Poorest Economies Can Export More

Finance & Development, December 2010, Vol. 47, No. 4

Katrin Elborgh-Woytek and Robert Gregory

Advanced and emerging economies can make it easier for the least developed countries to sell more products abroad

A MAJOR contributor to widespread poverty is the lack of integration of poorer economies into the global economy. Although trade is only part of the solution, were poorer economies able to sell more goods to advanced and emerging economies, they would benefit mightily.

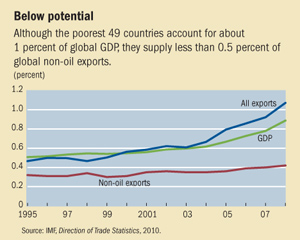

But exporters in poorer economies face obstacles both abroad and at home. Access to foreign markets is frequently limited by import barriers, while inadequate infrastructure and weak domestic policies often frustrate producers seeking to compete abroad. As a consequence, exports of the poorest countries have remained far below potential. The 49 poorest, or “least developed,” countries (LDCs; see box) account for nearly 1 percent of global gross domestic product (GDP) but less than 0.5 percent of global non-oil exports—a level virtually unchanged over the past 15 years (see chart). Only 1 percent of advanced economies’ imports come from LDCs.

The least developed countries

The United Nations identifies 49 countries as “least developed,” meaning that they are extremely poor, have structurally weak economies, and lack the capacity for growth.

Africa: Angola, Benin, Burkina Faso, Burundi, Central African Republic, Chad, Comoros, Democratic Republic of the Congo, Djibouti, Equatorial Guinea, Eritrea, Ethiopia, The Gambia, Guinea, Guinea-Bissau, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Niger, Rwanda, São Tomé and Príncipe, Senegal, Sierra Leone, Somalia, Sudan, Togo, Uganda, Tanzania, and Zambia.

Asia: Afghanistan, Bangladesh, Bhutan, Cambodia, Kiribati, Lao People’s Democratic Republic, Maldives, Myanmar, Nepal, Samoa, Solomon Islands, Timor-Leste, Tuvalu, Vanuatu, and Republic of Yemen.

Western Hemisphere: Haiti.

There are steps the poorest economies themselves could take to boost exports—such as reducing the often prevailing antitrade bias in their trade, tax, customs, and exchange rate regimes; issuing more transparent trade and customs regulations; and taking steps to improve such key service sectors as communications and transportation (see World Bank, 2010).

But the poorest exporting economies would benefit considerably if emerging as well as advanced economies gave them better opportunities for trade, which would improve their growth and productivity prospects (see Elborgh-Woytek, Gregory, and McDonald, 2010). There are a number of steps better-off countries could take to boost poor economies’ export potential. Some of them are well known to policymakers—in particular, concluding the current World Trade Organization (WTO) trade-negotiation talks, known as the Doha Round. Wide-ranging multilateral trade liberalization could spur growth and foster secure and open global trading. Poorer countries would gain from successful Doha Round conclusion through better access to advanced and emerging export markets.

Although broad-based multilateral trade liberalization is the ultimate policy target, there are less-obvious intermediate avenues—such as the extension and improvement of duty-free and quota-free (DFQF) trade preferences both by advanced and emerging economies—that could add nearly $10 billion a year to the coffers of poorer economies. These preference systems are designed to offset for the poorest countries some of the high trade barriers in sectors such as light manufacturing and agriculture—areas in which LDCs are likely to export.

Main avenues of integration

There are three main avenues for the more advanced and emerging economies to help integrate LDCs into the global economy:

•Remove all tariffs and quotas on products from LDCs.

•Make the rules that determine whether a product is deemed to originate from an LDC more flexible and consistent—including relaxing so-called cumulation rules, which govern the extent to which inputs from other countries affect compliance with rule-of-origin requirements for LDC exporters.

•Tilt preference benefits more specifically toward poorer economies.

