Sustaining The Recovery

Following the pandemic, the global economy has been remarkably resilient, and inflation has been steadily receding toward central bank targets. While most signs point to a global soft landing, greater divergence in growth and inflation has emerged among countries, buffers have been eroded, and medium-term growth prospects are lackluster. Equally worrisome, vulnerable countries are at risk of falling further behind.

Against this backdrop, the key policy priorities are to rebuild buffers, revive medium-term growth, and ensure that IMF policies, its lending toolkit, and its governance are fit for a changing world.

Global inflation is forecast to decline steadily, with advanced economies returning to their inflation targets sooner than emerging market and developing economies. Fully restoring price stability is not yet guaranteed, and central bankers will need to carefully balance the risk of premature easing against that of delaying too long. Varying inflation dynamics call for country-specific approaches.

Figure 1.1

Global Inflation to Steadily Decline

(Percent; solid line = April 2024 WEO, dashed line = October 2023 WEO)

Source: IMF staff calculations.

Note: Core inflation excludes volatile food and energy prices. EMDEs = emerging market and developing economies; LAC = Latin America and the Caribbean; ME&CA = Middle East and Central Asia; SSA = sub-Saharan Africa.

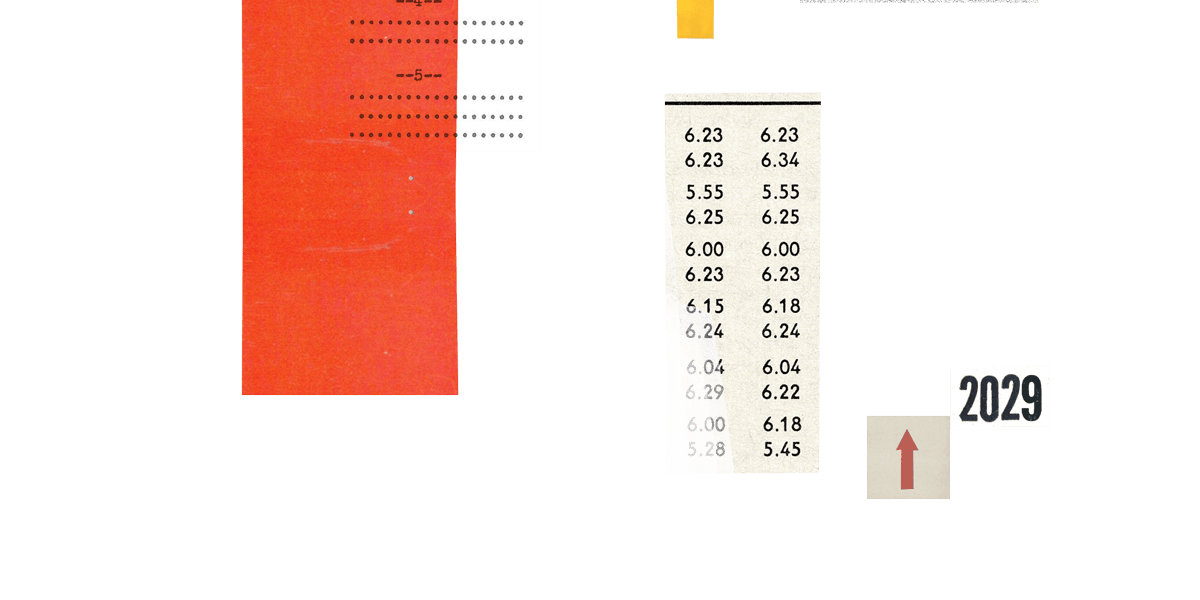

The forecast for global growth is expected to be

in 2029—one of the lowest five-year ahead forecasts for decades.

Medium-term growth is expected to remain low. According to IMF projections, the forecast for global growth is 3.1 percent in 2029—one of the lowest five-year-ahead forecasts in decades. This does not augur well for the poverty reduction and job creation needed for burgeoning populations of young people in developing economies and emerging markets. Slowing growth prospects mean that some—particularly low-income—countries face being left behind in the march toward income convergence.

Four years after the outbreak of COVID-19, fiscal deficits and debts are higher than pre pandemic projections and are forecast to remain higher over the medium term. Without decisive action, global public debt is projected to inch above 100 percent of GDP by 2029.

The priority then must be to rebuild fiscal space to make economies more resilient to future shocks and to allow for needed public investment to manage climate and technological transitions. For example, a carefully calibrated mix of revenue and spending will allow for the achievement of climate goals while ensuring debt sustainability and political feasibility. Carbon pricing will be a necessary instrument and should be complemented by policies to address market failures and catalyze private financing and investment in low-carbon technologies.

Figure 1.2

Medium-Term Growth to Remain Low

(Real GDP; index, 2020: Q4 = 100)

Sources: Haver Analytics; and IMF staff calculations.

Note: The figure plots the median of a sample of 44 economies. The bands depict the 25th to 75th percentiles of data across economies. AEs = advanced economies; EMDEs = emerging market and developing economies.

To support medium-term growth, countries will have to select an appropriate policy mix to contain inflation and put public finances on a sustainable track. In addition to rebuilding buffers and safeguarding debt sustainability, creating space for investment will be challenging, as economies continue to struggle with the legacies of high debt and deficits.

Well-designed fiscal policies to stimulate innovation and the diffusion of technology can deliver faster productivity and economic growth across countries. Policymakers should also usefully leverage areas highlighted by the IMF to counter lower, medium-term growth, including measures such as encouraging greater female participation in labor markets and enhancing green investment.

Four years after the outbreak of COVID-19,

fiscal deficits and debts are higher

than prepandemic projections.

In 2024 more than half the world (as measured by both population and GDP) is scheduled to hold elections. It will be tempting for governments to delay fiscal consolidation, but doing so could force a more painful adjustment later.

Debt refinancing risks remain high for many countries, and continued international cooperation is needed to improve the global debt-restructuring architecture, including through the Group of Twenty’s (G20’s) Common Framework and by further enhancing the global financial safety net. These initiatives and the work of the Global Sovereign Debt Roundtable will help economies in debt distress achieve debt sustainability.

In addition to managing fiscal resources, policymakers must also grow the economic pie. Targeted and carefully sequenced structural reforms will be critical to boost productivity, ease debt burdens, and support green and digital transitions. Similarly, green investments—or policies such as those that address unequal gender access in labor markets—will produce their own inherent boost to combat the low long-term growth outlook. For emerging market and developing economies, prioritizing reforms in areas such as governance, business regulation, and external sector policies could unleash productivity gains.

Global trends such as those discussed in “Spotlight 4: High Uncertainty and the Unknown,” later in this report, hold great promise for higher productivity and improved trend growth, but they also risk triggering dislocations, notably in labor markets. Other trends, such as rising geoeconomic fragmentation, a surge in trade restrictions and industrial policies, and climate change, could further undercut the weak outlook. These trends call for more international cooperation and a concerted multilateral response to limit their costs and leverage their benefits.

Against this backdrop and in line with its mandate, the IMF has provided policy advice, financing, and capacity development to its members, remaining flexible and responsive to evolving circumstances. It will continue to play a critical role in facilitating global cooperation and strengthening the international monetary system.