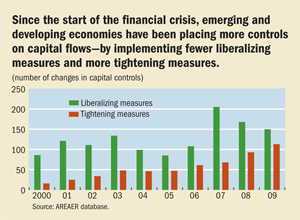

Data Spotlight: Coping with Capital Inflow Surges

Finance & Development, September 2010, Vol. 47, No. 3

In response to recent inflow surges, some emerging markets are again using capital controls

ONE of the effects of the recent global crisis has been a surge in capital flows to emerging markets, particularly to those with strong growth prospects. Capital inflows have well known benefits—by supplementing domestic savings in financing economic growth, fostering the diversification of investment risk, and contributing to the development of financial markets. Still, a sudden surge of incoming capital can complicate economic management, lead to asset price bubbles, and increase systemic risk in the financial sector. In addition to the traditional policy responses—exchange rate changes, adjustments in fiscal and monetary policies, foreign exchange intervention, reserve accumulation, and prudential measures—emerging economies often use capital controls—tightening controls on inflows, easing controls on outflows, or both—to try to mitigate risks associated with fluctuations in international capital flows.

Before the recent global crisis, many emerging markets followed the advanced economies by opening up their economies to foreign investment and allowing domestic investors to put their money abroad. As a result, cross-border capital flows—from advanced economies to emerging economies and between emerging economies—increased over the past two decades. But some emerging economies responded by placing restrictions on these flows. For example, Argentina, Thailand, and Colombia implemented unremunerated reserve requirements on most types of capital inflows in the second half of the 2000s. Thailand also actively liberalized outflow controls to balance part of the capital inflows by allowing residents to invest abroad. To address the large increase in credit expansion, Croatia applied a mix of prudential measures and capital controls on banks’ foreign borrowing. While both India and China pursued a gradual liberalization of the capital account, controls were tightened on specific capital inflows in 2007. More recently, Brazil introduced a tax on some foreign exchange transactions at the end of 2009 and supplemented it with another tax on certain equity inflows in 2010.

But the evidence on the effectiveness of capital controls is mixed. They generally cannot reduce the total volume of inflows or reduce exchange rate volatility. However, they appear to lengthen the maturity structure of inflows, resulting in more stable flows, and provide some monetary independence by maintaining a wedge between domestic and foreign interest rates. The measures introduced in Malaysia in 1994 and in Chile in 1991 to stem short-term debt inflows were successful in reducing the volume of net inflows and in lengthening their maturity structure.

What are capital controls?

While there is no unique generally accepted legal definition of capital controls, in the broadest sense, they are measures that regulate inflows and outflows of capital. Controls can take many forms, but they generally fall under two main categories: administrative and market based. Market-based controls, such as unremunerated reserve requirements and taxation of financial flows, discourage the targeted transactions by increasing their cost. Administrative controls prohibit or impose explicit quantitative limits on capital transactions. Because they often subject these transactions to the approval of the authorities, administrative controls are typically less transparent than market-based controls.

About the database

The Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER) database tracks exchange and trade arrangements for all 187 IMF member countries since 1950. This unique database is updated yearly based mostly on information from country authorities. The database also provides information on different types of capital controls used by countries, restrictions on current international payments and transfers, arrangements for payments and receipts, procedures for resident and nonresident accounts, exchange rate arrangements, and the operation of foreign exchange markets. It also includes measures implemented in the financial sector, including prudential measures. The database is available on a trial basis at www.imfareaer.org (user name: trial; password: imfareaer).