First, if advanced and emerging markets ended all duties and quotas on LDC exports, the effect would be sizable. Major emerging market countries’ preference benefits to LDCs could be very valuable and help them improve their export performance. Exports from LDCs to Brazil, China, and India grew by an annual average of more than 30 percent during 1999–2009, and these three countries account for a third of all LDC exports. In 2008, China overtook the European Union as the largest single importer of LDC products, buying 23 percent of their exports. With substantial reforms since the 1990s, these emerging markets have reduced average tariff rates for nearly all trade partners to about 11 percent, but tariffs remain some 6 percentage points higher than those of the major advanced economies’ markets.

The share of exports from LDCs that are eligible for preferential treatment has increased from 35 percent in the late 1990s to over 50 percent today. However, preference programs vary considerably in product and country coverage, with sometimes significant gaps in coverage and high administrative costs. Gaps in preference programs of emerging market economies are usually wider than those in industrialized countries’ programs, reflecting their relatively recent development. High tariffs remain concentrated in agriculture and labor-intensive low-wage manufactures, the sectors in which LDCs have a comparative advantage and where 90 percent of their non-oil exports are concentrated.

In the 2000 United Nations Millennium Declaration, advanced economies committed to “a policy of duty- and quota-free access for essentially all exports from the least developed countries.” Following up on this commitment, WTO members agreed in the 2005 Hong Kong Ministerial Declaration that developing countries “in a position to do so” should make the same commitment. In practice, many advanced and emerging market economies have agreed to allow DFQF market access for LDC products under at least 97 percent of tariff lines. While the difference between 97 percent and 100 percent may seem insignificant, many LDCs export so few product categories that even a small number of exclusions can sharply limit the benefits of trade preference programs.

Exports would grow significantly

If all exports from developing countries were exempt from tariffs and quotas, LDC exports to both advanced and emerging markets would grow significantly—on the order of $10 billion a year, or about 2 percent of their combined GDP (Laborde, 2008; and Bouët and others, 2010). Broadening the coverage of preferences by major advanced markets could generate increased exports from LDCs of about $2.2 billion a year, or about 6 percent of net official development assistance from industrial countries to LDCs. The potential increase is even larger for exports to emerging markets—about $7 billion a year in additional exports (Bouët and others, 2010). Although the positive impact on LDCs would be sizable, the negative effect on advanced and emerging economies would be tiny because of the low level of LDC exports.

Second, if better-off economies were to make rules of origin more flexible, LDCs would benefit too. Rules of origin determine whether a good “originates” in a country that benefits from a preference system. The rules specify the minimum amount of economic activity that must be undertaken in the country benefiting from the preference and whether inputs from other countries count toward this minimum. Rules of origin differ widely across countries’ preference programs. They are frequently based on the amount of value added in the preference-eligible country or on the transformation a good undergoes in that country (measured by a change in tariff classification). These rules strongly influence where an LDC buys its inputs, which affects the overall economic consequences of a preference program.

To qualify for a preference program, LDC exporters must often limit input sourcing to suppliers in their own country or those from the country granting the preference—even if it would be cheaper to buy inputs elsewhere. This can be difficult for less-diversified LDCs, which depend on intermediate goods, processes, or patents from other countries. Rules of origin can also be a source of distortion, if exporters turn to less-efficient, more costly input sources to qualify for preferences. Moreover, the administrative burden of meeting complex rules of origin can be substantial, costing as much as 3 percent of export value (Hoekman and Özden, 2005). As a result, perhaps a quarter to a third of eligible imports do not gain preference, and some trade that might have benefited from better-designed preferences is likely never undertaken.

Permitting more flexible sourcing

More liberal rules of origin allow producers to source inputs flexibly. Such rules implicitly acknowledge LDCs’ low capital intensity and lack of horizontal or vertical integration. Under China’s preference program, for example, origin (and thus preference benefits) can be conferred on a product based either on a minimum local value-added threshold or a change in tariff classification—implicit acknowledgment that the product is different and the LDC has added value. India’s low 30 percent value-added threshold gives potential LDC exporters flexibility in sourcing their inputs.

