Reducing the Staggering Costs of Cheap Energy

Finance & Development, June 2010, Volume 47, Number 2

Dominique Guillaume and Roman Zytek

Eliminating domestic energy subsidies is tricky, but oil-exporting countries that do so will see a clear payoff

AS oil prices have risen in recent years, governments in oil-producing countries have faced a hard choice: should they allow domestic subsidies to rise to keep fuel affordable for their citizens—or reduce and even eliminate subsidies and allow market forces to play out? Already, some oil-producing countries, such as the Islamic Republic of Iran, have taken steps toward removing domestic subsidies.

By choosing to allow domestic energy prices to rise to their international level, policymakers in oil-producing countries could discourage wasteful consumption and earn additional revenues from profitable oil and gas exports. The government could then redistribute most of the additional revenue collected from the price increase through an oil dividend, which would buy public support for the price increase.

However, to be successful, any such reform must be accompanied by supportive microeconomic and macroeconomic policies. In their absence, abrupt price hikes could easily spark street riots (as has happened in many countries), lead to high inflation, and trigger further economic losses and social pain.

Energy prices and consumption

From 1940 to 1960 and again in the 1980s and 1990s, when international energy prices were low, giving gasoline, diesel, and natural gas away to domestic users seemed like a simple way for oil-exporting countries to distribute some of their national oil and gas wealth. In addition, the allure of plentiful cheap energy brought investment and much-needed jobs. And as long as domestic prices covered the production costs of energy, subsidies were a nonissue.

Things have changed dramatically in the past decade. On the supply side, the low prices and excess capacity of the 1980s and 1990s kept investment in oil and gas exploration and extraction low. On the demand side, low prices stimulated global demand. Rapid economic growth in many populous emerging markets, such as China and India, pushed demand even higher as the global middle class, with its energy-intensive consumption aspirations, grew.

With demand growth outstripping additions to supply, crude oil prices rose from about $17 a barrel in 1998 to $97 on average in 2008. The high oil price made governments of oil-exporting countries aware of the fact that they were losing billions of dollars in possible revenues by underpricing oil products in their domestic markets. Policymakers in those countries had to wonder if they could do better than practically giving away something that could bring much wealth if sold on the international market.

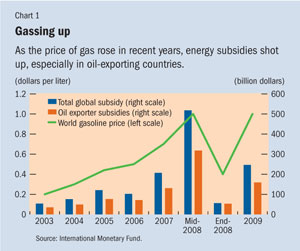

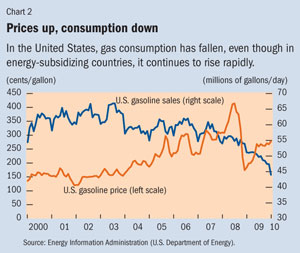

On a global scale, as the price of oil rose from an annual average of $29 a barrel in 2003 to about $145 a barrel in July 2008, total oil subsidies rose from $54 billion in 2003 to an annualized peak of $518 billion in mid-2008, of which two-thirds were in oil-exporting countries (see Chart 1). At the same time, in the past few years demand for petroleum products has increased at double-digit rates in oil-exporting countries—much faster, even, than in India and China. By contrast, in the United States, where prices reflect market movements, gasoline prices almost tripled in the same period, from an average of $1.64 a gallon in 2003 to an average of $3.21 a gallon in 2008, dampening demand (see Chart 2).

Costs of cheap energy

The notion that cheap energy brings only benefits to its users is increasingly questionable. Breathing can be hazardous in the cities of oil-producing countries. And navigating the bumper-to-bumper traffic in Cairo, Caracas, Jakarta, Kuala Lumpur, Lagos, or Tehran is costly in terms of time, stress, and lost productivity and income.

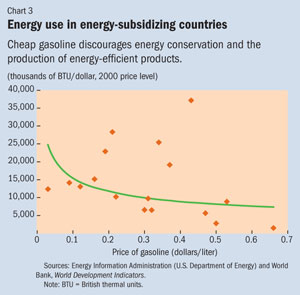

Claims that cheap energy promotes economic development are equally dubious. There is clear evidence that energy intensity (measured as energy use per unit of output) increases with subsidies to energy (see Chart 3). Cheap energy discourages energy saving and, in countries that produce mostly for their domestic market, impedes the production of energy-efficient goods, such as cars, that are likely to be purchased in international markets. This inability to compete internationally hampers specialization and slows economic growth and job creation. As a result, attempts to diversify the economy fail, and oil-producing countries remain even more exposed to the vagaries of international energy markets.

Finally, low energy prices can hardly be supported on social equity grounds. In the end, they benefit mainly the biggest energy users, who tend to be the richest and the most able to afford large cars and energy-guzzling appliances.

