It is helpful to restate the role of the business sector in any VAT system to serve as a tax collection agent for the authorities. The central question that arises is: How far can the small business sector go in performing that role? To begin answering, it must be acknowledged that perspective matters. For example, how small is small depends on the specific situation at hand and on the economic structure of the country of interest.

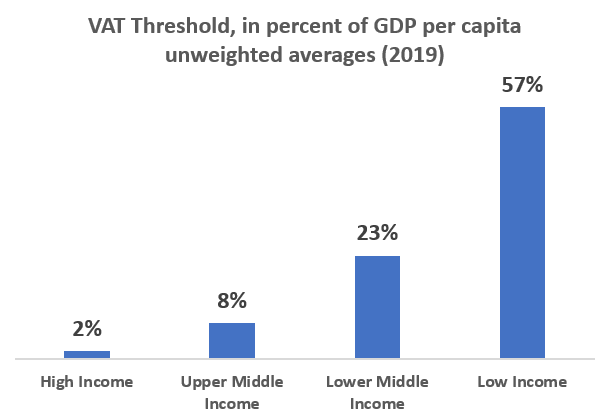

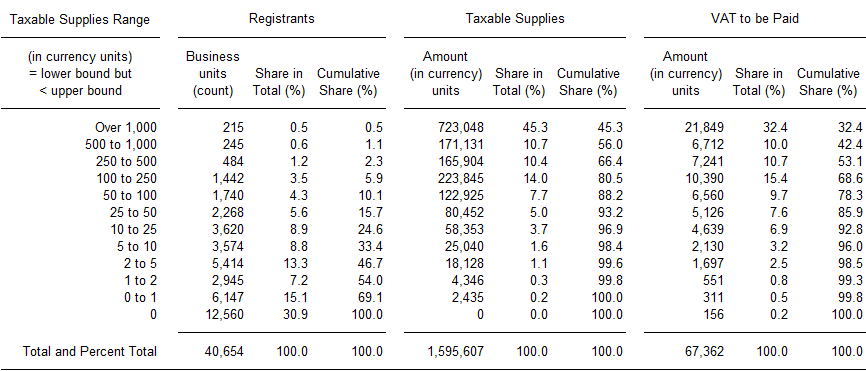

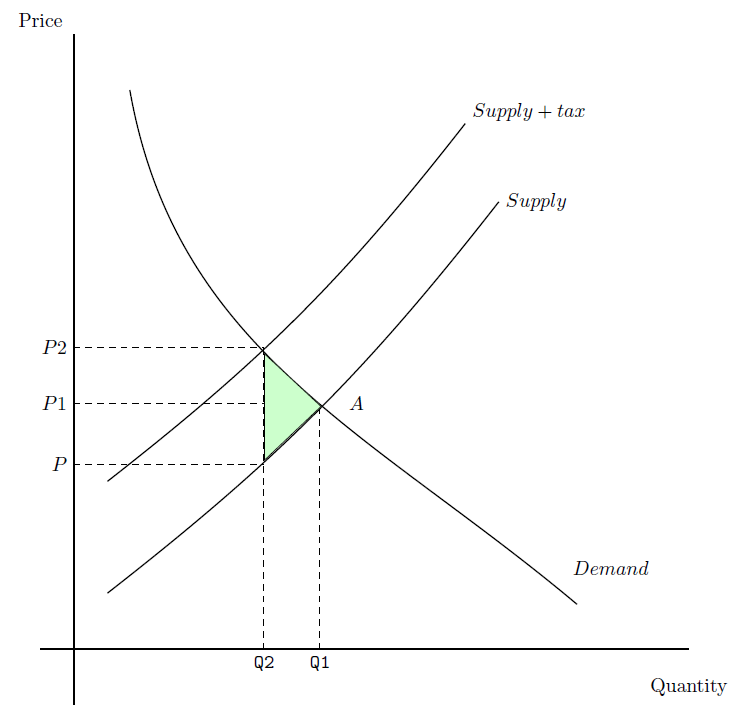

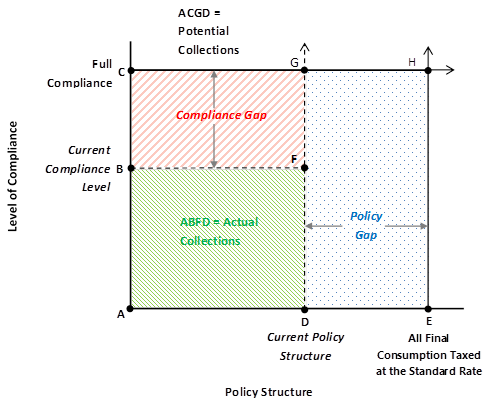

In practice, the treatment of small business—or the belief about what it should be in a normative sense—remains one of the most confusing and confused areas of the nexus between tax policy and administration. From the point of view of VAT design, the VAT threshold can effectively serve as the first-line instrument to handle small business, especially if supported by a voluntary registration threshold that lies somewhere between zero and the threshold. The threshold policy decision determines the small business base since establishments with taxable supplies below the threshold are effectively subject to a VAT exemptions unless they voluntarily choose to register. Voluntary registration depends on the election being available in the law, and usually on the approval of the tax administration. Exempt small business do contribute to collections since they pay VAT on taxable inputs they purchase. In that sense, small businesses that are not registered for VAT pay VAT—on inputs—and save any compliance costs they would have to incur were they registered.

In a practical sense, this is fine. However, Ministries of Finance, tax administrations, and the medium and large business sectors often seem uncomfortable with the idea of leaving small business outside the ambit of VAT registration. This discomfort may stem from a misunderstanding of the nature of exemption, threshold, and collection (compliance plus administration) costs. Small businesses that are not registered are exempt. Yet, many VAT systems – in developing and developed countries alike – insist on attaching additional tax mechanisms to small businesses, oblivious to the fact that a reasoned decision on the VAT threshold already incorporates consideration of the trade-off between collections and collection costs. By setting the threshold to an amount of X, the authorities acknowledge that they should not deal with businesses with taxable supplies below X. If they wanted to, then they would set the threshold lower.

Authorities often insist in imposing duplicative policies that fall under the general heading of special regimes for small business. Special regimes can take several forms:

- Turnover tax for small business with turnover below the threshold;

