Revenue Mobilization Thematic Fund

Securing Revenue for Development

The Revenue Mobilization Thematic Fund (RMTF) was launched by the International Monetary Fund (IMF) in June 2016 , in partnership with several donor agencies, to help meet increased demand for technical assistance from low- and lower middle-income countries in the area of domestic revenue mobilization (DRM). RMTF was launched as a successor to the very successful Tax Policy and Administration Thematic Fund (TPA-TF).

Overview

A larger and more ambitious initiative compared to its predecessor TPA-TF, the RMTF is an important response by the IMF and its partners to the “Addis Challenge” in the area of domestic revenue mobilization (DRM). This challenge reflects the recognition—embodied within the 2030 Agenda for Sustainable Development—that many low- and lower middle-income countries have a critical need for assistance in improving their tax capacities. The RMTF is a unique opportunity for a broad range of development partners to take a collective approach in supporting a holistic, medium-term capacity development (CD) initiative to strengthen tax policies and administrations in a select group of countries.

The RMTF’s core focus for assisting low- and lower middle-income countries has two main delivery approaches:

- Intensive engagement in support of transformational reform. This involves supporting the comprehensive reforms beneficiary countries make to their tax systems, including redesigning tax policy frameworks and strengthening revenue administrations. This engagement requires country authorities’ sustained commitment, along with well-sequenced support from the RMTF and other technical assistance (TA) providers.

- Targeted support for reforms. This work focuses on specific areas of the tax system where improvements are most needed. This more targeted support is also framed in the context of a multiyear engagement, and provides scope for assisting in cases where more comprehensive reform programs are not needed, or where a country has lower absorption capacity.

Other important components of the RMTF work in support of sustainable DRM:

- Diagnostic tools play a key role in defining reform priorities and subsequent capacity building activities. In particular, the Tax Administration Diagnostic Assessment Tool (TADAT), the International Survey on Revenue Administration (ISORA), and the Revenue Administration Gap Analysis Program (RA-GAP) will be used to assess where the impact of TA is likely to be highest, as well as to monitor the progress of reforms.

- Synergies between IMF TA and training are to be achieved for maximizing the beneficiaries’ capacity for tax reform. A specific training module focuses on face-to-face and online courses to support and complement TA delivery on selected tax policy and administration topics, particularly for low-capacity countries.

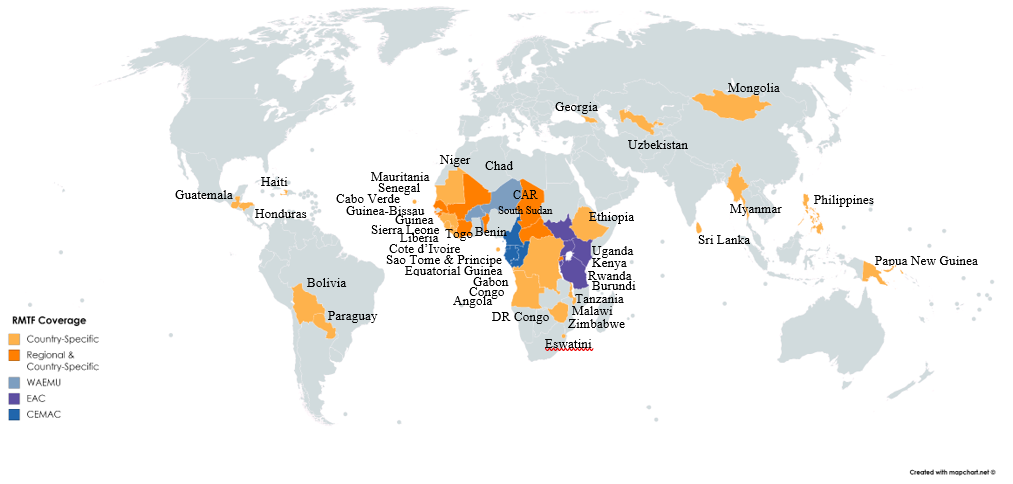

The RMTF is envisaged as a US$77 million program and has received funding from Australia, Belgium, Denmark, European Union, Germany, Japan, Korea, Luxembourg, Netherlands, Norway, Sweden, Switzerland (as of April 2019). Its project portfolio has a broad geographical coverage with over 30 country-specific and regional CD projects activated worldwide.

Analytical Work

The RMTF also supports applied analytical work that examines developments associated with revenue reform, in particular in low- and lower middle-income countries. Research produced so far includes working papers on the use of electronic fiscal devices by tax administrations and on the international benchmarking of the performance-related data derived from the Revenue Administration Fiscal Information Tool (RA-FIT). Technical notes on specific topics, such as the management of tax administration reform programs and taxpayer services, are also a core component of the RMTF analytical work.

In addition, results achieved under RMTF projects can feed into the broader analytical agenda of the IMF’s Fiscal Affairs Department (FAD), with a view of deepening available knowledge on certain issues or finding solutions for common problems. Examples include recent work on tax coordination in West Africa (e.g., Mario Mansour and Grégoire Rota-Graziosi, Tax Coordination and Competition in the West African Economic and Monetary Union, International Tax Notes, volume 74, No. 2, April 14, f) and the How-to-Note on Tax Expenditure Reporting and Its Use in Fiscal Management.

