The Tragedy of Unemployment

Finance & Development, December 2010, Vol. 47, No. 4

Mai Chi Dao and Prakash Loungani

Governments can do more to alleviate joblessness and its human costs

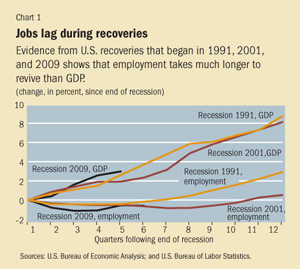

THE world faces an unemployment crisis. Across the globe, an estimated 210 million people are unemployed, an increase of more than 30 million since 2007. Three-fourths of this increase has occurred in the advanced economies. The problem is particularly severe in the United States—the epicenter of the Great Recession and the country with the highest increase in the number of unemployed people. There are 7.5 million more people unemployed today than in 2007. And while the U.S. recession has been declared to have ended in June 2009, evidence from the past couple of recoveries shows that employment has taken quite a bit longer to recover than incomes (see Chart 1).

Measuring misery

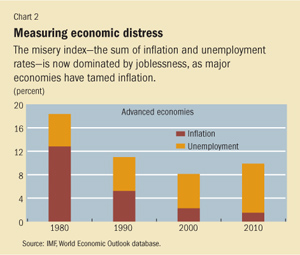

The misery index—the sum of the inflation and unemployment rates—gained popularity as an indicator of economic distress during the U.S. presidential election of 1980. Since that time, the index has declined in the United States and in advanced economies, in large part thanks to the taming of inflation (see Chart 2). Unemployment, however, has remained a problem, and its contribution to the misery index increased sharply during the Great Recession.

The so-called misery index, the sum

of the inflation and unemployment rates,

is now almost totally dominated by joblessness (see box). The human toll of the slow recovery in jobs in the United States and elsewhere could be very high. Studies have demonstrated that the

costs to the unemployed include a persistent loss in earnings through career downgrading, reduced life expectancy,

and lower academic achievement and earnings for their children. These costs

are greater for those who have been unemployed longer.

There are many facets to joblessness. This article will look at

• the human cost of unemployment and how governments’ policy responses during the Great Recession kept it from being even bigger;

• near-term policies to aid labor market recovery; and

• the challenge posed by the high level of long-term unemployment.

Human cost of unemployment

Research on the effects of past recessions gives us a good idea of the often high and persistent cost of unemployment for individuals and their families (see Dao and Loungani, 2010, for a survey).

Layoffs are associated with loss of earnings not just during the jobless episode but far into the future (see Sullivan and von Wachter, 2009). The losses are higher if the unemployment occurs during a recession. Studies of the United States and Europe show that even 15 to 20 years after a job loss during a recession, earnings of those who lost their jobs are 20 percent lower than those of comparable workers who kept their jobs. The adverse effects on lifetime earnings are most pronounced for unemployment episodes experienced by young people, especially following college graduation. In a recession, young workers tend to take worse jobs than they would during better times. And as they settle into family life and become less mobile, it is hard to recover from this “cyclical downgrading.”

There is persistent and large loss of earnings in other countries as well—Germany, for example—and it is of similar magnitude. As the German example shows, even in countries with more generous welfare systems and lower earnings inequality than in the United States, workers are not shielded from lifetime earnings losses caused by job displacement.

The human toll is not limited to monetary losses: layoffs may also be associated with loss of health and life, according to recent studies. To rule out spurious associations—unhealthy individuals may, for example, be less productive and thus more likely to become unemployed—and other confounding factors, the studies use data sets that allow researchers to control for preexisting health, socioeconomic, family, and other background characteristics as well as the timing of health and job outcomes. Even after accounting for these factors, layoffs are associated with a higher risk of heart attack and other stress-related illnesses in the short term. In the long term, the mortality rate of laid-off workers is higher than that of comparable workers who do not lose employment. For the United States, the increased mortality rate due to joblessness is estimated to persist up to 20 years after the job loss and lead to an average 1- to 1.5-year lower life expectancy.

Job loss can reduce the academic achievement of children of the unemployed: one study found that children whose parents experienced job loss were 15 percent more likely than other children to repeat a grade. In the long term, fathers’ income loss also reduces the earnings prospects of their children. In Canada, for instance, children whose fathers were displaced from their jobs were estimated to have annual earnings nearly 10 percent lower than similar children whose fathers remained employed. This relationship holds after controlling for other individual and family characteristics that might have an impact on earnings. In Sweden, lower parental income has been correlated with children’s significantly higher mortality later in life, even after controlling for the children’s own income and education.

