About F&D Subscribe Back Issues Write Us Copyright Information Free Email Notification Receive emails when we post new

items of interest to you. |

Assessing the Dangers Christian Mulder Spotting vulnerability to financial risks is key to preventing crises. The most destructive financial crises of recent years involved sudden, sharp capital flow reversals that caused havoc in the emerging market countries affected. To forestall such crises in the future, the IMF has been making a major effort to assess the vulnerability of its member countries to changes in external circumstances. Its goal is to help countries become more resilient to shocks from abroad, particularly by encouraging them to strengthen their financial systems in the widest sense and by improving advance information about possible trouble so that they can take preventive action. The IMF has conducted vulnerability assessments of all of its members for many years as part of its continuous review of national economic conditions and policies. To strengthen the assessment of risk in the financial system, the IMF and the World Bank have begun to conduct health checkups of members' financial sectors with the aid of national experts. These checkups are part of the Financial Sector Assessment Program (FSAP). Separately, the IMF also assesses and reports on member countries' adherence to international standards and codes, including those on corporate governance, accounting standards, data dissemination, and the transparency of fiscal and monetary policy. Countries' adherence to such standards ensures the availability of valuable information that enables governments to address weaknesses and helps markets to price risks more accurately. With crises occurring more frequently, becoming more complex, and unfolding more rapidly than in the past—because more countries are susceptible to rapid capital outflows—and with a greater risk of spillovers, a special system has been put in place over the last two years to strengthen the IMF's ability to identify vulnerable emerging market countries. The system focuses on countries with exposure to international capital markets as well as on those whose own vulnerabilities could have an impact on other countries. It should enable the IMF to give better advice to these countries on avoiding trouble and to forewarn other countries so that they can build firewalls in case a crisis still strikes—because even when weaknesses are identified and a high risk of crisis is assessed, countries cannot or do not always take all the measures necessary to prevent it. IMF economists use a number of analytical inputs to identify weaknesses, including the three discussed below—early warning systems (EWS), analyses of financing requirements and reserve adequacy, and market information. Early warning systemsThe IMF uses econometric models known as early warning system (EWS) models in its efforts to predict currency crises—defined as a sharp currency depreciation or loss of foreign exchange reserves or both—before they occur. These EWS models focus on external volatility and exploit systematic relationships apparent in historical data between variables associated with the buildup to crises and the actual incidence of crises. The variables include the ratio of short-term debt to foreign exchange reserves, the extent of real exchange rate appreciation relative to trend, and the external current account deficit. Both theory and evidence suggest that the higher the value of each of these variables, the greater the probability of a crisis. Extensive tests have been performed to determine which of these empirically based models best fits the data and is the most robust. The IMF's EWS models focus on a relatively long prediction horizon of 12-24 months to provide countries with enough lead time to adopt corrective policies. The focus is, after all, on prevention. The IMF also keeps an eye on alternative EWS models developed by the private sector and explores variations on the central IMF model. The private sector models, produced chiefly by investment banks, have shorter time horizons because the aim is to guide short-term investment decisions. Among the IMF's alternative models, one focuses on balance sheet variables, notably for the financial and nonfinancial corporate sectors, and another (estimated with annual data) focuses on fiscal variables. As might be expected, EWS models are imperfect tools. They often produce false signals predicting crises that do not occur and miss crises that do occur. However, they do provide useful information. One ex post assessment of the predictive power of the IMF's core EWS model showed that when the model signaled a crisis (that is, when the estimated probability of crisis was above the threshold for calling a crisis), a crisis occurred 22 percent of the time; when the estimated probabilities were below the threshold, a crisis occurred only 8 percent of the time. The advantage of the models is that they systematically and objectively describe the historical relationship between variables associated with the buildup to crises and the crises themselves. This is also their disadvantage: they attempt to fit all countries and crises into one box while ignoring the huge amount of information that cannot be easily measured. Another weakness of the approach is that, because it focuses on crisis prediction, it does not easily yield policy prescriptions for a vulnerable country. The IMF uses EWS models as only one indication of a problem. It does so not only because of the occurrence of false signals but also because different tools provide different signals, and policy prescriptions depend on the analysis of the vulnerability. The prescriptions vary widely depending on the exact diagnosis of a country's difficulties. For example, a country suffering from an aggravated risk of external volatility is not necessarily at risk of defaulting. Because of the models' limitations, other diagnostics of the potential for crises need to be closely examined as well. Liquidity checksLack of a liquidity buffer is a key predictor of both the likelihood and the depth of a currency crisis. Official reserves, the main such buffer for emerging market countries, can drop precipitously in an environment of open capital accounts because of a decline in a country's access to international capital markets and capital flight. Such a decline can be caused by investors' doubts about the validity of domestic policies, such as fiscal sustainability, or by a decrease in their appetite for emerging market risks in general because, for example, of a crisis elsewhere. In these circumstances, it is important to have some estimate of

