Return to Form

Finance & Development, September 2010, Vol. 47, No. 3

Helge Berger and Martin Schindler

Germany’s economy is again Europe’s locomotive, but its export dependence is both a blessing and a curse

GERMANY’S ability to produce goods that the rest of the world wants to buy has been a constant theme in Europe’s post–World War II economic history. Its impressive export performance is a sign of economic muscle and enduring competitiveness. But even though German exporters have historically maintained an edge in many high-value markets, the precrisis export surge, and consequent very high current account surpluses, is fairly new and most likely a temporary phenomenon.

Germany’s export performance has led to a rapid industry-led recovery following the global economic crisis. But its dependence on exports has come at a cost: the ups and downs in global demand for German products sent the economy on a roller-coaster ride during the financial crisis, when strong precrisis expansion was followed by an unheard-of output drop of over 4½ percent in 2009, before resurgent world trade brought growth back into positive territory. Because of its current account surpluses, Germany has also featured prominently in discussions of such surpluses’ role in balanced global growth. Observers in both Europe and the United States have urged the German government to boost domestic demand as a means to spur global recovery.

A closer look at Germany’s net-export performance can help inform this—at times heated—debate. Temporary cyclical factors influence foreign and domestic demand but in themselves are little reason for concern. Likewise, surpluses resulting from structural developments such as an aging population are not only natural but a welcome development as the economy moves toward a new demographic equilibrium. Other structural factors could be less benign, however. For instance, persistent rigidity in service and labor markets might limit growth from domestic sources and, by deepening dependence on trade, lead to unwanted volatility. It is in these areas that economic policy could play an important role in adjusting Germany’s current account dynamics.

Roller-coaster ride

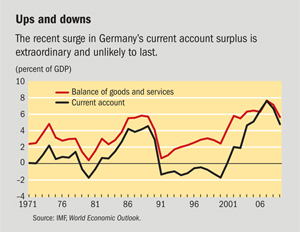

The most remarkable characteristic of Germany’s trade and current account balances since the 1970s is not their size, but their ups and downs (see chart). Driven by cyclical factors and structural shocks, current account balances have fluctuated substantially over the past four decades, and small—even negative—balances are, historically speaking, more typical for Germany than the recent record highs.

Two current account balance surges from past decades stand out: one during the run-up to German reunification in 1990 and another over a period in the late 2000s. After averaging only 0.6 percent of gross domestic product (GDP) during the 1970s and 1980s, the current account balance increased to more than 4 percent in the years prior to German reunification, driven by a cyclical upswing in the world economy and only moderate increases in unit labor costs as a result of robust labor productivity growth.

The deterioration of the current account that followed the reunification of East and West Germany lasted throughout the 1990s. High government deficits associated with reunification and catch-up consumption reduced aggregate savings. At the same time, low labor productivity in the former East Germany, along with an increase in labor costs because of an unfavorable conversion to the deutsche mark, weighed on external competitiveness. A slowing world economy further reduced external demand for German exports, while imports remained stable. The result was a sharp decline in Germany’s net foreign trade position.

It was not until after 2000 that the current account turned positive again and began a period of steep ascent to reach the heights observed today. This most recent episode has been exceptional in terms of both the speed at which current account balances rose and their levels, peaking at nearly 8 percent of GDP in 2007. External and domestic factors have both played a role in shaping the recent current account dynamics: the rise in the current account balance has accompanied a mounting share of exports in GDP, as German exports kept pace with expanding world trade. Imports, by contrast, grew less strongly, suggesting that domestic factors also have contributed to recent current account surpluses.

Value for money

The post-2000 reversal in Germany’s current account dynamics reflects improved competitiveness, which had declined during the 1990s and contributed to German exports’ shrinking share of world trade at that time. German firms and unions responded to the challenge of declining competitiveness with a series of agreements that limited wage increases. These, along with improving labor productivity, helped limit the increase in unit labor costs and offset the impact of the substantial exchange rate appreciation that followed the introduction of the euro in 1999.

Germany’s traditionally high nonprice competitiveness and its export composition also played an important role, positioning German companies to participate in global trade growth. In particular, Germany’s strength in the area of manufactured capital goods helped the economy benefit from surging growth in emerging markets, generating strong demand for investment goods. Demand from the United States also played a role, both directly and indirectly—U.S. demand for Chinese consumption goods fueled much of China’s demand for investment goods, for example.

Finally, German exporters benefited from their specialization in machinery equipment and manufactured goods and from their traditional focus on innovation and flexibility, including strong after-sales services. This winning combination meant that German exports were less sensitive to price increases than many other goods, a fact that also helped the economy hold its own as the euro appreciated.

Saving for a rainy day

The rising current account surplus also reflects Germany’s increased savings and lower domestic investment, both of which are the result of structural changes in Germany’s domestic and external environment. A strong euro, Germany’s reunification, and the eastward expansion of the European Union contributed to the internationalization of Germany’s supply chain: German firms shifted their manufacturing capacity abroad to benefit from lower production costs and as a hedge against further exchange rate appreciation. This meant that foreign direct investment to some extent displaced domestic investment, a development that contributed to the sharp rise in the current account surplus, especially during the early 2000s.

Germany’s high savings, in turn, are influenced by cyclical and structural factors. The volatile nature of international trade flows exposes the economy to increased economic uncertainty regarding wages, profits, and employment, prompting many firms and households to save more for a rainy day. Indeed, private households started spending less of their income on private consumption, especially as net trade was increasing during the 2000s.

High savings are, in part, also the result of slow-moving structural factors, in particular Germany’s waning and aging population. When fewer young people carry the burden of financing the health care and pension needs of retiring generations, higher savings are a natural response. For this reason, positive current account surpluses should come as no surprise. They are, in fact, necessary until a new demographic equilibrium is reached.

Facing up to structural factors

Many factors have contributed to Germany’s current account surpluses. Some are clearly temporary, such as those linked to cyclical upswings in Germany’s trading partners. Others are more structural in nature. Much of Germany’s high level of savings is a rational, and welcome, response to the aging of its population. Similarly, Germany’s strong export performance is a reflection of just how globally competitive its companies are.

These factors all reflect legitimate market choices that have served Germany and its export partners well, and more generally, high trade and current account balances are only undesirable insofar as they reflect market distortions. Thus, attempts to shrink Germany’s current account surplus through measures that reduce its external competitiveness, as some recommend, would hurt both the German economy and that of its trade partners.

But other structural factors that contribute to the high level of current account surpluses might be less desirable. In particular, rigidity in the German service and labor markets continues to limit domestic growth. It also contributes to structural unemployment, which remains high, and exacerbates Germany’s dependence on trade. For example, regulations that make it difficult to start a new business in the service sector limit economic growth and job creation. Moreover, a generous social benefit system can have unintended consequences for the labor market, where reduced incentives to take lower-paying jobs will tend to fall hardest on the service sector.

A broad reform agenda, encompassing both the service and labor markets, could unleash Germany’s domestic growth potential. A larger, more productive service sector would increase the relative importance of the domestic economy, which should help reduce income volatility and the associated need for precautionary savings. New businesses in the service sector are also likely to trigger higher investment, at least initially, and new jobs would support consumption. Both higher consumption and investment would tend to increase imports, potentially reducing the current account surplus while strengthening growth.