Moreover, better-off countries could make it even easier to stimulate trade among LDCs if their rules of origin specifically allowed preference-eligible countries to buy inputs from other preference-eligible countries. If these so-called cumulation provisions allowed inputs from two or more countries to be counted together, it would make it easier for the preference-eligible country to meet the minimum requirements under the rules of origin. In contrast, narrow or restrictive cumulation provisions rules do not allow the use of inputs from other countries, often fragmenting established cross-border production relationships. Cumulation provisions therefore determine how easily preference beneficiaries can trade among themselves, using intermediate goods or processes that originate in other countries.

Permitting wider cumulation would assuredly mean that LDCs could meet the rules of origin more easily and at lower cost and would also encourage south-south trade. Allowing the poorest countries to source inputs from all LDCs and other developing countries while remaining eligible for preferences would provide the added flexibility needed for effective use of preference programs.

Tilting toward developing countries

Finally, both advanced and emerging economies could tilt their preference benefits more specifically toward the poorest developing countries. Some advanced economy market preference programs favor a wide range of developing countries, not necessarily the poorest. Advanced economies also often have regional trade agreements that grant preferences to the countries in the pact. The combination of regional and less-focused preference programs reduces the effective preference margin available to LDCs. In those cases, phasing out benefits to more developed countries over time could be considered, taking into account the impact both on exporters and importers. Graduation provisions, which determine when an economy is no longer eligible for preferential treatment, should always be transparent and predictable, with ample notice of withdrawal. In the interest of predictability, preferences for LDCs should be renewed well in advance, allowing time for investors to make decisions accordingly.

In setting out changes in trade preference programs for the poorest economies, emerging markets may play a more important role than advanced economies, most of which have had such programs for many years. Several major emerging economies have introduced and expanded LDC trade preferences, but coverage remains selective. Because they are at an earlier stage of implementation than those of advanced economies, these preference programs have room to grow, albeit at a pace consistent with the remaining development needs of the emerging economies that are the new preference providers. It may take longer for emerging economies to phase in the proposed changes, but the key direction for expansion and improvement of their programs is broadly similar to that of advanced economies. Because adjustment pressure is likely limited to a narrow range of product categories—in which there could be direct competition with LDC exports—some emerging economies may need several years to implement these LDC benefits. ■

Katrin Elborgh-Woytek is a Senior Economist and Robert Gregory is an Economist, both in the IMF’s Strategy, Policy, and Review Department.

References

Bouët, Antoine, David Laborde Debucquet, Elisa Dienesch, and Kimberly Elliott, 2010, “The Costs and Benefits of Duty-Free, Quota-Free Market Access for Poor Countries: Who and What Matters,” CGD Working Paper 206 (Washington: Center for Global Development).

Elborgh-Woytek, Katrin, Rob Gregory, and Brad McDonald, 2010, “Reaching the MDGs: An Action Plan for Trade,” IMF Staff Position Note 10/14 (Washington: International Monetary Fund).

Hoekman, Bernard, and Çaglar Özden, 2005, “Trade Preferences and Differential Treatment of Developing Countries: A Selective Survey,” World Bank Policy Research Working Paper WPS 3566 (Washington).

Laborde, David, 2008, “Looking for a Meaningful Duty-Free Quota-Free Market Access Initiative in the Doha Development Agenda,” Issue Paper 4 (Geneva: International Centre for Trade and Sustainable Development).

World Bank, 2010, Doing Business project trading across borders data. Available at www.doingbusiness.org/Data/ExploreTopics/trading-across-borders

World Trade Organization, 2007, Market Access for Products and Services of Export Interest to Least-Developed Countries (Geneva: World Trade Organization).