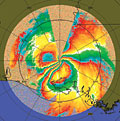

Such data are systematically collected and summarized in financing requirement tables, which also provide a cross-check on global financing needs and allow an assessment of the size of possible demands for the IMF's resources. The assessment of the risk of a liquidity crunch as the trigger for a crisis—and whether reserve buffers are sufficient to prevent such crises—is very much focused, for emerging market countries, on the ratio of short-term debt to reserves. Studies have found that, for these countries, this ratio is far more effective than other reserve ratios (such as ratios of reserves to imports or to broad money) in predicting the likelihood and depth of currency crises. Moreover, empirical studies have found that a ratio of short-term debt to reserves of one (roughly, a cushion of reserves equal to one year's debt repayment) is an important benchmark that countries should watch closely. This benchmark has therefore become a starting point for much liquidity analysis. But a host of other factors need to be taken into consideration as well (for example, through stress tests), such as current account deficits, the quality of private sector debt management, an overvalued currency, secure forms of financing, and additional risks, such as derivative exposures of the central bank and large prospective rollovers of domestic government debt. The reserve adequacy analysis discussed here is a close complement to the analysis of whether a country's debt is sustainable. (See "Debt: How Much Is Too Much?" in this issue.) While the reserve adequacy analysis focuses on the liquidity risks, the debt sustainability analysis focuses on solvency or repayment risks. These approaches have a key element in common: like many other tools of vulnerability and sustainability assessment, they can be summarized in useful, universal indicators, such as the reserves-to-short-term-debt ratio or the debt-to-exports and debt-to-GDP ratios. Indeed, a solid analysis of a country's vulnerabilities must include a full range of vulnerability indicators and provide both historical data and projections. The indicators selected to highlight a country's state of affairs are based on (1) analytical methods (including the balance sheet analysis described in "The Bottom Line") and (2) empirical models (such as currency crises models) that focus on different aspects of vulnerability. In this vein, IMF staff reports on countries that have uncertain access to capital markets contain several pages of indicators, including a standard vulnerability indicator set. Market pulseAnother type of vulnerability assessment is based on financial market information. Financial institutions in the private sector invest a lot of resources in making their vulnerability assessments of emerging market countries as accurate as possible. These assessments focus on repayment risks, rather than the risks of currency crises or external volatility that are the focus of the EWS models or the more policy-oriented assessments of liquidity and debt sustainability. Indeed, bond market spreads—that is, the differentials between bond yields in a particular emerging market and the corresponding yields in a benchmark mature market—and credit ratings, in essence, both reflect repayment risks. The increasingly widespread assignment of sovereign ratings and growing issuance of bonds for emerging market countries since the early 1990s have opened the door not only to close monitoring of this information but also to analysis of the features of economies that markets weigh most heavily and to techniques that predict market reactions. For example, wide spreads, especially when combined with inverted yield curves, may signal the markets' expectation of an imminent default. Analysis of market behavior helps countries assess whether they can use expansionary fiscal policies to offset some of the negative demand effects of a crisis, as some of the better-rated Asian countries did during 1998-99, or whether such action would only exacerbate the crisis. Another example of useful market information is the correlation of spreads across countries, which can provide evidence about tendencies toward contagion. They may also provide insight into whether markets are able to differentiate between the risks associated with the particular characteristics of different emerging market countries. For example, in the run-up to Argentina's crisis, markets started to differentiate more between countries: the correlation between spreads on Argentine debt instruments and spreads for most other emerging market countries declined rapidly, indicating that they were being increasingly assessed in different ways (see chart). The persistently high correlation with Brazil, in contrast, suggests that, from early on, markets were expecting Argentina's woes to spill over to Brazil.

As nuclear scientist Niels Bohr remarked, "It is difficult to predict, especially the future." It is not surprising that crises are still, by their nature, hard to predict with confidence. One reason is that policymakers may take action to avert them once risks are apparent; another is that crises are often precipitated by unexpected shocks that can also derail crisis-prevention efforts. Moreover, the perceptions of market participants can determine whether a vulnerable country "goes over the edge," and these market perceptions are themselves hard to predict with confidence. Using the analytic inputs described above—in addition to the country-specific analysis that is at the core of the IMF's work, the monitoring of financial sector health and adherence to international standards, and the tools described in the other articles in this issue—the IMF is looking at vulnerabilities and policy prescriptions from a number of different angles and attempting to improve its ability to predict and head off crises.

|