People in Economics: Undercover Operator

Finance & Development, September 2010, Vol. 47, No. 3

Simon Willson profiles Maria Ramos

ECONOMIC policymaking is testing enough in today’s globalized world for those who are duly elected or appointed, and are supported by the accoutrements of office. But Maria Ramos started drafting macroeconomic policy options for South Africa in the 1980s while undercover as a member of a then illegal organization, traveling between continents with hidden briefing papers. It was just another stage in her preparations to serve in South Africa’s first majority government, which took office in 1994 facing the daunting task of reconciling the resources of a chronically weak economy with the expectant demands of the newly enfranchised.

Ramos joined the government a year after it gained power, when its drive to restore fiscal sustainability began to generate real friction from entrenched interest groups and big-spending ministries. First as deputy director-general for financial planning in the Finance Department, and then as director-general of the Treasury, Ramos’s studied practicality and penchant for detached analysis qualified her well for a role as a planner and ideas formulator for economic ministers sorely in need of workable options.

Earlier experience as a firebrand student and academic in South Africa’s liberal hothouse at the University of the Witwatersrand had laid Ramos’s solid political foundations as a supporter of and activist for majority rule. When these progressive instincts combined with her subsequent endeavors as a researcher and commercial bank economist, she embodied a formidable force that promised quick results for any enterprise intrepid enough to harness it. The African National Congress (ANC), as it formed South Africa’s first majority-rule government, assiduously tapped Ramos’s zeal.

Direct approach

The first entity to experience Ramos’s signature direct approach to problem solving was the commercial bank where she took her first job in 1978. Born in Lisbon, Portugal, to a family that emigrated to South Africa when she was aged 6, Ramos went through school in a town 60 miles from Johannesburg. “When I started at the bank I realized that they had a great scholarship, and when I applied for it I was told it wasn’t open to women,” Ramos recalls. “I started a big battle with the bank about how unfair this was. Eventually there was a change of management at the bank that also changed the rules of the game. By then I had fought this for about five years, all the way up to the head office, and they decided I had caused enough chaos. They changed the rules, and I was the first woman they sent to university on that scholarship.”

Exposure to the political radicalism at the University of the Witwatersrand (known as “Wits” for short) changed Ramos. It was the mid-1980s, when international sanctions were beginning to bite South Africa and to encourage greater domestic activism against minority rule. “I went to Wits in what were some highly political years, and I got a bit involved and I certainly got very sensitized politically. And it was quite hard to come back to work at the bank after university.” She returned to academic life as an economics lecturer, and connected with the ANC, the political movement that is now South Africa’s ruling party but was still outlawed—“banned” under domestic laws—in the 1980s. While teaching in posts at Wits, the University of South Africa, and the London School of Economics (LSE), Ramos covertly joined the ANC’s economics section.

“I was quite involved in shaping a lot of the debate as part of the economics policy team in the ANC. I spent a lot of time flying between Johannesburg and other places to do political work before the ANC was unbanned. A lot of the economic policy documentation in the ANC we wrote outside the country.” Even now, Ramos does not specify where. In 1990 the ANC was unbanned, de facto leader Nelson Mandela was released from jail, and its officials prepared to govern. “It was quite a heady time: we had responsibility, we were putting things together, we were making policy as we went along, taking pieces of the ANC’s policy and trying to shape it and put it into place. I was part of a team that worked on the chapter on finance for the interim constitution, which included the independence of the central bank.”

Dual role

Ramos continued her dual role, but in the open this time. “I did a lot of commuting between London and Johannesburg, and a lot of commuting between teaching and negotiating. At one point I was teaching monetary theory to honors students and negotiating the clauses on the independence of the central bank, so it was an exciting time for me and the students. By the time we went into government there was a body of work and thinking. Of course, none of us had any experience of what it meant to run a government.”

The ANC duly won South Africa’s first free elections in April 1994 and formed the country’s first majority government. Ramos, her work done—or so she thought—headed back to the LSE, intent on converting her research on central bank independence into a doctorate. But her erstwhile ANC colleagues wanted their hard-edged policy planner back, and approached her about a vacancy in the new government’s Department of Finance. She did not take long to decide. “I probably underestimated how difficult the separation was going to be when you had been that involved.” The doctorate remains unfinished.

Alec Erwin, deputy finance minister in the first majority government, recruited Ramos to join the Treasury. “When I became deputy minister we began to look for people with experience in our own policy framework, and that is when I approached Maria,” Erwin recalls. “She was a fairly clear choice, being a senior policy planner who had sat in on some of the government transition meetings, and having banking experience. I didn’t have to twist her arm too hard. She had been working with all of us for a long time.”

Entering government, Ramos was shocked. “The surprise for all of us was just the realization that as a country we were in pretty bad shape. Our fiscal position was fairly precarious. We were spending marginally more on education than on servicing debt. That borders on the unsustainable. If we had maintained that trajectory, our projections showed that two years down the line this would reverse and we would be spending more on debt than education in a country where that should be the other way around. We actually needed to create the fiscal space to be spending more on education, health, and social infrastructure than on anything else. Basic rationality tells you that you can’t get there without taking some really tough decisions, and what’s been remarkable about South Africa is that it’s had the political leadership with the courage to take those really tough decisions and not to shy away when the time came.”