- Flat-rate scheme; and/or

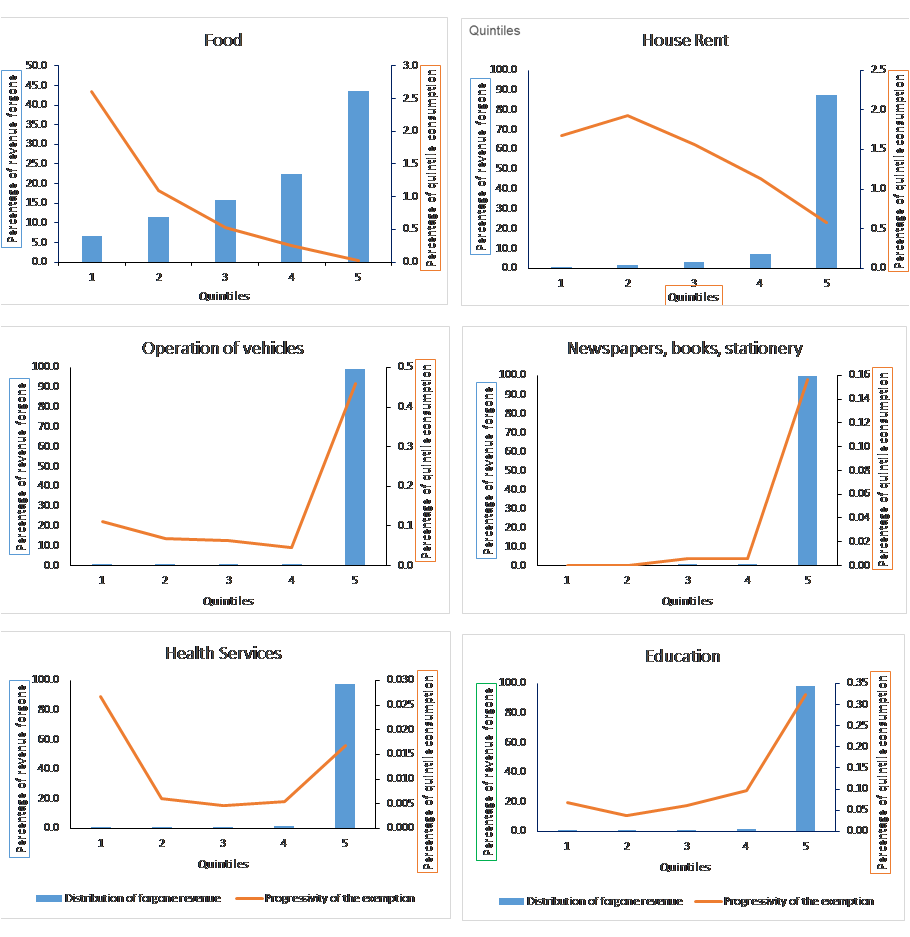

- Combination of input exemption, reduced (including zero) rates on inputs, and output VAT relief.

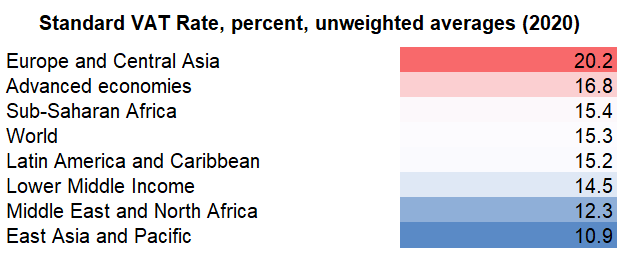

The turnover tax is quite widespread despite the fact that this is precisely the type of inefficient tax VAT meant to replace. It should also be noted that turnover usually exceeds taxable supplies so a turnover tax at a rate below the standard VAT rate may overtax the business. The turnover tax may also cause additional complications when authorities insist on harmonizing the turnover tax threshold for the business or income tax threshold, in an effort to design a tax that liquidates both VAT and income tax obligations. In that case, income tax-like problems contaminate the VAT.

All the above schemes require additional administrative resources and their own information so they impose collection costs that would not exist with a threshold alone. Field experiences with such schemes and variations on turnover taxes show that the extra revenues collected rarely justify the added collection costs. Policies could then better focus on the correct determination of the VAT registration threshold and the voluntary registration threshold.

Flat-rate schemes charge a presumptive VAT on sales from small businesses to large businesses in prescribed sectors. Eligible small businesses impute and retain this presumptive VAT as compensation for VAT on purchases. Large purchases in turn claim that VAT as input VAT. In practice, flat-rate schemes can over-compensate or subsidize small businesses and hence retard their development by removing any incentive to grow and lose the benefit of the scheme.

