How Grim a Fiscal Future?

Finance & Development, September 2010, Vol. 47, No. 3

For most advanced economies, both the near term and the longer term are tight, but there are ways to ease budget pressures

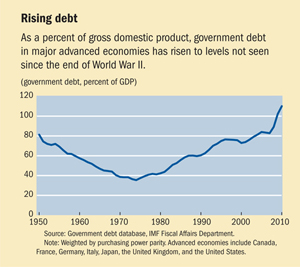

THE abrupt deterioration of fiscal positions in advanced economies, emerging markets in central and eastern Europe, and elsewhere has been a key consequence of the global financial crisis. These large budget deficits have caused a sharp rise in public debt in advanced economies that likely will continue through the next five years, pushing government debt well above levels seen at any time since the end of World War II (see chart).

Sharply elevated deficit and debt levels may well place pressure on interest rates and undermine economic growth in these economies and could spill over to other emerging and developing economies. Financial markets have become increasingly unsettled both by the surge in debt and by uncertainties about future taxation and expenditure policies, particularly in Europe. To preserve the recovery, markets must be reassured. In the short run, policymakers face a crucial dilemma. If they consolidate too soon—that is, they take actions to reduce budget deficits in the near term—they could kill the recovery. But inaction or policy mistakes could lead to concerns about further debt accumulation and ultimately reignite a crisis.

Those are the short-run problems. The longer-run issues may be even more difficult. A major consolidation—reining in spending and increasing revenue—will be needed to restore fiscal positions and to reduce debt to more prudent levels to ease pressures on interest rates and growth. The need for fiscal adjustment is particularly acute in advanced economies, but consolidation is also needed for many emerging and developing economies. The path will be steeper in many countries where intense spending pressures will arise from aging populations (see “A Hidden Fiscal Crisis,” in this issue of F&D).

Hit hard by the crisis

Budget deficits worldwide have grown dramatically as a result of the global financial crisis. The crisis hammered economic activity in advanced economies and devastated trade and financial flows to emerging and developing economies (although capital inflows have recovered in some regions and emerging market countries). In the mid-2000s, some country authorities reacted to exceptionally buoyant tax revenues by cutting taxes or by increasing spending in sensitive categories, such as wages and transfer payments, including pensions. The falloff in economic activity during the crisis caused tax revenues to decline markedly, and many countries also increased spending to shore up their economies. In the advanced economies, budget deficits rose, on average, about 8 percentage points, from 1 percent of gross domestic product (GDP) in 2007 to nearly 9 percent of GDP in 2009. Deficits exceeded 10 percent of GDP in several countries—Greece, Iceland, Ireland, Japan, Spain, the United Kingdom, and the United States. Advanced economy fiscal balances are likely to worsen further in 2010, driven by continued weaknesses in revenue collections and stepped-up stimulus in Germany and the United States (and higher U.S. defense spending).

Fiscal positions should begin to improve in 2011, as the recovery continues and crisis-related stimulus is withdrawn. Beyond the withdrawal of stimulus, other adjustment measures are planned in most countries. However, on average, budget deficits in advanced economies will remain substantial—5 percent of GDP or higher through 2015—unless further measures are taken. The persistence of sizable deficits reflects, in large part, sustained revenue losses from the steep decline of potential GDP during the crisis—with the financial and real estate sectors taking a permanent hit. Higher spending on health, pensions, and interest payments is another factor underlying the high deficits. The result will be a nearly 40 percentage-point rise in advanced economy public debt ratios during 2007–15, two-thirds of which is linked to the output collapse and the hit on tax revenues.

Doing better than advanced economies

The impact of the crisis on public finances in emerging and developing economies has been more muted, except for economies in central and eastern Europe. For emerging economies as a whole, deficits widened with the crisis by 5 percentage points of GDP from 2007 to 2009. In Asia, the deterioration was just over 4 percentage points, on average; in Latin America, it was 2!/2 percentage points. In developing economies, deficit ratios fared even better than those in most emerging markets—worsening by just 2 percentage points during the crisis. On average, the crisis-spawned increase in deficit ratios should begin to reverse this year. In some regions the improvement will be traced to the strong recovery of activity; in others, particularly eastern Europe, it will be dictated by pressure from financial markets to reduce the deficit.