Ramos had found her niche. Someone behind the scenes had to draw up the tough policy options needed for fiscal stability, and place them before the executive branch of government. As director-general of finance, the responsibility fell to her. “Our job as civil servants was to put the options before the minister and cabinet and to work out the different choices and potential outcomes. South Africa was able to build a solid base from a tax point of view, to reform its revenue services, to put in place the institutions of fiscal governance, and shift its fiscal spending patterns away from debt servicing to actual, proper investment in social services. I often think that as South Africans we don’t really recognize how hard it is for a country to do that, and in a relatively short space of time.”

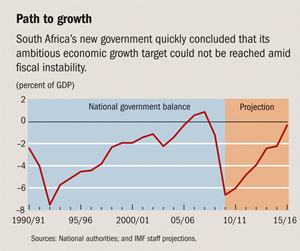

The scale of South Africa’s fiscal rebalancing during the 1990s can be appreciated from the chart. From a national government balance of –5.7 percent of GDP when the ANC took power in 1994, the fiscal position swung to a small surplus in 2007. This achievement is all the more significant given the new government’s long list of spending commitments as it sought to fulfill its campaign promises (see Box 1). Ramos and her colleagues found a way for the government to finance the Reconstruction and Development Programme on which it had fought and won the election, while at the same time tightening fiscal policy enough to aim realistically for a balanced budget within a decade.

Box 1. Campaign pledges

Ahead of South Africa’s first majority-rule elections in 1994, the African National Congress campaigned on a Reconstruction and Development Programme (RDP) that detailed spending commitments including

- “Decent, well located, and affordable shelter for all by the year 2003

- Supply 20 to 30 liters of clean water each day to every person within two years

- Two and a half million more households and all schools and clinics will have electricity by 2000

- All South Africans should have access to a modern, affordable telephone system

- The publicly owned transport systems will be improved to be safe, convenient and affordable

- The government will develop a national health system offering affordable health care

- A new social security and welfare system will be provided to all.”

The RDP also addressed the issues of the cost of and payment for its commitments specifying that

- “Most expenditure on the RDP is not new: rationalization of existing systems will unlock resources

- We must improve the capacity of the financial sector to mobilize more resources and to direct these to activities set out in the RDP

- We must ensure that electrification and telecommunications will be self financing

- Improved and reformed tax systems will collect more tax without having to raise tax levels.”

“My job was to assemble and retain a team of really smart people,” Ramos recollects. “Many of them are still there. We also changed people’s perceptions of working for a government department: that it’s a professional place where we do things properly and build capacity. The more we achieved, the higher we set the base for our next effort. And the more we could do, the more fiscal space we had.” Ramos’s mathematical practicality lasered in on the idealism that accompanied the new administration into the corridors of power (see Box 2).

Box 2. Tough decisions

Maria Ramos and her Finance Department colleagues were charged with putting in front of South Africa’s ministers and cabinet viable options for reaching economic targets without jeopardizing financial stability. Ramos says nothing was sugar coated.

“In 1996 we had to put a fiscal policy in place that had to say to the nation that if we wanted to achieve a sustainable economic growth path of 6 percent, this was how we would get there. That was our starting point. People often think that the program of growth, employment, and redistribution was about cutting the deficit. That’s not the question we asked. We asked: ‘If we want 6 percent growth, what do we need to have in place to achieve it?’

“Very quickly, we came to the conclusion that you can’t get to 6 percent growth when you have a position of fiscal instability, because you can’t borrow your way out of a crisis. We didn’t want to go to the IMF—we didn’t think that was going to be a sustainable solution—and we were very close to that. South Africa had no reserves—in fact we had a negative reserve position because we had a net open forward position at that point of about $26 billion. We had debt-to-GDP ratios of around 50 percent, we had debt-servicing costs reaching the point where they were unsustainably high. So the fiscal position was pretty precarious: the metrics didn’t add up.

“So if you want to get growth there, you have to fix the base. And fiscal sustainability is hard to achieve and it’s easy to lose. That’s what we placed before policymakers, before the cabinet. And I have to say that, as hard as it was, when faced with that, I never came across a politician from the president down who said: ‘No, we can’t do this because it’s going to be unpopular for me.’ What’s been remarkable for me as a civil servant to see was that politicians from the top down were able to say ‘What is in the best interests of our country? It’s going to be painful, it’s going to be hard.’ Those investments continue to pay off today.”

Debt management

“I remember when I walked into the Department of Finance there was no approach to debt management,” Ramos recalls. “So we would borrow. At the beginning of the year we said ‘This is what we are going to spend, and this is what we are going to collect in taxes, and the difference is the deficit.’ So I would say ‘Okay, great: now how are we going to borrow—where on the yield curve do you want to do this?’ And the response was: ‘The yield curve—what is that?’ So I would say ‘Come on, we are the yield curve, so how are we going to shape this thing?’ But people didn’t think like that. They just took what you needed to borrow and divided it by 12.”