These costs are likely to be higher, the longer a person is unemployed. Not only are the earnings losses greater, but people who are out of a job for a long time lose self-confidence and skills and become detached from the labor force. This in turn affects how they are viewed by prospective employers and reduces their chances of finding a job. Data from the U.S. Census Bureau show that a person unemployed for more than six months has only a 1-in-10 chance of finding a job in the subsequent 30 days. By contrast, someone unemployed less than a month has a 1-in-3 chance of finding employment. Long-term unemployment thus means cyclical unemployment can become entrenched as a structural phenomenon.

Governments to the rescue

Most countries mounted a strong policy response without which unemployment—and its attendant human costs—would have been even higher. Broadly speaking, that response had three parts:

• support for aggregate demand through monetary and fiscal policy action;

• short-time work programs and unemployment insurance benefits to ease the pain in labor markets; and

• hiring subsidies to limit layoffs and accelerate jobs recovery.

Central banks moved quickly to stimulate aggregate demand by lowering policy interest rates and then, as interest rates fell to near-zero levels and could be lowered no further, through quantitative easing—that is, direct purchase of long-term government assets—and other interventions.

Fiscal policy turned accommodative, and governments allowed recession-induced lower tax revenue to be reflected in higher cyclical fiscal deficits, rather than trying to cut spending to match the decline. In addition, many governments provided direct support to their financial sector—fiscal stimulus and the so-called bank bailouts (see “Stimulus Worked,” in this issue of F&D).

To ease the pain in labor markets, governments complemented monetary and fiscal policy actions with active labor market policies. One of the key policies was to provide government financial assistance for programs to encourage companies to retain workers but reduce their working hours and wages. Such short-time work programs can spread the burden of the downturn more evenly across workers and employers, reduce future hiring costs, and protect workers’ human capital until the labor market recovers. During the Great Recession, such programs were extensively used in Germany, Italy, and Japan. Although it is too early to undertake a full assessment, these programs are credited with having played a crucial role in stemming unemployment in many countries. Governments also eased the pain of unemployment through provision of unemployment insurance benefits. Many countries had already extended the duration of these benefits; others extended it as the recession dragged on—in the United States, for example, unemployment insurance benefits were extended from 26 to 99 weeks. In recessions, the potential adverse effect of benefits on a job search effort is estimated to be very small (see Dao and Loungani, 2010).

The third part of the strategy was to use subsidies to directly speed up job recovery. It is difficult to design hiring subsidies that are effective: companies could end up with subsidies for jobs they would have created anyway or for jobs that should never have been created and should not be maintained in the future. However, in the midst of a deep recession, the costs of these inefficiencies were less severe than the costs of high unemployment. And steps that countries took to target subsidies toward those most adversely affected likely served to reduce the inefficiency costs. Subsidies were targeted to vulnerable groups such as the long-term unemployed and the young (in, for example, Austria, Finland, Portugal, Sweden, and Switzerland), hard-hit regions (as in Korea and Mexico), or specific sectors (such as services in Japan).

What next?

Over the coming year, the three-part strategy adopted during the crisis should remain in place. But the relative importance of the parts should shift over time as recovery takes hold and should differ across countries depending on their circumstances.

A recovery in aggregate demand is the single best cure for unemployment, and fiscal and monetary policies should, to the extent possible, remain supportive of such a recovery. The deficit-reduction plans that advanced economies have for 2011 imply an average decrease in the structural balance equivalent to 1¼ percentage points of gross domestic product (GDP). A more severe consolidation would stifle still-weak domestic demand.

Clearly, however, the fiscal situation varies across countries. The current debt-to-GDP ratio varies widely (see Chart 3). How much more fiscal space—that is, room to add debt—do countries have? To answer this question, Ostry and others (2010) define a “debt limit,” which is the debt-to-GDP ratio beyond which a country’s normal fiscal response to rising debt becomes insufficient to maintain debt sustainability. The normal response is estimated based on the country’s historical taxing and spending record.

The difference between the debt limit and the projected ratio in 2015 provides an estimate of the fiscal space available to the country. Because the normal fiscal response is estimated with uncertainty, there is also uncertainty associated with the resulting estimates of fiscal space. In Chart 3, countries whose probability of having fiscal space of 50 percent of GDP or more is quite low are shown in red. Greece, Iceland, Italy, and Japan fall into this category. Countries whose probability of fiscal space of 50 percent of GDP or more is moderate are shown in black. Ireland, Spain, the United Kingdom, and the United States are in this category. These calculations suggest that, in many advanced economies, what is needed is credible fiscal tightening over the medium term, not a fiscal noose today.