To accelerate economic growth in the non-oil sector and create jobs, policymakers in oil-exporting countries are starting to realize that they must implement reforms aimed at increasing economic efficiency and competitiveness. These reforms have garnered support from the international community. At the 2009 G-20 summit in Pittsburgh, participants said they would “rationalize and phase out over the medium term inefficient fossil fuel subsidies that encourage wasteful consumption” and asked the international financial institutions to “offer support to countries in this process.” Several oil exporters are now actively considering elimination of energy subsidies.

Removing domestic energy subsidies is risky, as demonstrated by the unrest in some countries that have attempted to do so. Most people cherish their access to cheap energy, even if they are aware that this is not the best way to benefit from their national wealth. Distrust of government can run deep, too. Yet the experience of eastern European countries in the 1990s shows that energy price reform can succeed, if a number of microeconomic and macroeconomic issues are taken into account during its planning and implementation (Guillaume and Zytek, 2010).

Justifying and implementing reform

The reforms must gain broad public acceptance. A simple cash transfer program to compensate all households for the price increase is easy to implement and understand. It effectively continues to give away the national energy wealth to all citizens and yet rationalizes energy use. Alternatively, a government could try to develop targeted cash transfers. However, any program that targets some groups of beneficiaries (the poor) while excluding others (the middle class) would alienate some of the most important stakeholders in the reform.

An important, if less obvious, element of energy price reform is the adjustment of the corporate sector. A large increase in energy prices in countries where firms have benefited from very cheap energy for decades will require massive restructuring of the production sector. The transition from high- to low-energy intensity can be lengthy and turbulent, as firms cannot just walk away from their machines and products and replace them with modern, energy-efficient equipment and technology. However, evidence shows that countries that moved fast on corporate restructuring—and did so in a credible, irreversible way after liberalizing energy prices—managed to achieve the largest gains in energy efficiency. Conversely, countries where enterprise restructuring was plagued by reluctance and delays have underperformed economically, experiencing slow growth and high inflation.

The corporate sector will find the increase in energy prices credible only if energy suppliers are allowed to suspend energy deliveries to users who accumulate payment arrears. At the same time, energy users must be able to adjust their product lines and prices to allow them to pay for their energy consumption from their revenues rather than by requesting additional bank loans or government subsidies. Though the elimination of energy subsidies will push costs and prices higher, including for many staple goods, policymakers should refrain from imposing price controls to limit pass-through of the higher energy prices. Price controls would only shift losses from energy producers to commercial users. Instead, supporting measures—such as tax rebates or well-targeted cash support for corporate restructuring—could help ensure profitability while providing incentives for companies to adopt energy-efficient technology.

In addition, bank credit allocation and monitoring need to be strengthened to ensure that banks are not pushed to bail out inefficient enterprises with soft loans. Banks should keep enterprises at arm’s length and preserve a strict creditor-debtor relationship so that the potentially negative impact of the reform on banks’ balance sheets is minimized.

Macroeconomic policies

Beyond the microeconomic considerations, energy price reform must be supported by sound and coordinated macroeconomic policies. Transparent and coordinated fiscal, monetary, and exchange rate policies are needed to limit price volatility over time and related market distortions.

Specifically, in addition to redistributing to households and enterprises revenues arising from the price increase, government fiscal policies should aim at setting aside reserves to provide temporary support to socially important institutions, such as schools and health care facilities, or to the most vulnerable groups, such as people laid off as a result of the closure of large and inefficient enterprises in sectors with few employment alternatives. Without fiscal reserves, policymakers would likely be tempted, in a knee-jerk reaction to political pressure, to resort to quasi-fiscal financing through the banking system or administrative controls, such as energy delivery quotas or temporary price reductions for selected users. Either would introduce distortions in the economy and undermine reform.

Exchange rate policy poses another challenge, particularly since many oil-producing countries with large subsidies maintain fixed or heavily managed exchange rates. If the exchange rate is kept unchanged in nominal terms—especially in countries where pre-reform energy prices were at a small fraction of their international level—competitiveness will suffer and political pressure will build to increase distortionary tariffs and nontariff protections. If the exchange rate is depreciated or floated without supporting fiscal and monetary policies, confidence in the national currency may be undermined, as inflationary pressures build and dollarization spreads.

Tight monetary policy will limit the secondary effects of a price increase on the aggregate price level. But implementing monetary policy during such a reform is a challenge, especially in countries where the required price adjustment is very large. After all, such reform aims to change the entire structure of the economy.

References

Zytek, Roman, “Subsidies in the Islamic Republic of Iran,” IMF Selected Issues Paper, June 2008.

D. Guillaume and R. Zytek, “The Economics of Energy Price Reform in the Islamic Republic of Iran,” IMF Selected Issues Paper, January 2010.