The Finance Department, it emerged, was carrying a cash buffer of 8–10 billion rand, or $1.1–$1.4 billion, a month as a contingency. The money sat on deposit at the central bank, collecting zero interest. So the government was borrowing on one side of the ledger and paying a prodigious coupon, and the proceeds were sitting unused as a pile of cash. “It was madness,” Ramos still rails. “I asked, ‘Have you ever heard of cash management? Let’s do some cash management here and let’s start slowly, so that you don’t all flip.’ We first reduced our cash buffer to R 1 billion a month and in the end we brought it down to about R 250–300 million a month, and the cost savings of that alone were enormous. This isn’t rocket science, it’s basic stuff.”

But how comfortably did a drive for fiscal sustainability sit with a government elected to right the socioeconomic wrongs of a bygone era? Was a balanced budget a justifiable goal for a country with mass unemployment and a rapidly urbanizing population? Erwin remembers hearing these questions in the corridors of power. “We were often accused of being orthodox and implementing neoliberalism, but this would be an understandable view in any country such as South Africa that has a communist party and strong trade unions. There would have been many people who saw Maria as too orthodox a financial specialist, and on the right wing of ANC policymaking. With hindsight we would argue that the path we trod was correct.”

Tito Mboweni, convener of the pre-government ANC’s economic planning department and later governor of the South African Reserve Bank, agrees that Ramos played an important practical role in a collective civil service effort to implement the ANC’s broad economic strategy. Mboweni also goes further in justifying the policies that the party adopted once in office. “We took the position that a left-leaning political party needs to adopt a conservative macroeconomic policy because the electorate normally doesn’t trust left-leaning political parties. And if you pursue a more prudent economic policy framework you are going to be criticized. People only begin to realize the benefits of these policies one or two decades later. We can claim that the country benefited from our early policy framework by looking at how South Africa survived the global economic crisis very well.”

By the end of 2003, after nearly nine years of proselytizing the virtues of fiscal rectitude, and seeing the budget move inexorably toward balance, Ramos was ready for a change. Transnet, South Africa’s state-owned transportation company, was looking for a chief executive. Here was a chance to enact the same market-related reforms on a sluggish bureaucracy that she had instigated at the Finance Department.

Ramos brought with her to Transnet the principle of commercialization at a state-owned enterprise. She focused on running the parastatal along business lines, demanding the same kind of efficiency as that expected from a private business enterprise. She inculcated an ethos that only the highest standards of delivery, performance, transparency, and accountability were acceptable for the company. She urged its staff to act as though the company was listed on the stock exchange and had to answer to real, private stockholders.

“The difference was that Transnet was state owned, and its return on equity had an element of a social return,” Ramos observes. “This was most evident in terms of the length of the period you had to make the investment in your capital work. So if you are investing in rail infrastructure, for example, as a state owned enterprise you might have a much longer period of time to make the returns on that work than if you were in a listed company.”

Private sector

After working in the civil service and then in the parastatal sector, Ramos’s next move in early 2009 took her back into private sector banking, but now as chief executive of Absa, South Africa’s biggest clearing bank. The business acumen and principles that she had brought to the rigid civil service structure at the Department of Finance and then to the hermaphroditic Transnet could now be deployed in the entirely profit-driven environment of the private sector.

Ramos pointedly observes that South Africa’s banks have been relatively untroubled by the financial turmoil that overtook the banking sectors of many bigger and more advanced economies during the global financial crisis. The country owed nothing to luck or geographical remoteness, she states. “The reason why South African banks have remained largely unscathed by the crisis compared with banks in the U.S. and the U.K. and some parts of Europe has primarily been because we have a regulator who is pretty active, and has kept very close and moved well ahead of many other regulators to increase capital requirements. Our regulator started looking at this probably 12 months ahead of the curve and started talking to the banks about pushing up capital requirements, and kept a very close eye on leverage ratios.”

Ramos acknowledges that the exchange controls that South Africa has maintained at varying levels for the past 50 years meant that individuals and companies had been unable to experiment with some of the fancier financial instruments recently available. “It’s been a combination of both but it comes down in the end to a very solid regulatory environment,” she states. She also rebuts claims that competition is restricted in South Africa’s banking sector. “It depends how you define that competition: we have competitors in different parts of the market. At entry and middle level, there are very profitable banks that have superior technology and understand that market well. They give the four clearers a run for our money in that market space.” Furthermore, she points to widening investment banking operations by big foreign banks.

Ramos remains an honorary professor of economics. Now married to former South African finance minister Trevor Manuel, Ramos is part of a power couple that must, over the kitchen table, take quiet pride in the country’s relative economic stability, even if it shows up the nation’s political and social situation as more volatile. Her ranking of ninth last year in Fortune magazine’s “World’s 50 Most Powerful Women in Business” will be satisfaction enough for someone so driven to make a government and then a parastatal run more like a business.

Reference

African National Congress, 1994, Reconstruction and Development Programme. www.anc.org.za/rdp/index.html