Like advanced economies, many emerging and some developing economies suffered revenue losses and provided fiscal stimulus, but emerging market and developing countries in general entered the crisis in better positions than did their advanced country counterparts. On the whole, emerging market and developing economies enjoyed sustained favorable economic performance and institutional improvements that contributed to deficit and debt reduction from the early 2000s, in contrast to advanced economies where debt ratios increased steadily. Developing countries also benefited from debt relief and lower interest payments. This divergence from advanced economies is expected to continue. Because emerging and developing economies have more favorable demographics and better growth prospects, their fiscal positions are expected to recover from the crisis relatively quickly, with debt paths stabilizing and resuming precrisis declining trends. However, the potential remains for renewed turmoil in advanced economies that would spill over to the rest of the world—this time arising not from financial excess but from fiscal stress.

Over the next few years, governments in many advanced economies will have exceptionally high financing needs to cover big budget deficits and to refinance maturing debt. Gross borrowing will reach 20 percent of GDP this year in Canada, France, Italy, the United Kingdom, and the United States. Financing needs have also reached that level for a handful of European countries that have been the focus of intense financial market scrutiny—Greece, Ireland, Portugal, and Spain. By contrast, only a few emerging market countries have financing needs of a similar magnitude.

With elevated financing needs and market concerns about future policies, average maturities on government securities in advanced economies have shortened and spreads have risen sharply in some countries—including Greece, Portugal, Ireland, and Spain—raising borrowing costs and adding to fiscal strain. Greece has called on exceptionally large financial support from the IMF, European Union (EU) institutions, and EU member countries to support an aggressive fiscal consolidation plan, while a number of other European countries have announced adjustment measures.

Facing a tighter spending environment

By 2015, gross public debt ratios in advanced economies are projected to reach an average of 110 percent of GDP (when weighted by economy size)—with the United States joining Belgium, Greece, Italy, and Japan as advanced economies with triple-digit debt levels. In some advanced economies, debt levels will still be rising in 2015, and in only a handful—Australia and Korea, plus a few smaller ones in Scandinavia and central Europe—will gross debt levels stay below 60 percent of GDP, the approximate median (unweighted) level that prevailed for advanced economies before the crisis.

Reducing public debt to more prudent levels—say to the 60 percent precrisis median—will require a sizable and sustained belt-tightening in many advanced economies. Economists tend to focus on the controllable deficit—the so-called primary deficit, which excludes interest expense. They are also interested in the underlying fiscal position, adjusted for the effects of the business cycle on revenues and spending. IMF staff projections suggest that, on average, if the cyclically adjusted primary balance improves by nearly 9 percentage points of GDP over the next 10 years and is then kept unchanged for another 10 years, debt levels will return to 60 percent of GDP by 2030. Primary deficits are expected to average 4!/2 to 5 percent of GDP in 2010. The adjustment will involve turning it into a sustained surplus of 4 percent of GDP from 2020 onward. Adjustment requirements vary; they are driven by starting deficit and debt levels. This consolidation would be on top of any automatic gains from higher revenues and lower spending on unemployment benefits and other social safety net programs that will come with recovery from the crisis.

Those most in need of tightening

As of July 2010, the largest consolidations among advanced economies to reach the 60 percent debt level by 2030 appear to be needed in Greece (17 percent of GDP, 7!/2 percentage points of which are planned for this year) and Japan (13 percent of GDP). The United States also faces a big adjustment need—nearly 11 percentage points. This is more than twice the consolidation needed in Belgium or Italy, two countries long saddled with high public debt.

Why is the necessary fiscal adjustment so large in the United States? A number of factors are at play:

- the more significant impact of the crisis on output and revenues in the United States than in many other countries,

- the major U.S. fiscal stimulus provided since 2008 and continuing in 2010,

- stepped-up U.S. social spending (e.g., unemployment benefits and food stamps) linked to the crisis, and

- other U.S. spending pressures, including higher defense outlays and continuing and accelerating spending on health and social security.

