, and has increased the demand for raw materials and intermediate inputs from other Asian emerging markets. The increase in trade flows among emerging economies has been accompanied by a rise in financial flows within this group.

• Broader divergence of emerging market business cycles from those of the advanced economies has also increased resilience. The rising intragroup trade and financial linkages discussed above have strengthened this trend. In addition, regional initiatives have encouraged financial integration and financial development among some Asian countries, although the scope and scale of these initiatives remain limited.

• Rising per capita income levels and a burgeoning middle class have increased the size of domestic markets, making emerging markets potentially less reliant on foreign trade to benefit from economies of scale in their production structures and less susceptible to export collapses. Still, private consumption may not always be able to take up the slack if there are adverse shocks to export growth.

The good and the ugly

These factors are brought into sharper relief when we examine more closely the experiences of two sets of emerging markets between which there is a clear contrast in terms of resilience to the global financial crisis. Before the crisis, average per capita GDP growth was highest in emerging markets in Asia and Europe. But since then these two groups’ fortunes have diverged. While Asian emerging markets, particularly China and India, were among the most resilient during the crisis, some economies of emerging Europe were the hardest hit.

Emerging Asia was relatively insulated from the effects of the financial crisis, possibly for the following reasons:

• Financial markets are relatively limited in their dependence on foreign bank financing, which narrowed the channels for financial contagion and also kept trade finance from collapsing.

• High and rising saving rates have more than kept pace with rising investment rates, leading to current account surpluses and growing stocks of foreign exchange reserves, thereby insulating the region as a whole from the effects of a sudden stop in capital flows from advanced economies.

• Prudent macroeconomic policies practiced by a number of these countries allowed for the fiscal flexibility to respond aggressively to the spillover effects of the crisis.

By contrast, emerging Europe was particularly vulnerable to the aftershocks of the crisis. It had a high level of dependence on external finance, as reflected in large current account deficits; significant exposure to foreign banks, which had many benefits but also served as a transmission channel for the crisis; and rapid credit expansion in the years before the crisis, which was difficult to sustain after foreign bank financing dried up.

Lessons

Our analysis points to some important lessons as well as a few instances where it may be tempting for policymakers to draw the wrong conclusions.

First, during good times, policymakers should work to create more room for macroeconomic policy responses to adverse shocks. Emerging economies that had lower levels of public debt (relative to GDP) were better able to conduct aggressive countercyclical fiscal policy responses to the global financial crisis and less concern about worsening their debt service obligations.

Second, a growth strategy that is well balanced between domestic and external demand can lead to more stable outcomes.

Third—and this is hardly new—emerging economies can derive significant indirect benefits from openness to foreign capital but should be cautious about dependence on certain forms of capital, particularly short-term external debt.

Fourth, a deep and well-regulated financial system can help absorb capital inflows more effectively and reduce vulnerability to volatile capital inflows. It can also enhance the transmission of monetary policy and add to its potency as a countercyclical tool. This means that financial market development and reforms are an important priority in most emerging economies. Although some emerging economies were not hit hard by the crisis precisely because they had underdeveloped financial markets, this has potentially adverse long-term implications for growth as well as the distribution of the benefits of growth (see “Trusting the Government,” in this issue of F&D).

Moreover, although large buffers of foreign exchange reserves can mitigate vulnerabilities stemming from the crisis, there are also significant costs associated with massive stocks of reserves. One cost is the interest payments on government bonds that are used to soak up the liquidity created by these inflows (when they are converted to domestic currency). Without such sterilization there would be risks of spiraling domestic inflation. Subtler but equally important costs are the constraints on domestic policies used to buttress fixed exchange rates; such constraints often include state ownership of banks, heavy restrictions on capital flows, and government control of interest rates.

Confronting new issues

In the aftermath of the crisis, there is a striking dichotomy between advanced and emerging economies in the short-term risks and policy issues they face. Among advanced economies, the major concern is weak growth and deflation pressures. Conventional monetary policy has reached its limits, and debt has risen to such high levels that it constrains the scope of fiscal policy. In many emerging economies, by contrast, growth has rebounded sharply, and some of these economies face rising inflation, surges of capital inflows and the accompanying risk of bubbles in asset and credit markets, and the threat of rapid currency appreciation.

Along with an increase in their economic heft, emerging economies are becoming more important players in setting global priorities. The unofficial anointment of the Group of 20 large economies as the major body determining the global economic agenda has given emerging markets a prominent seat at the table. The same is true in international institutions such as the new Financial Stability Board and the 65-year-old International Monetary Fund, where emerging economies are getting a much larger say than before.

Although emerging markets have attained a good level of maturity in many dimensions, they still face major domestic policy issues that could limit their growth potential. Financial market development is essential to channel domestic and foreign savings more efficiently into productive investment. In tandem with well-designed social safety nets, this is important for distributing the fruits of growth more evenly. The emphasis should be on more balanced growth rather than a narrow focus on boosting bottom-line GDP without regard for distributional and environmental consequences.

The global financial crisis presents a unique opportunity for emerging markets to mature in another dimension—taking on more responsibility for global economic and financial stability. While emerging markets, such as China and India, remain relatively poor in per capita terms, their sheer overall size makes it important for them to consider the regional and global spillovers of their policy choices. This will require them to play an active role in guiding international debate on key policy issues, including strengthening global economic governance. It is in their own long-term interest to take the lead on global challenges, from dismantling trade barriers to tackling climate change, rather than focusing narrowly on their own perceived short-term interests. ■

M. Ayhan Kose is an Assistant to the Director in the IMF’s Research Department. Eswar S. Prasad is the Tolani Senior Professor of Trade Policy at Cornell University, Senior Fellow and New Century Chair in International Economics at the Brookings Institution, and a Research Associate at the National Bureau of Economic Research.

This article is based on Emerging Markets: Resilience and Growth Amid Global Turmoil, by Kose and Prasad, published in November 2010 by the Brookings Institution Press.