Credit to the Private Sector Remains Weak

Finance & Development, June 2010, Volume 47, Number 2

José M. Cartas and Martin McConagha

Bank credit continues to fall despite the global recovery

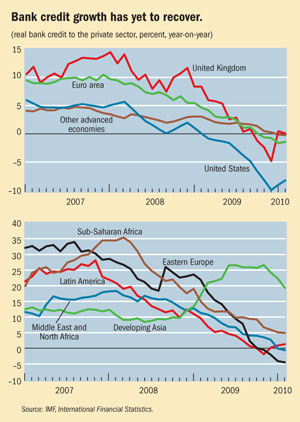

THE period preceding the international financial crisis of 2008 was characterized by excess global liquidity and a rapid expansion of credit, especially to the private sector. But as a consequence of the global crisis, the banking system cut back its lending to the private sector, as banks sought to improve balance sheets hit by declining asset prices, absorb a growing number of nonperforming loans and, in general, reduce risk by deleveraging. Bank credit growth has fallen sharply in real terms and is likely to remain subdued across most major economies and country groups.

A massive infusion of government funds and credit-easing policies in advanced economies, intended to fight a recession and support bank balance sheets, did not translate into increased credit to the private sector. After growing at an average annual rate of about 7 percent until mid-2008, bank credit growth in mature markets slowed and by the end of 2009 turned negative. Bank credit growth in 2009 dropped the most in the United Kingdom—by about 20 percent. In the United States, by early 2010 credit had fallen by almost 10 percent year on year. The euro area followed a similar trend.

Several factors explain why better financial conditions did not result in renewed credit growth to the private sector in these economies. First, as economic conditions weakened, demand for credit declined as firms cut output and households reduced consumption, decreasing their need for credit. Second, banks tightened lending standards in the face of greater uncertainty, weakening capital positions, and rising loan losses. Banks’ balance sheets still remain under strain and funding conditions are becoming tighter. In a flight to quality, banks are favoring government bonds over loans to the private sector. And uncertainty about future regulation may be reducing banks’ willingness to lend.

In emerging and developing economies, the region with the sharpest drop in credit growth is eastern Europe, which benefited from a substantial inflow of foreign funds and cross-border lending prior to the crisis. When the financial crisis struck, credit growth dropped dramatically and has not started to recover, in part because of a reversal in foreign finance to the banking sector. Credit growth in Latin America, sub-Saharan Africa, and the Middle East and North Africa has been quite similar, with growth rates hovering between zero and 5 percent as of end-2009.

In contrast, credit to the private sector in emerging and developing Asia did not seem to be affected by the financial crisis. In fact, bank credit growth in these countries increased during the crisis and has only recently begun to fall. However, this development has been heavily influenced by China, where bank credit has grown steadily since 2005, reaching 35 percent by end-2009 owing to strong economic growth prospects and rising asset prices.

About the database

The figures were compiled using monetary data reported by member countries to the IMF’s Statistics Department for publication in International Financial Statistics. Real domestic banking sectors’ claims on the private sector were calculated by deflating the nominal series by the consumer price index. Regional growth rates are weighted averages of individual countries’ growth rates. Country groups follow the classification in the IMF’s World Economic Outlook. The database is available at http://0-elibrary--data-imf-org.library.svsu.edu/DataExplorer.aspx