Building a Social Safety Net

Finance & Development, September 2010, Vol. 47, No. 3

China embarks on an effort to improve both pensions and health care in the world’s most populous nation

THE global financial crisis had many casualties. Banks failed. Markets seized. Recessions ensued. Out of this chaos, however, has emerged one potentially positive development: a concerted effort by China to strengthen its social safety net.

When the global economy collapsed and external demand for Chinese products dried up, especially from advanced economies, the Chinese government looked inward for domestic sources of demand. It put in place a major program of fiscal expansion with a heavy emphasis on infrastructure spending. But a not insignificant amount came from policies aimed at improving China’s pension system and putting in place a better, more effective health care system aimed at covering all of the Chinese people. China’s recent steps were but the beginning of its renewed efforts to put in place a social safety net that lessens income inequality and improves the livelihoods of well over a billion people. China’s reforms come at a time when advanced economies, including the United States and much of Europe, are grappling with their long-term pension and health care costs.

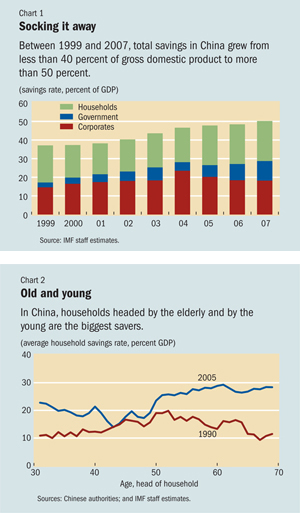

Reducing the need for Chinese saving

Just about everyone in China saves (see Chart 1). Corporate saving is high. The government is a net saver. And households save. Not only do households save, it is the young and the elderly who are the biggest savers—age groups that, by contrast, are usually the least prone to saving in advanced economies (see Chart 2). A large part of the saving by older Chinese has been linked to a strong precautionary motive, borne out of concern that, given the long lifespan of the average Chinese, either living costs or health care costs may exhaust a person’s means and leave them destitute in their old age. Even younger households face the risk of a costly catastrophic or chronic illness. Because the market for private health insurance and private annuities is underdeveloped, it is very difficult for Chinese citizens to insure against such individual-specific risks. Households, therefore, have a strong incentive to save more than they need to, in order to self-insure. A stronger social insurance system would reduce the need for this type of precautionary saving and thereby boost private consumption. The boost to consumption is in many respects a beneficial by-product to reforms that are justified in their own right to protect the poor and improve livelihoods. Moreover, it would also have positive spillovers to the rest of the world: some of the increase in China’s consumption would be from imports, which would help reduce global imbalances.

Improving a pension system

China has struggled for years with a fragmented and complex pension system that neither covers a large share of the population nor offers a convincing support system for those who are covered. There are significant differences in the pension systems across provinces; between rural, migrant, and urban residents; and even across professions. Transitioning from this tangled web to a more coherent system has long been a challenge. However, in recent years, there has been significant progress.

Most important, in the midst of the global crisis, the government rolled out a new rural pension scheme that already has more than 55 million enrollees and by the end of this year will cover some 23 percent of rural counties. The program provides a basic monthly pension of between 60 and 300 yuan, depending on the region and size of an individual’s account. Participation is voluntary and requires individuals to make an annual contribution typically in the range of 100 to 500 yuan. Additional funding comes from a mix of central, local, and provincial governments, but the central government covers most of the costs in the lower-income western and interior provinces. This reform will help support consumption by reducing precautionary saving and, even more directly, by boosting the income of those who enroll—already more than 16 million people have claimed benefits.

At the same time that the scope of the basic pension has been expanded, efforts are also under way to improve the workings of the existing urban pensions. The government has introduced a program to allow these pensions to be portable across provinces and for contributions in one province to count as credit toward retirement, even if the person subsequently moves to a difference province. These reforms should help facilitate labor mobility. In addition, many provinces are working to increase risk pooling by aggregating the pension fund contributions and outlays across the whole province.

While the changes introduced in the wake of the global crisis go a long way toward improving the existing system, there is still much to be done. In particular, efforts can be made to make pension schemes more uniform across the country to facilitate portability and ensure equality across geographic areas. In addition, simplification of the current system of provincial, national, and occupational pension schemes is warranted. The authorities should also work toward the ultimate goal of national-level pooling of risk to ensure that the Chinese pension system evolves into a truly effective safety net that ensures a minimum standard of living for all China’s elderly and, in doing so, lessens their motivation for high levels of precautionary savings. At the same time, China also has the opportunity to learn from any missteps of the advanced economies and ensure that the short- and long-run fiscal costs of pension reform are manageable.

Expanding health coverage

In addition to changes to social security, in 2009 China announced a comprehensive, three-year reform of its health care system with the aim of ensuring reliable and affordable health care for the whole population by 2020. The principal goals are to

- Make health care more equitable by substantially building up health care services in rural areas, broadening access to health insurance schemes, and reducing households’ copayments. Rural households, for example, now get reimbursed for 55 percent of expenses, which shows both the substantial progress in recent years—the rate was less than 30 percent in 2004—and the scope for further improvement.

- Reduce costs through a range of programs to revamp medicine and medical services pricing and to remove incentives for overuse of medical procedures and drugs. Over time, the system would move away from fees for individual medical services toward lump sum payments to providers that are priced according to illness.

- Increase risk pooling by increased participation in health insurance plans and greater portability of insurance programs.

- Improve quality by increasing training and research; improving the supervision, regulation, and quality standards for doctors, hospitals, and pharmaceuticals; boosting disease control, preventative, maternal, and childcare services; and increasing the availability of publicly funded health education.

As part of this effort, public spending on health care will be increased by almost 3 percent of GDP in 2009–11. About two-thirds of this additional financing will be directed toward expanding insurance coverage in rural areas and for retirees, the unemployed, university students, and migrant workers living in urban areas. By the end of 2011, the government intends to cover 90 percent of the population by some form of health insurance scheme. Part of this increase in coverage will be higher subsidies to rural households that pay into health insurance schemes. Additional funds will also be deployed to ensure that all rural regions have access to county hospitals, township health centers, and village clinics. To achieve this, the government intends to build 29,000 township health centers and 2,000 county hospitals over the next three years. The government will also train 1.4 million new health care professionals to staff these facilities.

While it is still too early to assess outcomes, the government has made it a high priority to strengthen the health care system and do so in a way that is sustainable and avoids the fiscal problems that escalating health care costs are causing in many advanced economies. It is clear that China has a reinvigorated commitment to making high-quality health care and a universal basic pension available to all China’s citizens. This should lessen risks for the elderly and, over time, as credibility is established that good quality health care is provided by the government and is widely available, will reduce the motivation behind high levels of household precautionary saving.