These factors have combined to leave the United States with a very large underlying primary deficit (the deficit adjusted to take into account changes in revenue and spending that stem from the business cycle) of 6!/2 percent of GDP. The underlying primary deficit in Belgium is just 1 percent of GDP and in Italy there is a surplus of 1 percent of GDP. These high-debt countries provided less stimulus.

At the other end of the belt-tightening spectrum, some advanced economies already have debt levels well below the 60 percent threshold—including Australia, Denmark, Finland, Hong Kong SAR, New Zealand, Norway, Sweden, and Switzerland. Several of these countries also have substantial government assets that could be used to repay debt, if needed.

Consolidation outside advanced economies

For emerging economies, the challenge is less daunting. For them, debt levels viewed as prudent are lower than in advanced economies—possibly 40 percent of GDP—but many are already there. The emerging economy average is 38 percent of GDP. But several important countries—Brazil, Hungary, India, Malaysia, Pakistan, Poland, and Thailand among them—have debt above 40 percent. A reduction in the structural primary balance of about 3 percentage points of GDP on average must be reached by 2020, and maintained until 2030, to bring debt levels below 40 percent of GDP. Moreover, emerging market circumstances vary widely. Some with relatively high debt levels, such as Brazil and Hungary, also have sizable primary surpluses, limiting their adjustment needs if they can maintain the surpluses. Others, such as India and South Africa, have benefited from relatively deep domestic sources of financing. Some Eastern European countries have been hard hit by the crisis—Latvia, Lithuania, and Poland—while others, including Bulgaria and Estonia, entered the crisis with lower debt levels and stronger fiscal positions.

Developing countries also confronted the crisis with sharply reduced deficit and debt levels than they had at the start of the decade. For a group of 43 developing countries, debt levels dropped, on average, from over 80 percent of GDP in 2000 to under 40 percent of GDP in 2007. The improvement was helped by debt relief and by improved fiscal positions, as deficits were cut from 4 percent of GDP in 2000 to less than 2 percent, on average, in 2005–07. Stronger fiscal positions and lower debt created room for an active response to the crisis, which helped lessen the impact and duration of the downturn compared with past crises. The IMF helped, providing $5 billion of financing to sub-Saharan Africa in 2009, five times more than in 2008. The allocation of new Special Drawing Rights to these countries in 2009 gave them an additional $21 billion in reserve assets.

Developing country budget deficits fell back to an average of 4 percent of GDP as a result of the crisis, reversing the gains made over the 2000s. However, as global growth is restored and countercyclical fiscal support is withdrawn, budget deficits should decline gradually to 2!/2 percent of GDP by 2015, with debt stabilizing and then trending down. For some developing countries, however, improvements in fiscal balances brought about by the restoration of growth will not be sufficient to stabilize public debt levels and further adjustment—or sustained mobilization of highly concessional donor support or grants—will be needed. In sub-Saharan Africa, for example, this includes a handful of countries in west Africa (Burkina Faso, Mali, and Niger) and a few natural-resource-producing countries (Botswana, Chad, and Nigeria), whose prospects could change rapidly should international commodity prices increase.

Problems in advanced economies, however, could threaten this scenario. Developing country budgets continue to receive sizable grants (4 percent of GDP, on average) and concessional financing from advanced countries. If cash-strapped advanced economies reduce support—and growth slows and interest rates rise—developing economy debt could resume a sharply upward trend and either force cuts in spending or threaten the gains made in the precrisis period.

Aging populations add to the adjustment burden

Expected spending pressure from aging populations makes adjustment in advanced economies more complex. On average, spending on health and pensions is projected to increase by 5 percentage points of GDP or more over the next 20 years. This would continue the trend of age-related spending increases of the past few decades, with health spending accounting for most of the change. Key drivers have been new, more expensive diagnostic and treatment technology; aging populations, which need more health care; and higher incomes, which result in greater demand for health care.