Modular Approach

The RMTF design has ten modules that center on the key areas in building sustainable revenue systems. Assistance can be delivered under any given module or in small packages as needed, and is normally integrated into a sequenced TA program over several years:

- Module I: Reform strategy and management (multi-year revenue policy and administration plan and reform governance).

- Module II: Tax policy design (country-specific tax policy frameworks, including in international taxation).

- Module III: Tax administration organization: (function-based headquarters and field office structure reflecting taxpayer segments).

- Module IV: Tax administration corporate and compliance risk management (country-specific capacity to identify, assess, and mitigate institutional and compliance risks).

- Module V: Tax administration core business functions and procedures (efficient and effective registration, filing, payment, taxpayer services, tax audit, and dispute resolution processes).

- Module VI: Tax administration support functions (operational plans, performance monitoring, human resource and information technology policies, and budgeting processes).

- Module VII: Training (tax policy and administration training to raise human capacities).

- Module VIII: Conferences (international and regional conferences to promote dialogue across countries).

- Module IX: Fiscal tools development and dissemination (RA-FIT management platforms and delivery of the annual RA-FIT updates, and analytical development of the RA-GAP methodology).

- Module X: Research and analytical work (information and input to support capacity development work).

Delivery Modes

The RMTF delivers TA through multiple channels in order to maximize impact:

- IMF headquarters staff design and deliver technical assistance, in the context of diagnostic and review missions, working with country authorities to provide advice that is tailored to their needs and implementation capacity.

- Under the oversight of IMF staff, short-term experts provide specialized skills in specific areas to support the implementation of IMF technical advice.

- Long-term experts are deployed as resident advisors to provide on-the-ground capacity development and to support implementation of reforms.

- Workshops and seminars deliver targeted training and disseminate lessons learned.

Seminar: Managing Tax Administration Reform Programs

June 28–30, 2016

Kempinski Hotel, Accra, Ghana

OBJECTIVES/DRIVERS

This seminar had three principal aims, namely, for beneficiary country authorities to:

- Convey what they see as the main challenges they face as they undertake policy and legislative reform, institutional development and organizational restructuring, process improvement and reengineering, and automation;

- Identify the steps and approaches they are taking to address these challenges in the context of each country’s local conditions; and

- Assess the scope for more collaborative approaches (involving the authorities, FAD, and partners) to managing tax administration reform programs.

AGENDA

Click to view the Seminar's Agenda and the list of participants.

PRESENTATIONS

Managing Tax Administration Reform Programs Seminar photos; June 28, 2016

Drivers for Tax Policy and Administration Reform

Managing Tax Administration Reform Programs

Diagnosis and Strategy Formulation

Project Design, Implementation, and Management

Capacity Development Sustainability and TA Coordination: RTAC Perspective

Capacity Development Sustainability and TA Coordination: HQ Perspective

Design of Phase II of the TPA TF (RMTF)

Governance Structure

A Steering Committee comprising representatives of the external donors and IMF staff guides the RMTF work. This Steering Committee provides strategic guidance and contributes to setting policies and priorities, endorses annual work plans, and monitors program performance and achievements. Technical assistance needs and work plans are identified and prioritized in discussions between recipient countries and the IMF.

Beneficiaries

Intensive CD programs:

- Georgia (modules I, II, III, IV, and V)

- Guatemala (modules I, II, IV, V, and VII)

- Liberia (modules I, II, IV, V, VI)

- Mongolia (modules IV, V, VI, VII, and VIII)

- Myanmar (modules I, II, III, IV, V, and VI)

- Senegal (modules II, III, V, and VI)

- Papua New Guinea (modules I, II, IV, V, VI)

- Senegal (modules II, IV, and V)

- Uzbekistan (modules I, II, III, IV, V, VI)

Targeted CD programs:

- Benin (modules IV and V)

- Bolivia (modules IV, V, VII, VIII, and IX)

- Cabo Verde (modules I, V, and VI)

- Central African Republic (module V)

- Côte d’Ivoire (modules IV, V, and VI)

- Ethiopia (modules I and V)

- Guinea (module II)

- Guinea Bissau (modules I, II, IV, V, and VI)

- Haiti (module II)

- Honduras (Modules II, IV, V, and VIII)

- Mali (modules IV, V, and VI)

- Mauritania (modules IV and V)

- Paraguay (modules IV, V, VII, and VIII)

- Sao Tome and Principe (modules I, III, V, VI, and VII)

- Sierra Leone (modules I, V, and IV)

- Sri Lanka (modules IV, V, VII, and VIII)

- Swaziland (modules III and IV)

- Angola (modules II, IV, V)

- Chad (modules I, V)

- Democratic Republic of Congo (modules II, V, VI)

- Malawi (modules I, V)

- Philippines (module II)

- Rwanda (module II, III, IV, V, VI)

- Zimbabwe (modules I, V, V)

Regional and other programs:

- East African Community (EAC) (module II)

- Central African Economic and Monetary Community (CEMAC) (module II)

- West African Economic and Monetary Union (WAEMU) (module II)

- Tax Expenditure Assessment (module IX)

- Electronic Tax Administration Capacity Training (e-TACT) (module VII)

- Building Tax Policy Analysis and Revenue Forecasting Capacity (module VII)

- RA-FIT/ISORA/ISOCA (module VIII)

- Autonomy in revenue administration (module IX)

- HR Reform in Tax Administrations (module VI)