Monetary policy remains an important policy lever to support aggregate demand. Inflation pressure is subdued—headline inflation in advanced economies is expected to remain at about 1½ percent in 2011. As a result, accommodative monetary policy can continue in most advanced economies. Moreover, if growth falters, monetary policy should be the first line of defense in many advanced economies. With policy interest rates already near zero in many economies, central banks may again need to rely more strongly on quantitative easing. Although these demand-stimulating measures seem necessary to ensure recovery in most advanced economies, their implications for international capital flows and emerging market countries’ exchange rates and external balances must also be taken into account.

If the recovery takes hold, subsidies for short-time work and the various types of hiring subsidies introduced during the crisis could start to be phased out. Such subsidies put a strain on public finances and can give firms an incentive to free ride even when conditions improve. And if the fortunes of certain firms and industries are permanently affected, subsidies can obstruct reallocation of resources to other industries. The provision of unemployment insurance benefits should be tied to compulsory job training and community service, so that those who are unemployed remain attached to the labor force.

The challenge of long-term unemployment

The proportion of the long-term unemployed—those out of work for 27 weeks or more—has increased in most advanced economies since the start of the Great Recession. In the few cases where it did not—such as in France, Germany, Italy, and Japan—long-term unemployment had been persistently very high even before the crisis. In the United States, the numbers of workers unemployed for 27 weeks or more (as a share of the total number of the unemployed) has risen during every recession since 1980, but the increase during the Great Recession was alarming: nearly half of all unemployed people have been out of work 27 weeks or more.

Much of the increase in long-term unemployment during the Great Recession may be a result of structural factors. This is because recessions can have very different impacts across industries. Some industries suffer and recover along with the overall economy. Others, such as some service industries—for example, health care—shrug off the effects of the recession. And some industries suffer a permanent decline. In many cases, these are industries that—in hindsight—had expanded too much before the recession. Examples of these are the high-tech industry prior to the 2000 dot-com bust and the construction sector ahead of the Great Recession.

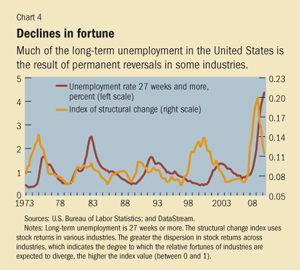

Chart 4 shows an index of structural change in the United States using data on stock returns in various industries. The greater the dispersion of stock returns across industries—indicating the extent to which the industries’ fortunes are expected to diverge—the higher the value of the index. Historically, the more intense the structural change that precedes or accompanies a recession, the higher the incidence of long-term unemployment. During the Great Recession, the index rose sharply and was matched by a steep rise in long-term unemployment. There is a similar increase in the intensity of structural change and the incidence of long-term unemployment in many other advanced economies (see Chen and others, forthcoming).

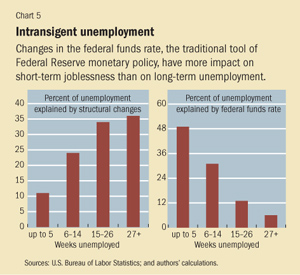

A recovery in aggregate demand, using monetary and fiscal policy, will lead to a decline in long-term unemployment. But there is evidence that recovery in aggregate demand takes too long to lift the boats of the long-term unemployed, and even then does not give them much of a lift. For instance, in the United States, movement in the federal funds rate, the traditional instrument of monetary policy, has more of an impact on short-term than on longer-term unemployment (see Chart 5, right panel). In contrast, the index of structural change is more strongly associated with long-term than with short-term unemployment (see Chart 5, left panel).

This suggests that tackling long-term unemployment will require that aggregate demand policies be supplemented with more targeted labor market policies, such as retraining, to put the long-term unemployed back to work. ■

Mai Chi Dao is an Economist and Prakash Loungani is an Advisor, both in the IMF’s Research Department.

References

Chen, J., P. Kannan, P. Loungani, and B. Trehan, forthcoming, “Stock Market Dispersion and U.S. Long-Term Unemployment,” IMF Working Paper (Washington: International Monetary Fund).

Dao, Mai Chi, and Prakash Loungani, 2010, “The Human Cost of Recessions: Assessing It and Reducing It,” background discussion paper for the Joint International Labor Organization–IMF conference on the Challenges of Growth, Employment, and Social Cohesion, September (Oslo).

Ostry, Jonathan D., Atish R. Ghosh, Jun I. Kim, and Mahvash S. Qureshi, 2010, “Fiscal Space,” IMF Staff Position Note 10/11 (Washington: International Monetary Fund).

Sullivan, Daniel, and Till von Wachter, 2009, “Job Displacement and Mortality: An Analysis Using Administrative Data,” Quarterly Journal of Economics, Vol. 124, No. 3, pp. 1265–1306.