Belgium, Finland, Germany, the Netherlands, Russia, Slovenia, and the United States face aging-related spending pressures in excess of 5 percentage points of GDP over the next 20 years. France, Greece, Ireland, Spain, the United States, and the United Kingdom all confront difficult dual problems: high adjustment requirements of 8 percentage points or more to reduce public debt to precrisis levels and additional health and pension spending pressures of 4 percent of GDP or more.

Confronted with the prospect of higher taxes and massive spending cuts, country authorities might naturally reach for a less demanding adjustment target and borrow the difference. After all, they might reason, Italy and Japan have lived with higher debt levels for many years. But high debt levels would ultimately translate to higher interest rates and slow growth, even assuming the debt can be easily rolled over. IMF estimates suggest that the nearly 40 percentage-point rise in the debt-to-GDP ratio that has occurred could lead to an increase in interest rates of about 2 percentage points over the next several years, with adverse consequences for emerging and developing economies. Further estimates suggest that the 40 percentage-point increase in debt could lead to a slowdown of growth by a half to a full percentage point per year. Indeed, if governments fail to adjust, the combination of higher interest rates and lower growth would increase the required consolidation effort at the same time that age-related spending was growing. Of course, failure to roll over the debt would lead to more dire consequences.

Approaching adjustment

Although the global economy is recovering, the pace varies across regions and downside risks persist. Recent adverse market developments have mostly reflected fiscal uncertainties. To preserve the recovery, authorities in many advanced economies should reassure markets by communicating concrete and ambitious fiscal consolidation strategies with a visible anchor, in terms of an average adjustment pace or a fiscal target to be achieved over the medium term.

Advanced economies are planning an adjustment of about 1 1/4 percentage points of GDP in 2011. This seems broadly adequate, although some countries must commence tightening already this year because of market concerns. Fiscal adjustment should be accompanied by reform of goods, labor, and financial markets to boost economic growth—including reducing barriers to competition in retail distribution and network industries, such as telecommunications; reforming employment insurance; and decentralizing wage bargaining. Strong growth is key to successful adjustment.

What should the consolidation for advanced economies look like? The adjustment should focus on spending cuts, given already high tax burdens in many countries, although tax increases will be necessary for countries with lower tax rates and larger adjustments. There is likely to be substantial potential to eliminate exemptions from the value-added tax (VAT) in many countries—or to raise the VAT rate in Japan and to introduce such a tax in the United States—and to increase significantly revenues from taxation of tobacco, alcohol, and carbon emissions.

Expenditure policy could aim to freeze per capita spending outside of health and pensions, with a focus on total government wages (the “wage bill”) and transfers as well as cuts in agriculture and energy subsidies. Spending cuts will not be easy and will involve touching politically sensitive areas, such as entitlement spending and civil service wages in some countries, and cuts in military spending in others. Measures to ease pension-related spending pressures should focus on raising statutory retirement ages (somewhat faster than rising life expectancy, to generate savings), increasing contributions, and reducing benefits. A range of approaches could be taken to target health spending pressures, including improving information technology and reimbursement mechanisms to improve efficiency and tighten provision of services, increasing cost sharing, reducing subsidies for private health insurance, and strengthening the evaluation of the cost-effectiveness of medical treatments and technologies.

Emerging and developing economies face a less daunting adjustment path, but there are also significant risks, particularly from financial market turbulence and higher interest rates in advanced countries. Emerging and developing economies should ensure that crisis-related fiscal stimulus does not become permanent, and where necessary, take further measures to promote budget flexibility and ensure that debt is on a downward path. Fiscal consolidation may also moderate the impact of capital inflows and appreciation pressures on local currencies. Some emerging economies like China plan to spend more on health and education (see “Building a Social Safety Net” in this issue of F&D). Of course, emerging market and developing countries with relatively large initial primary deficits or elevated debt levels must do more. In contrast to advanced economies, there may be greater potential for emerging and developing economies to raise revenues—both by improving tax instruments and by strengthening revenue administrations.

This article draws on two IMF publications: “Fiscal Monitor: Navigating the Fiscal Challenges Ahead” (May 2010) and “From Stimulus to Consolidation: Revenue and Expenditure Policies in Advanced and Emerging Economies” (April 2010).