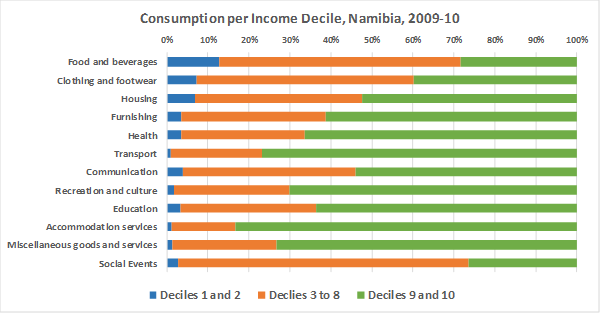

In practice, the damage to VAT from small business policy does not end with special regimes. It often extends to further weakening of the VAT by providing lower-than-standard (including zero) rates and exemptions of business inputs, regardless of whether they have dual use or not. The irony is that many developing countries with weak tax administrations push far in this direction.

Far better alternatives exist by way of policies that simplify compliance and administration: less frequent filing of VAT returns, alternate accounting methods, minimum threshold to claim refunds. Ultimately, choosing such policies should be based on benefit-cost considerations. An informed and deliberate decision on the threshold makes special schemes unnecessary. If the authorities believe that administrative simplification is insufficient, then they should consider raising the threshold and/or simplifying policies with respect to rates and exemptions.

References and further reading:

For a comprehensive discussion of special regimes, see Sijbren Cnossen (2017), 'VAT and Agriculture: Lessons from Europe,' International Tax and Public Finance, Vol. 25, Iss. 2, pp. 519-551.

Pierre-Pascal Gendron (2017), ‘Real VATs vs the Good VAT: Reflections from a Decade of Technical Assistance,’ Australian Tax Forum, Vol. 32, No. 2, pp. 257-282.